Motivation is difficult to maintain with the enormous amount of distractions that we encounter every day. We want to stay productive, but that can be impossible to do if we can’t maintain our focus.

Luckily, we are spoiled for choice when it comes to organizational apps. Applications such as the Hourstracker can help us to determine how much time we spend on each task we perform throughout the day. This knowledge can help us to make better use of our time, and complete those tasks more efficiently.

Efficiency does not always lead to productivity

As helpful as these tools may be in theory, we are not so inclined to use them because they are so professional. We spend so much of our lives staying on track and being professional that sometimes it’s nice to partake in something a bit more light and fun. On a real note, professional style apps can be boring.

In order to stay motivated and feel motivated to use the apps, we need a little push from a more whimsical direction.

Cue, the Forest App.

The answer to your motivational issues lies within this one app. Forest makes staying motivated fun, which is not an easy feat to achieve.

The point of the application is to train you to put your phone down and stay focused on the task at hand. But the playful nature of the app will make your achievements that much more satisfying, because it’s fun!

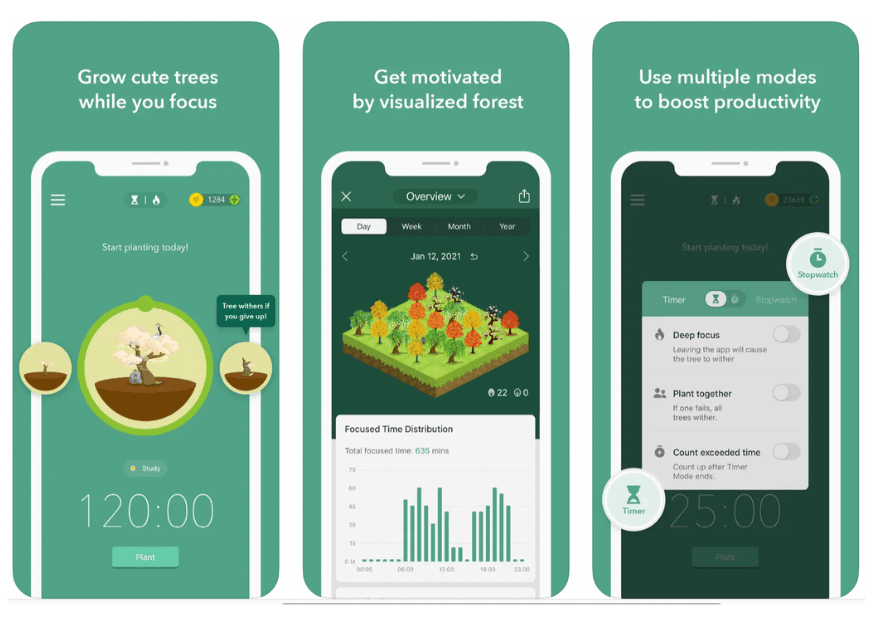

Forest also keeps track of how many times you broke your focus to check on your phone, to give you an idea of how long you can stay focused for as well as the progress you are making.

So here’s how it works

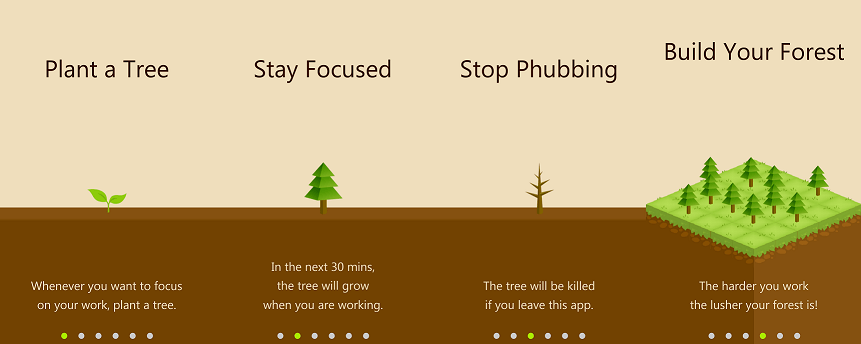

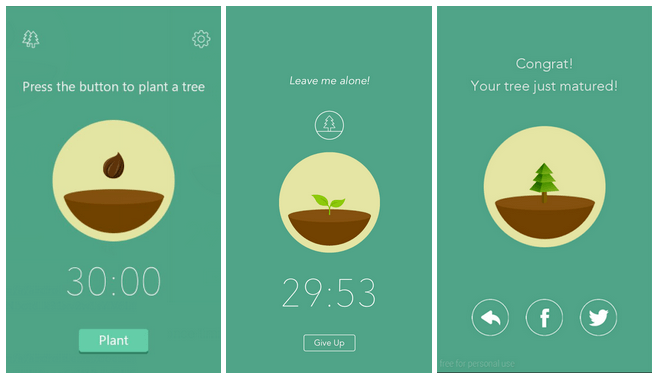

So you’re probably dying to know at this point how to app actually works. What groundbreaking and fun technique could it possibly have? The answer: planting trees.

You got that right. Planting trees. Every time you want to stay focused, you plant a tree on the app and allow it to grow while you work. If you manage not to check your phone for 30 minutes, you will end up with a fully grown tree. The size of your forest depends on the length of your motivation.

If you lose motivation and habitually reach for your phone which is bound to happen (at first) your tree will die. Forest plays on your emotions by giving you a sense of responsibility to the tree. You will feel inclined to stay away from your phone and stay focused on your agenda. The balance of the trees life is in your hands!

Although the application does provide their stats in the form of graph and charts, it is much more fulfilling to see it in the form of your own personally grown forest, nurtured by your motivation and achievements. You will be surprised to see how quickly you become invested and care for your little forest.

If you want to take it a step farther, you can plant real trees through the app as well. For a small fee you can grow an actual forest of your own. You can feel good about knowing that you are giving back to the earth while giving to yourself as well.

And don’t worry. This isn’t a forever kind of thing. When you’re done with your tasks and want to reconnect, you can close the app just like any other. But when it’s time to lock it down and get things done, open up the Forest App. Plant some trees and allow your forest to flourish as well as your achievements.