Do you feel as though you don’t have enough time? And you’re not really in control of time, is it?

We have no control over how quickly time passes; especially with so many demands on our time and energy for everyday matters, we can easily feel overwhelmed and swept. As a result, we may feel helpless or as if time is working against us.

While you can’t control time itself, you can control how you spend it. It is much preferable to spend one hour of high quality time on things that are important to you than ten hours doing things that are not time-worthy. When it comes to time, quality is always more important than quantity.

In this article, you will learn how to improve your quality of time and take back control of your day with LifeHack’s unique framework on time management.

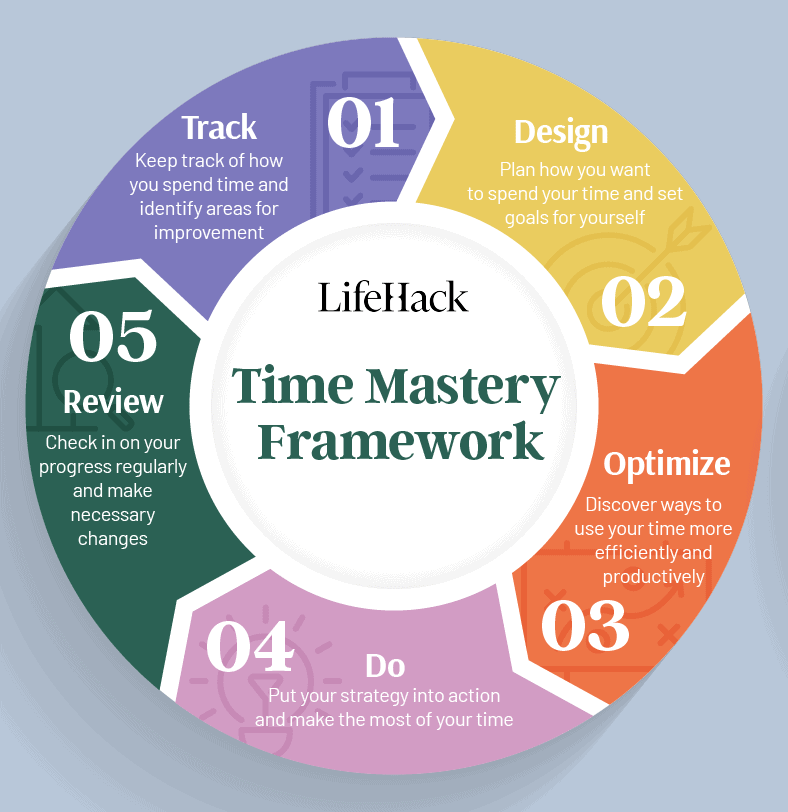

The Time Mastery Framework

The Time Mastery Framework is a framework I’ve gradually developed since starting LifeHack.

Around ten years ago, LifeHack was a one-man show, and I was on my own with no family obligations. I had plenty of time, so I built the website from scratch and wrote and edited all of the articles myself. Now that I’ve grown my company with a larger team and am the father of two sons, my demands and responsibilities have skyrocketed in recent years.

As you can see, there have been numerous changes. After all, I’m a human, and it wasn’t easy to shift from being responsible to myself (and my parents) in the past to being responsible to everyone on the LifeHack team and my entire family. I was overwhelmed and stressed at first, and I worried that I wouldn’t have enough time to complete everything I needed to do.

I had to juggle work and family life a lot because I was always so busy. I wanted my company to expand, but I also wanted to spend more time with my children and wife. What’s worse is that, I felt guilty when I unconsciously thought about work while playing with my sons and my wife was upset about this. What’s worse is that my wife got upset because I often thought about work while playing with my sons. I felt so guilty about this.

That’s when I realized I needed to change.

I began by gathering all of the tips and insights I’d gained from various productivity books and studies, and I reflected on my daily schedule to find out what went wrong with my time management.

It took some time for me to review and improve my time management system. But it eventually worked.

Even though I still have the same responsibilities, I no longer juggle. Now I have a better time balance between work, family, and personal care.

It turned out that it wasn’t a lack of time, but rather a failure to optimize some of my time that caused me to suffer.

My struggle inspired me to create the Time Mastery Framework which I created while attempting to solve my own time management issue. It was also improved after I introduced it to the LifeHack team at work. Everyone at LifeHack has experienced success with it.

The Time Mastery Framework is a 5-step Framework:

- Track – it is keeping track of how you are currently spending your time in order to identify areas where you could improve.

- Design – It entails making a plan for how you want to spend your time and setting goals for yourself.

- Optimize – This refers to discovering ways to use your time more efficiently and productively.

- Do – It is all about putting your strategy into action and making the most of your time.

- Review – It entails checking in on your progress on a regular basis and making any necessary changes to your plan.

Now, let me break down the step-by-step process:

1. Track

Tracking your time is essential since it allows you to understand where your time is being spent and discover areas where you can improve. You can see how much time you have available for other activities by being realistic about your usable time and organizing your must-do items in a calendar format. This can help you prioritize your work and make better use of your time.

Tracking your time might also help you detect time-wasting habits and make changes to increase your productivity. You can obtain a better knowledge of your priorities and make more effective use of your time if you keep a regular record of how you spend your time.

2. Design

The second step, “Design,” involves making a schedule for how you want to spend your time and establishing personal objectives. This is making a list of goals or tasks that you want to do and ranking them in order of importance and urgency. It is critical to be realistic and prioritize only a few of your goals, as you will most likely not have the time to complete everything on your list.

Once you’ve determined your top priorities, divide each goal into smaller, more doable actions. This can assist you in making progress toward your goals without feeling overwhelmed.

Starting with little, non-ambitious bits of work allows you to gradually develop momentum and make steady progress toward your goals. This can also help you keep focused and motivated since you will be able to see how far you have come and how far you still have to go.

A planner comes in handy here. It can help you get organized by creating a list of prioritized goals and to-dos. LifeHack’s Full Life Planner can do just that. It is a useful tool for aligning your schedule with your objectives.

3. Optimize

The goal of “Optimize” is to uncover methods to use your time more efficiently and productively. This means reconsidering your priorities and asking yourself questions like, “Do I really have to do this task?” Is it truly urgent? Is there a better way to accomplish it? Can I assign it to another person?

These questions will help you identify activities that are not urgent or important so you can postpone them. By doing so, you can focus on the most important tasks and cut down on time spent on unimportant activities.

Put tasks in the “Backlog” category if they are not urgent or important but still need to be completed. Examine these Backlog tasks once a week or once a month to see if it’s time to schedule them.

For example, at LifeHack, each team member brainstorms and creates project backlogs in their to-do list each week based on their quarterly goals. Then, each morning, we choose from the to-do list what to work on for the day and block a time to finish it.

Furthermore, by looking for better methods to do things and contemplating delegating or outsourcing, you can find ways to accomplish your goals more efficiently and save time in the long run.

4. Do

“Just do it!” as Nike advertised. “Do” refers to taking action. Whatever you’ve tracked and planned is meaningless unless you act on it.

Use the Time Blocking method to set aside time for important tasks. The practice of allocating large chunks of time to related tasks is known as block scheduling. For example, you could schedule meetings on Mondays and strategy on Tuesdays.

By setting time limits, block scheduling can also help you produce higher quality work in less time. Setting time limits can deflate a ballooning task and help you get things done, as Parkinson’s Law states that “work expands so as to fill the time available for its completion.”

5. Review

So you’ve taken action on your important tasks; how are things going? This is what the final step “Review” is for.

Keep track of your progress and continue to review it as you carry out your important work. Are you getting closer to your goal? What are your thoughts on your progress so far?

This final step enables you to assess your current situation and the amount of work still needed to accomplish your objectives. When you keep track of your progress, you can see what works and what doesn’t, and make changes along the way to get closer to your goal more quickly. Furthermore, by constantly reviewing your progress, you will be able to celebrate your small victories and will not lose motivation as easily.

With the above 5 steps, you will gradually regain control of your time and accomplish more of what is important to you in less time.

Conclusion

Time may appear to be uncontrollable, but there are things you can do to maximize your time and feel more in control of your life.

By being mindful of how you spend your time, setting priorities and creating a plan, you can make the most of the time you have.

Featured photo credit: Donald Wu via unsplash.com