Shopping for clothes online is fun, but being faced with thousands of online stores to choose from can be overwhelming, and coming across beautiful yet expensive items can be discouraging. It helps to have a list of highly recommended, chic budget-friendly online stores that offer great deals and allow you to stay within your financial limits. These sixteen online fashion stores offer a variety of stylish, attractive choices for all of your clothing and accessory needs at very affordable prices.

1. 10DollarMall

10DollarMall offers fun, stylish shoes, clothing and accessories for teens and children, and everything is $9.99 or less. Whether you’re looking for dresses, jeans, shorts, tops, swimsuits, sandals, purses, scarves or something else, you’re bound to find it for a cheap price at 10DollarMall, the perfect place to stock up on basics and stylish pieces for the school year or summer.

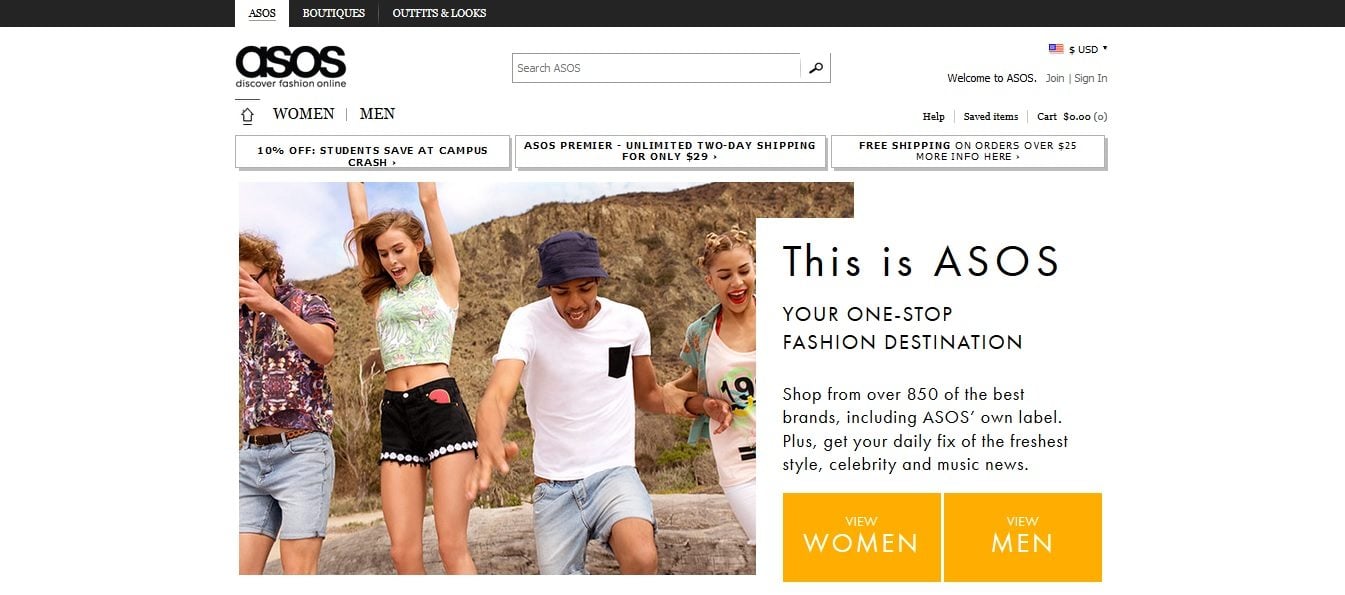

2. ASOS

ASOS is your style destination if you are looking for a place where you can shop the hottest brands of men’s and women’s clothing and accessories at a great value. Pick your favorite brand from their handy alphabetized list, or even shop from ASOS’ own exclusive line. Searching for exactly what you want is easy because you can refine your search by clothing color, style, length, size, price range, or brand. Shop the sale section for the best deals, and don’t forget to use promo code GAME10 to get an extra 10% off sale prices. You’ll even get free shipping on orders that are $25.00 or more.

3. Bella Ella Boutique

Bella Ella Boutique, based out of Utah, is the perfect place to find tasteful, feminine women’s clothing and accessories at prices you will love. Bella Ella Boutique’s fun, colorful clothing provides options for every season and occasion, so you can feel gorgeous and put together wherever you go.

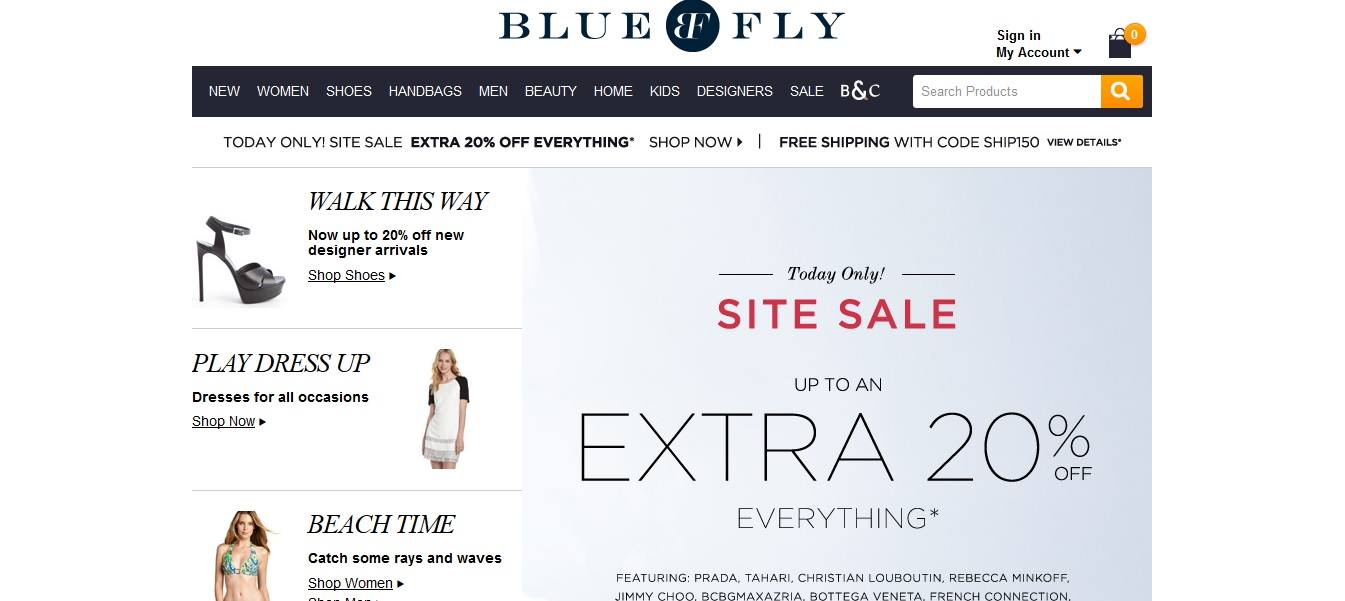

4. Bluefly

Bluefly offers the most fashionable trends and designer brands at the best prices. With tons of markdowns to fit any budget, you can find the best clothing and accessories for men, women and kids. Whether you’re shopping for yourself or someone else, Bluefly has everything you need. There is a complimentary personal shopper service available over the phone or through live chat.

5. Foreign Exchange

Foreign Exchange is a new clothing company with a mission: to represent worldwide cultures through men’s and women’s clothing and accessories. Designers from all around the world contribute to Foreign Exchange’s collection, ensuring every individual will find something perfect for their own unique style. From the office over a night out to the beach, Foreign Exchange will take you anywhere you want to go at prices just right for you.

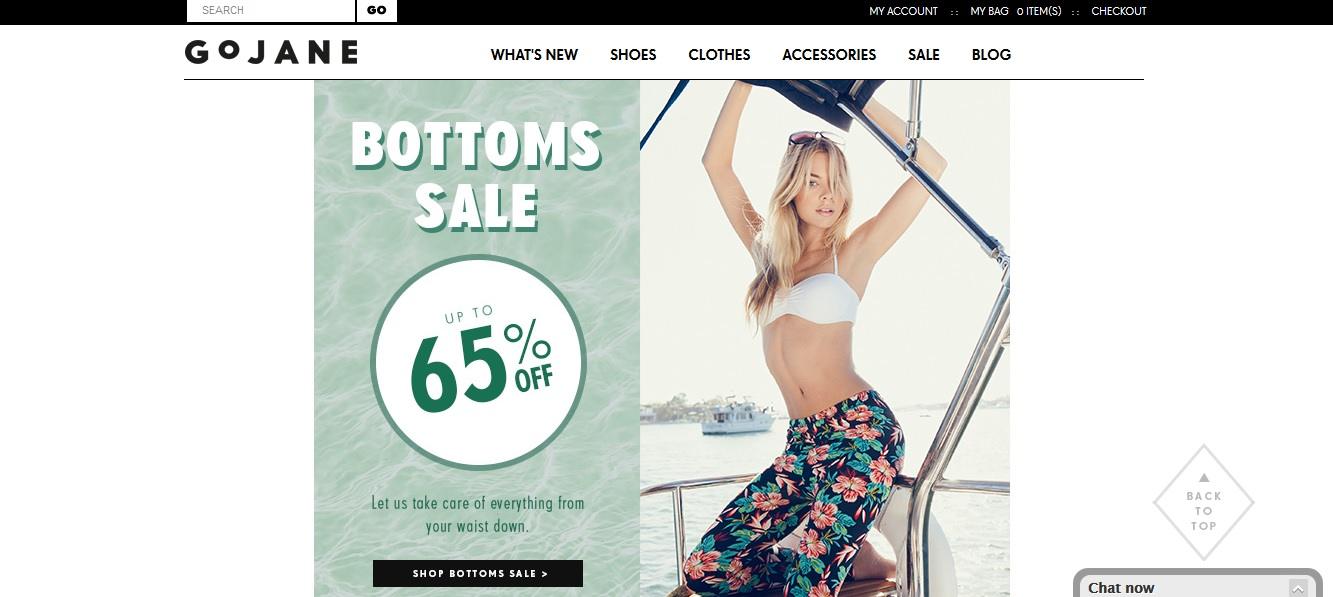

6. GoJane

GoJane is dedicated to finding the hottest styles for trendy young women who are looking for fashionably fun clothing and accessories while on a budget. GoJane dresses are sure to turn heads in vibrant colors and patterns, and shoe fanatics will love GoJane’s extensive footwear collection.

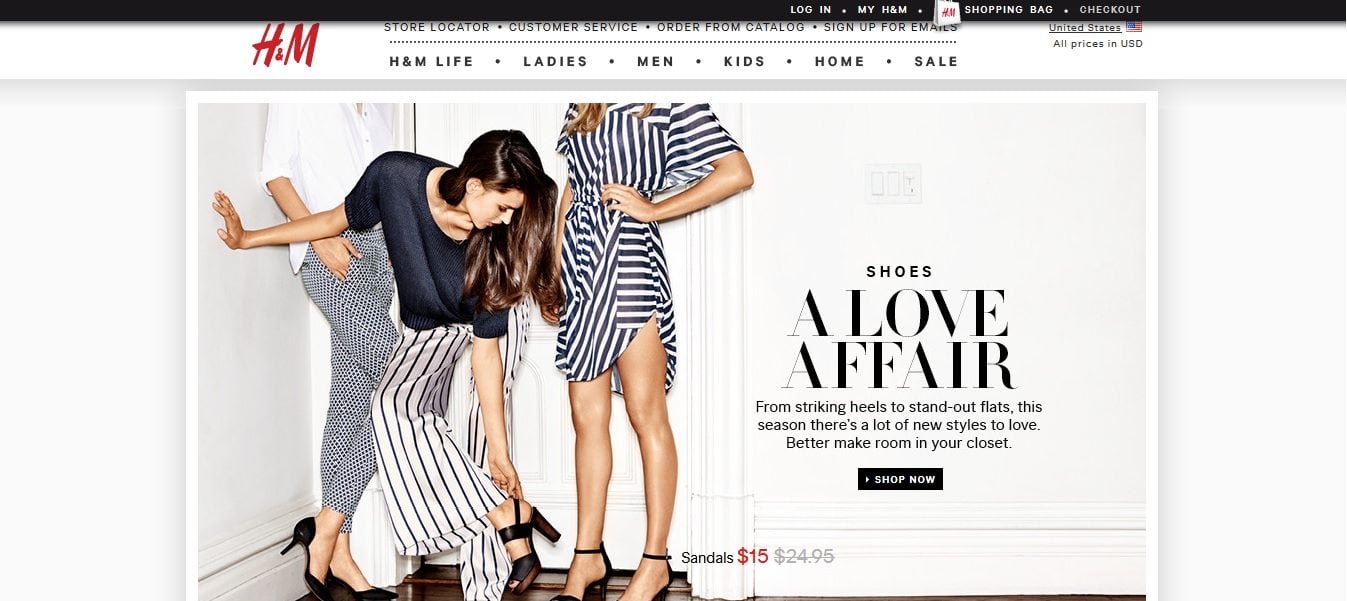

7. H&M

H&M is an international retailer of men’s, women’s and children’s clothing and accessories, with thousands of stores around the world and a dedication to sustainable fashion for the best value. From the hottest trends to the most essential basics, H&M can meet the needs of every wardrobe. H&M’s maternity line helps expecting mothers feel fashionable and chic, and families can find stylish yet durable outfits for babies to children of all ages

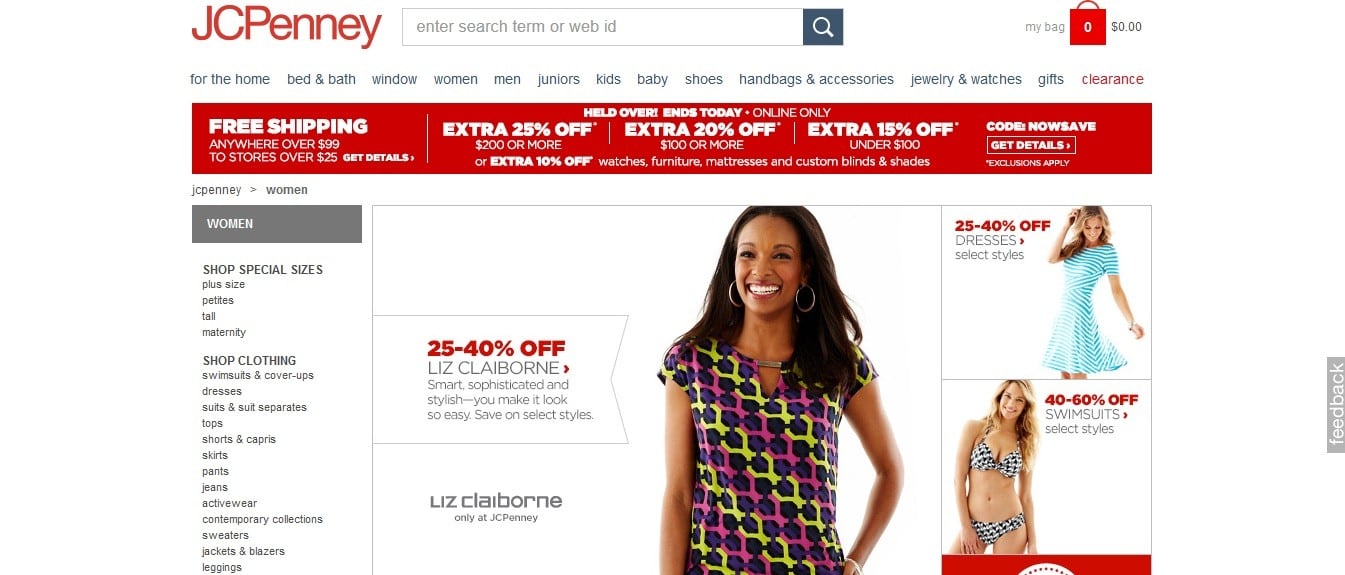

8. JCPenney

JCPenney has been serving the clothing and accessory needs of men, women, juniors, children and babies for more than 100 years. Today, you can still find all the clothing essentials at a great value for every shape and size. Women’s clothing is available in petite, tall, plus size and maternity categories, and men’s clothing is available in young men, big and tall categories. Women love the huge selection of business casual shirts and blouses that offer a flattering and comfortable fit. You can pick up your order at a JCPenney store near you with free shipping to stores with an order over $25.00, or free shipping to your home or office for orders over $99.00.

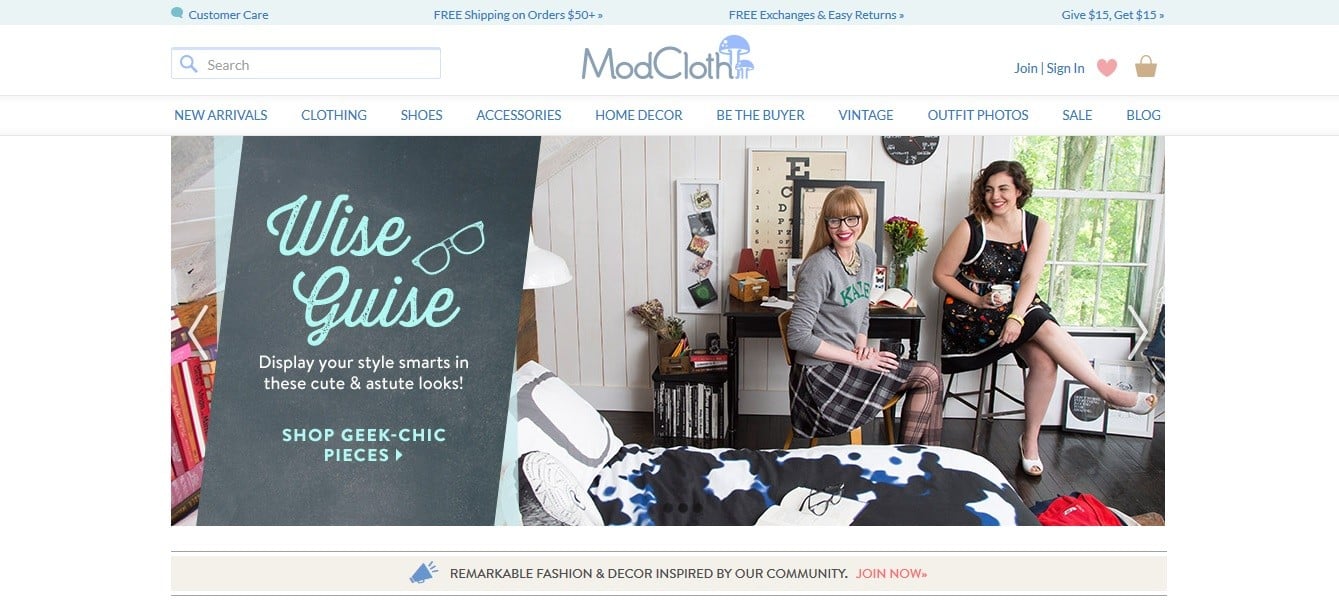

9. ModCloth

ModCloth specializes in vintage-inspired clothing and accessories for juniors and women. From their carefully tailored, sophisticated dresses to their unique, whimsical graphic tees, ModCloth shows incredible attention to detail with every item available. Many product listings include customers wearing the cloth or even videos of a model wearing it with audio commentary on item details and suggestions of complementary pieces.

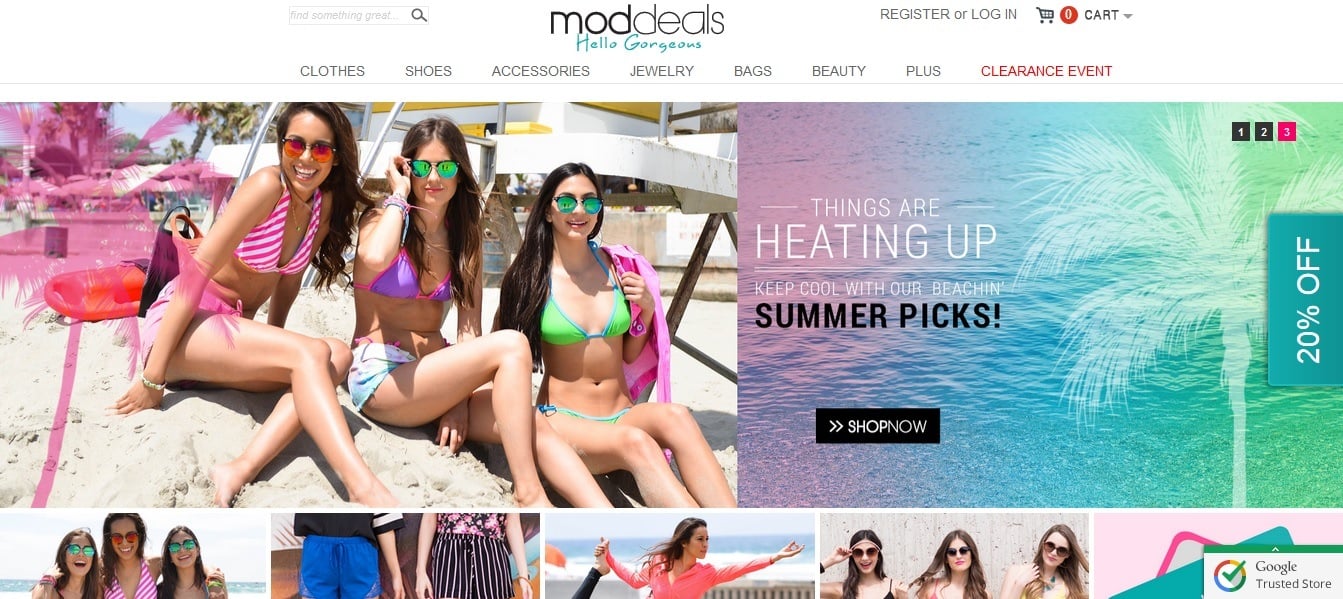

10. ModDeals

ModDeals is a new online store run by experts who search far and wide for the best junior’s fashions and offer items at prices up to 70% off their retail value. You can grab gorgeous dresses for as low as $10.00 each, or stylish cardigans for a steal at $7.50. You can stock up on $5.00 basics and hip $10.00 handbags, too. ModDeals is ready to meet every occasion with quality products at unbeatable prices.

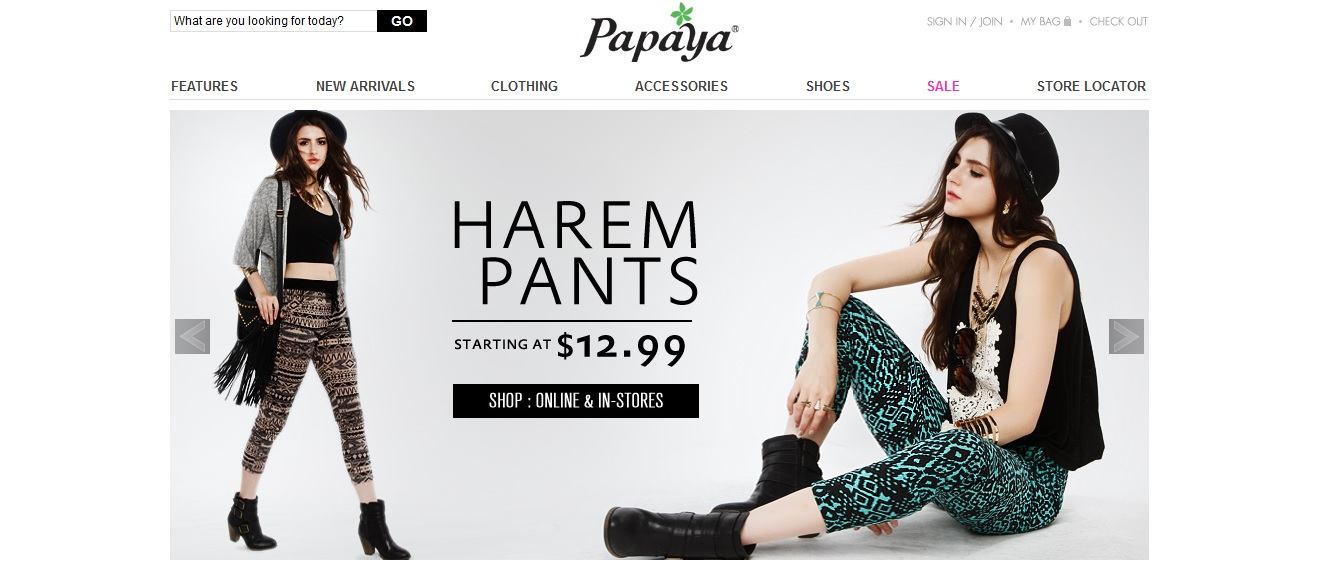

11. Papaya Clothing

Papaya Clothing is an upscale online retailer offering women’s clothing and accessories for ages 16 to 25. Constant sales and hot deals abound for tops, dresses, sandals, swimwear, activewear, summer rompers, and much more. Basics for as low as $2.99 come in tons of colors and styles. It’s easy to find any kind of clothing or accessory to fit your budget with Papaya Clothing.

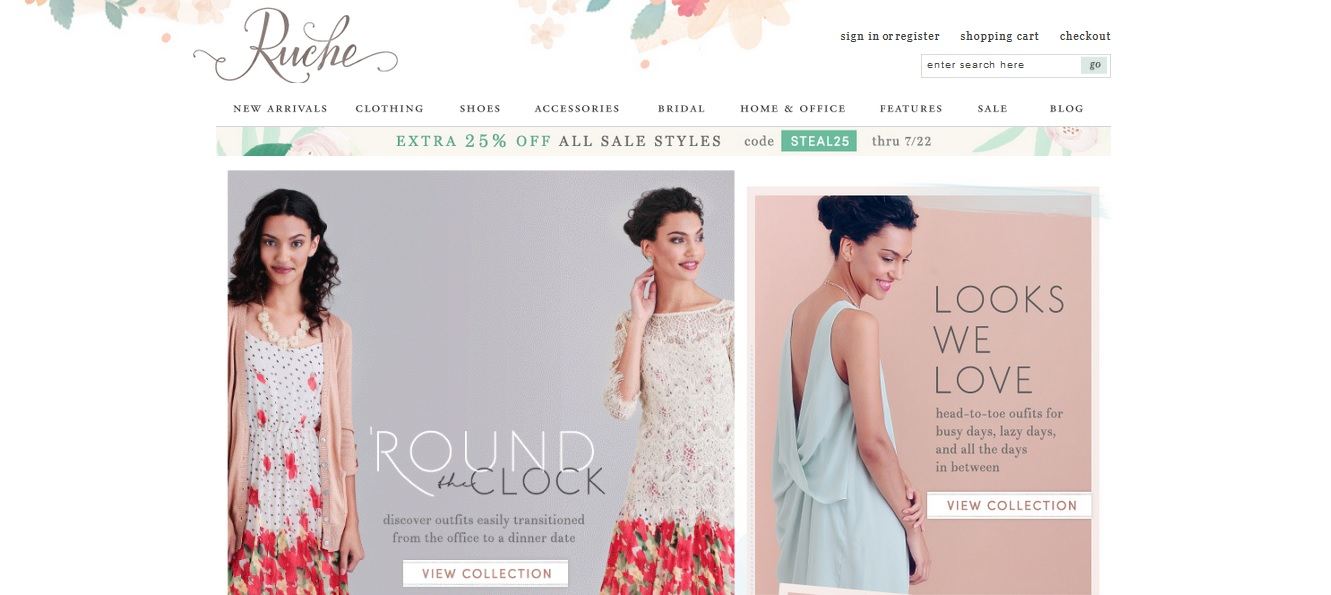

12. Ruche

Ruche is an online clothing retailer lovingly established by Mai and Josh Olivo. Ruche products had their start in an eBay store operated out of the Olivos’ home, which soon grew into a budding startup based in Fullerton, CA. Clothing and accessories from Ruche are elegant, modern, vintage-inspired treasures designed to make women feel sophisticated with an indie flair. Ruche offers everyday women’s wear, a modest line for babies, as well as an exclusive bridal line with simple, affordable wedding dresses, bridesmaid dresses and bridal accessories. “Ruchettes” can feel good about supporting this locally owned retailer that has been encouraging women to live beautifully for six years and going strong.

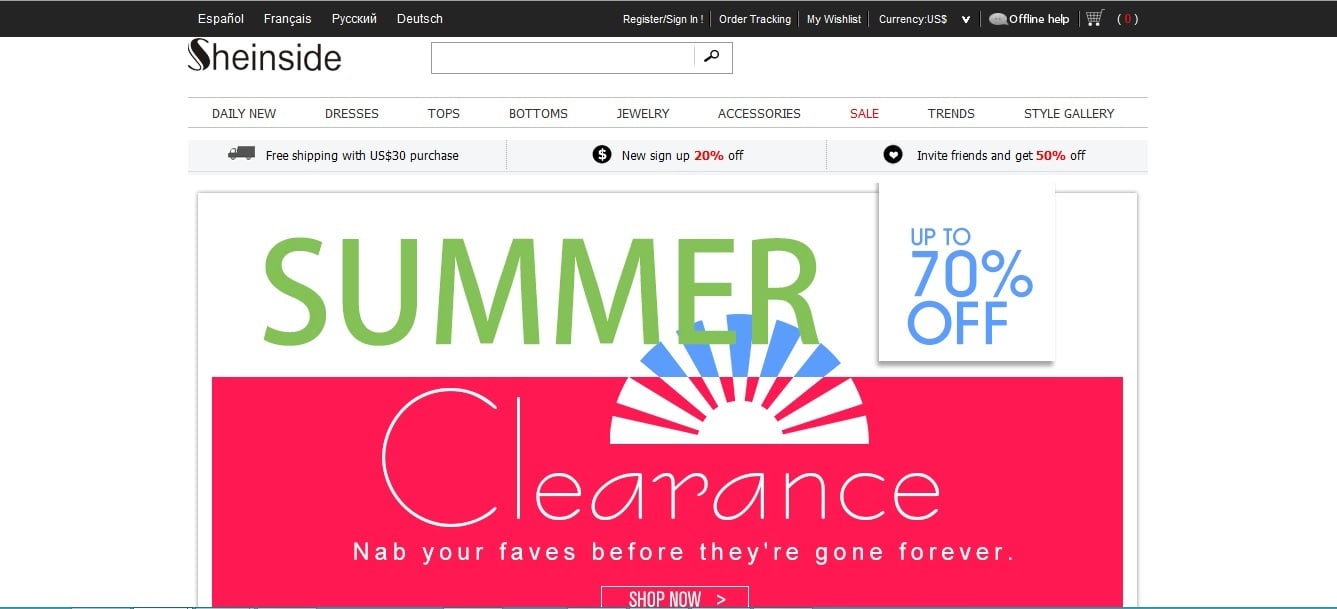

13. SheInside

SheInside, based in China, constantly has its fingertips on the pulse of the fashion market. SheInside brings customers the hottest styles from Paris, London, New York, Shanghai and Tokyo, at affordable prices women love. At SheInside, women ages 18 to 35 can find the most unique pieces that will make them shine like the fashion-forward trendsetters they are, including exclusive pre-sale items, daily new items, and dazzling accessories you can’t find anywhere else.

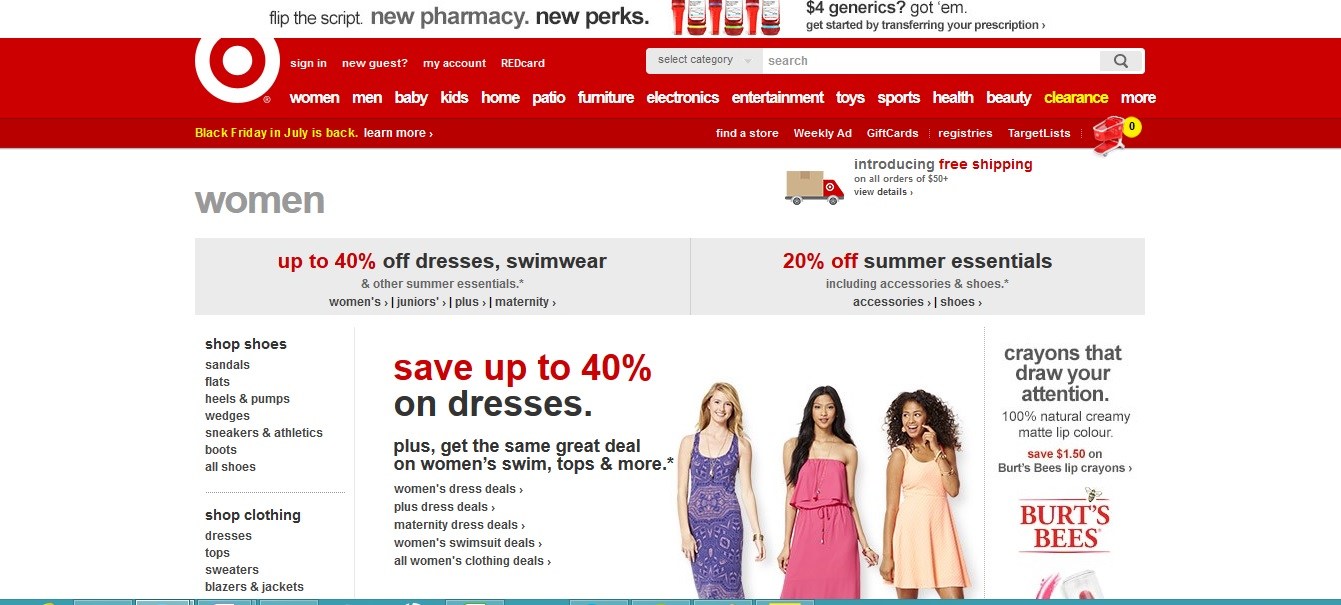

14. Target

Target has been a trusted household name for value, style and simplicity for 52 years. Offering everything from men’s, women’s and juniors’ clothing and accessories to kids’, toddlers’ and infants’ clothing and accessories, Target promises the highest level of customer service to ensure satisfied shoppers both in-store and online. Basics and designer brands alike are available at low prices everyone will love.

15. The Polkadot Alley

Originally just a custom towel wrap brand, The Polkadot Alley expanded into apparel and hasn’t looked back since. A family-run operation, The Polkadot Alley is a fun and fashion forward online boutique that can fit within anyone’s budget, even one of a college student. Additionally, they offer deep discounts on their Facebook page every Wednesday and Sunday night at 8:45pm CST.

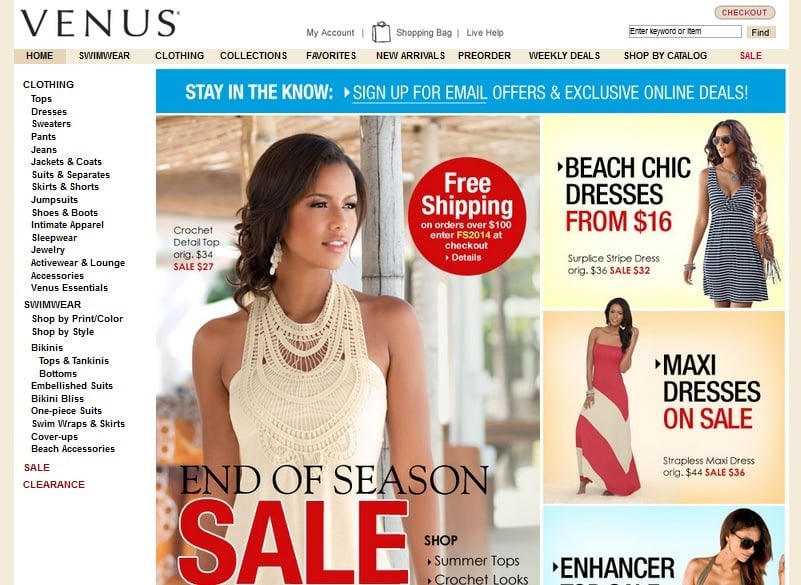

From its start-up beginnings to its current workforce in Florida offices, Venus has been committed to serving the fashion needs of women everywhere since 1982. Venus brings the hottest new styles from the runway to your home with dedicated customer service every step of the way. Venus strives to make every woman feel like a goddess with their quality, stylish clothing items and accessories, from casual wear to glam dresses or suits and separates.

Featured photo credit: Creativa via shutterstock.com