Mobile apps are quickly becoming one major way we run our daily lives. But when it comes to more important matters,like personal finance and household budgeting, there are some apps out there that are really worth their weight in gold.

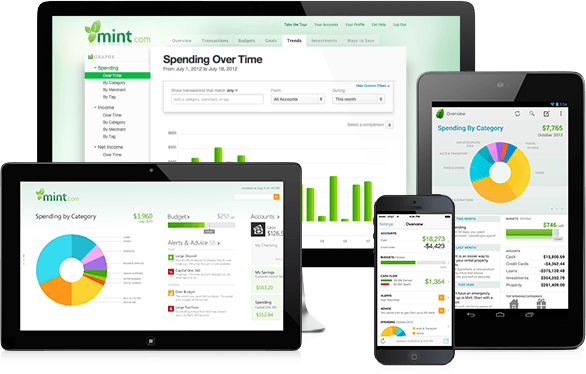

1. Mint

Mint allows you to pull all of your personal finance accounts into one place so you can manage your money from anywhere. You can track your spending, create a budget, and get bill alerts and reminders from this mobile app that allows you to see all of your accounts – checking, savings, and credit cards – in one place.

Download Mint here. (Reviews here)

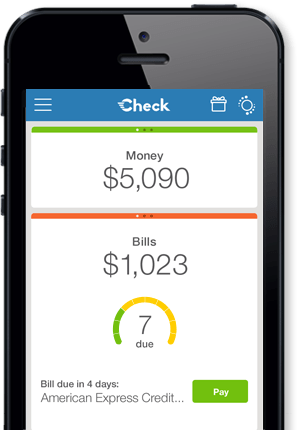

2. Check (formerly Pageonce)

This app is a very simple and easy to use tool to help you remember when payments are due and to create monthly budgets. Check stays on top of your bills and money for you, so you can avoid missing a bill payment or getting hit with late fees. When bills are due or funds are low, the app will let you know so you can address the issue before it becomes a problem.

Download Check here. (Reviews here)

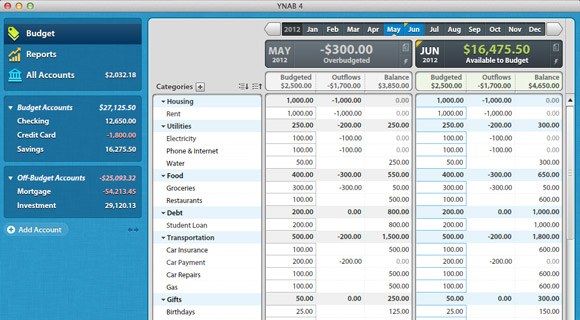

3. You Need a Budget

As the name suggests, YNAB helps you build a reasonable budget and stick to it to help you get out of debt. It helps you make smarter decisions when it comes to purchases by giving you an overall picture of what your financial situation looks like. It is subscription based, which will cost you $60.00, but offers a free 34 day initial trial period before you commit to buying.

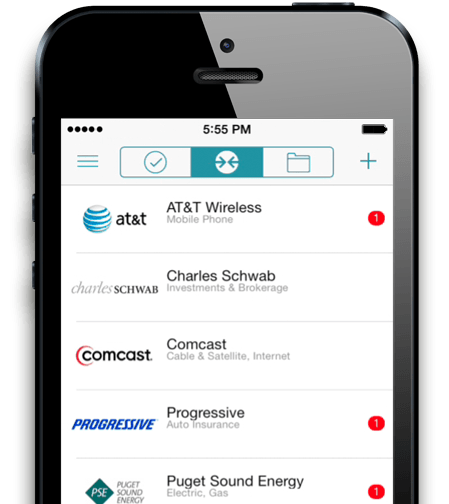

4. Doxo

Doxo is a new app, created based on the success of social media apps like Facebook and Twitter. Doxo allows you to centralize all of your important family information into one organized space, helping you move beyond financial management and into household management. It allows you to back-up important family documents, manage household payments, and connect with utility and service providers.

Download it here. (Reviews here)

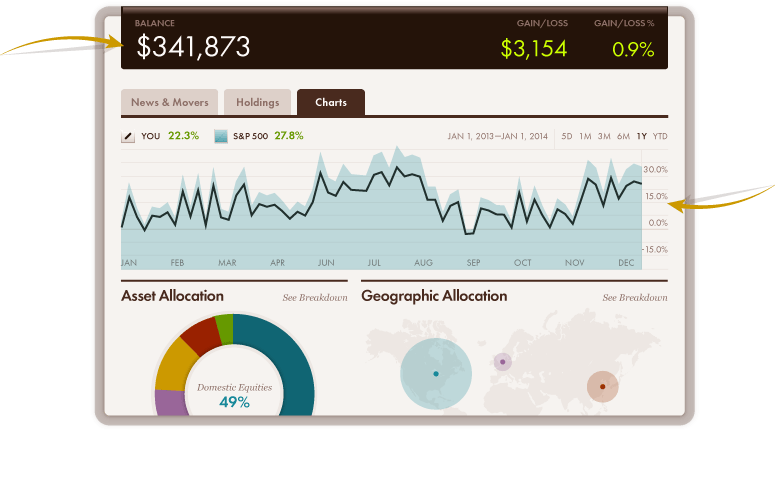

5. SigFig

SigFig is a mobile app that will design you a professionally diversified investment portfolio, monitor it, and automatically make the necessary changes to keep it on track. Once you sync your accounts (currently works with over 100 brokerages including Fidelity, Vanguard, Schwab, Ameritrade, E*Trade, and Scottrade), it allows you to see all your investments, including your 401K and IRA, in one central place.

Download SigFig here. (Reviews here)

6. Toshl Finance

It’s easy to forget that all of those morning cups of coffee, fast-food lunches, and gas station fill-ups add up. This app tracks it all for you, and was built behind the belief that knowing where your money is at all times is the first step to financial freedom.

Download it here. (Reviews here)

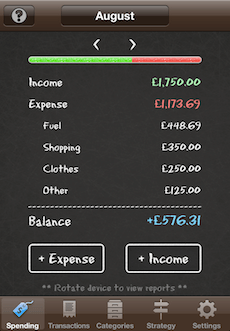

7. Spending Tracker

Spending Tracker is one of the easiest and most user-friendly personal finance apps you can find today. It helps you to track your spending so that you are better able to stick to a budget and save money.

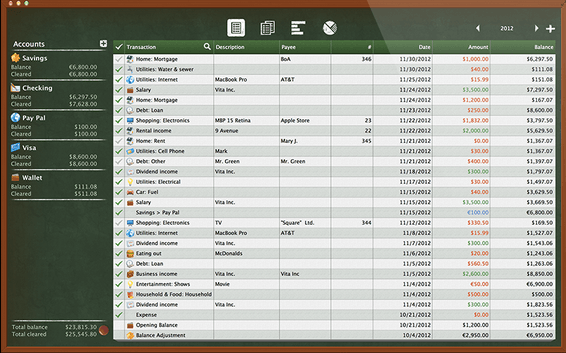

8. Checkbook

Checkbook replaces your paper checkbook with a quicker, more convenient way to manage your daily finances. You can reconcile transactions, save recurring expenses, and schedule items to take place ahead of time.

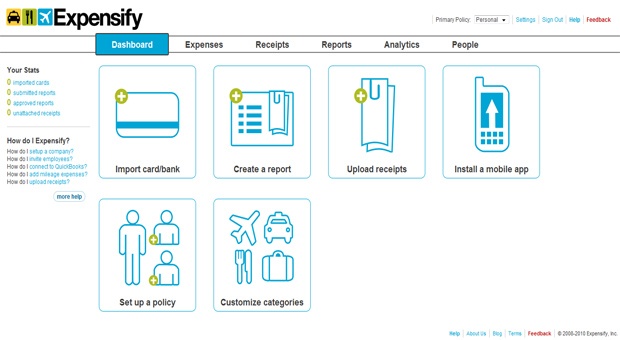

9. Expensify

This mobile app is a must-have for entrepreneurs who have to track their business expenses for reimbursement or tax purposes. Their “SmartScan” technology reads the receipt and records the expense, and the app helps track your mileage and record your business related travel.

Download it here.

10. Mvelopes

Have you ever heard of the envelope system of budgeting? This is where you set your monthly budget for various items and then when you get your paycheck, you literally put cash into different envelopes, each labeled with a different category from your budget. Well, if this budgeting method works for you, then Mvelopes is the app you need.

Download it here.

Many people believe that using apps can help them make real financial progress with both eliminating and preventing debt. If nothing else, it can certainly help you become more disciplined and aware of your spending habits.

Featured photo credit: Ken Teegardin via seniorliving.org