When it comes to selling your stuff, the possibilities have become endless. At the same time, it can be overwhelming to find recommendations and difficult to find the right apps that will earn you extra cash.

Whether you are a frequent buyer, collector or a passionate consumer that takes good care of products, there are ways to bank substantial cash with these highly-recommended apps.

In this article, I will highlight the most popular sell your stuff apps — which also market your merchandize or items effectively to maximize your cash earnings.

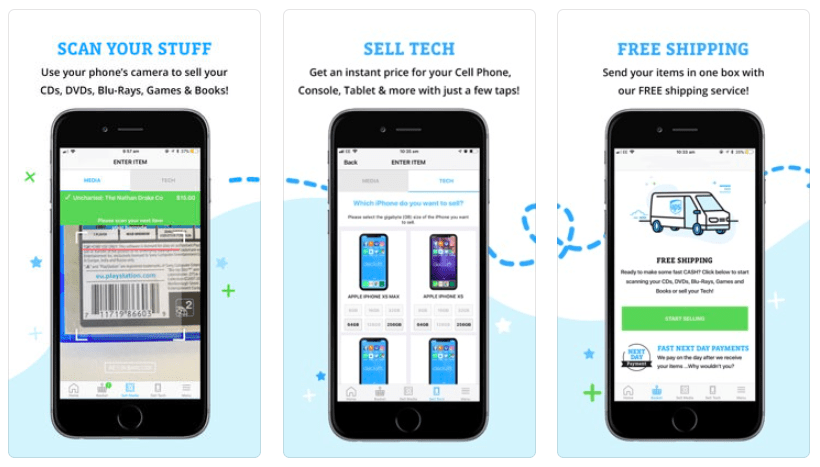

1. Decluttr

Decluttr launched in 2013 and began its advertising campaign in the same year. The business venture and app has been featured on Good Morning America, The Today Show, Fox News and others.

If you are looking to sell old or unwanted items for fast cash, Decluttr is your solution. They accept items like DVDs, cell phones, textbooks, video games, consoles tablets and LEGOS.

Make sure that the items you are looking to sell are in good condition. If the item you are selling is in demand you may receive payment the next day. Payment options are PayPal, direct deposit or a paper check via the mail.

Get the app here: iOS | Android

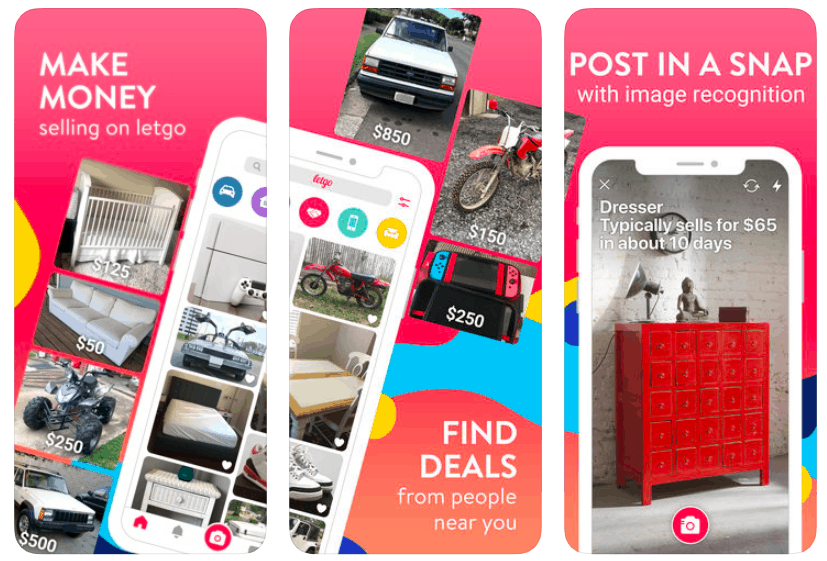

2. Letgo

Letgo was founded in 2015 and is worth over $1 billion. You can sell your old stuff for cash. It has become a competitor for the likes of Craigslist and Facebook to buy or sell used products.

You can download the Letgo app on iOS or Android. In addition, you can view your listings via the app or the desktop version of the mobile app. All of the product listings are based on location, so results will be based solely on geographic proximity.

According to Business Insider, the app is frequently and consistently being featured as one of the top 50 free apps.[1] So, the app has been used and downloaded by millions of users because of its approach to buying and selling products.

Get the app here: iOS | Android

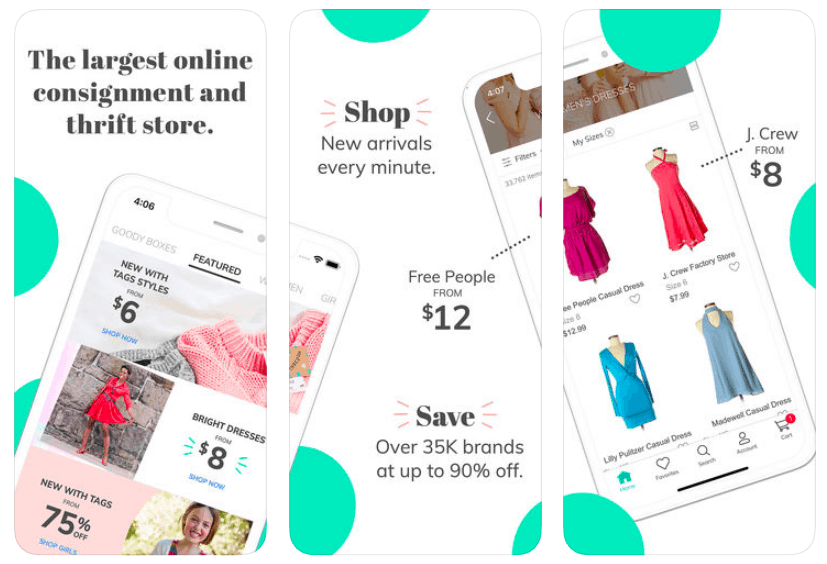

3. ThredUP

ThredUP is a fashion resale website for consumers founded in 2009. The company allows you to buy or sell secondhand clothing online. The service is built on sharing economy and part of a collaborative consumption movement.[2] In other words, you can share a good or service by a group.

Once you get setup with the company, you will first need to order a free close clean-out kit. Days later, ThredUP will send via the mail a bag where you can place old clothes. Once this is received, a payment will be made on PayPal, ThredUP shopping credit or a VISA prepaid card.

The company is built on transparency, so you can get an estimate before sending goods in. The company has also built-in to the app a payout estimator so you can get a good idea of your potential earnings prior to mailing your kit.

Get the app here: iOS | Android

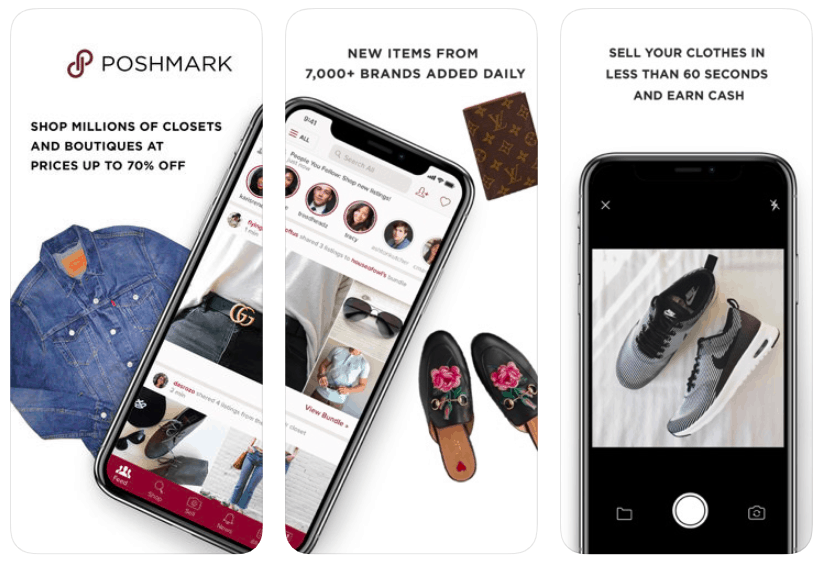

4. Poshmark

Poshmark was launched in 2011 and has not slowed down in terms of growth. It has rapidly grown to a community of five million sellers. It allows users to list on the app adult and children’s clothing absolutely free. Poshmark goes the extra mile by sending a free prepaid shipping label when you make a sale on goods you advertised.

The app with just a few pictures can be uploaded in real-time. Think of the app as your own personal closet, except you are showcasing your best and used clothing to make a profit.

According to Business Insider, the company plans an initial public offering (IPO) later this year.[3] To date, the community of sellers have been paid out $1 billion.

Get the app here: iOS | Android

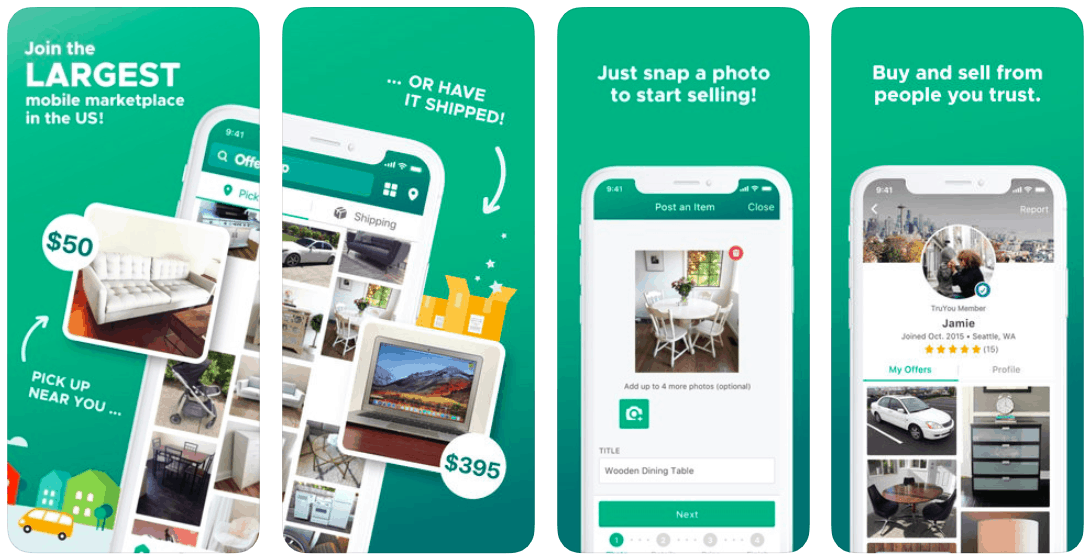

5. OfferUp

The company launched in 2011, and has been synonymous to as a local version of eBay. The OfferUP app offers rewards to successful repeat sellers with excellent customer experiences. Moreover, the seller and buyers can leave each other feedback on transactions.

The transparency is an appealing part of the company’s app, and you can add customizations to your experience. For instance, you can create a watch list, ask for information for sellers through the in-app chat feature and negotiate a price.

The app uses geolocation and users can navigate listings by browsing through categories or proximity.

Get the app here: iOS | Android

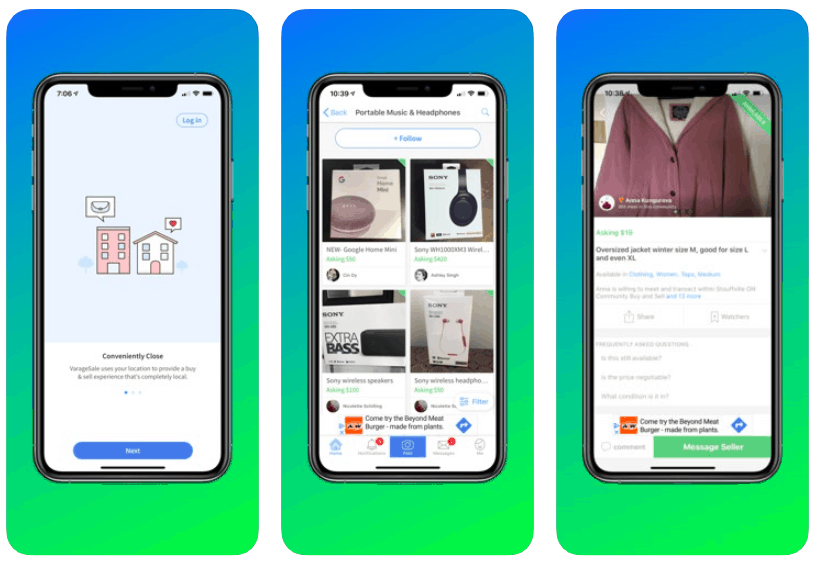

6. VarageSale

As the name indicates, VarageSale is a virtual garage sale app. Users can download the app on Android or iOS. VarageSale has presence all across the U.S, Canada, Germany, Italy, Japan, UK, etc.

The company was founded in 2012 and allows you to sell new or used products. Popular items to sell or trade are smartphones, furniture, electronics and others.

The service is also built on reliability and transparency. Users must create and complete profiles with all required information. The platform comes equipped with a 24-hour support line to report fraudulent or suspicious activity.

Get the app here: iOS | Android

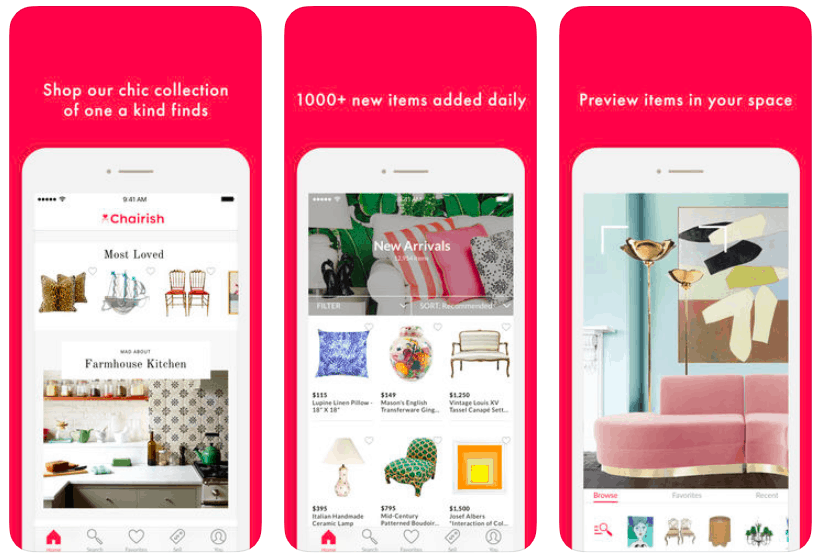

7. Chairish

Chairish was founded in 2013 and is a multi-faceted sales service. It is an online vintage furniture, art and home accessories destination.

Listings are free in Chairish, yet there is a 20 percent commission charge for the items you sell. Items here have a higher selling price. In other words, sellers looking to score serious cash need to guarantee the promoting items are in good condition.

Get the app here: iOS

Takeaways

In conclusion, there are a variety of resources and options to make cash with any of these 7 mobile apps. It is important to conduct a little bit of research before publishing listings. You want to make sure the service and the listings match up closely to what it is you’re trying to sell.

Not all of the services are created equal. All of these cash-based apps are tailored to specific audiences and markets. Look up items to see how frequently they appear and listed prices. Based on this, you can safely assume that this is the right service to promote and market items.

Featured photo credit: Le Buzz via unsplash.com