These days, the idea of setting goals is touted everywhere – by motivational speakers, in self-help books, and in countless success stories. It’s become the standard approach for chasing what we want, be it personal growth or career success.

Yet, amidst all this buzz about goal setting, it’s natural to wonder if it’s just a passing trend or if it truly holds weight. Do we really need to set goals to reach our ambitions?

This article delves into the science behind goal setting, uncovering why it’s a critical tool for success. We’ll explore real-life instances where setting clear goals has led to remarkable achievements in various aspects of life.

Table of Contents

What Is Goal Setting?

To grasp goal setting, it’s essential to first differentiate between goals and objectives.

Imagine a goal as your long-term destination – the broader picture you’re aiming for.

Objectives are like the steps on the path to that destination. They’re the smaller, specific tasks you need to accomplish to reach your overarching goal.

Goal setting is about pinpointing these objectives and developing a strategy to hit them. It’s a process of figuring out what you need to do and planning how to do it. American motivational speaker Les Brown once said,

“Your goals are the roadmaps that guide you and show you what is possible for your life.”

This encapsulates the essence of goal setting – it’s like creating a roadmap for your life or your organization.

The practice usually involves breaking down a big goal into smaller, achievable objectives. It’s about outlining the steps to take for each objective, setting deadlines, and establishing ways to track your progress.

This method not only makes your goals more attainable but also gives you clear milestones to reach along the way.

Understanding your goals gives you a sense of purpose and direction. It’s a powerful way to keep focused on what matters most to you.

Plus, goal setting isn’t limited to one area of life. It can enhance academic performance, boost your career, and foster personal growth. It offers a structured approach where you can channel your efforts and resources effectively to achieve what you set out to do.

Why Is Goal Setting Important?

Understanding the impact of goal setting helps clarify its significance. The American Psychological Association has identified ways goal setting affects outcomes, which can be summarized in four key areas:[1]

- Choice – Goal setting sharpens your focus. It helps you concentrate on actions that are in line with your goals and avoid distractions. This selective approach means you’re more likely to engage in activities that bring you closer to your goals.

- Effort – Goals drive you to work harder. This increased effort stems from a desire to reach your goals and the value you place on achieving them. Simply put, having a goal often means you’re willing to put in more effort than if you were aimlessly working.

- Persistence – Goals foster resilience. When facing challenges or setbacks, a clear goal can be a powerful motivator to keep going. It’s about maintaining your course even when the going gets tough.

- Cognition – Goal setting leads to deeper reflection on your actions and habits. It encourages you to think about what’s needed to achieve your goals, often leading to positive changes in behavior, like adopting new habits or routines.

With these outcomes in mind, we can see the benefits of goal setting:

Maximizing Your Success Potential

By focusing your efforts on relevant activities and steering clear of distractions, goal setting helps you make the most of your time and resources. This targeted approach increases your chances of success.

For instance, someone aiming to lose weight will likely prioritize healthy eating and exercise while avoiding high-calorie foods and sedentary behaviors.

Elevating Motivation and Performance

Setting goals means committing to specific outcomes within a set timeframe, which can be a strong motivator. This commitment can lead to better performance and achievement. Studies have shown that people tend to perform better when working towards specific goals.[2]

Strengthening Resilience in Adversity

Goals provide a sense of purpose and direction, helping you anticipate and prepare for challenges.

When you’re clear about what you want to achieve, you’re more likely to seek necessary resources and support, turning setbacks into opportunities for growth and learning.

Fostering Personal Growth and Development

Goal setting is like plotting a personal roadmap. As you progress towards your goals, you often gain new insights and perspectives, leading to personal growth.

For example, someone training for a 10k race might start with shorter runs and gradually build up, discovering their potential in the process. Setting goals also encourages self-reflection and self-improvement, fostering continuous personal development.

How to Set Goals Effectively

Now that we’ve established why goal setting is crucial, let’s talk about how to do it effectively. The key is not just setting goals but setting them the right way.

1. Set a SMARTer Goal

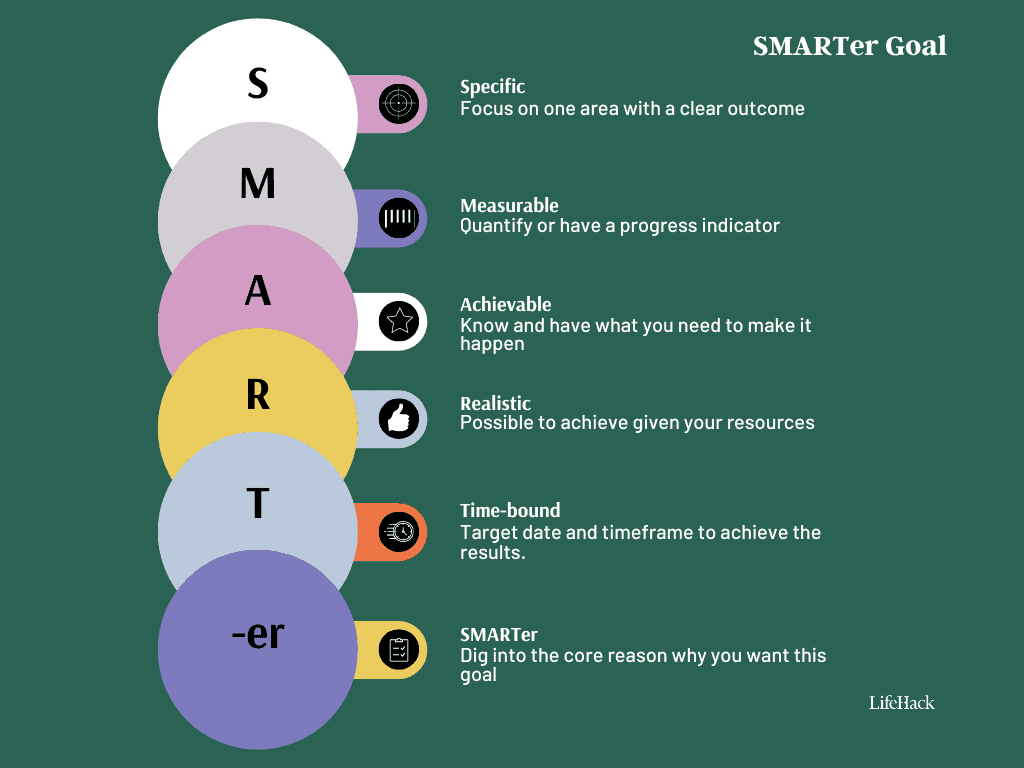

You might be familiar with the concept of SMART goals, but I suggest going a step further with SMARTer goals.

Beyond being Specific, Measurable, Achievable, Realistic, and Time-Bound, a SMARTer goal delves into understanding what you really want to achieve and why. This clarity and purpose are what keep you driven.

Using the 5 Whys framework is a great way to uncover this. You keep asking “why” until you hit the core reason behind your goal.

For example, consider the goal of ‘getting promoted.’ Let’s break it down:

- Why do you want to get promoted?

“To have more responsibilities at work.” - Why do you want more responsibility?

“To contribute meaningfully and have a say in decisions.” - Why is contributing and decision-making important?

“I want to progress in my career and be part of the company’s success.” - Why do you want career progress and to contribute to success?

“To feel fulfilled at work and achieve financial stability for my family.” - Why is fulfillment and financial stability important?

“To live comfortably and securely while providing for my family.”

See how we moved from a simple desire for promotion to understanding the deeper motivation of living a comfortable and secure life while supporting your family?

This deeper purpose will keep you going even when things get tough.

So, the SMARTer goal becomes:

“I want to get promoted within the next year by taking on more responsibility and making meaningful contributions to the company’s success, to achieve financial stability for myself and my family and feel fulfilled in my work.”

For more insights on setting long-term goals and achieving significant success, check out How to Set Long Term Goals to Achieve Big Things.

2. Break Down Your Goal into Smaller Milestones

Tackling a big goal can feel overwhelming. That’s why breaking it down into smaller, manageable steps – or short-term goals – is vital.

This approach keeps you motivated and prevents that feeling of being swamped by the enormity of the task.

Let’s take our example of aiming for a promotion. We can divide this larger goal into achievable milestones:

- Initial Discussion: Within the next 3 months, have a conversation with your supervisor about possible new responsibilities.

- Taking on More: Aim to handle at least one new responsibility in the next 6 months.

- Skill Enhancement: Attend a professional development course or conference in the next 6 months to sharpen skills crucial for your role.

- Project Completion: Identify and successfully finish a project that positively impacts the company within 9 months.

- Regular Feedback: Every other week, get feedback from your supervisor and peers to ensure you’re on the right track with your new responsibilities.

- Performance Review: In 12 months, aim for a performance review that indicates you’re ready for that next step up.

By focusing on one step at a time, you can maintain motivation, as each milestone achieved is a sign of progress.

Additionally, breaking down your goals helps you identify potential challenges and obstacles early on. This foresight allows you to plan and strategize effectively, keeping you on course to achieve your ultimate goal.

3. Create an Action Plan

Now that you’ve segmented your goal into manageable milestones, the next crucial step is to map out a detailed action plan.

This plan will be your guide, outlining the specific steps you’ll take to reach each milestone. Here’s how to structure it:

Set Timelines for Each Milestone

Assign a specific timeline to every step in your action plan. This creates a structured approach, helping you track progress and stay focused. It’s like having mini-deadlines that keep you moving forward steadily.

Identify Necessary Resources and Support

Consider what you need to achieve each milestone. This might include additional training, certain tools or software, or support from colleagues or mentors.

Knowing what you need in advance prevents last-minute scrambles and ensures you’re well-equipped for the task.

Regularly Review and Adjust Your Plan

It’s essential to revisit your plan periodically. This is not about rigidly sticking to a plan but adapting as you go.

Regular reviews help you identify any roadblocks or unexpected challenges and adjust your strategy accordingly. It’s about being agile and responsive to the situation.

Creating and following a structured action plan keeps you focused and motivated. It’s a tangible representation of your journey, turning the abstract goal into concrete steps.

Plus, it gives you the satisfaction of ticking off each milestone as you complete it, fueling your motivation even further.

4. Track Your Progress

The final step in effective goal setting is monitoring your progress. Seeing how far you’ve come, especially during challenging times, can give you that extra push you need to keep going.

Some reasons why tracking progress is so important:

Boosting Motivation

It’s inspiring to see the ground you’ve covered. Each milestone reached is a mini-celebration, a tangible sign that your efforts are paying off.

Ensuring That You’re Moving the Needle

Regularly tracking progress ensures you’re moving in the right direction. It’s a reality check. If you find you’re lagging in certain areas, you can adjust your strategy and get back on course.

Improving Adaptability

Goal tracking is also about recognizing and responding to challenges. When you monitor your progress, you can quickly identify and address any issues, making your path to the goal more efficient.

For business or personal development goals, a spreadsheet or a goal-tracking app might be ideal to help you track your progress. For fitness goals, a fitness tracker could be the way to go.

The key is consistency. Choose a method that fits your goal and your style, and stick with it. Seeing your progress visually can be a powerful motivator, transforming the abstract concept of a goal into something tangible and achievable.

How to Achieve Your Goals

The true essence of goal setting isn’t just in the planning; it’s in the doing. Turning your goals from plans into reality requires consistent action and dedication.

To actually reach your goals, you need to stick to your plan and take steps regularly.

Here’s how to make it happen:

Consistent Action

It’s not about making huge leaps every day. Even small, consistent steps can lead to big achievements over time.

Regular action keeps the momentum going and brings you closer to your goal.

Stay Adaptable

Be ready to tweak your plan as needed. Life throws curveballs, and being flexible in your approach means you can navigate these changes without losing sight of your goal.

Overcome Obstacles

Challenges are part of the journey. Instead of viewing them as roadblocks, see them as opportunities to learn and grow. Every problem you solve makes you better equipped for the next one.

For more in-depth guidance, take a look at The Ultimate Guide to Goal Achieving & Goal Setting. With the right approach, you can achieve your goals and lead a fulfilling life.

Final Thoughts

Goal setting is a continuous journey, not just a one-off task. It’s about integrating your goals into your daily life and treating them as promises to yourself.

The value of a goal lies not only in its achievement but also in the growth and learning you experience along the way.

Be patient and keep pushing forward, even on tough days. Every small step counts. And don’t forget to celebrate your progress, no matter how minor it may seem. These celebrations are reminders of your capability and dedication.

Ultimately, the journey towards your goals is as significant as reaching them. It’s a path of personal growth and satisfaction, knowing you’re actively shaping your life according to your aspirations.

And to help you make the process more effective, try our Time Flow System to find your North Star and create actionable plan to reach it.

Reference

| [1] | ^ | American Psychological Association: The Study of Work Motivation in the 20th Century. |

| [2] | ^ | American Psychologist: Building a practically useful theory of goal setting and task motivation – A 35-year odyssey |