As the economy continues to improve, more and more people are growing increasingly confident in starting up their own business. The internet provides a great platform for most businesses to start for relatively low expenditure; reducing the need for physical premises which can be very costly. While it does seem a hugely attractive proposition, there are still things the potential start-up needs to plan meticulously to ensure they don’t fall at the first hurdle. Failing to do so usually means the business will fail, when in fact a stricter hold on the planned finances may mean success.

Planning is Key to Success

At the face of it, starting a new business can be a daunting prospect. As well as planning the overall business model, you need to see if you have the capital to get the idea off the ground in its infancy. While the initial outlay for a business is often relatively straight forward for people to calculate as they intuitively understand that they will need to pay for rent, desks, computers and the like, the piece that people find more difficult to model and understand is their cash flow and working capital.

In particular, holding and ordering stock can cause real issues. When stock has to be paid for (for new businesses generally on delivery), and in what quantities it has to be ordered often impacts an early stage business’s cash flow far more than the more easily understood items such as rent, salaries and the like. Obviously if you don’t have sufficient capital to fund the period between paying for your stock and receiving the cash from your sales of that stock, then you won’t be able to continue trading. So this is critical to understand and think about before starting a business. Also, if your customers pay later than they are supposed to and you have staff that are due to be paid, do you have the capital to cover this? These are all things that, although difficult, when planned properly are very manageable issues that your business can sustain.

Free Start-Up Business Budget Planning Tool

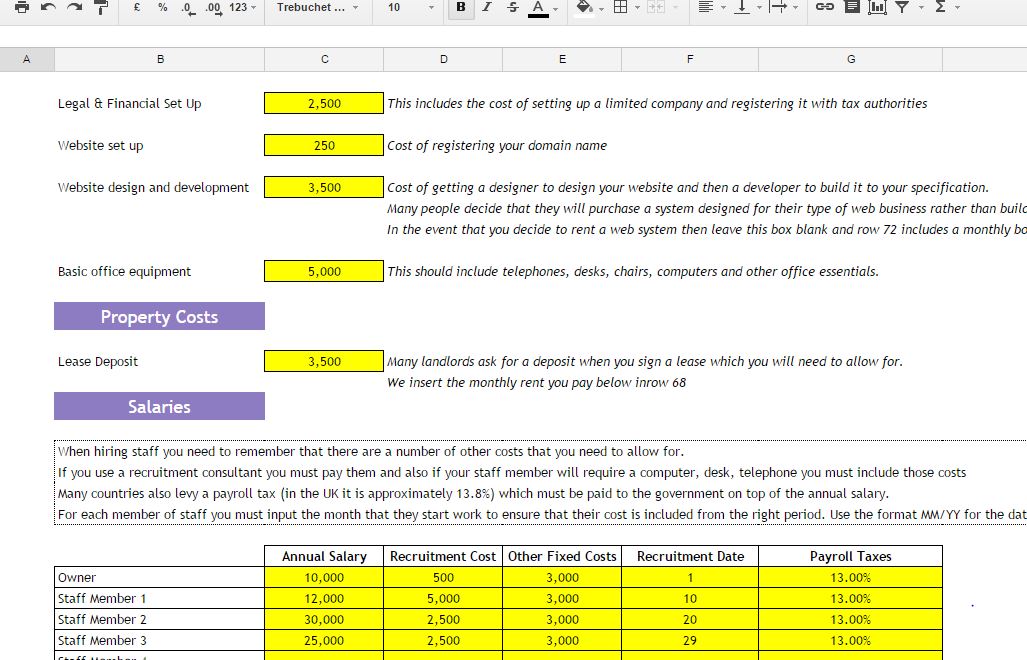

We’ve recently had a number of people on our Excel training courses trying to build financial models to understand how a business that they are looking at might work. Given that, we have created a simple model that can be used to map out all associated costs in the start-up of a new business.

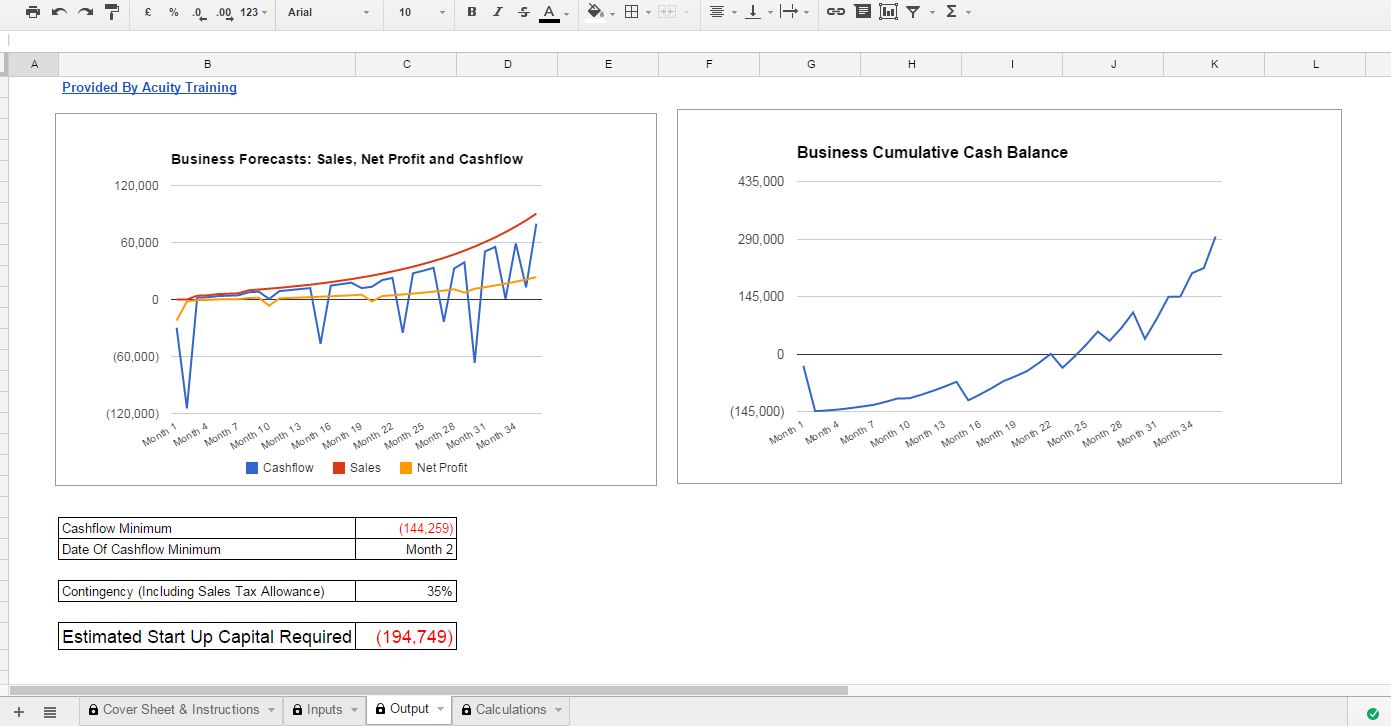

This business plan template is designed to allow you to quickly and simply assess approximately how much capital you need to launch your start up idea. The sheet overleaf ‘Inputs’ asks you to answer a number of straight forward questions and will then automatically generate a set of financial forecasts for your business and estimate how much capital is will require. This is shown on the ‘Outputs’ sheet.

It’s been designed with web based businesses in mind but can easily be used for any small business. If you’re a physical retailer or a cafe your website development and advertising costs won’t be much but equally you’ll have physical fit out costs and ongoing marketing and promotion so just use those boxes for the equivalent for your business.

To use the tool, click the link below, make a copy and fill in your details. It’s that easy.

Start up business plan template supplied by Acuity Training

Please note: these forecasts are for illustrative purposes and should not be relied upon. This financial model is general in nature and you should take appropriate specific detailed professional advice before deciding to start a business. These forecasts should not be treated as a recommendation or endorsement of your business idea and Acuity Training Limited accepts no responsibility actual or implied.

Featured photo credit: Business man/Kim Andre Ballovarre via flickr.com