Do you want to become a billionaire? Then quit your job and forget your own path. That’s the advice of the second annual Billionaire Census.

According to the census, “Entrepreneurialism and private wealth are key to becoming a billionaire.”

There’s no mention of a lifetime of frugality, 401K, nor working the way up the corporate ladder.

If you didn’t already have the motivation to quit your job and pursue that idea that’s been rattling around in your head, you might have it after reading the report (or watching the video about it).

The census, conducted by Singapore-based ultra high net worth firm Wealth X, reveals that 81 percent of the world’s billionaires made the majority of their fortunes themselves.

Broken down further, it’s seen that 55 percent made all their wealth themselves, and 26 percent inherited a portion of their wealth and converted it into billions.

The other biologically blessed 19 percent of billionaires inherited their entire fortune (You’re the best, mom and dad!).

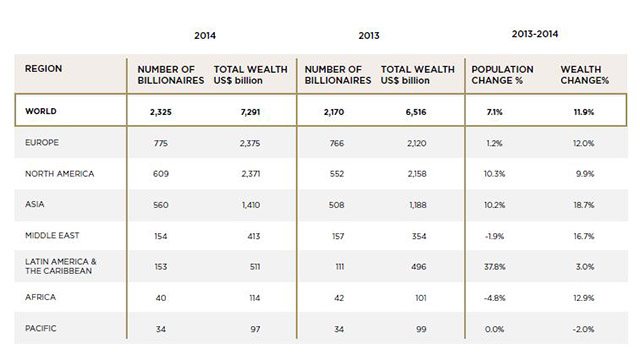

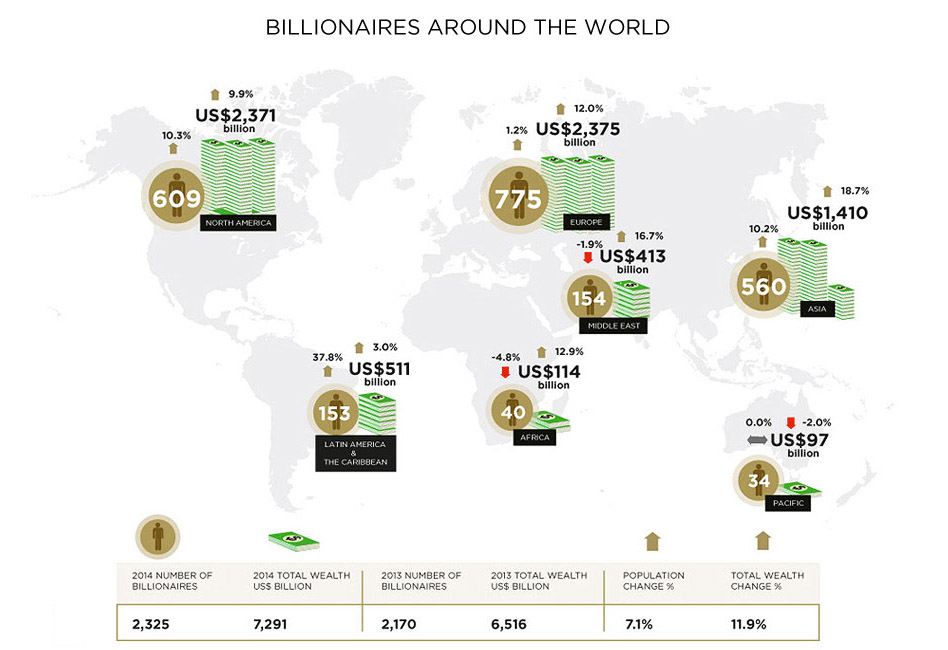

One-hundred and fifty five folks joined the illustrious billionaire ranks over the past year, swelling numbers to 2,325.

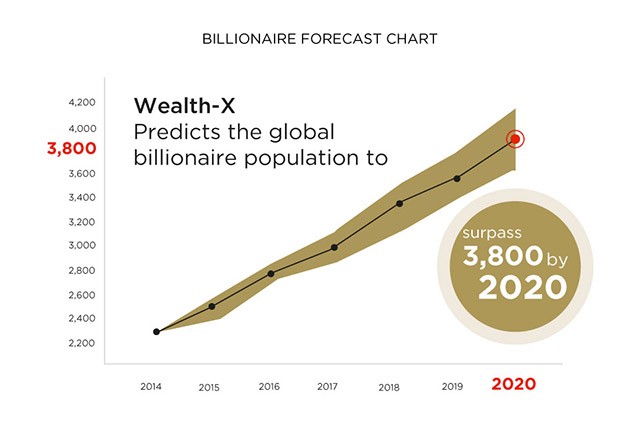

Wealth X predicts that by 2020 there will be 3,873.

So get crackin’, that’s 1,548 spots waiting to be filled!

Like a mirror of an Olympic medals table, the USA sits atop the list of billionaires with 571, well clear of China in second place.

The census comes with no specific directives about which industry to deploy your plan in to reach that elusive billion.

It suggests that there are billions to be made in most areas; though there is a predisposition for the finance, banking and investment industries.

What is clear is that working for “The Man” for a lifetime is almost guaranteed not to reward you with billionaire-scale riches.

It shows that entrepreneurial grinding and hustling is the best road to a billion dollars. A little startup cash doesn’t go astray, either, as 26% of billionaires will attest.

Combined, the world’s billionaires are worth $7.3 trillion. The top four are each worth more than $50 billion.

That’s a hell of a lot of money even they couldn’t afford to complete construction of the Death Star.

On average, the members of the Billionaire’s Club keep $600 million of their assets in cash. You know, just in case.

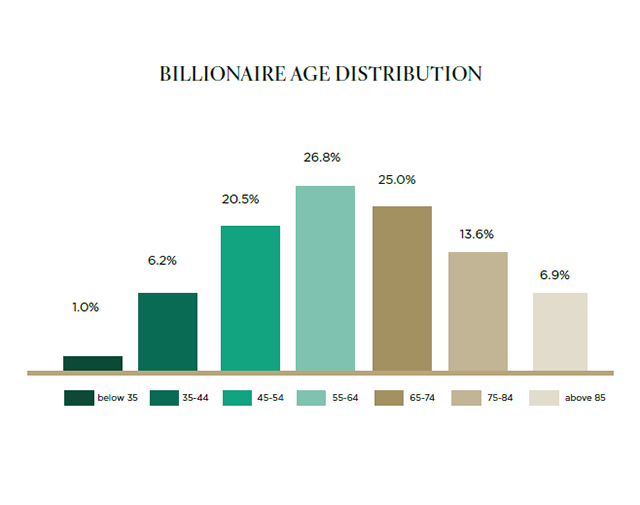

Shaking the newfound perception of youthful tech billionaires, the census shows the average age of billionaires is 63, and it typically took around 45 years for each of them to reach a billion dollars.

So don’t be so down on yourself if you’ve reached 30 without making your first billion.

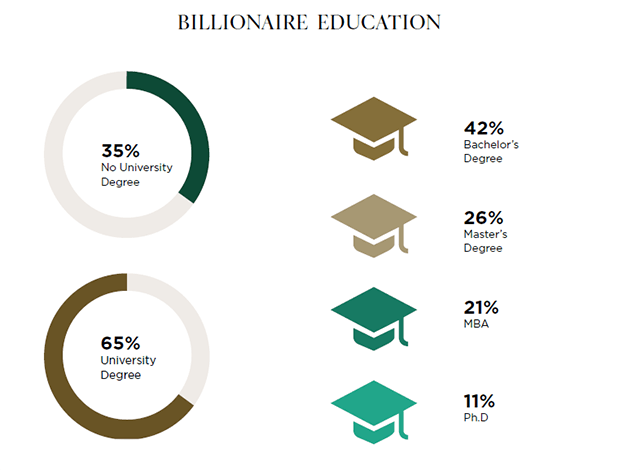

A college degree isn’t mandatory to reach the billionaire level, according to the census, but it does help.

Thirty-five percent have no degree, compared to 65% who completed their studies.

Just over one-fifth of the world’s billionaires hold an MBA.

The University of Pennsylvania (Go Quakers!) is responsible for the most billionaires, making their founder Benjamin Franklin proud and further justifying his place on the $100 bill, by churning out 25 billionaires.

The super wealthy have a tendency to give, on average they each donate $100 million to charity over the course of their lifetime.

A billion dollars is a long way off for most entrepreneurs, especially those starting out.

It is a goal that sneakily creeps into the mind of any budding business owner. But be careful not to become to enamoured with this distant monetary halo.

Focus on providing value now, that can bring the fortunes later.

Alternatively, if you’re not planning to start your own business and don’t have any billionaire relatives nearing the end, there’s always the, ahem, “other” way to make yourself a billion: 3.1 percent of billionaires are single.

Check out the full report here: https://www.billionairecensus.com/home.php