If you were looking for a new job, how would you go about finding one? Instinctively you’d probably start off by filtering through all of the common job archive websites; Craigslist, Indeed, Monster, etc. in order to find something related to your field. Which is fine, if you don’t mind settling.

We have been programmed to work this way, to take whatever job is convenient in order to pay the bills and support our lifestyle. For many this system works well enough. But this is how people fall into complacent jobs that don’t truly satisfy them.

If you want to land the job of your dreams, you’re going to have to go out there and get it

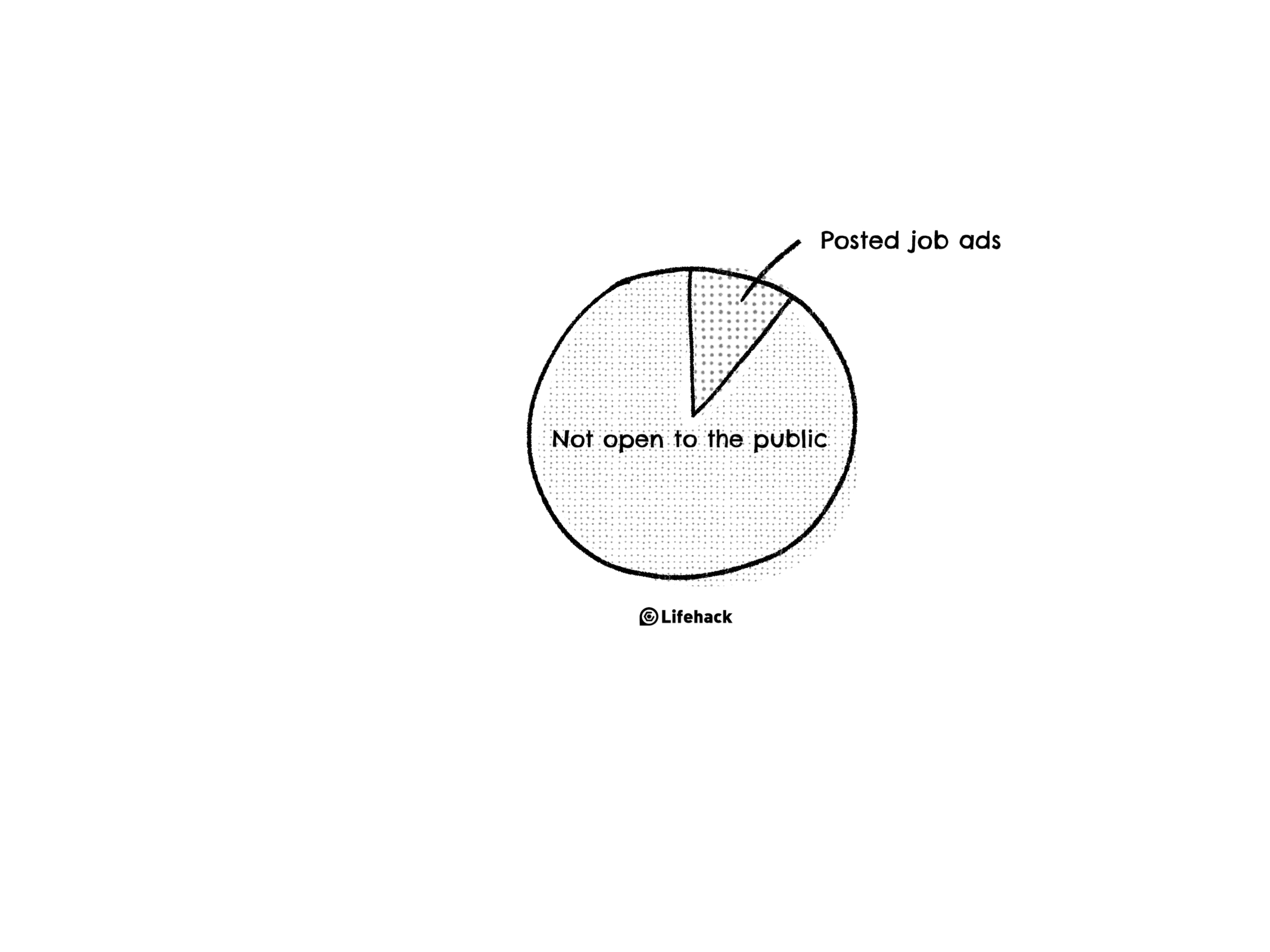

The truth is, the best jobs aren’t listed. Around 80% of opportunities in the market are not open to the public and can only be acquired internally. So if you’re basing your search on the 20% that have actually been listed, you’re going to have a very difficult time landing that dream job.

So instead, you’ll end up with a job that “works for now.” Eventually you’ll come across the job you’ve been striving for and make the switch. But what if that opportunity never comes? You’ll most likely fall into a routine with your sub-par job and justify it by saying that most people never get to have their dream job.

How can you solve that issue? By taking the initiative and creating an opportunity. But before you’re able to finagle your way into your dream company, you must first understand why 80% of jobs are not available to the public, and how to work that fact to your advantage.

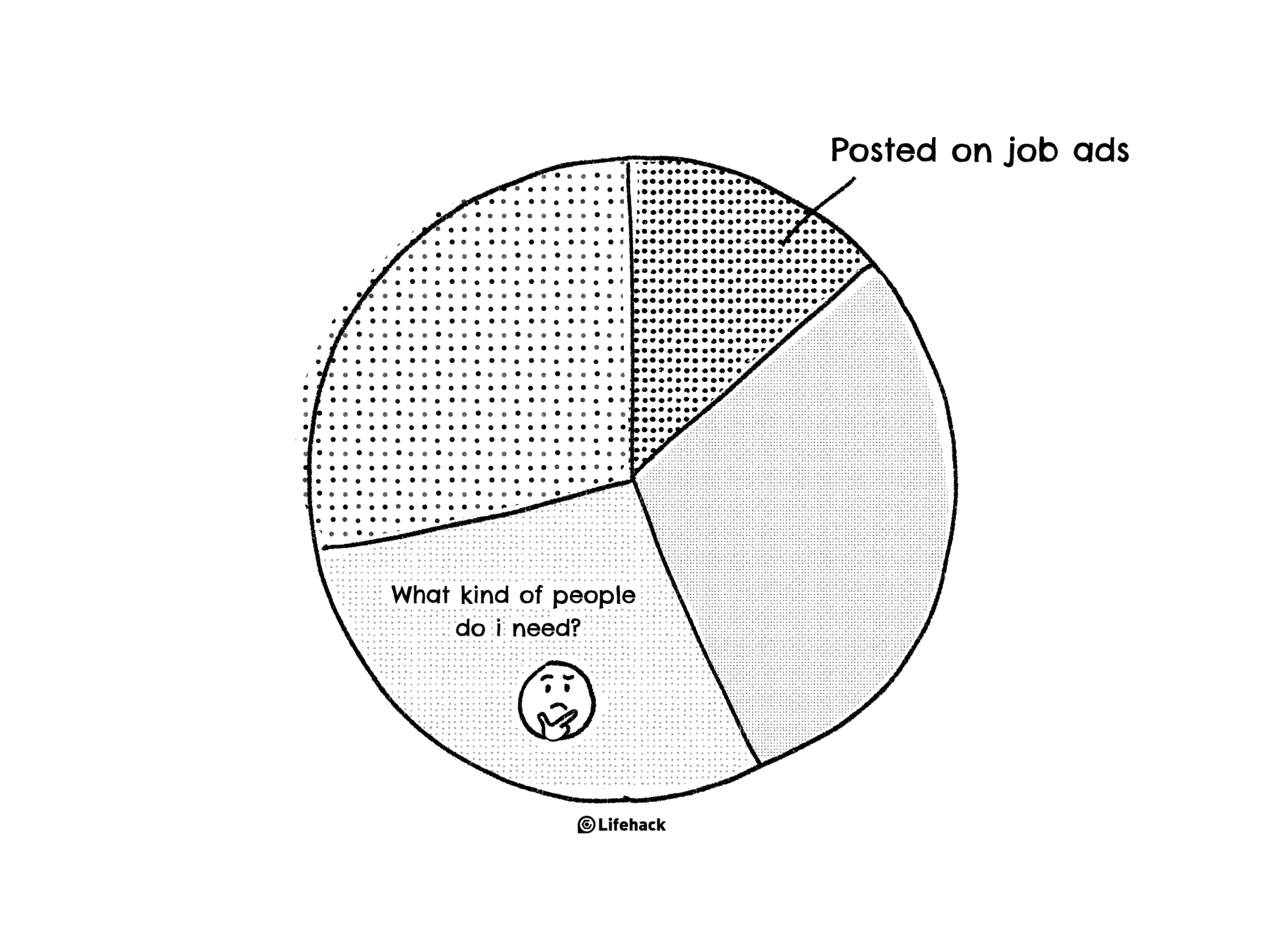

1. Businesses are not sure what or who they are looking for

This is usually true for startup businesses that are trying to expand into a new market. It’s uncommon ground, so it’s tough to project what they really need.

If they don’t know who or what they’re looking for in order to move in a new direction, then it’s nearly impossible to create a job ad for a position that does not yet exist.

What they need is human resources. A fresh perspective that can give them a new edge. This is the perfect opportunity for you to up-sell yourself and the value that you can bring to the company.

Take a look at their weaknesses and what could be improved. You could be the answer to all of their problems. Offer your skills in such a way that they can’t afford not to have you.

2. Companies tend to train-up internal staff instead of hiring new employees.

Some employers don’t want to go through the grueling trial and error of the interviewing process. Unsure if they’ll be able to find the people with the skills they’re looking for, they will train their already existing staff to do the job instead.

The mentality is, “the more I invest in my employees, they more likely they are to stay and contribute.” While in some cases this may be true, it’s not very cost efficient and may not work out as they hoped.

There is no certainty that the employees will stay, especially if there is a change in their job description. Many people are creatures of habit and want to stick to what they know.

It can be difficult to predict how much time could be wasted training employees to learn these new skills. And in that time you’re taking man power away from already existing projects. In turn, those projects could be neglected and end up hurting the company.

This is your golden opportunity. Showcase the fact that you already possess the skills they are looking for. Explain the resources they could save by simply hiring you instead of training up their staff. Your drive and passion will make you stand out as the best cost-efficient choice.

3. The company truly does not have any openings.

There is still room for opportunity here. Similar to the previous points, you can scale the company for their weaknesses and needs, and offer yourself as the solution. You could bring ideas to light that probably would have never been considered.

Your attention to detail and willingness to improve will make you a valuable asset.

What you do for work is important because it affects your happiness too

Your dream job isn’t going to fall into your lap. You need to be a little aggressive and create that opportunity. Even if the company of your dreams truly isn’t looking for new employees right now, they will remember you if you make a good impression.

Your job doesn’t have to just pay the bills. With the right career, you can find your purpose, devote yourself to your work, and live a meaningful life that brings you satisfaction.

I mean think about it, you spend the majority of your life working. If you don’t enjoy your job, then you’re leading a miserable life. On average, you spend 8 hours a day at work. That’s 22 working days out of the month; 2,112 hours a year! Wouldn’t you rather spend all of that time working towards something you truly care about?

Mental Notes On How To Manifest Your Destiny!

At this point I’m sure I’ve got you convinced. You deserve the job of your dreams. In order to approach these opportunities and make them a reality, there are three components to keep in mind:

1. Display expectations for yourself, and the company

Check out resources such as LinkedIn to research the expectations for the job you are pitching for. Research the job descriptions for a grade or two above your skill set. See what goals you need to work towards and which skills you need to improve.

Explain the progression you would like to see in yourself, and how your progression will benefit the future of the company. Self-reflection is very important to employers, so be transparent about which skills you need to improve upon that can also improve the company.

2. Understand competitions the company is facing

In order to understand what the company needs, you need to know what they’re competition is doing. Is it working for them? Could you advance those ideas and make them your own?

Show them that you know which issues they are facing, and suggest strategies to solve these issues. Offer your skills and explain how they will give them a new edge in this growing market.

3. Don’t just tell them what you can do, show them.

Prepare a portfolio of your previous projects to show off your capabilities and experience. After explaining what you have done, tell them your plans for the future. What are you doing to enhance your skills? What could have been improved in previous projects?

If you show that you are actively improving your skill set, prospective employers can expect that your skills will improve their business plan.

So remember, don’t wait for the perfect job. Create it.

Featured photo credit: Manny Pantoja via unsplash.com