You do not need to spend a fortune to travel. Nowadays, you can go almost anywhere you want on a limited budget. Let’s have a look at some websites which will help you reach your dream destination even if you don’t have a million in the bank. Spice up your travel experience and make your life much easier. I wish I knew of them before I traveled abroad for the first time.

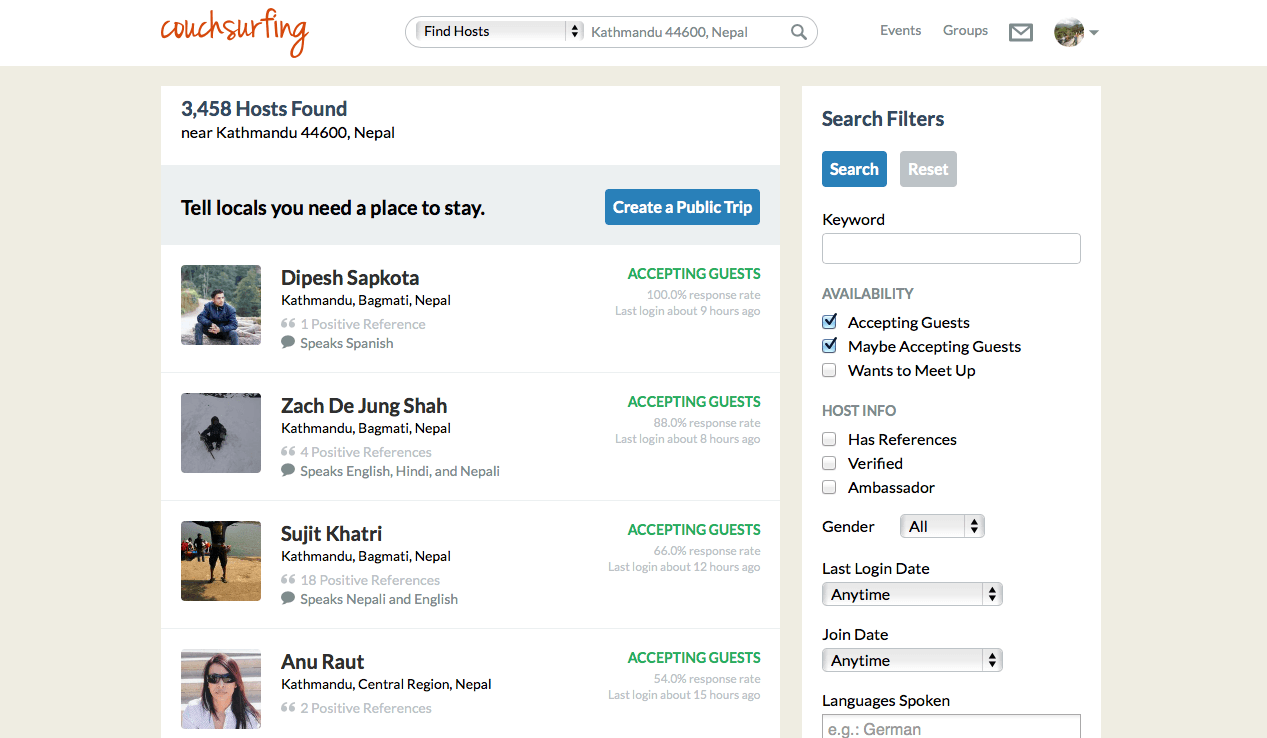

Couchsurfing

Couchsurfing is a network for passionate travelers and hosts who want to meet up with people from around the globe and share their experience and culture. If you want to save money on accommodation and meet a local, Couchsurfing might be the website for you. Sign up and start searching for hosts offering free couches. You can find travel buddies or locals to hang out with. A friend of mine met her husband through Couchsurfing. Seriously. Are you little hesitant to sleep at places of unknown people? Do not be. Everyone who is serious has filed out a profile and provides references. The community of couchsurfers organizes events from time to time. Check if there are some going on in your city and join them. You will meet interesting people and learn how couchsurfing works.

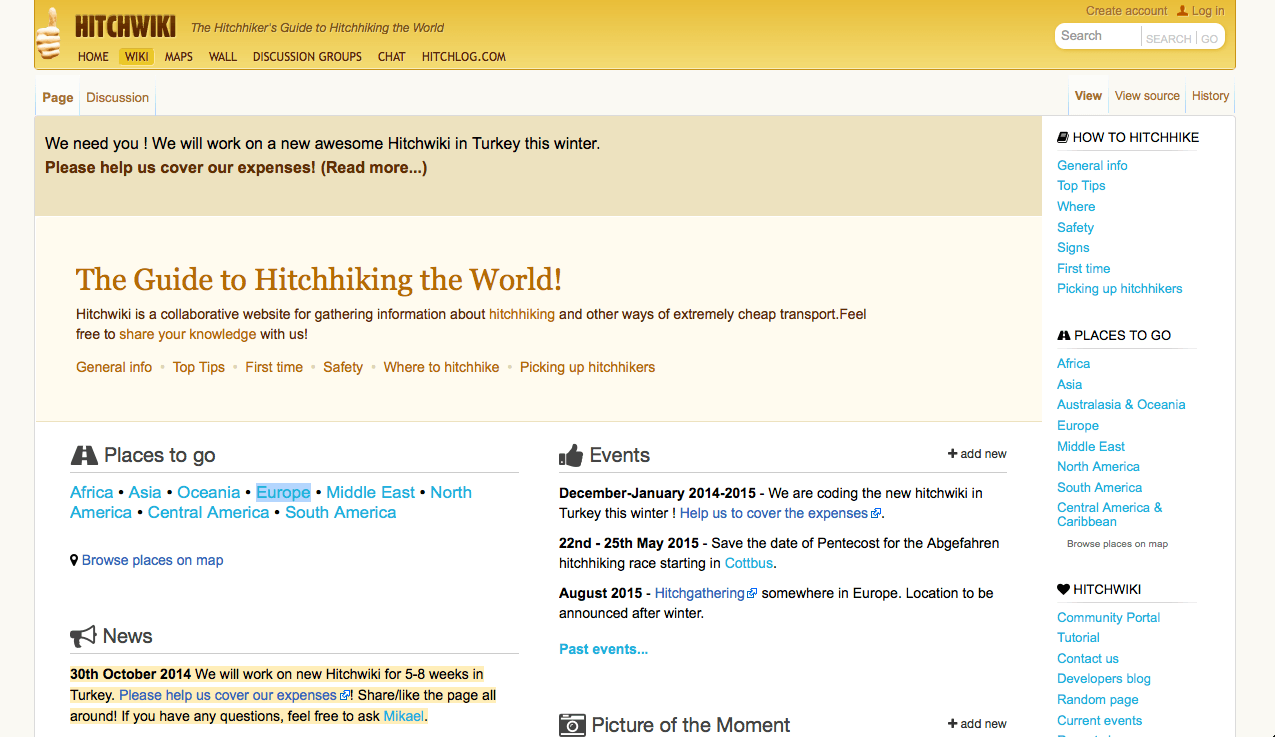

HitchWiki

If you are an adventurer, you might like to try hitchhiking. HitchWiki is a collaborative website made by hitchhikers all around the globe sharing their knowledge from the road. Since this is not the safest way to travel, you better read some stories from experienced people. You will learn how to increase your chances of getting a ride, how to stay safe, how to create a hitchhiking sign and what the status of hitchhiking is in particular countries. If you have any questions, join the discussion group and ask more experienced hitchhikers for their advice.

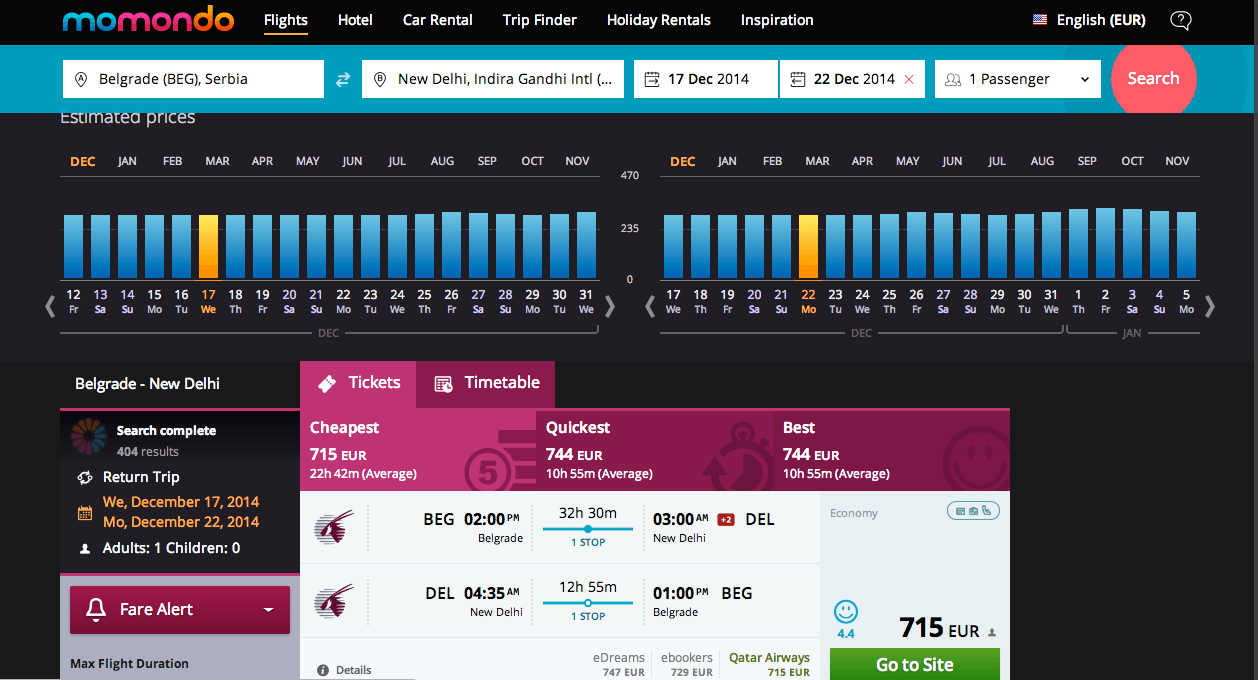

Momondo

Need an airline ticket? Try out momondo. First of all, you get great deals. But if you just feel like traveling and you do not know where, momondo will solve can decide for you. Set up your money limit, airport you are flying from and get a list of all the places you can fly to within your budget. When you click on the city you are interested in, momondo will provide general info about the place, weather info, hotel deals, and ideas for your additional travel from your selected place. To save you some cash, you will also get advice about the best time to buy a ticket.

Staydu

No hotel in the world will give you the same experience as staying with a local. Staydu is a network for budget travelers, who need a place to stay, and hosts, who like to meet new people from different countries. You can get accommodation from the host for free, a small fee or for some help you may be able to offer the host. If you need a travel buddy, sign up and share your plans. There is a chance you will meet one. The only disadvantage is pretty is the low member base compared to stronger websites like Couchsurfing.

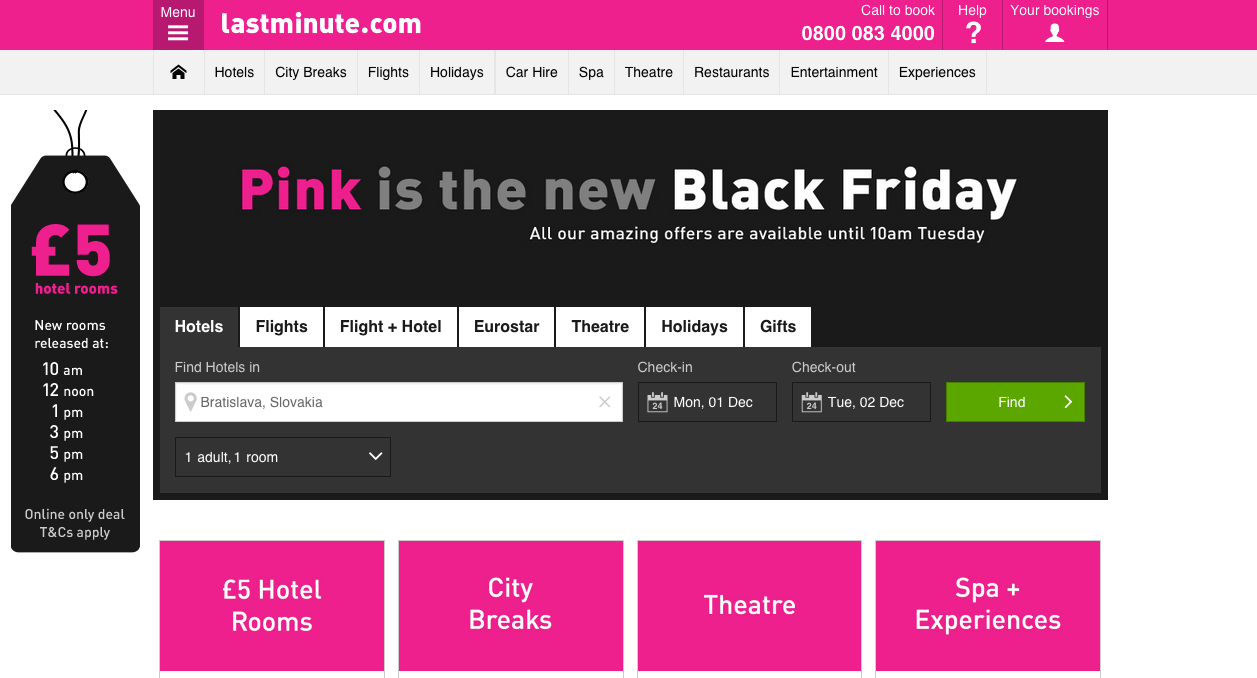

Last Minute

Sometimes you just wake up and you know it is time to do something different. If you belong to this group of spontaneous people, you might like to dig into last minute deals and start your journey immediately. On Lastminute.com, you can find offers for last minute airline tickets, train tickets, attractions and hotels all in one database. Deals on spas, theaters, restaurants and entertainment are available in the UK, USA and some western European countries. Next time you have an idea to go somewhere, first check the last minute deals.

Stay.com

Choose a city and create your own guide. Stay.com has around 100 destinations listed where you can create your personal itinerary. Select the place and pick attractions you would like to visit. You can download your itinerary as a pdf and print it, or you can just download their app for iOS and Android and use it on to go. You can change your list anytime and add new places. I personally like the view options on the map. You do not need to buy maps with tourist attractions anymore. The app works offline and is free.

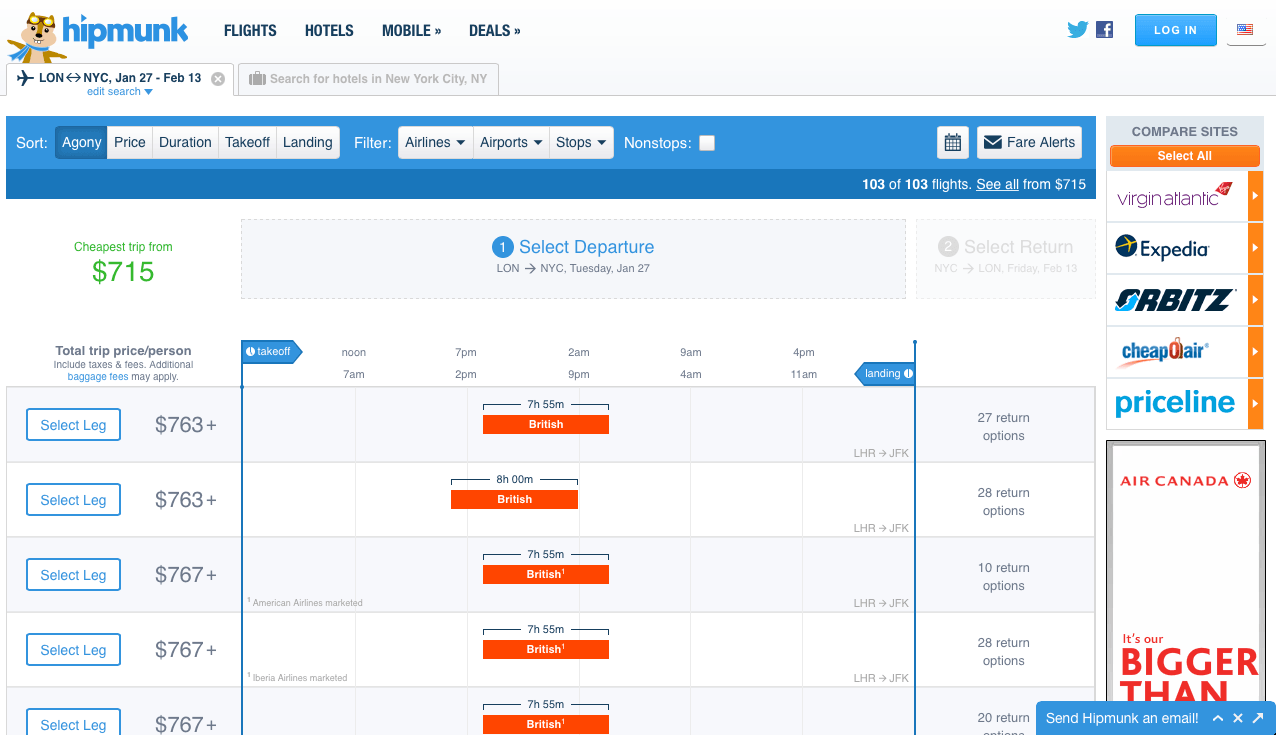

Hipmunk

Flying can be fun. Sometimes. Imagine a flight with 2 or 3 stops lasting a couple of hours. That’s not fun. That’s annoying. Hipmunk is a search engine for airline tickets which compares offers from airlines and travel sites. You can search your flights according to price, duration, take off, landing and AGONY. Agony is combination of price, number of stops and flight duration. Next time you are buying an airline ticket, go check hipmunk and find a flight with good price and less agony.

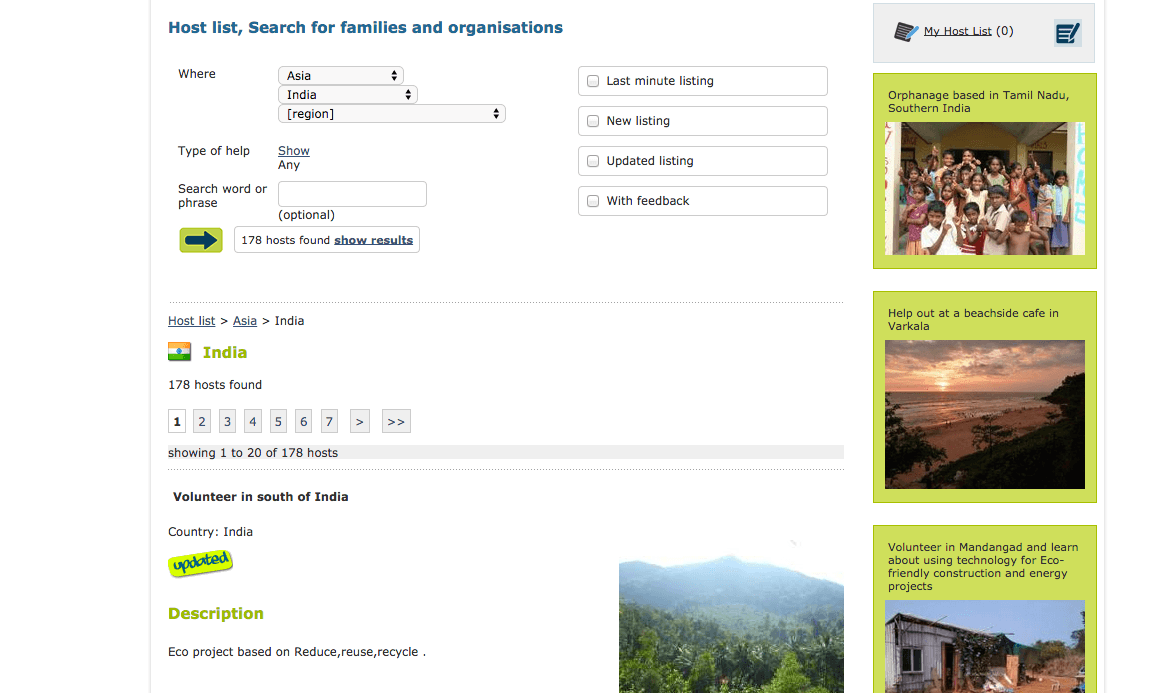

Workaway.info

Learn something new, help someone, meet locals, travel and get free accommodation and food. Sounds like a pretty cool offer, right? On workaway.info you can find small jobs in more than 135 countries around the world. Standard volunteer rate is 5 hours a day for 5 days a week. You can help families or small organisations. Living with locals and learning new skills will make your trip unforgettable.

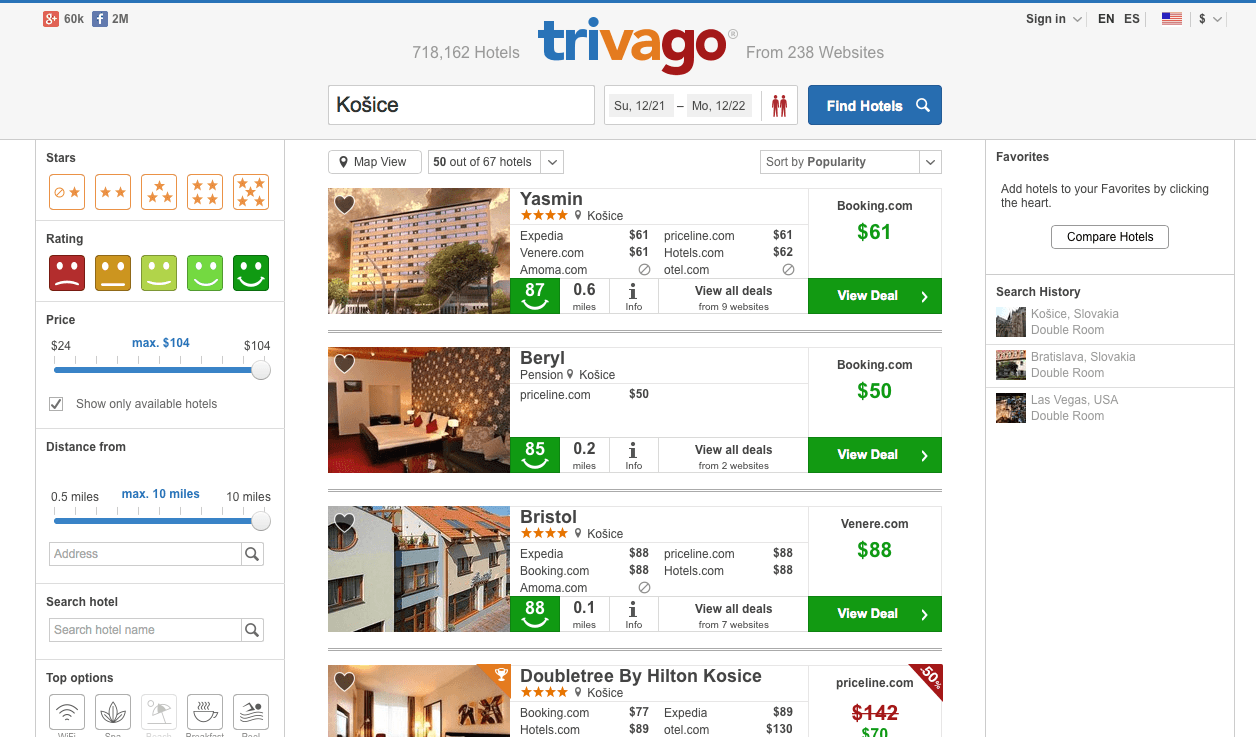

Trivago

You need a place to stay. So you are thinking about all the websites you need to go trough to find an affordable and nice hotel room. Well, you do not need to do that anymore. Trivago is the largest hotel search in the world which compares deals from around 238 booking sites. Simply search the place where you want to go and set criteria important to you, like your budget or even the size of the hotel and distance from city center.

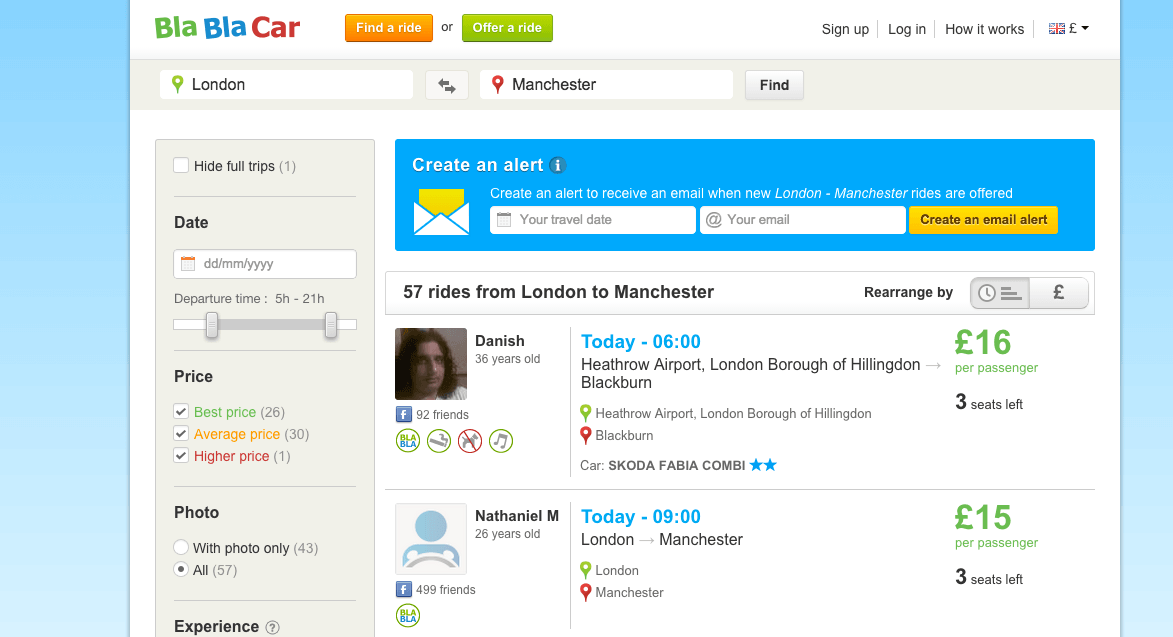

Bla Bla Car

Need a ride? Find travelers who are offering free seats in their cars for your trip. Bla Bla Car is pretty popular in UK and Europe, serving almost 10 millions members. Besides finding a cheaper ride, you can meet interesting people. Every member has their profile, ratings and you can see what type of car they are driving. It is like a safer version of hitchhiking.

As you can see, travelling doesn’t have to cost a fortune. What’s more, cheaper options sometimes bring more adventure and a richer experience. Try out these websites and find services for budget travel which suits you the best. If you want to know more tips and tricks for budget travelers, check out 40 Budget Travel Tips Evert Wanderlust Should Know.

Featured photo credit: pixabay via pixabay.com