A study in the Journal of Consumer Research[1] reveals that the busier we think we are, the more important we feel. This perceived busyness boosts self-worth and even our status in the eyes of others. But when it spirals out of control, it costs us dearly across various aspects of our lives.

While we often flaunt our busyness as a badge of honor, believing it’s essential for success, it doesn’t necessarily mean being productive. Busy just means a full plate, while productivity is about completing tasks—achieving, not just filling time.

True productivity doesn’t rely on being busy. It’s about the outcomes, not the hours spent.

Breaking this cycle starts with understanding why we keep ourselves so busy.

Table of Contents

- Why Should You Stop Being Too Busy?

- Signs You're Too Busy and What to Do About It

- 1. You Rarely See Your Family

- 2. You’ve Lost Your Why

- 3. You're Always Trying to Meet Expectations

- 4. You're Never Really Here

- 5. You’re Worn Out

- 6. You Feel Like You're Falling Behind

- 7. Vacations Feel Like a Luxury You Can't Afford

- 8. You Can't Stick to One Task

- 9. You're Unhappy for No Obvious Reason

- 10. Decisions Feel Overwhelming

- 11. Asking for Help Feels Like a Weakness

- 12. Meals Are Just Another Task

- 13. What Did You Even Eat for Breakfast?

- 14. Your Desk is a Disaster

- 15. Appointments Clash and Slip Through

- 16. Mornings Are a Drag

- 17. Loneliness Has Become the Norm

- Reclaim Your Time

Why Should You Stop Being Too Busy?

Being too busy wreaks havoc on your well-being. Here’s a quick rundown:

- Physical Health Deteriorates: Stress can spark serious health issues like heart disease.[2] Lack of sleep compromises your cognitive functions,[3] and poor habits like skipping meals or grabbing fast food negatively affect your nutrition and fitness.

- Mental Health Declines: Constant pressure increases anxiety and leads to burnout, reducing your ability to think clearly[4]

- Productivity Sags: Overworking causes mistakes, dampens creativity, and leads to procrastination.

- Relationships Suffer: Less time for loved ones and stress-induced miscommunication can strain even strong bonds.

- Personal Fulfillment Drops: When work overshadows everything else, life feels unbalanced and joys go unnoticed.

- Growth Stalls: Without downtime for self-reflection, personal and professional growth halts.

Knowing this, let’s look at the signs you’re too busy and how to dial it back.

Signs You’re Too Busy and What to Do About It

Here are 17 signs you might be too busy, and what you can do to prevent busyness from overtaking your life.

1. You Rarely See Your Family

Missing family dinners? Can’t recall the last time you hung out with your kids? If your days consistently stretch into 12 or 14 hours at work, it’s not just a busy season—it’s a lifestyle that could be harming your family connections. If this sounds like you, it’s a strong indicator you’re too busy.

2. You’ve Lost Your Why

Do you feel passionate about your work, or are you just ticking boxes to get paid? If you’re compromising your values and taking shortcuts, it might mean you’ve lost your purpose to constant busyness. If this rings true, it’s time to step back and realign with what matters.

3. You’re Always Trying to Meet Expectations

Are you glued to your email or always on calls, feeling increasingly resentful? This could be a sign you’re too caught up in meeting others’ expectations, sacrificing your own boundaries in the process.

4. You’re Never Really Here

Is your mind always racing ahead to the next task, or are you too distracted by your phone even in company? This indicates that being overly busy might be stealing your ability to truly engage with loved ones.

Mindfulness meditation has been shown to help focus and appreciate the present.[5] By practicing mindfulness, you bring yourself back to the now, enhancing engagement with your current activities. Consider starting with mindfulness exercises to reclaim your presence.

5. You’re Worn Out

If you’re burnt out, simple tasks feel overwhelming, and minor setbacks cause major frustration. Constantly waking up tired, even after a full night’s sleep, suggests you’re spending too much physical and emotional energy staying “on.”

6. You Feel Like You’re Falling Behind

Struggling with finances, neglecting exercise, or feeling mediocre in your skills might indicate you’re spread too thin. If you often say, “I am too busy,” it’s time to reassess and scale back.

7. Vacations Feel Like a Luxury You Can’t Afford

Hoarding vacation days? Fearing time off might leave you behind? This reluctance shows you value doing over being. Yet, science supports taking breaks[6]—planning a vacation can even boost your happiness weeks before you leave.

8. You Can’t Stick to One Task

If multitasking has become your normal mode and you’re flipping between tasks, it’s a sign of chronic busyness. This constant switching sabotages your focus and productivity.

9. You’re Unhappy for No Obvious Reason

Keeping busy might be your way of dodging life’s tougher moments. This avoidance can lead to persistent unease and anxiety.[7] It’s important to confront these feelings rather than sidestep them.

10. Decisions Feel Overwhelming

Ever felt too anxious to even choose a toothpaste in the store? This paralysis is often due to a desire to keep all options open, a common trap of busyness. Remember, not every decision is monumental, and simplifying choices can alleviate this stress.

11. Asking for Help Feels Like a Weakness

Are you the go-to person because you always get things done? This can make it tough to ask for help when you need it. In fact, reluctance to seek help is common.[8]

But it’s okay to ask for assistance. It doesn’t just lighten your load—it also gives others the opportunity to contribute.

12. Meals Are Just Another Task

If you’re catching up on emails or calls during meals or while driving, you’re too busy. Efficient time management is one thing, but not having a moment to focus even on eating suggests you need to shed some tasks.

13. What Did You Even Eat for Breakfast?

Skipping breakfast or grabbing fast food on the go because you’re “too busy”? It’s time to prioritize your health. Breakfast is essential, not just another chore. Make time for it to fuel your body and mind properly.

14. Your Desk is a Disaster

If your workspace is chaotic and it’s stressing you out, it might be a sign you’re taking on too much. Taking time to organize your space can help clear your mind too.

15. Appointments Clash and Slip Through

If you’re often double-booking or missing meetings, it’s a clear sign you’re overstretched. Saying ‘yes’ too quickly and too often can overload your schedule. It might be time to start being more selective about your commitments.

16. Mornings Are a Drag

When the thought of starting your day fills you with dread, it’s a signal that you’re too busy. If every morning feels overwhelming, it suggests burnout. Ideally, a new day should bring some level of energy and enthusiasm.

17. Loneliness Has Become the Norm

Busy periods can isolate us. If you’re feeling lonely because you’re always working and turning down social invitations, it’s important to make time for friends. Reach out to someone you haven’t spoken to in a while. Remember, work will wait—it’s crucial to maintain connections and recharge with your community.

If you’ve checked off five or more points from this list, it’s time to pause. Your time is precious—don’t waste it on just being busy.

Reclaim Your Time

Here at LifeHack, we’ve developed a straightforward approach called the Time Flow System. It’s all about managing your time more effectively, cutting through the noise, and leading a more fulfilling life. Here’s the gist of it:

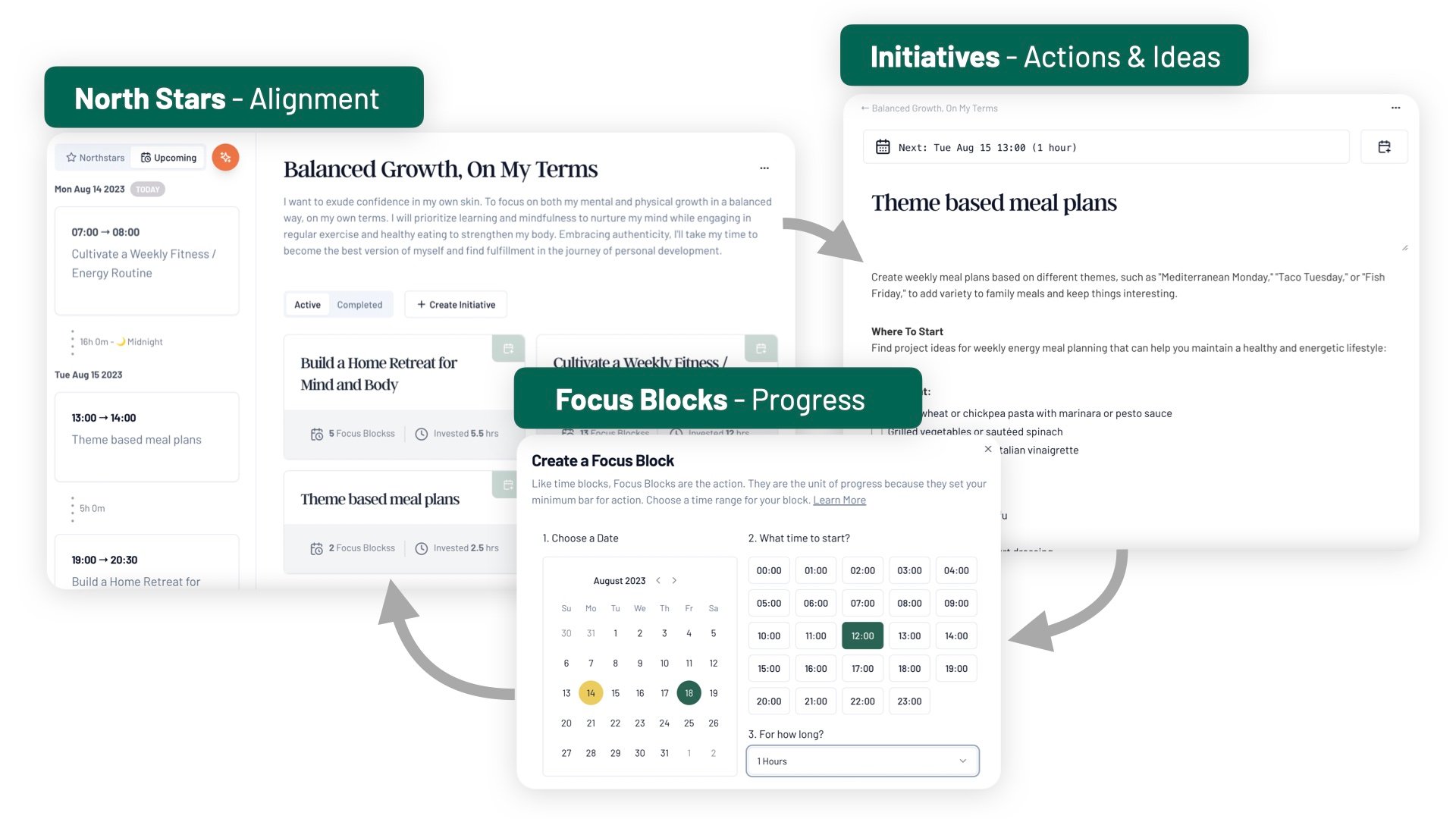

North Stars

Think of North Stars as the key goals in your life—the big milestones you’re working toward. They provide direction and keep you focused on what really matters. These goals are solid; they don’t shift unless your life does.

Initiatives

Initiatives are how you make progress. They turn your North Stars into actionable plans, honing in on specific milestones. They keep you honest, pushing you to make sure every task truly helps you advance toward your goals, not just busy work.

Focus Blocks

Focus Blocks are where action happens. By scheduling what to do and how long to spend on it, you stay focused without overdoing it. This method is about efficiency—maximizing impact while respecting your time.

Using the Time Flow System ensures every minute counts, steering you towards the life you envision. It’s not just about saving time—it’s about making sure the time you have is spent moving forward.

Whether it’s freeing up time for family, diving into personal projects, or pushing your career forward, the Time Flow System helps you concentrate on actions that really move the needle.

Reference

| [1] | ^ | Journal of Consumer Research: Conspicuous Consumption of Time: When Busyness and Lack of Leisure Time Become a Status Symbol |

| [2] | ^ | Cureus.: Psychological Stress as a Risk Factor for Cardiovascular Disease: A Case-Control Study |

| [3] | ^ | Neurosciences (Riyadh): The consequences of sleep deprivation on cognitive performance |

| [4] | ^ | American Psychological Association: How stress affects your health |

| [5] | ^ | Psychological Reports: Mindfulness Meditation Improves Visual Short-Term Memory |

| [6] | ^ | Alina Health:Importance of taking a vacation |

| [7] | ^ | Computation Psychiatry: Anxiety, avoidance, and sequential evaluation |

| [8] | ^ | Early Intervention in Psychiatry: Help‐seeking beliefs for mental disorders among medical and nursing students |