It’s time for a new set of wheels. Maybe you’re ready for something newer, faster, bigger. Or maybe your current ride is collecting problems faster than your paycheck can cover. Either way, you need to get as much money as possible from your old car. But stumble into one of these common pitfalls, and you could lose hundreds of dollars or blow the sale entirely.

Here are five of the worst mistakes to make when you are selling a car, and how you can avoid them:

Skip the Wash

If your car is full of dog hair, stale cheerios and food wrappers, the trash distracts a potential buyer from seeing your car’s actual condition. A washed car always looks better and a clean interior always smells better, making your ride more enticing all around. This also shows the buyer that you take care of your car.

At the very least, do a thorough vacuum and scrubdown. With this illustrated guide, washing and drying will take you about an hour. Plan on a full detailing if your asking price is more than $5,000. This includes shining the interior, washing the windows inside and out, and applying a glossy new coat of wax.

Head Straight to the Dealer

One of the easiest ways to unload your old car is to trade it in at the car dealer, where selling and buying happen in one step. However, this gets you the least amount of money for your car. Trading in a 2009 Hyundai Elantra (for example) nets you a $5,400 credit at the dealer, but puts $6,800 in your pocket if you sell the car yourself. Overall you’ll save several hundred dollars, even if you need to rent a car for a few days before you buy your next set of wheels.

Use the Wrong Price

Many people don’t realize there is more than one blue book — using the right price from the right book makes a big difference. The well-known NADA Guide lists retail prices for dealers and banks but isn’t a good source when selling your own car. Use a site like Kelley Blue Book to find the private party value (the term for selling your car directly to another person). Enter in your zip code, select your car’s options and estimate its condition to determine fair market value.

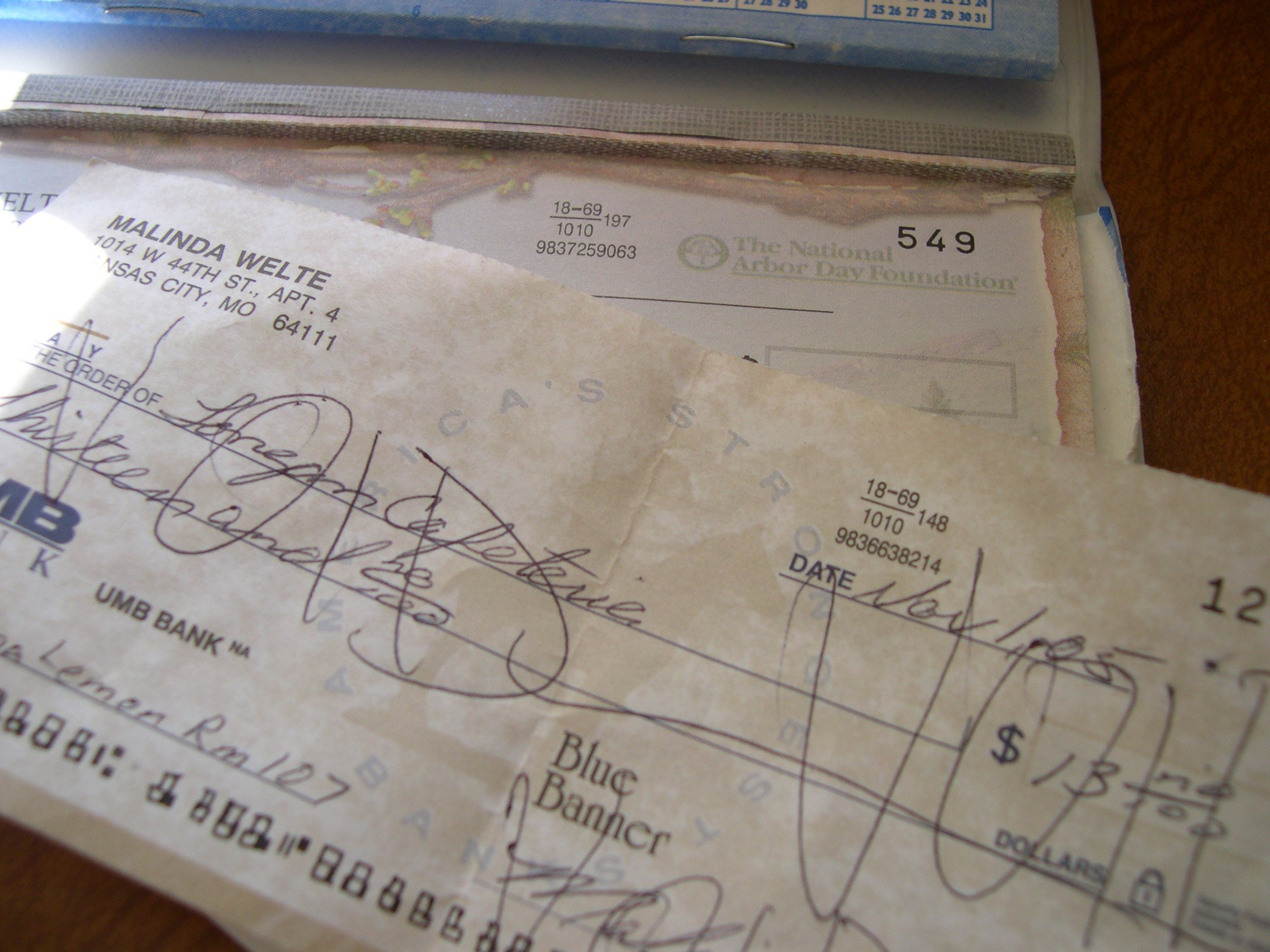

Forgetting the Paperwork

Before you list your car, get all of the paperwork together. Make sure you know where the title is and get two copies of a bill of sale (one for you, one for the buyer). These are often available for free at your local DMV office; if you use a blank template, make sure it’s valid for your state. Keeping a copy of the bill of sale is important for two reasons: first, it helps protect you from liability if the buyer is in an accident before they transfer the title into their name. Second, the “as-is, where-is” clause reiterates that you aren’t including any warranty or making any promises about the condition of the car. Ultimately, it’s up to the buyer to inspect the car for mechanical issues before they buy.

Take a Check

Scams with cashier’s checks have been in the news for years. If you aren’t familiar with this rip-off, it goes like this: You get an email from someone that’s living in another town or out of the country or otherwise unavailable. They want to buy your car sight unseen and send you a cashier’s check for the full asking price. It sounds too good to be true because it is — resist the temptation of this seemingly quick sale. But even if a buyer meets you in person, it’s generally not a good idea to accept a cashier’s check (which may be forged) or a personal check (which can have the payment stopped after they drive away). It’s best to take cash only. If you feel uncomfortable driving around with thousands of dollars in your pocket, have the buyer meet you at your bank to finalize the sale.