Productivity is the ability to perform tasks efficiently and in a timely manner. In today’s busy and competitive business world, productivity is paramount for any business, organization or corporation.

Productivity is more than just performing tasks successfully. It is about investing and allocating resources, so the company or business can perform to meet its core goals.

As part of 2019, it is important to commit to new goals. When shopping around for new productivity software keep in mind the following things: cost, reliability, cross-platform compatibility, on the go, technical support, etc.

In the subsequent sections, we will examine the most recommended productivity software in the marketplace. In addition, we will look at what makes them tick and what separates them from the rest of the pack.

Projects and Tasks Management

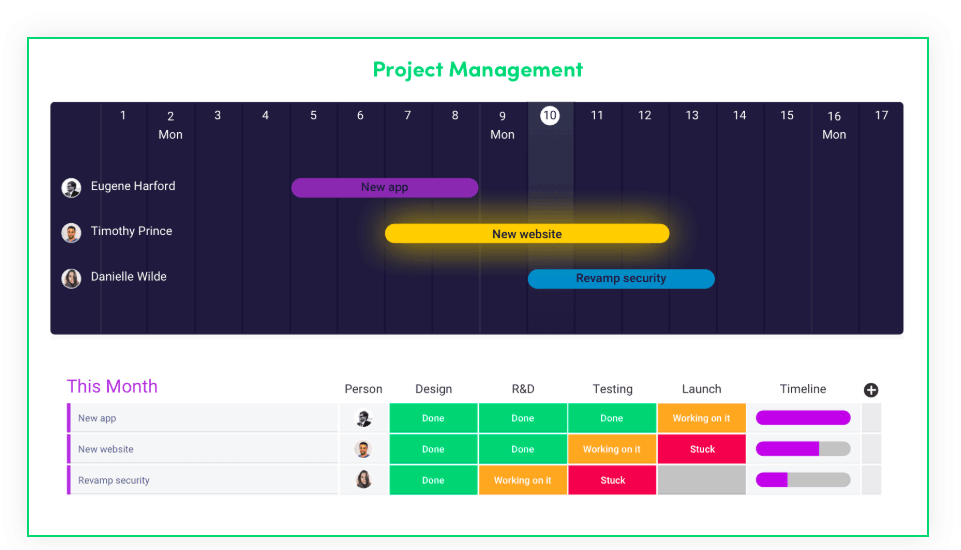

1. Monday dot com

Monday dot com was founded to create a team management solution so people connect to workplace processes across any industry. The productivity tool is used in more than 140 countries.

The user interface is intuitive and impressive. It makes collaboration productive and fun because of its simplicity.

The tool is deemed to have one of the best user experiences across the mobile and online project and task management platform.

The product includes usability, customization, admin control, group management and control, private or public control, in-group messaging and more.

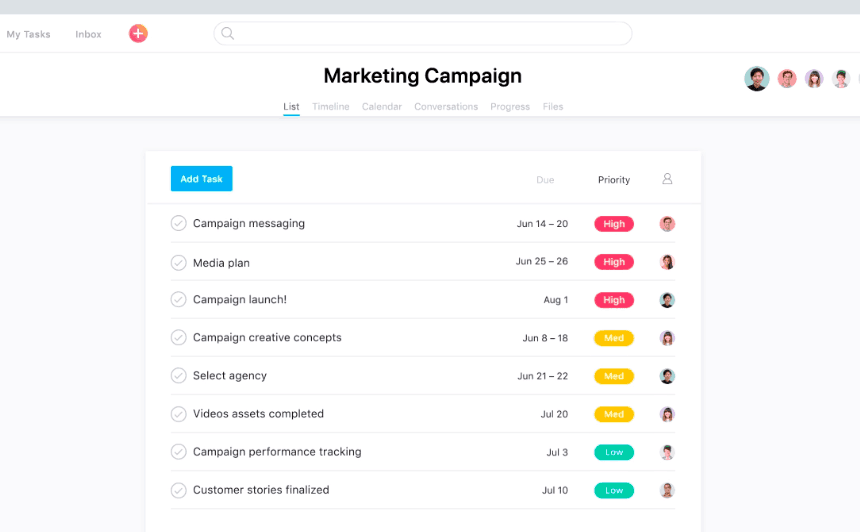

2. Asana

The mantra behind Asana’s product is to enable teams from across different organizations to work together effortlessly.

The software comes with lots of customizations. When you create a project as a user, you can choose between a traditional task view and the kanban-style board view. The dashboard allows you to see the progress on a project, and it includes an excellent advanced set of search tools.

Also, Asana’s Android and iOS apps do retain the web interface’s clean look and feel.

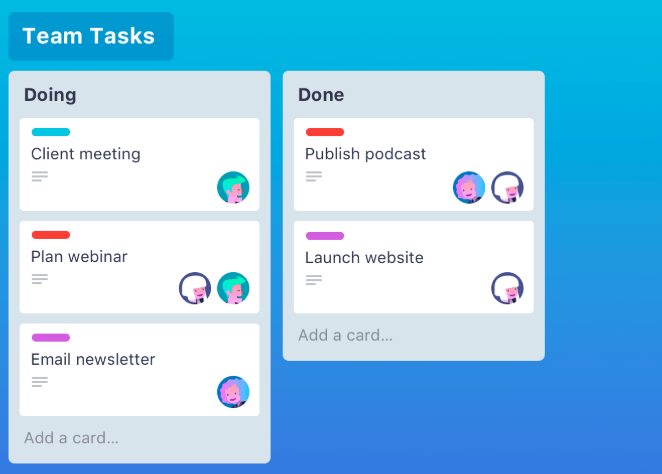

3. Trello

Trello was founded in the summer of 2010 and two years later the platform added 500,000 members. Anyone within sales, marketing, HR and operations can collaborate successfully with this product.

Moreover, the tool has over 100 plus integrations with Google Drive, Slack, Jira and others. The product works flawlessly across various platforms.

Some of the well-known features includes is speed, easy-to-use, and set up. The interface includes due dates, assignments, file storage, checklists and more.

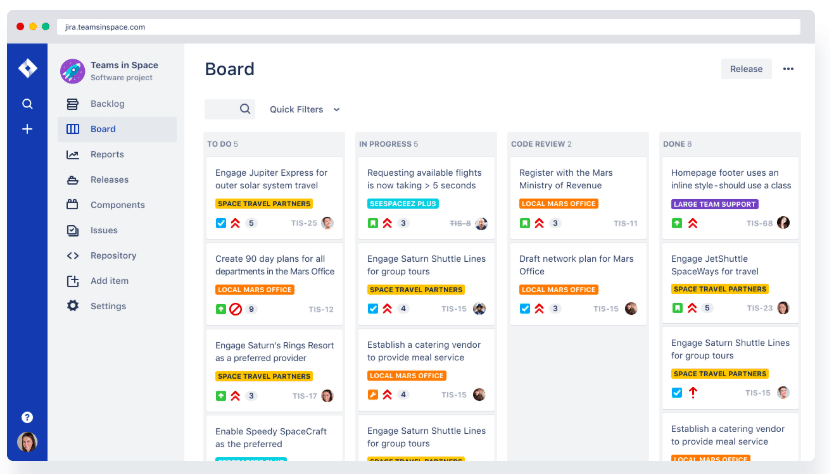

4. Jira

The Jira software is flexible and heralded as the next-generation project.

The software allows teams to design and adapt the software to an organization’s needs. This includes having visibility into long term goals, project roadmaps, status of work, real-time release information and more. In addition, the interface is customizable.

The Atlassian Cloud does not support multiple separate domains, subdomains or domain aliases in Google Apps.

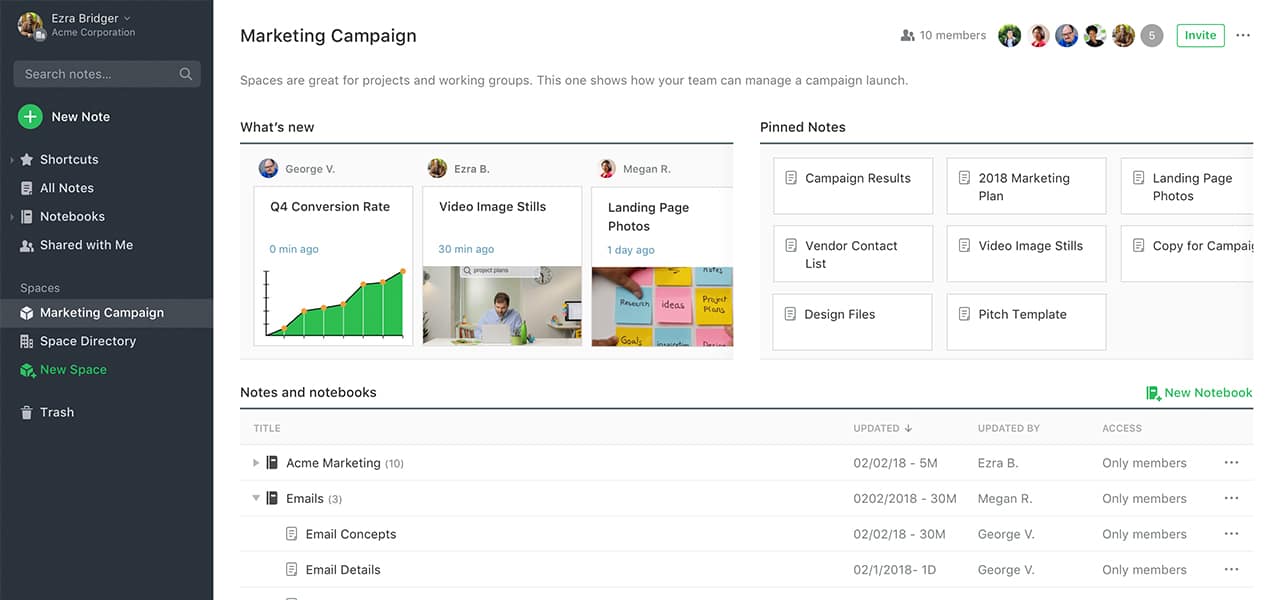

5. Evernote Business

Evernote was founded in 2008 and reached 11 million users by 2011. The company was founded on the premise that their product should address the ever-increasing volume and speed of information.

The product helps bring together groups of teams because of versatility and functionality. It creates documents, collaboration on projects, store information all a single location.

Moreover, you can find information quickly and includes effective search capabilities and integrations with existing tools you may already use.

Communication

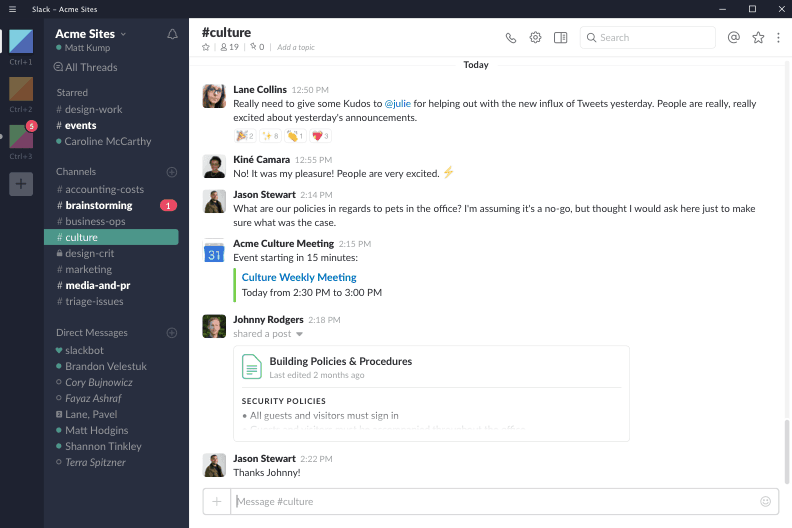

6. Slack

Slack was founded in 2013 and the tool is heralded as a collaboration hub. Slack is where productivity happens. When you start a new project, hire new staff, deploy a code, review a sales contract, finalize on a budget, Slack covers all of these. Some of the major highlights include highly customizable notifications and seamless integrations with other collaboration and office tools. The free version of the software comes loaded with features, but does not archive old message. So, you have to review what are the best options for your organization or business.

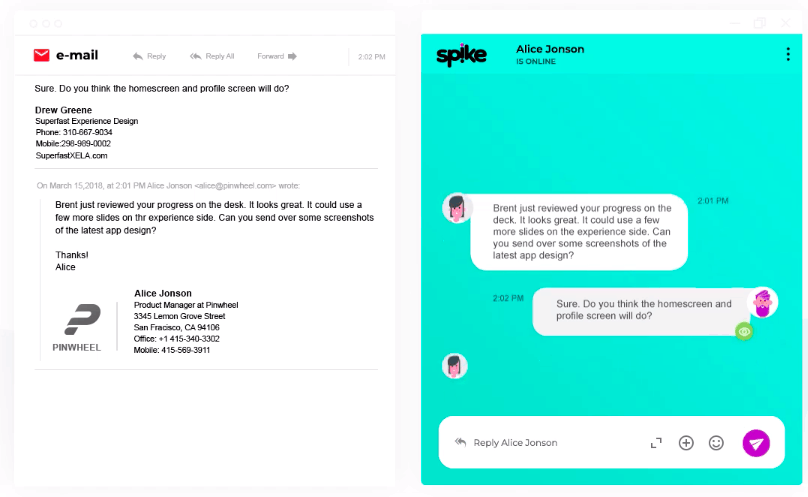

7. Spike

Newcomer Spike makes emails more conversational by helping teams maintain productivity, communication, and collaboration. All of these are achieved from within their inbox.

Spike works on top of any existing email (O365, G suite, and IMAP) turning it into a real-time messenger and making your communication much more functional and efficient.

Spike’s features include built-in groups and channels, voice and video calls, email encryption, instant access to all your files, and much more.

Creation

8. Office 365

Microsoft’s Office 365 could not be excluded from the conversation and especially as it pertains to productivity software.

Of course we are all familiar with Word, Excel, PowerPoint, and Outlook. But there is more capabilities that come with it.

You have business-class email, online storage space, and teamwork solutions. These services can be accessed from just about anywhere.

Within this suite is Microsoft Sway, which is a presentation software and a step above PowerPoint.

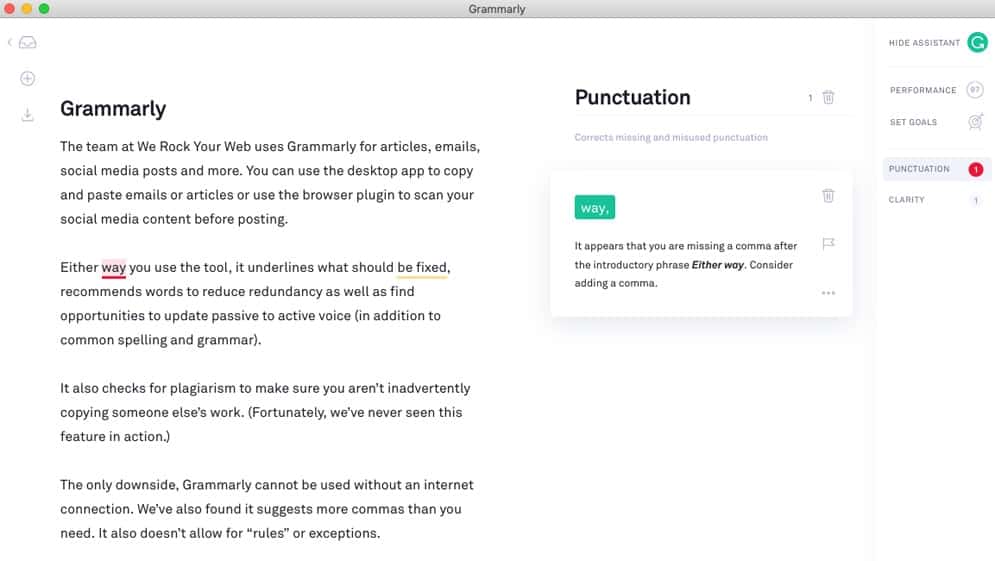

9. Grammarly

Grammarly helps to cut down time on editing. Professionals in several industries like law, healthcare, academia, marketing, engineering and journalism use it to provide instant feedback on the accuracy of writing in English.

Once you install the extension from Google Chrome, you can get corrections when you are drafting an email, using social media and other apps.

Grammarly is AI powered and it’s a wonderful tool to have to check spelling and grammar before a presentation.

Team Analytics

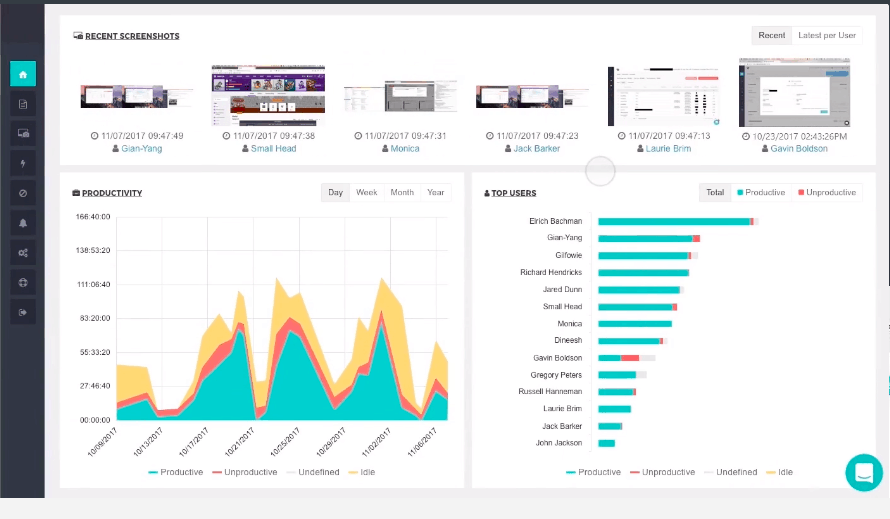

10. ActivTrak

ActivTrak is a business intelligence tool that allows you to access team behavior analytics. In other words, it is data-driven.

The pros include two-factor authentication with active directory integration. You can also automate your alerts and it has an intuitive interface with easy-to-use admin controls.

Furthermore, it comes with Google sign-in, iOS app, productivity track, and more. The bottomline is the product offers employee productivity metrics along with team behavior analytics.

The Bottom Line

Depending on the size, budget, resources, and immediate needs of your company, not all productivity software will exactly solve your problem. You will have to contact any of the providers above and probe extensively to find the right product that is made for your business.

More Productivity Tools

- 18 Best Time Management Apps and Tools

- 7 Best Project Management Apps to Boost Productivity

- 10 Must-Have Personal Project Management Tools

Featured photo credit: Domenico Loia via unsplash.com