Looking for ways to effectively track, plan, and manage your budgeting? Well, there is a multitude of apps for that! Finance apps are the best options around for tracking and planning your budget and keeping you accountable. After all, using a pen and paper can make it cumbersome to track.

The apps that we’ve listed below do a ton of the heavy lifting for you and provide a wide array of functions to help you with your financial needs.

How to Pick a Suitable Finance App

When looking at some of the best finance apps that are ideal for budgeting, we found these particular features to be important. Keep these in mind when looking for ideal finance apps.

- User interface – Navigation is key in any circumstances of an app. This is especially true for helpful apps like finance apps. You want to be using them regularly. As such, the interface should be simple to navigate.

- Habit building – Finance tracking is all about building money habits, and apps have unique ways of building those habits. There is the app itself but features like push notifications are also essential in some circumstances.

- Syncing – You should be able to connect your bank account to these finance apps, and that process should also be pretty easy to do, too.

- Usefulness – The number of features that the app has should be relevant and make it something you want to check. Sure, some of these finance apps work in the background, but those on this list help significantly when you check them regularly.

- Data presentation – The number of reports and analytical data is a core focus for these finance apps as well since it allows you to make sound financial decisions.

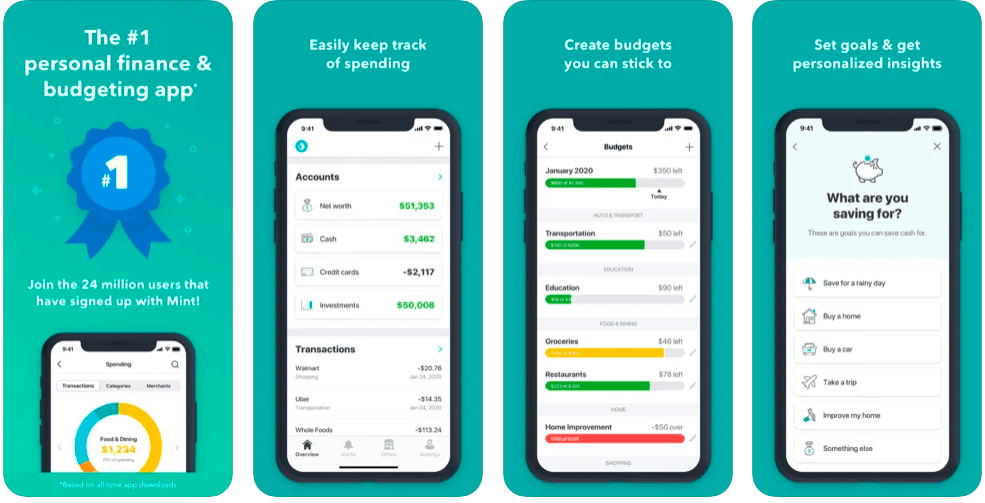

1. Best Finance App Overall – Mint

If you’re looking for an overall quality finance app, Mint is the first that comes to mind. It’s one of the most well-known personal finance apps around and for good reason. It provides you with a complete financial picture all in one place.

By connecting your debit and credit cards to your account, Mint will provide you with a list of transactions and break them into categories, showing you exactly where you are spending your money. You can also track billing and create a budget on the app to help you stay on track of your savings goals.

A new feature that Mint rolled out recently is the ability to see your credit score. Through this feature, you can also see the factors that are contributing to your credit score. Beyond that, you can also track investments and schedule routine utility payments.

Download Mint here.

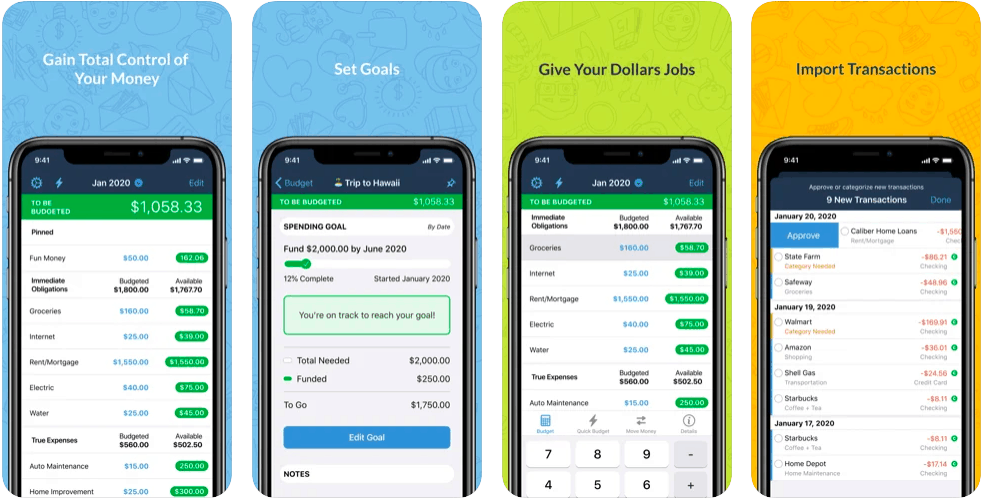

2. Best Finance App for Debt Management – YNAB

You Need A Budget (YNAB) is an app that is built on four rules:

- Give every dollar a job.

- Embrace true expenses.

- Roll with the punches.

- Age your money.

Based on these four rules, the app will help you build a better budget while also allowing you to gain control of your spending. You can import transactions from your checking account and apply them to each budget category to get an accurate look at your spending.

This app also provides detailed reports to show you your spending habits while you are striving to keep a balanced budget in the various categories. YNAB will also point out other spots that you can improve your spending.

According to YNAB, the average user will save about $600 in the first two months and can save over $6,000 in the first year. It sounds promising for a debt management app.

Download You Need A Budget here.

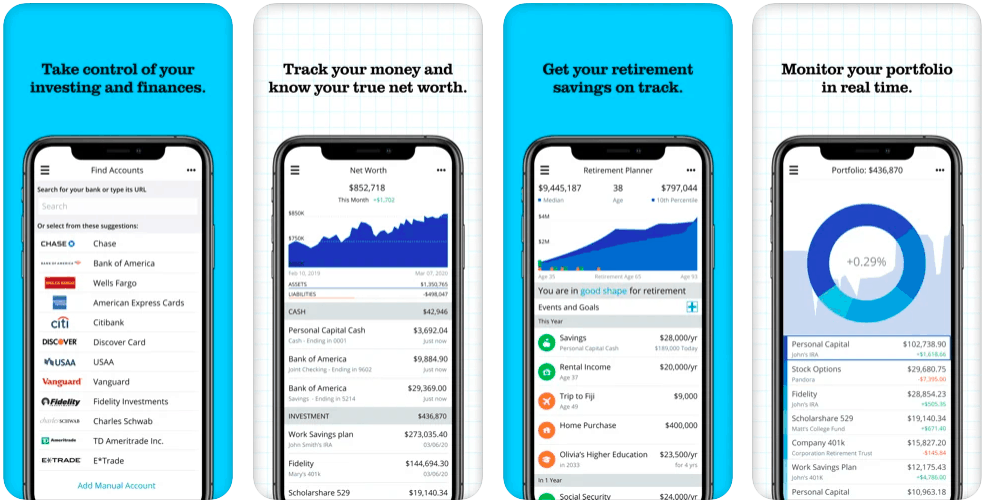

3. Best Wealth Management App – Personal Capital

Another solid choice is Personal Capital. It focuses on wealth management but also serves as another personal finance app. Through this app, you can manage assets and investments along with setting up a budget for everyday spending accounts.

This service integrates with over 14,000 financial institutions, allowing you to link your bank account(s) directly to the app and through it. By linking your bank account to the app, you can track your spending, too.

That said, the app really shines when you connect it to your investing accounts. By doing so, you have a convenient spot to track your portfolio by account, asset class, or individual security. The app can also show you opportunities to diversify, manage risk, and find any hidden fees that you could be paying.

You can also compare your own portfolio to the major market benchmarks to help you keep track of whether you’re on track to reaching your goals. You can also get financial advice from this app as the financial advisors here are registered and can provide you with advice tailored to your goals.

Download Personal Capital here.

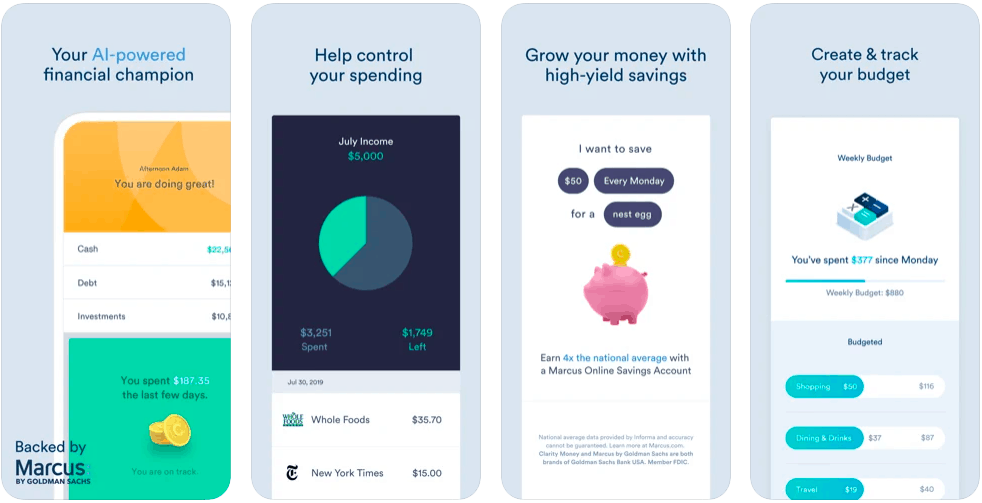

4. Manage Your Subscriptions – Clarity Money

One of the popular business models that companies are moving to these days is subscription-based. While this model does have its merits, one of the many problems that we face with this model as consumers is that we find ourselves subscribed to things we don’t need. Paying for a streaming service is nice, but many people often are subscribed to multiple streaming services.

Because it’s so difficult to remember and even track all the subscriptions we’re paying for, this particular app can provide us with clarity. Clarity Money is all about bringing to light what you are paying for and providing you with a convenient way to cancel and throw away unused subscriptions you’re not using.

Beyond removing unnecessary subscriptions, the app also looks at your spending behavior and offers suggestions for ways to improve your financial health. You can even make deposits to your savings account through this app.

Download Clarity Money here.

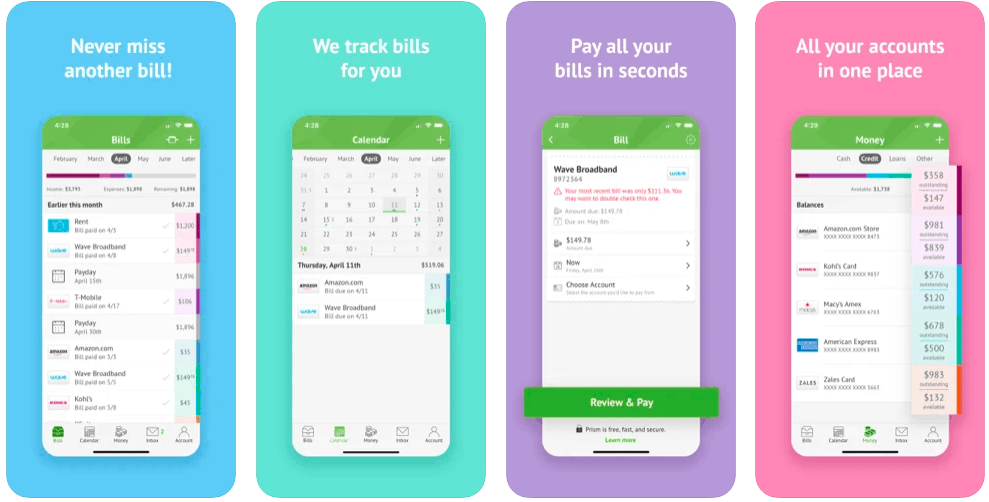

5. Best Bill Paying App – Prism

If you’re looking for a convenient app that shows all of your bills and financial apps, this is the app for you. Prism takes pride in having 11,000 billers on this app. This is the highest amount of billers on bill-paying apps you can find. From billers like large banks to even small utility companies, chances are high that the company you’re paying for accepts this app.

In terms of actual function, you can add your bills to the app and the app will then automatically track it. It’ll send you date reminders to pay the bill as well so you won’t get hit with late payments. On top of that, you can schedule payments to be made the same day or several days in advance as well. Prism is a nice app that allows you to pay bills in one sitting without having to log in to several accounts.

Download Prism here.

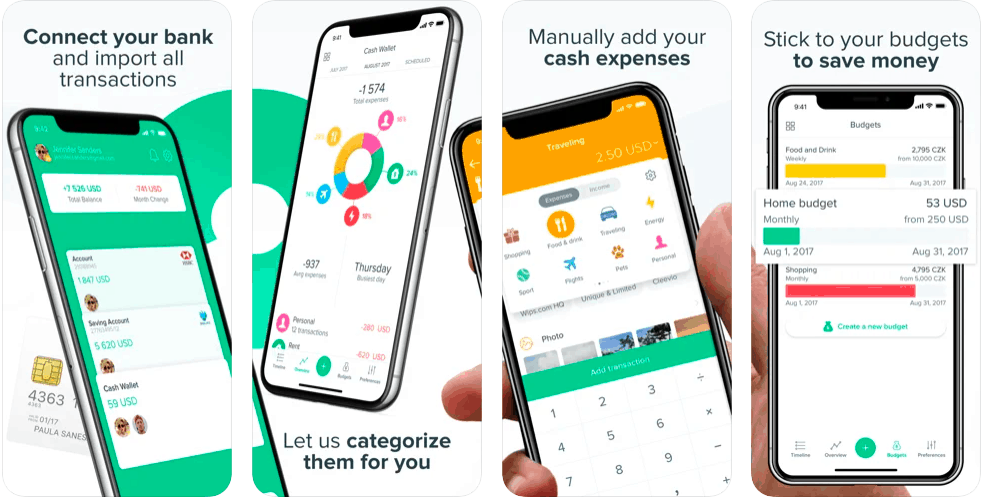

6. Best Shared Expenses Management App – Spendee

Many of these apps are focused on providing services to a single user. This is natural considering most of these apps are asking for your banking information. However, this is one of the few apps on here that allows multiple people to use it.

With Spendee, the idea is to create shared wallets with your friends and family that you can then use to manage shared expenses for a household budget. You will need to get bank transactions for this to work, but that is fine. After that, the app will categorize all of the transactions and tally how you’re spending money every month.

You’ll be able to add cash expenses manually as well for accuracy. Beyond those features, you’ve got bill tracker functionality to ensure you pay your bills and avoid late payments. There is also a budget component that will allow you to save and ensure you don’t overspend.

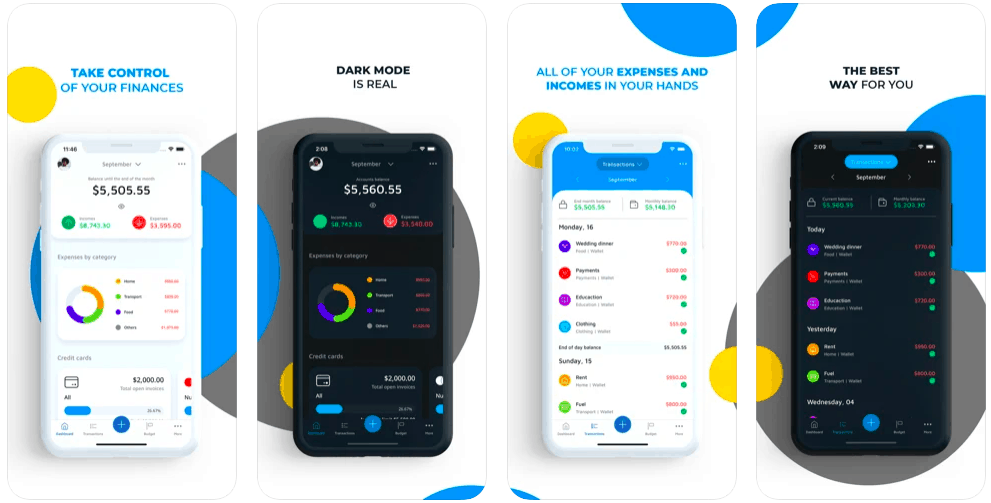

7. Best Visuals on Finance App – Mobills

Mobills is another bill management app that offers a great presentation of information. The app focuses on bill management and offers typical features you can find in these apps. These include categorizing your bills, paying them through the app, and setting up budgets to ensure you stick to them.

That being said, Mobills delivers these features remarkably. It presents you with charts that are completely interactive and can help you analyze your financial life. Also, moving bills to various categories is easy and smooth to do.

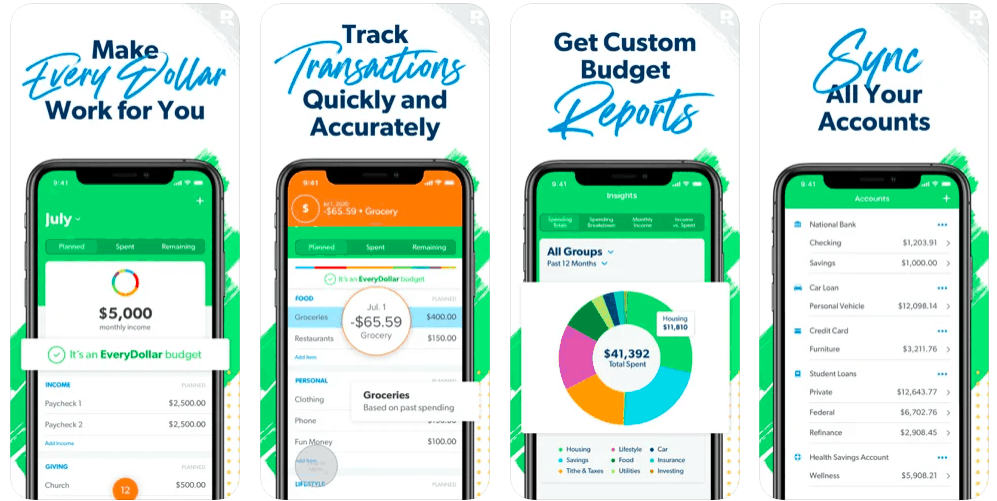

8. Best Finance App for Budgeting Overall – EveryDollar

Dave Ramsey is a personal finance expert who urged people to follow a zero-based budget method. This method is the idea that every dollar serves a purpose in your budget. It’s this concept that has inspired the name of this app: EveryDollar.

With that in mind, the app provides a monthly expense tracker that you can connect your bank account to. This will take note of important transactions to ensure your spending is in check. You can even split expenses between multiple budget items. The tracker also provides you with an overview of how much money you’ve spent this month and what you’ve got left.

Staying true to the name, EveryDollar also has a money management aspect that will help you set up a money management plan. You’ve got access to money management experts who will guide you through financial planning.

Final Thoughts

Many financial apps are available to help you achieve your financial goals. Each app has its own perks and benefits to consider. The nice thing about many of the apps on this list is that they have free trials that allow you to get a good feel of them before fully getting them.

More Finance Apps

- Best 9 Money Management Apps for Easy Financial Planning

- Top 10 Money Management Apps Every Personal Finance Enthusiast Must Use

- 10 Personal Financial Management Apps You Need To Build Wealth

Featured photo credit: Austin Distel via unsplash.com