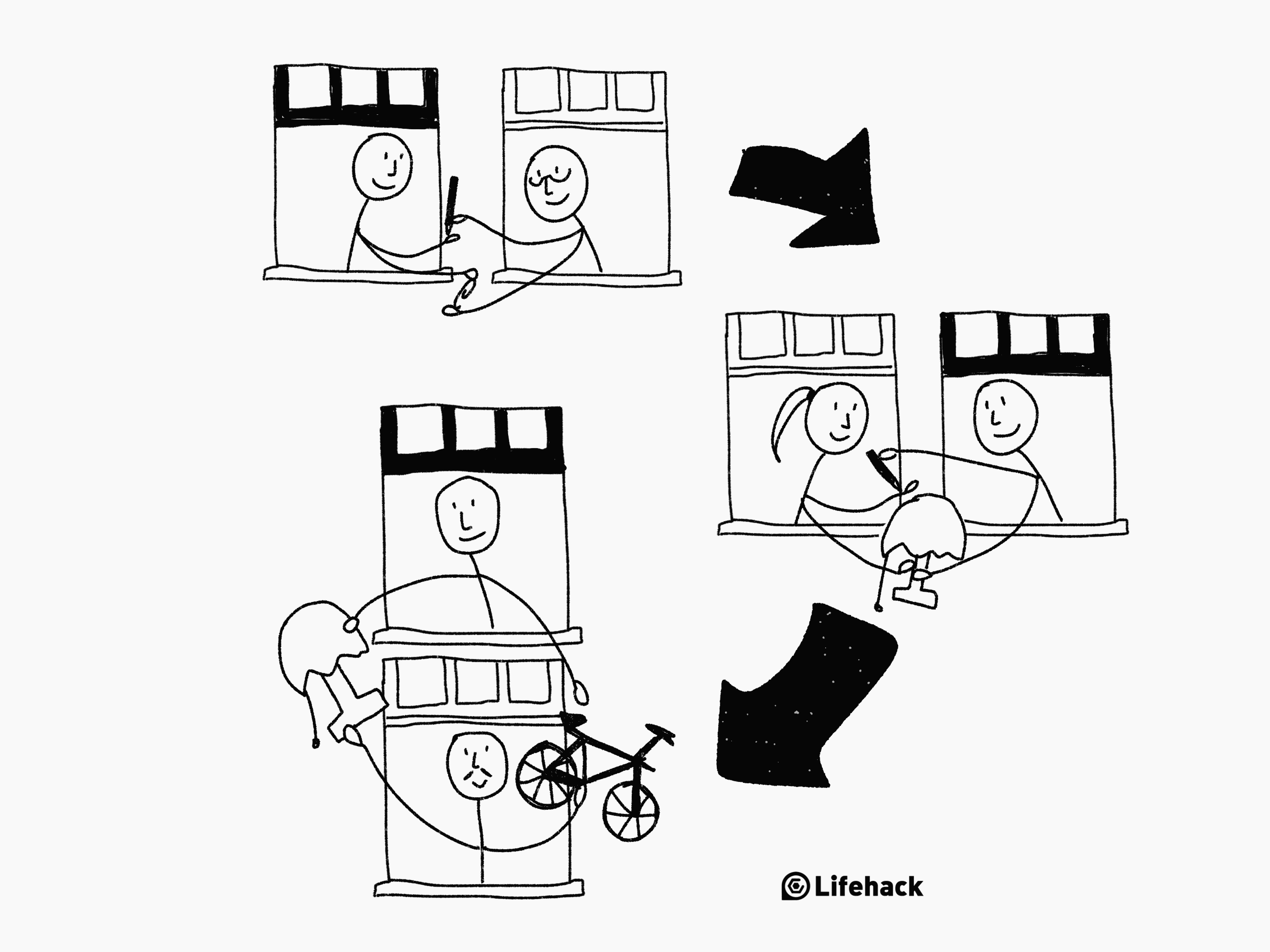

Have you ever played the team-building game called Bigger or Better?

The game is like an adult version of Trick or Treat and works in the following way:

You start off with a small item such as a paperclip or pencil, and you have to try to turn it into something more valuable by doing small trades with other players. If you play the game skillfully, you can eventually exchange your small item into something more expensive (e.g., an iPhone or a bicycle).[1]

The reason the game is often played in team-building exercises, is that it demonstrates how successful people get from the bottom to the top. The game also shows how insignificant items (like a paperclip), after trading with different people, can end up becoming something big and substantial.

Just as in the make-believe game of Bigger or Better, there is a little-known way of reaching the top in your chosen career.

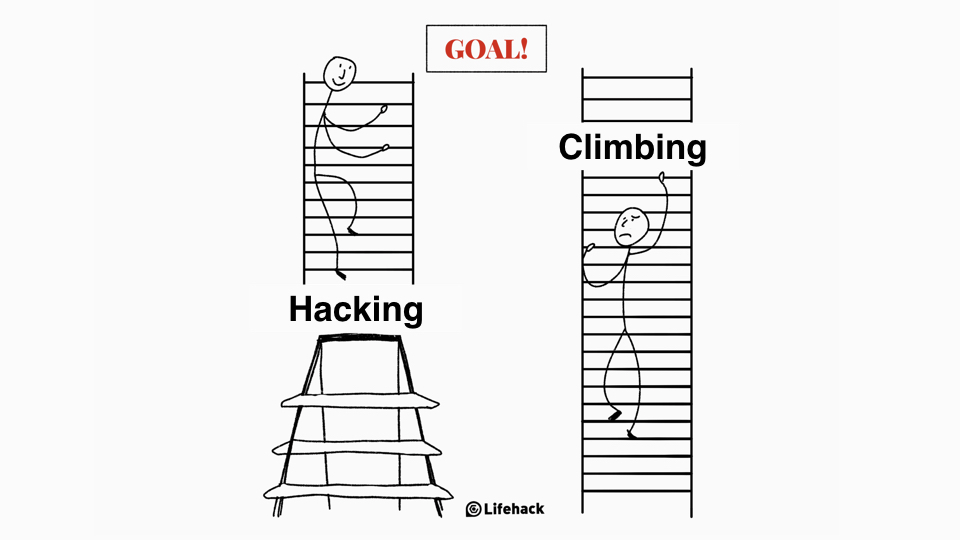

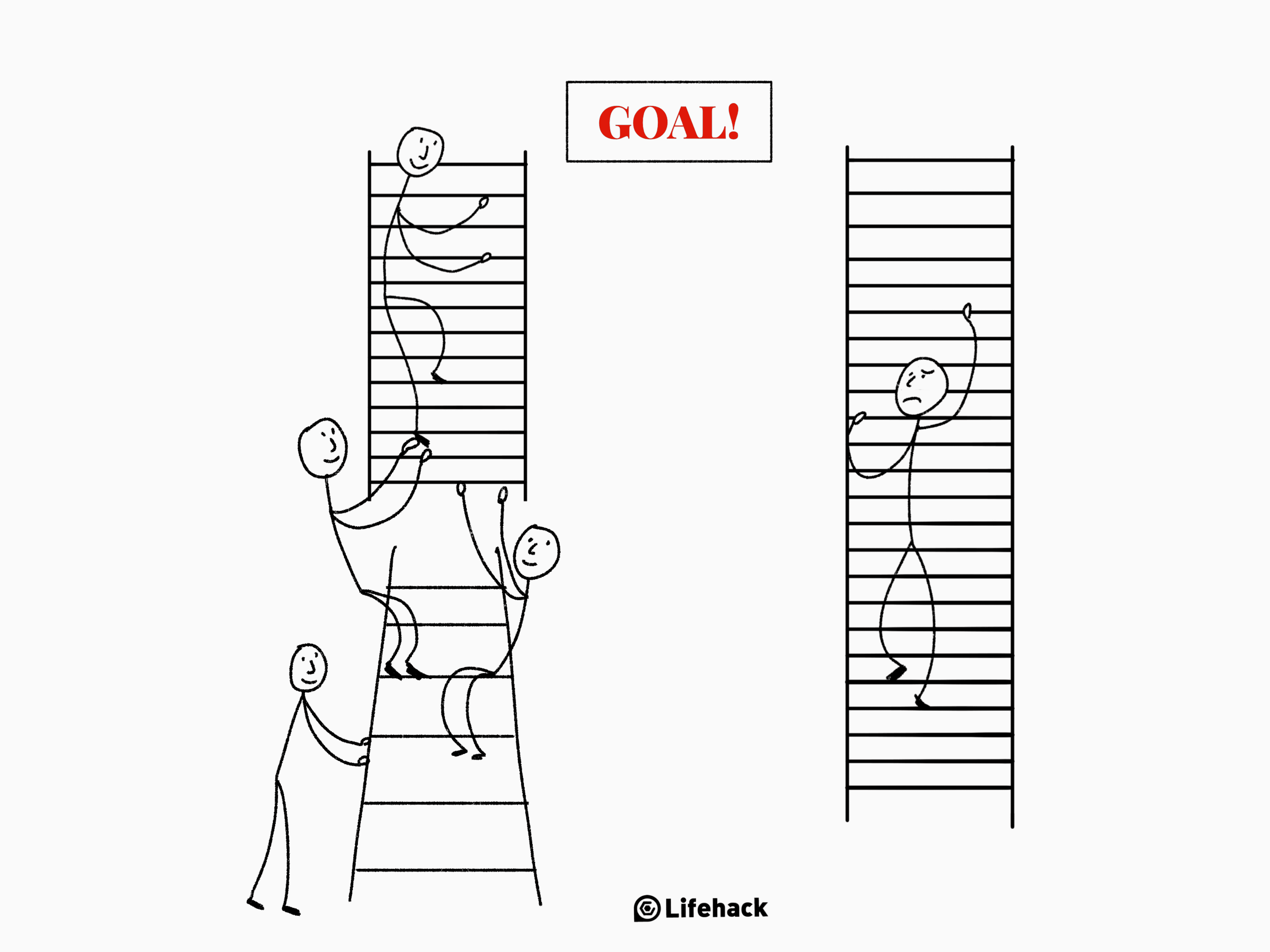

Stop Climbing, Start Hacking

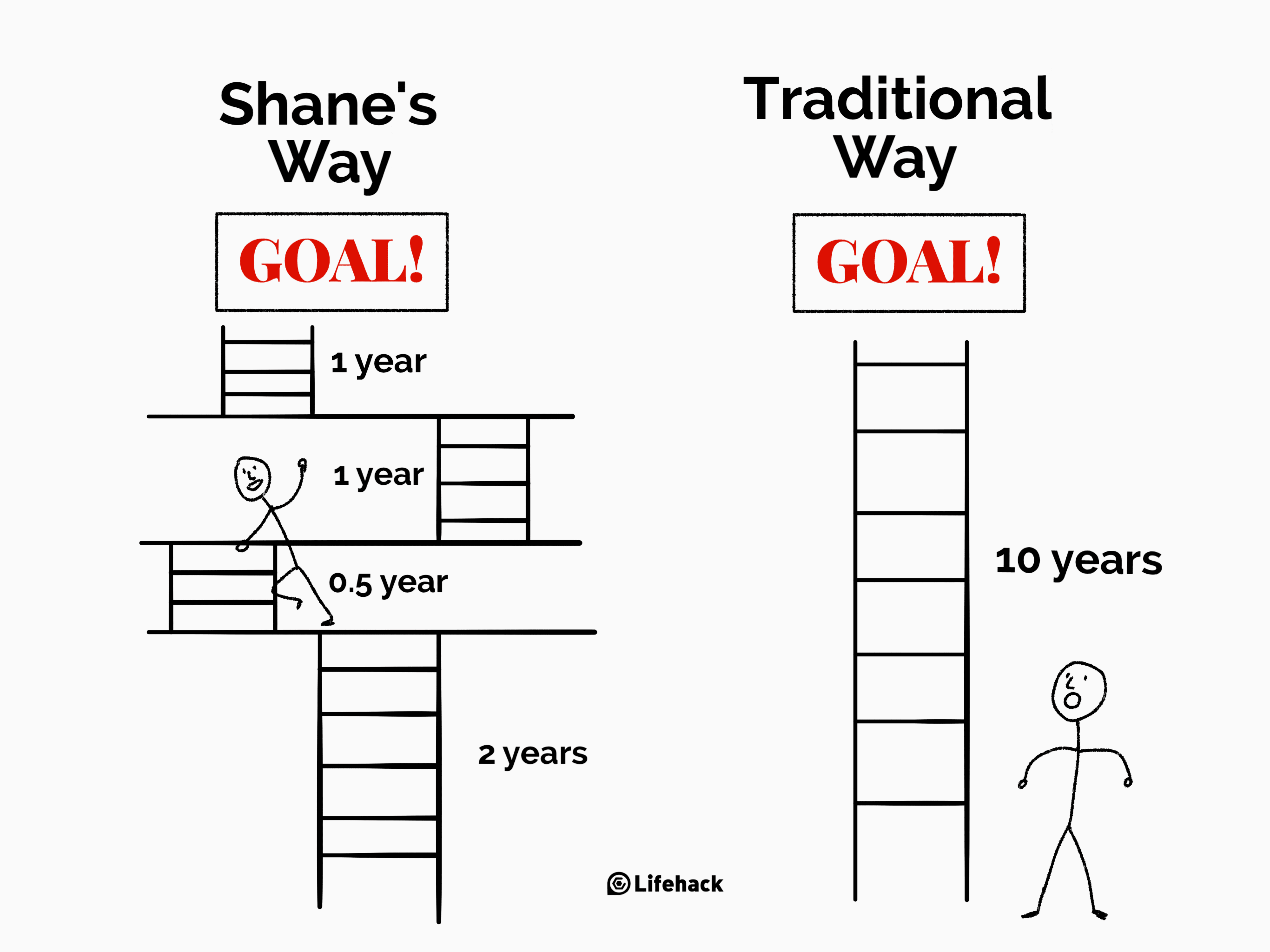

The method involves not just finding a career ladder and trying to climb it, but switching ladders at appropriate times, with the aim of bypassing ‘dues’ and accelerating along your very own Bigger or Better cycle. The idea of switching career ladders has been well developed by author Shane Snow in his book Smartcuts: How Hackers, Innovators, and Icons Accelerate Success.

Shane Snow is a journalist, web entrepreneur and the co-founder and Chief Creative Officer of Contently – a tech platform that matches qualified freelance journalists with online media outlets in the rapidly changing world of publishing. He was named Inc Magazine’s “Inc. 30 Under 30” in July 2012, and Business Insider’s “Silicon Valley’s 100 Coolest People In Tech,” also in July 2012.

The framework Shane created (and showcased in his book) is for anyone who wants to take their career to the next level in the most efficient way.

His framework is very similar to Bigger or Better. However, instead of switching small items for bigger ones, and bigger ones for even bigger ones – you replace these items with your career choices. The idea is to create a winning cycle that accelerates your achievements and success. After lots of small wins, eventually you find yourself with a major win (think paperclip to bicycle).

It’s the same for your career. Rather than following the traditional way of going step-by-step along the same straight path – you switch paths when the one you’re on is not working – or you switch based on your previous success to get something better.

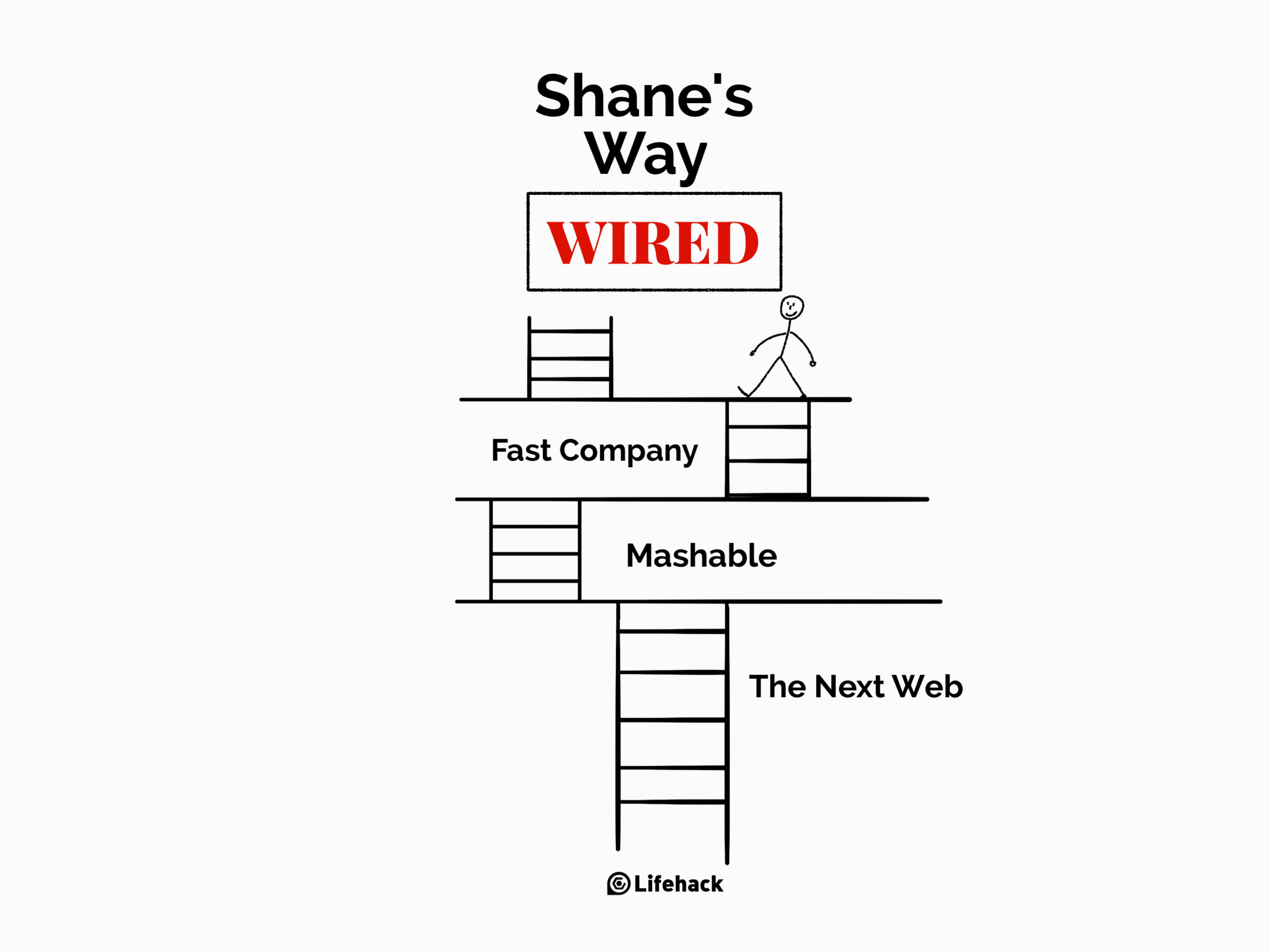

In his acclaimed book, Shane tells the story of how he ‘hacked’ his career ladder.

He had a goal of becoming a writer for WIRED magazine, but knew that without relevant experience, this could take years to achieve. So, he put his creativity to work, and came up with the following process:

- He put together a list of sites and magazines that if he wrote for, would impress the editor of WIRED.

- His list looked like this: The Next Web > Gizmodo > Mashable > Fast Company.

- He then applied to write for The Next Web (which is certainly not a simple feat – but definitely easier than trying to become a writer for WIRED).

- Once he was established as a writer for The Next Web (and had articles under his name as proof), he then applied to write for Gizmodo.

- I’m sure you can guess the next steps, which eventually led to him securing work as a writer for WIRED.

Now, here’s the amazing part. From starting on the path to achieving his goal of writing for WIRED, Shane took just six months![2]

It worked for him, and it can work for you too. Let’s see how.

How This Method Fast-Tracks Your Success

I’ll say it again, traditional career paths are slow. Mostly, this is caused by the conventional waiting periods needed to move up the ladder to higher positions.

If you don’t mind spending years in the same role before moving up – then the traditional route may be the way for you. However, if you want to be competitive and innovative, forget the traditional way. It will frustrate you – and your career ambitions!

So, what to do?

Well, firstly, think laterally rather than just vertically. By thinking laterally, you’ll immediately step outside of the career path that most people are trying to move along. This will give you an advantage over them.

Just to be clear, by moving from time-to-time in a sideways direction doesn’t mean you’re changing your end goal. In reality, you’re just making your route to the top more flexible and adaptable.

Now, here’s the key thing to remember. Once colleagues and managers see you as a success in one role, they’ll automatically assume that you’ll be successful in any other role that you’re placed in. In other words, success breeds success!

Let’s dig a little deeper into how this method works.

Every time you move to a new role or company, you’ll meet and attract new and varied people. And if you’re doing a good job, then these people will become your allies and partners. Think of it this way: you’ll be rapidly building your own personal network of individuals who can help support your goals and dreams.

On the other hand, if you choose to stick to the traditional career ladder, it’s likely that you’ll have a limited network of contacts, as you’re only growing within a small department – or within the same organization.

The method is really just common sense. But it’s not something that we’re taught at school or college.

So, are you ready to fast-track your career? Here are my recommended steps:

- Know exactly what your end goal is.

- Meet a minimum standard of credibility for any required tasks (either show years of experience, or show that you’ve ‘made it’ somewhere comparable).

- Once you start off at the ground level, think of ways of how you can get to the next level (don’t limit yourself to the same ladder).

- Keep going upwards by using new ladders and with the help of your ever-increasing network of contacts.

Don’t Leave You Career to Chance

Climbing the traditional career ladder is often a slow, laborious and frustrating experience. You may wait years for a promotion, only to find that a younger, less-experienced colleague has been given the job.

So, decide on the big goal that you want to achieve, and then implement the methods suggested in this article to help you reach it. By following these little-known methods, you can enjoy a fun, adventurous and rewarding career.

Featured photo credit: Freepik via freepik.com

Reference

| [1] | ^ | How Do You Play Games: How to Play the Bigger and Better Game |

| [2] | ^ | Medium: The 9 Secrets Hackers, Innovators and Icons use to Accelerate Success |