The biggest drawback towards using social media is that it seems to take up too much time. Due to the time commitment, businesses are not leveraging the full positive impact that social media can bring.

There are 3 reasons as to why social media becomes too time-consuming.

- There are so many different sites and you don’t know how to use them. Therefore you have to figure out how to use them, which eats up your time.

- You don’t have a solid plan and just enter the websites on the spot looking for the right thing to say. When you aren’t sure, you get sucked in and spend a lot of time on the sites.

- You consume everyone else’s content and posts. You click on links, look at pictures and watch videos because you aren’t clear on what else you could do while there.

In order to overcome these three time wasters and take back you time on social media, you must have a clear plan.

Creating a plan means getting clear on what you’re on social media for. It also means that you need to line up your content creation and curation in a way that supports that.

For example, my personal strength on social media is engaging with people. I could have conversations with people all day long, but I also need to remember to incorporate a healthy dose of content marketing into the mix. I’m on social media both to market my business and to create relationships. Knowing that I need to add content marketing is the reason why I come up with a content plan before I enter the sites.

Knowing what your audience wants to see.

If you don’t know what type of content your customer is interested in, then do some research on your target audience. Figure out where they already hang out and what types of content pieces are already resonating with them. This is a clue as to the types of content you can potentially share with them.

One of my clients has a retail-based business. I know that when I find content which is retail specific or customer service focused, my client would be interested. I curate it and share it with them in a way that they will receive and read it.

Once you identify what your target audience wants to see, organize this content into themes.

Create five themes and 10 sub-themes to post about on social media.

Let’s say your target audience is interested in learning more about social media. Break this down more specifically. In this specific case, the topic of Facebook can be one theme that you post about. Twitter can be another theme.

Sub-themes are smaller topics that relate to the theme. If your theme is Facebook, your sub-themes can include Facebook ads, Facebook pages, Facebook graphics and Facebook groups. These are all separate topics related to the main theme.

Once you organize these five themes and 10 sub-themes, it’s time to create the content and the content plan.

Where do you find content for your audience?

Create original content based on those sub-themes that you created. You can get content from your blog posts or just from your expertise. For example, if I want to post about Facebook ads I can find relevant blog post that I have previously written about and create social media posts from this content.

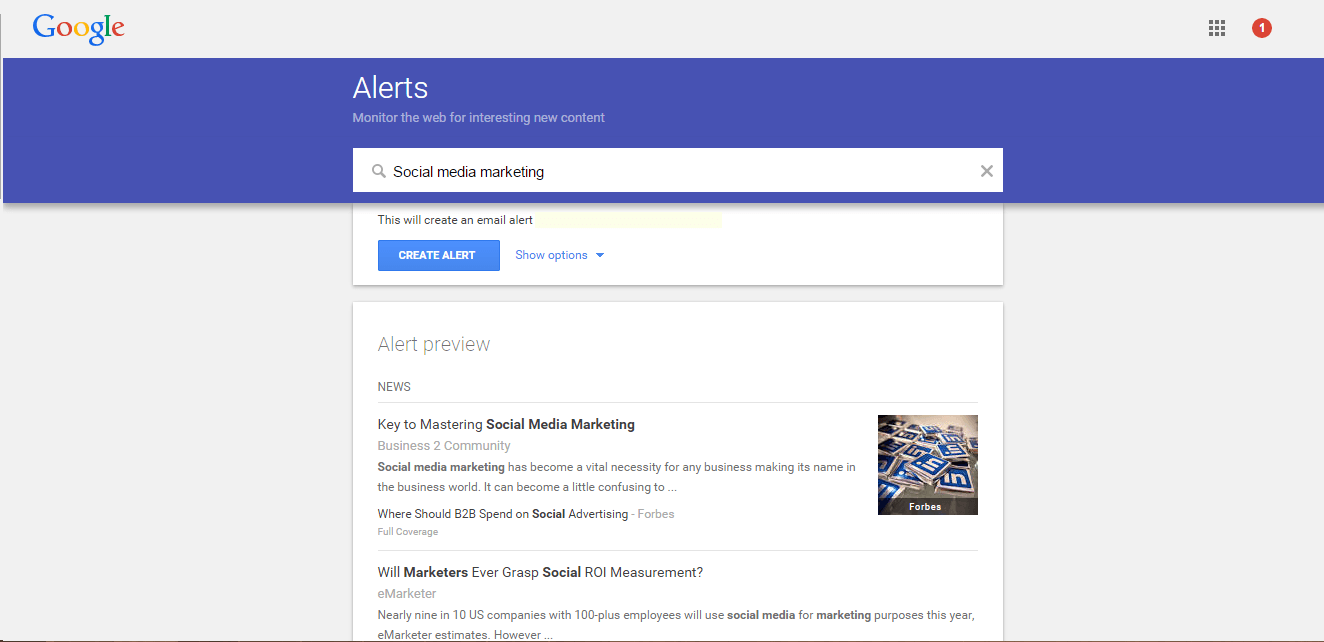

The other content you can share is other people’s content. To find content relevant to the themes that you have identified set up Google Alerts. Google will then alert you when they find new content related to the terms you set up.

To do this, use the information you found after researching your target market. Go to www.google.com/alerts and type in the topic that you are interested in. Click “Create Alert”. You will then be notified via email of content created with that topic.

By this point you are well on your way to creating your plan. You have identified your goals for the social media platform (i.e. use it to market your services, become an industry leader, etc.), identified your target audience, listed all the topics you will specifically post about, and created a pool of original posts as well as other shareable content.

Now it’s time schedule these posts.

Decide at what times a day you will post, and on which platforms you will post on and then schedule the posts. You can use one post and share it across different social media sites.

By taking these steps you will no longer go onto social media pointlessly, try to come up with content on the spot and get lost in your newsfeeds. You will know exactly what you need to post to reach your goals and your target audience, and you will where to get the information for the posts.

Finally, book time in your schedule to create and publish these posts so that you only have to spend one time per week on social media.

If you tap into your audience and share content that you know they are going to enjoy, you will spend less time throwing spaghetti at the wall to see what sticks and more time delivering interesting content with high value.

Featured photo credit: Clock/Pixabay via pixabay.com