It’s hard to describe the frustration you feel when your professional goals keep falling flat. You’re floundering and you’re not where you want to be professionally, which bleeds into your personal life and causes you to get upset and sad easily.

You need a system, a way to set goals that makes them attainable 100 percent of the time. When you establish your system, it takes the guesswork out of goal achievement and makes it a matter of completing specific steps.

Where would you be right now in your life if you had followed such a system from the beginning of your professional career and stuck with it? Would you be owning and running your own business, would you be working for a company you love, or would you be independently creating great work that keeps you in high demand?

This is where it gets good. The following tips will cover the most actionable ways to set professional goals (with professional goals examples included). If you follow these tips and do your absolute best each step of the way, you’ll have no choice but to launch into a new, exciting period in your professional life.

Start with tip number 1 — this tip is essential to any and all of the other tips on this list. Although you’re starting with 1, this is not a linear list. You can take each tip by itself and run with it, or you can implement as many as possible — the choice is yours. That said, the more action you take, the closer you are to making tip 1 a reality.

Ready to grasp the very essence of what it is to succeed? Keep reading.

1. Identify What You Love — and Make a Statement

This is it — the single most important word is not career, it’s love. Your primary, overarching, life-defining career goal must center around what you love.

You figured out what you love when you were young, and then somewhere along the way you lost it in the noise, the pressure, and the clutter of everyday life.

Billions of people exist on this Earth, and things aren’t what we wish they could be because we succumb to fear instead of doing what we love.

How can you take what you love and serve this love with your career?

- Create a statement, a single sentence that encapsulates your overarching career goal. Make it specific.

- Write the love-of your-life career goal sentence down and pin it to the wall where you’ll see it every day.

- Make sure this sentence informs all your other objectives.

- Make sure your primary career goal is the result of what you love to do.

Example:

“Be a successful nonfiction author: Write nonfiction content — books, poems, essays, blog posts — to help people realize the priceless importance of love and the imagination, and get your content published.”

2. Don’t Just Create SMART Objectives — Be Ultra-SMART

Now that you have your ultimate career goal nailed to the wall, it’s time to get SMART. That is, use the SMART acronym to create objectives:

- Specific

- Measurable

- Achievable

- Relevant

- Timed

Your SMART objectives are micro-goals that fit all of the above criteria. They are not nebulous, vague, and tough to complete. They are daily objectives you know you can handle, and they’re necessary.

You have to complete SMART objectives in order to meet other, tougher goals, which ultimately contribute to your main goal.

So how do you make your SMART objectives ultra-SMART? Push yourself. Don’t settle for the same level of output every day. Don’t hold yourself to low standards. Think about quality and do your absolute best.

Example:

SMART: “Today I will write 500 words about the power of love between 10am and 2pm.”

Ultra-SMART: “Today I will write 500 words about the power of love between 10am and 2pm, and will find 3 accredited, scientific sources to backup my argument.”

Note that “Ultra-SMART” is not about writing more — more isn’t necessarily better, and if you’re just starting out, may not be achievable; rather, ultra-SMART is about focusing on quality within a reasonable framework.

3. Identify an Absolutely Essential Stepping Stone and Step to It

No one realizes their ultimate goal without finding a job that will push them in that direction. Jobs pay, and you need money to survive, but you don’t want a job that has nothing to do with your career goal. Pinpoint a job that is like an apprenticeship for what you ultimately want to do.

Example:

When famous author Neil Gaiman delivered his commencement address — which, by the way, is phenomenal — to University of the Arts in Philadelphia, he said something that makes perfect sense:

“I wanted to write comics and novels and stories and films, so I became a journalist, because journalists are allowed to ask questions, and to simply go and find out how the world works, and besides, to do those things I needed to write and to write well, and I was being paid to learn how to write economically, crisply, sometimes under adverse conditions, and on time.”

Note that Gaiman’s goal was to be a creative writer, but he took a position in journalism, which isn’t creative writing; it’s about facts, writing them well, and having discipline. For Gaiman, journalism was a stepping stone towards achieving his overarching goal.

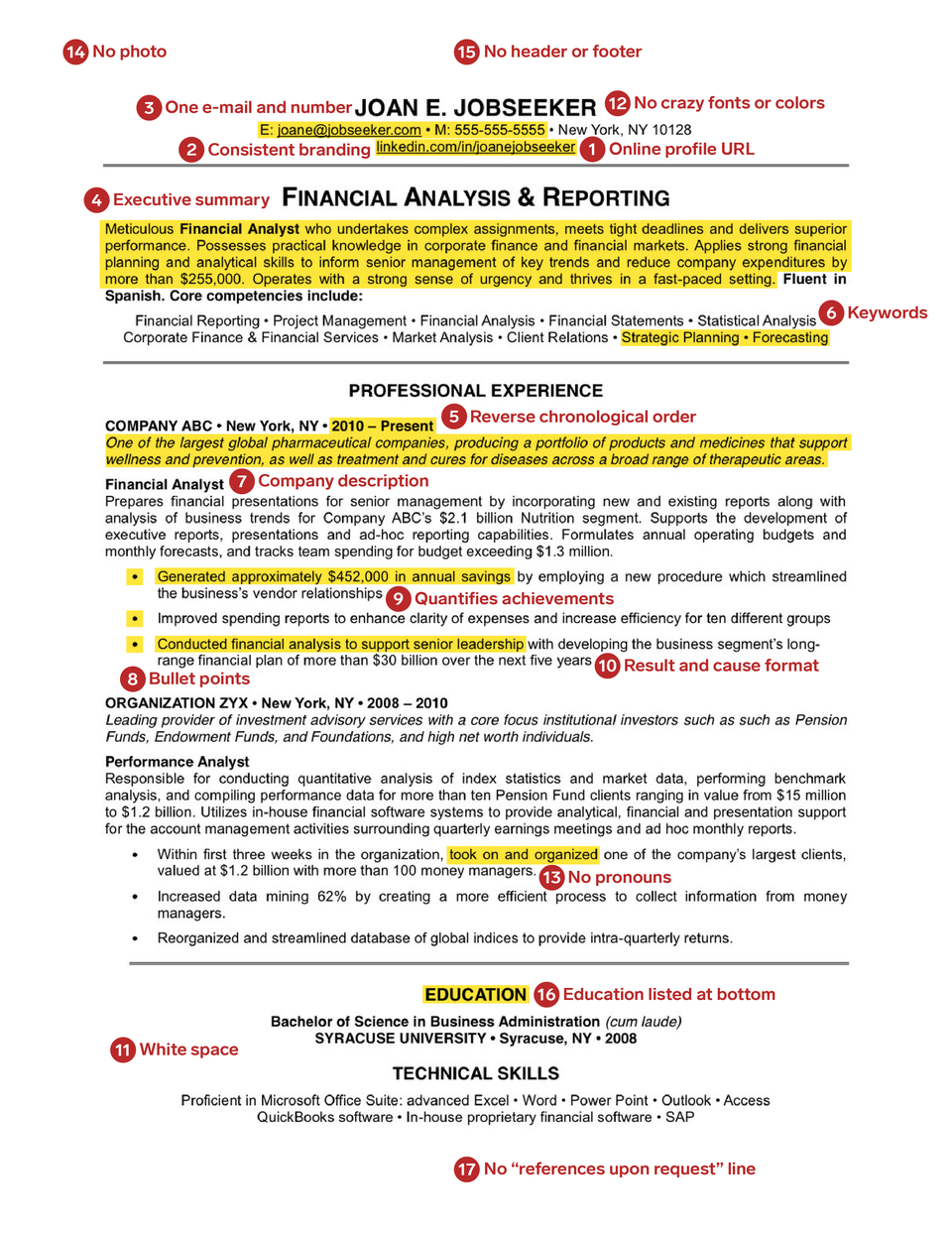

4. Get Really, Really Good at Crafting Your Resume

You’re not going to settle, and there are multiple stepping stones towards your final destination. But here’s the clincher:

Crafting a great resume is about more than landing a job.

Crafting a great resume is about learning how to think from someone else’s perspective. If you can imagine what someone else wants to see in a great resume, you can view other things from their perspective too, and that’s important in the professional world.

To do a resume the right way, consider the mistakes you should avoid:

- Avoid disorganization: Provide your name, work experience and corresponding titles, education, relevant skills.

- Avoid irrelevant information: Consider the position you’re applying for carefully and focus on information relevant to it.

- Avoid length: A one page resume with just the right wording is a thing of wonder.

- Avoid showy fonts and words: Be basic but let your personality shine through.

- Avoid sloppiness: Check for typos, misspelling, and grammatical mistakes.

Example: Here’s a great resume example, courtesy of Shayanne Gal from Business Insider:[1]

5. Ask Yourself the Most In-Depth Questions

Throughout your educational career, you heard teachers say, “There are no bad questions” or something to that effect.

It’s true; however, this mantra ignored the fact that some questions are better than others.

Asking, “How can I do x in a unique and interesting way?” is better than asking “How can I do x?”

You can set professional goals that you might accomplish, or you can set professional goals you’re highly likely to accomplish because you went in-depth with your questions. This goes very well with SMART goals. Specificity and detail are the hallmarks of achievable goals.

Example:

Say, for instance, you’re at the point where you feel you can start your own business from home. The Hartford offers pertinent questions you should ask before doing so:[2]

- Will your house accommodate your business?

- Can you find work-life balance?

- When you interact with customers, how will you showcase a professional image?

- Are there city zoning ordinances you need to consider?

- Do you have the insurance and tax liabilities covered?

6. Use a Digital Assistant to be Insanely Efficient

Executives and bosses have personal assistants to help them with scheduling, organization, and other time-consuming tasks.

You may not be at the point in your career where you can afford to hire somebody, which is why it helps to have a productivity assistant to help you be more efficient.

Use an app to keep track of mundane scheduling and other minute details so you can free up your mind for creativity.

Example:

See this list of task management apps . Out of all of them, Any.do has one of the best interfaces, and it will give you the reminders you need to stay on task.

7. Create a Vivid Mental Picture

Discouragement can and will happen — it’s a part of life, whether professional or personal. Don’t wait until you get discouraged to visualize yourself doing well.

Practice your mental picture of success even at the times when everything is going so well it’s unbelievable, but you’re not quite at the end-point yet.

When things aren’t going well, it’ll be the much easier to remain in a positive mind-state because you practiced being there.

Example:

Social scientist Frank Niles provides a perfect example of goal visualization:[3]

“Former NBA great Jerry West is a great example of how this works. Known for hitting shots at the buzzer, he acquired the nickname ‘Mr. Clutch.’ When asked what accounted for his ability to make the big shots, West explained that he had rehearsed making those same shots countless times in his mind.”

Note that West visualized sinking the exact shots; again, specificity matters.

8. Express Your Professional Goals Positively

This goes directly with the visualization process. Goals can seem like chores, which is why it’s important to use positive, proactive wording when you’re vocalizing or writing things down.

Through positive expression, you’re training your brain to take a certain path whenever you think about your professional goals. This translates into forward, positive momentum whenever you take action.

You’re more likely to take action if you associate that action with positive thoughts and feelings.

Example:

Instead of, “It isn’t that hard to type 500 words in 4 hours,” say, “I like taking advantage of the time I set aside to zone in and really have fun with what I’m doing.”

Note that the specific goal — 500 words in 4 hours — is implied because you already know it.

The point of this statement is to associate a feeling of enjoyment with commitment and focus.

9. Build Your Network with Passion and Purpose

A professional network will help you hit those stepping stones necessary to achieving your ultimate goal. But you don’t want to network with just anyone.

Build a network with other people who share your passion, build it based around your specialty, but also look for people from outside your usual sphere who can help you gain a different perspective.

Demonstrate your passion by helping other people, and listen more than you talk.

Example:

Find a mentor — it’s perhaps the most critical networking move you can make. MileIQ provides some examples of where to start:[4]

- The SCORE Business Learning Center

- Small Business Development Centers

- Women’s Business Centers

- Veteran’s Business Outreach Centers

- Minority Business Development Agency

- A trade association through your SBA district office

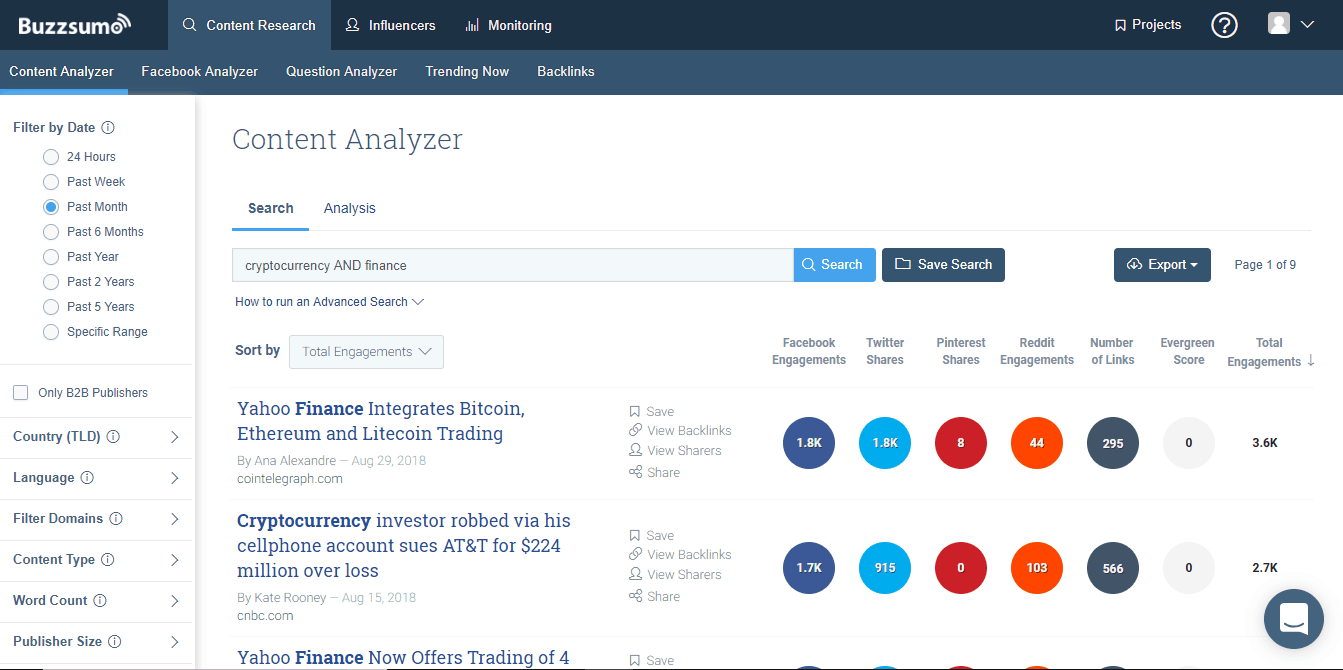

10. Benchmark a Competitor Like a Boss

If you’re freelancing or running your own business, this one is particularly applicable to you.

Is there an exemplary freelancer or small business owner with whom you’re impressed? Analyze what this person has done to get where they are, find a metric to serve as a benchmark of their success, and aim to do better.

Example:

Benchmark social metrics — say, for example, you’re writing an article on cryptocurrency for a finance website. Buzzsumo[5] provides a tool you can use to benchmark the number of social shares a competitor has earned for this topic:

11. Master Time Management

Here’s the thing about professional goals:

You must master time management to accomplish them. Understand how much time to set aside for each objective; and when you’re working on objectives, use your time not just efficiently, but mindfully.

That means immersing yourself in the activities that are essential to completing objectives. Focus on what works best to achieve your desired outcome.

Example:

Life and business strategist Tony Robbins recommends “chunking your goals,” otherwise known as compartmentalization:

- Write down tasks you need to get done during the week.

- Group different tasks together based on their categories, e.g. “Consult SCORE about a mentor” and “talk to Ted about job opportunities” would be categorized under “Networking.”

- Set aside time for each category.

- Work on the tasks for a single category during a specific chunk of time.

12. Identify Your Strengths and Weaknesses — and Get Strategic

As you move toward accomplishing your primary career goal, you’ll note that different objectives fit into different categories, and you’re better at some categories than you are others.

Once you know what you’re good at, focus on it. Spend as much time as you can concentrating on your strong-points.

When it comes to your weaknesses, ask for help.

Forbes contributor Elana Lynn Gross reveals that asking for help the right way can advance your career. “Ask targeted questions that will allow you to set your strategy,” Gross says.[6]

Within any category, work on what you’re good at first, and then ask your network for help with blind spots.

Example:

Christine Wallace, VP of Branding and Marketing at Startup Institute, told Fast Company how she ended up dropping her first venture:

“I took a train from the Valley up to San Francisco and met with two mentors, who agreed that it was the end of the road for Quincy [Apparel]. After it was all over I spent three weeks straight in bed. Then after 21 days of sleeping, crying, I put on my big girl pants and rejoined the world.”

In Wallace’s case, she needed to ask her mentors for help to understand when to move on.

Don’t be afraid to ask for advice when something isn’t working.

13. Take Advantage of Awesome Resources at Your Disposal

When it comes to setting professional goals, tunnel-vision and short-sightedness are big problems for many of us.

We think there’s only one way to complete an objective. The truth is there are multiple ways to approach any problem.

This implies taking a moment to step back, view your objective from a distance, and survey your options. Think differently, use your imagination, and do a thorough search — online and off — for resources.

Example:

Get a library card, scour the shelves, AND crowdsource ideas from social media — you may find something unexpected.

14. Be a Brand That Stands Out

Believe it or not, your brand is a very important part of your overall career goal. There are two aspects here:

- How you appear via any published format

- How you appear in person

It’s more important to have a quality brand than it is to be prolific, so don’t publish anything — on social media or elsewhere — that you will regret.

You will make mistakes in your endeavors, and in fact it’s important to take risks and make mistakes.

There are good mistakes. Good mistakes are the screw-ups that show you’re striving toward your goal. Anytime you set an objective, think about how it aligns with brand and overall goal. In other words, know when to say “no” to projects that don’t compliment your brand and overall mission.

Example:

View yourself as a thought leader, be one, and make content that showcases your thought leadership:[7]

- Videos: Post on YouTube, your website, and social media

- Podcasts: Learn how to start podcasting.[8]

- Workshops or meetups: Look for a community space and invite others to join you in discussion.

- Blog posts and newspaper op-eds: Share your knowledge and opinions.

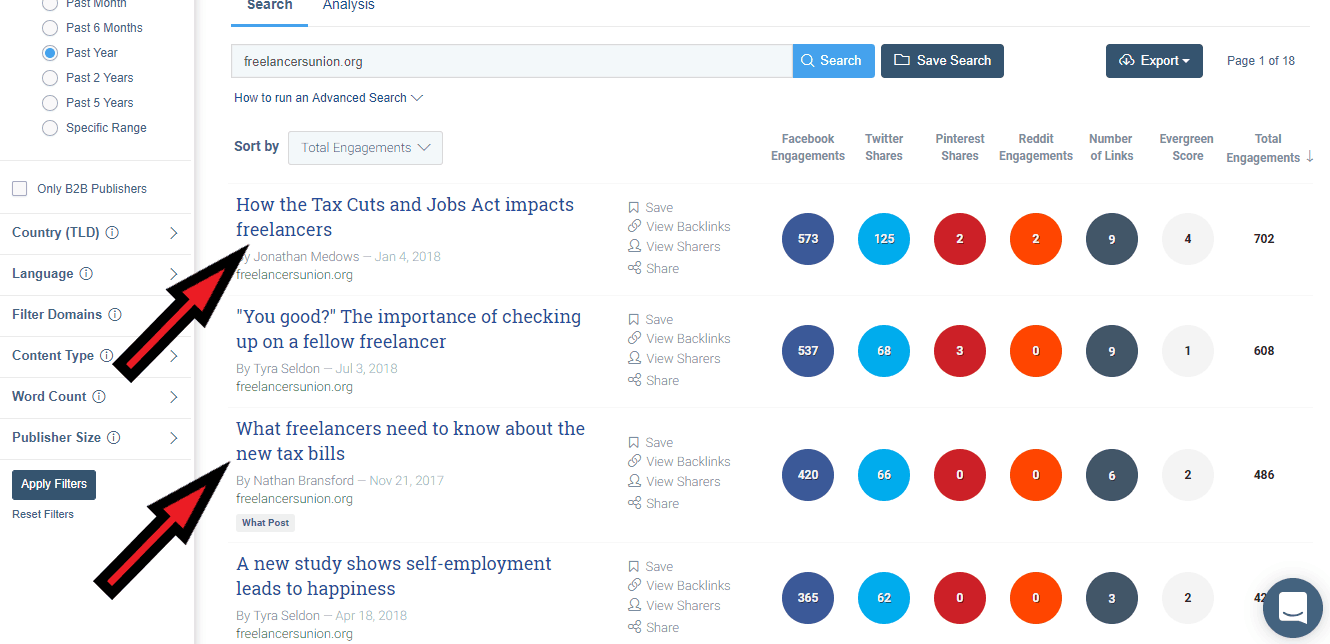

15. Steal Ideas from Your Competitors

This is the one truth that’s hard to stomach. Great ideas come to those who steal. You may not be sure of your next step, your next objective, and time is precious.

Observe what other great professionals are doing, capture the core of their objectives, make them your own, and craft them into something new.

Example:

Steve Jobs, the visionary behind Apple, fully endorsed the Picasso quote, “Good artists copy, great artists steal.”[9]

In 1989, Xerox sued Apple for stealing ideas and incorporating them in the Macintosh and Lisa computers, but lost the lawsuit. That’s because Apple made something new.

Here’s a simple way to go about this. Say you’re writing about freelancing, and the Freelancers Union blog is one of your top competitors. Pop the URL into Buzzsumo. You’ll see that the top articles are about taxes:

In that case, you can write a “Definitive Guide to Taxes for Freelancers” or “Definitive Guide to Tax Breaks for Freelancers.”

It’s About Passion and Practicality Combined

Your primary career goal must be about what you love to do. Otherwise, why would you want to do it?

To reach your goal, you must make small, practical steps. Don’t expect everything to go perfectly along the way, and don’t eschew hard work that isn’t exactly exciting.

Too often, we get caught up in the excitement of the dream, and when the step-by-step isn’t nearly as exciting, we quit.

Learn how to do the boring, rote tasks with joy because you’re doing them to achieve greatness.

Always remember why you set out on a mission to begin with, and let your brain follow your heart.

Reference

| [1] | ^ | Business Insider: “17 Things That Make This the Perfect Resume” |

| [2] | ^ | The Hartford: “Five Questions to Ask Yourself Before Starting a Business From Your Home” |

| [3] | ^ | Huffington Post: ”How to Use Visualization to Achieve Your Goals” |

| [4] | ^ | MileIQ: “How to Find a Business Mentor” |

| [5] | ^ | Backlinko: “Buzzsumo: The Definitive Guide” |

| [6] | ^ | Forbes: “How Asking for Help the Right Way Advances Your Career” |

| [7] | ^ | Amsterdam Printing: “Want to be a Thought Leader? Here Are 5 Ways to Showcase Your Expertise” |

| [8] | ^ | Buffer: “Podcasting for Beginners: The Complete Guide to Getting Started with Podcasts” |

| [9] | ^ | CNet: “What Steve Jobs Really Meant When He Said, ‘Good Artists Copy, Great Artists Steal’” |