Facebook has three features that help you manage both time and relationships in your business. They are relatively new features that can completely transform the way you use Facebook.

These features are Search, Save, and Stop.

Business is about people, and your ability to find information about people who matter in your business is important. These features help you do exactly that.

1. The Save Feature

Have you ever been on your newsfeed reading something when all of a sudden, the newsfeed jumps as it updates, and you lost what you were reading? This happens to me daily, then I have to waste time scrolling to find that same post.

Have you ever seen a post in your newsfeed that you wanted to explore? Maybe it was a video or an article, but the timing wasn’t right to check it out.

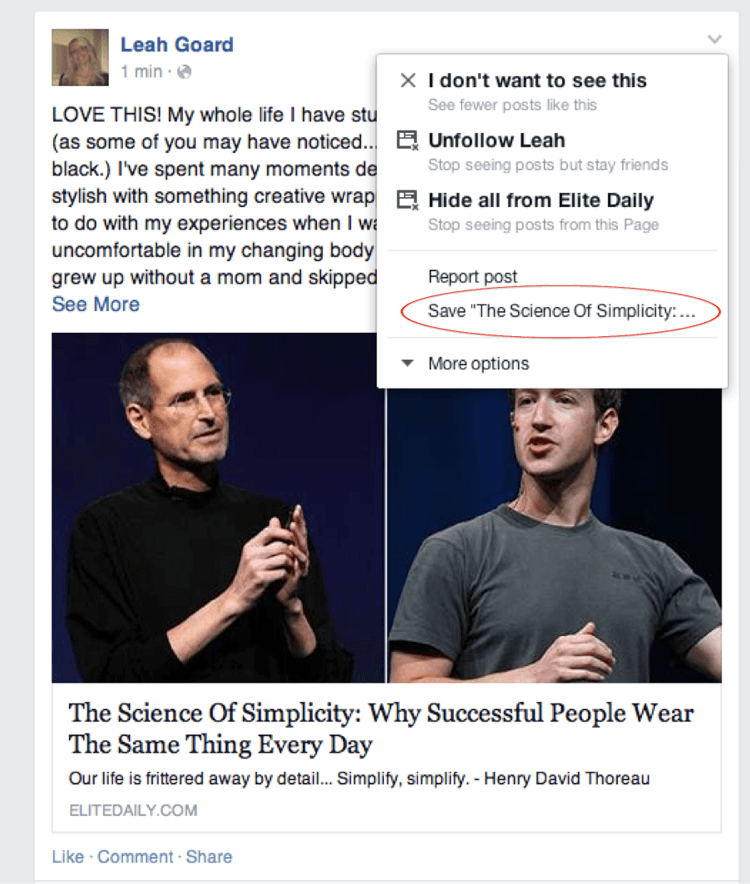

The save feature can help in these two situations. With millions of posts being shared each day, it is often hard to consume what you want, when you want. But with the save feature, you can easily find and read any post. To use the feature, click the drop down arrow on the top right side of the post and select “Save”.

For example, let’s say I see an article like the one below that Leah shared and I want to read it but don’t have time. Let’s pretend Leah is a customer or prospect of mine, and paying attention to what she shares matters to me as a business owner because I want to interact more with her and support what she shares. But out of integrity, I don’t want to engage until I have read the whole article.

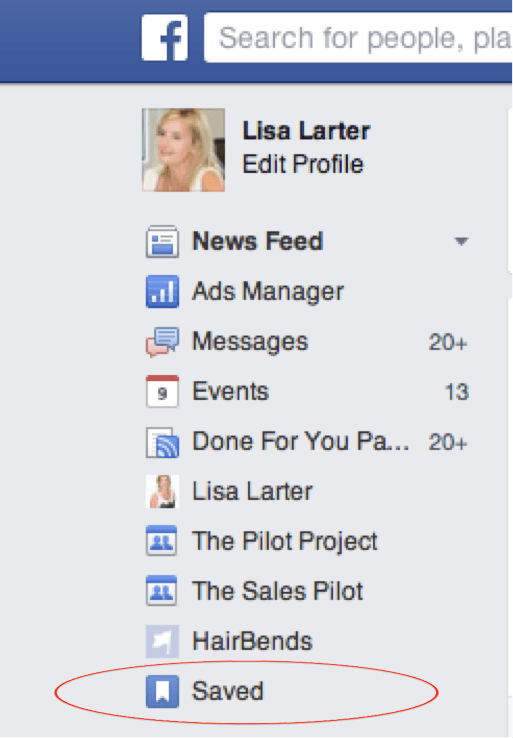

Once you have time in your day’s schedule, you can access all the items you saved on your Facebook homepage on the left of your profile (facebook.com/saved). You will be directed to another page where every piece of saved content is listed.

Once you’re done with a saved item, you can click the “x” in the corner and delete it from the list.

What can you do with these saved items? You can share this curated list with your own followers on your business or personal page, or you can engage in the original post by leaving a comment. Saving prevents you from getting lost down a rabbit hole and losing 30 minutes to Facebook when you really only logged in to reply to a message someone sent you.

Now that you have a great tool to collect and share content, you may run into another rabbit hole…the never-ending stream of Facebook notifications.

2. The Stop Feature

If you are part of any Facebook group that has a high level of activity, your engagement on a single post by commenting can risk you having handfuls upon handfuls of notifications on your profile, letting you know who else commented and what they had to say.

You may even find yourself asking if you really want to comment because of having to deal with all the notifications that come afterwards.

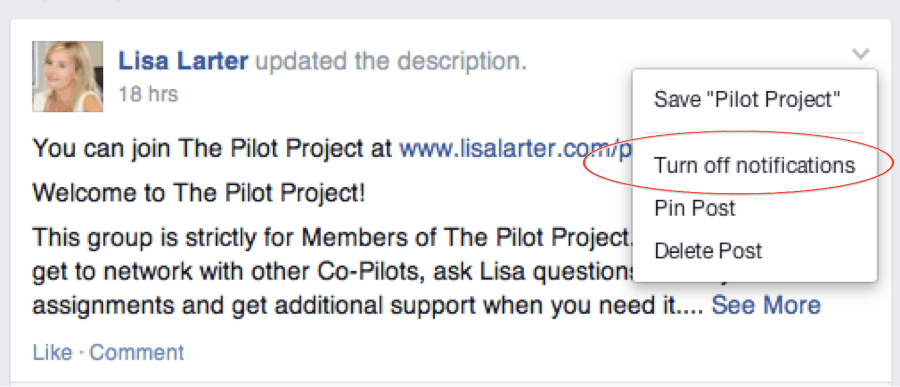

The stop feature allows you to stop notifications for a single post. Whether you post the content yourself or you commented on someone else’s post, you can click the drop down arrow and turn off notifications.

This will stop all notifications on that particular post so you no longer get emails or those little red notifications at the top of Facebook. If you really do want to know what people are saying, use the save feature and come back to it later.

3. The Search Feature

This feature is a little more advanced but very important for business owners using Facebook.

Imagine that your client, Joanne, posted an amazing article that you wanted to share, but when you go to her profile you realize that she is a content posting machine. You search and search her profile feed but you just cannot find what you are looking for. Yet you’re sure she posted it just a few days ago.

If you type in the word “Joanne” and a keyword that relates to the piece of content you are looking for into the search box, you can find that exact piece.

You can also use the search feature with just keywords to find people in your network who are actually looking for your services.

Facebook may very well become the new Google for finding the things that people you are connected to share!

How do you see Search and Save helping you to connect better with people?

Featured photo credit: Mans Hands Woking On Laptop And Smartphone With Coffee/Ed Gregory via stokpic.com