It’s a human impulse, isn’t it? The burning desire to do more, to tackle everything all at once. We often think we’re built to chase numerous goals simultaneously, failing to notice that by doing so, we might not truly achieve any of them.

Have you ever gazed at your computer screen, bewildered by countless open tabs, each vying for your attention? Or perhaps you’ve bounced between various TV shows, never truly committing to any single one.

While such a pattern might give the illusion of progress, the reality is stark: important elements are missed. It’s those tiny but vital details that often get neglected.

And here’s the harsh truth: multitasking is a mirage. Far from being an asset, it’s more of a pitfall.

I remember working with a project manager who saw multitasking as her edge, often handling emails, updates, and meetings simultaneously. However, she consistently faced errors and missed deadlines. I suggested she try single-tasking. After she started dedicating specific time blocks to each task, her productivity soared, the quality of her work improved, and her stress diminished.

Let’s dismantle the myths about multitasking and discover how focusing on one task at a time truly opens the door to real achievement and satisfaction.

Table of Contents

Multitasking in a Nutshell

A lot of folks reckon that multitasking means juggling multiple tasks simultaneously. You’ve seen it, right? Someone chatting on the phone while hurriedly composing an email, or another bobbing their head to music while drafting a report.

But that’s not quite accurate.

What we often label as multitasking isn’t about doing many things at the same instant. Instead, it’s about darting from one task to another in quick succession, aiming to finish them all in less time.[1]

Don’t just take my word for it; there’s actual research on this. Cynthia Kubu, a brain expert said:[2]

“When we think we’re multitasking, most often we aren’t really doing two things at once. But instead, we’re doing individual actions in rapid succession, or task-switching,”

To paint a clearer picture, let’s consider someone neck-deep in a report. But, they’re also juggling email responses and maybe even a virtual meeting.

Rather than genuinely doing all these tasks together, they’re simply zipping between them. A few minutes on the report, a quick glance at an email, a nod in the meeting, and then back to the report. It’s a hectic dance, not a harmonious duet of tasks.

Why Multitasking Doesn’t Work

Let’s face it, our brains aren’t built like the latest computers. They can’t run several high-powered programs simultaneously without a hitch.

Every time we bounce between tasks, the brain needs a moment to adjust. It’s like pausing one video to play another – there’s always a little buffering time. And just like videos, the constant starting and stopping of tasks can eat away our time and sap our energy, often making the end result less than stellar.

Here’s the lowdown on why trying to do it all doesn’t get it all done:

The Toll of Task-Switching

You might think hopping between tasks saves time, but you’d be mistaken. Research highlights a hidden catch known as “task-switching costs”—essentially, the time and mental energy it takes each time we switch tasks. These little detours can consume up to 40% of your prime working time.[3]

Consider studies from 2001 by Joshua Rubinstein, PhD, Jeffrey Evans, PhD, and David Meyer, PhD, who found that young adults switching between tasks like solving math problems or classifying shapes lost time with each switch. This loss increased with the complexity of the tasks, leading to significantly longer switch times for more complex tasks.[4]

Imagine you’re deep into writing a report and suddenly, “ping!” an email arrives. Curiosity wins, you check it, and a minute slips away. Returning to your report, you lose another minute just finding your place.

That’s the “task-switching cost.” Do it often, and the minutes stack up, undermining the time you thought you were saving. Multitasking might feel like a shortcut, but it’s more often a long detour, costing you more than just minutes.

Dipping Work Quality

Ever heard of the saying “jack of all trades, master of none”? That’s what multitasking turns us into. Studies have unambiguously shown that when we play this juggling act, the quality of our work tends to suffer.

The crux of the problem? Divided attention. With each hop between tasks, our brain needs to recalibrate. In these moments of adjustment, focus wanes, mistakes creep in, and the quality drops. We’re not fully “there” for any single task, making the end product somewhat, well, half-baked.

Let’s get real-world for a second.

Ever tried changing radio stations while driving? Or maybe sent a text at the traffic lights? Research tells us that even these seemingly simple additions to driving can send our performance on the road into a tailspin.[5]

We’re not just bad at the added tasks; we get worse at driving too, spiking our chances of becoming a traffic stat.[6]

As if poor performance wasn’t enough of a bummer, there’s another unwanted guest at this multitasking party: stress. When we pile tasks on top of each other, the weight gets heavy, quick. This mounting pressure can cloud our judgment, slow our reflexes, and result in choices that, on a clearer day, we’d steer clear of.

In essence, multitasking often delivers less – less quality, more mistakes, and a heftier dose of stress.

Mental Juggling Weakens Cognitive Muscle

Splitting your attention is like trying to run in two directions at once. You won’t get far in either.

When we scatter our focus, the brain’s got to constantly flip the switch, toggling between tasks. It’s like changing channels every two minutes – before long, your brain’s remote starts to wear out, making it tough to understand the storyline of any show.

Juggling tasks isn’t just about time; it’s about data overload too. Imagine trying to catch rain with a sieve. That’s your brain on multitasking.

A barrage of information storms in from all directions, and the brain’s gotta sift the gold from the gravel. But this sifting process? It’s draining and can lead to crucial nuggets slipping away.[7]

Now, consider your brain’s “bookmarks.” Jumping between tasks forces the brain to remember two storylines: where you paused in the first task and where to kick off in the next. It’s like reading two books simultaneously and trying to remember which chapter you’re on in each.

This mental hopscotch can mean missing vital plot points, leading to a muddled understanding of both.[8]

The verdict? When you spread your mental butter too thin, you end up with a lot of dry toast.

How to Be Productive Without Multitasking

I get it. You’ve got a mountain to move, and you’re trying to shove it all at once. But remember: even mountains are climbed one step at a time.

Ditch the multitasking mayhem. Here’s a better game plan when your plate’s piled sky-high:

1. Prioritize

Ditch the juggling act and anchor yourself with priorities. Instead of splintering your attention, gather up those tasks, lay them out, and shine a spotlight on one at a time.

Doing this trims the fat of task-switching and lets you really sink your teeth into each job.

Have a gander at LifeHack’s Superstructure Method. It’s like building a house, brick by brick.

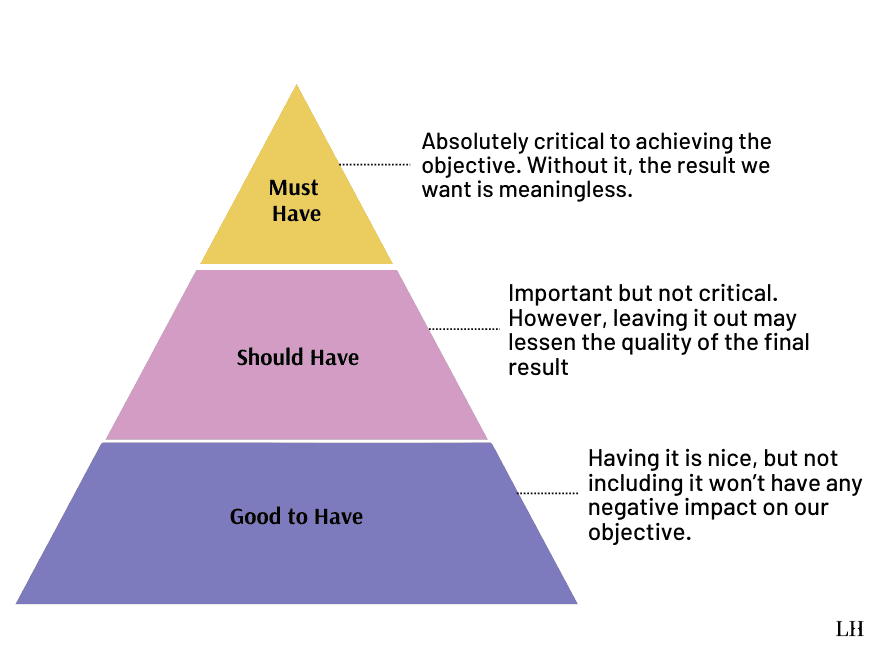

First, sketch out what the house (your goal) should look like. Then, stack your bricks (tasks) based on their importance:

- Must-haves – These are your foundation bricks. Without them, the house collapses. They’re non-negotiable to hit your goal.

- Should-haves – Think of these as the walls. They give the house structure, but without a foundation, they’re just freestanding barriers.

- Good-to-haves – These are like the decorative bits. Nice garden gnomes or flashy window curtains. Great if you have them, but the house still stands firm without.

Now, let’s anchor this in my own experience as a leader at LifeHack:

Must-haves

I ensured that every team member knew their performance goals right from the start. Support was always on standby to tackle any issues that cropped up.

Should-haves

I regularly checked in on progress, providing feedback that was clear and constructive. My strategy also included initiatives to lift team morale and drive productivity.

Good-to-haves

To keep our approaches fresh and effective, I participated in management workshops and arranged training sessions. These not only enhanced our skills but kept everyone aligned and moving forward.

By ranking your tasks like this, you first ensure the stability and functionality of your team (must-haves). Then, you optimize for performance (should-haves). And when everything is running smoothly, you sprinkle in enhancements for continuous growth (good-to-haves).

For a deeper exploration on prioritizing effectively, especially when everything seems urgent, head over to The Ultimate Guide to Prioritizing Your Work And Life.

Navigate through it, and you’ll be a master at handling even the busiest of days.

2. Dive Deep with One Task at a Time

It’s tempting, in our always-connected world, to juggle. But have you ever seen someone juggle without eventually dropping a ball? The same goes for tasks.

Juggling multiple tasks may seem productive, but often leads to dropped balls—mistakes, inefficiencies, and burnouts.

That’s where “single-tasking” or “monotasking” comes into play. It’s not a new-fangled idea. It’s just the art of dedicating yourself wholly to one task at a time.

By giving a singular task your undivided attention, you wrap it up faster, make fewer mistakes, and deliver with finesse.

It’s like tuning out all radio stations to listen to one, clearly. This clear, undistracted approach not only speeds up work but can be a real stress-buster.

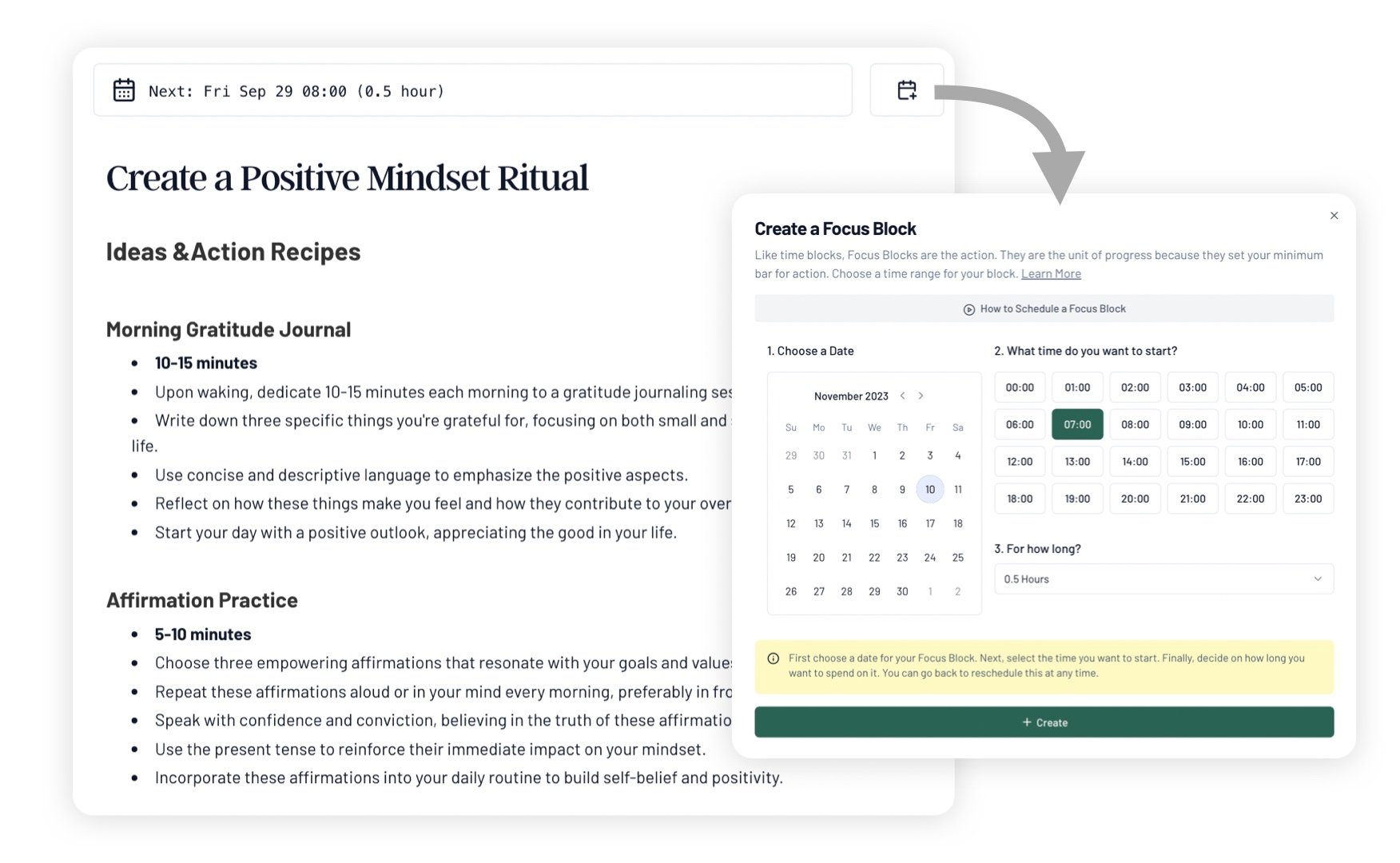

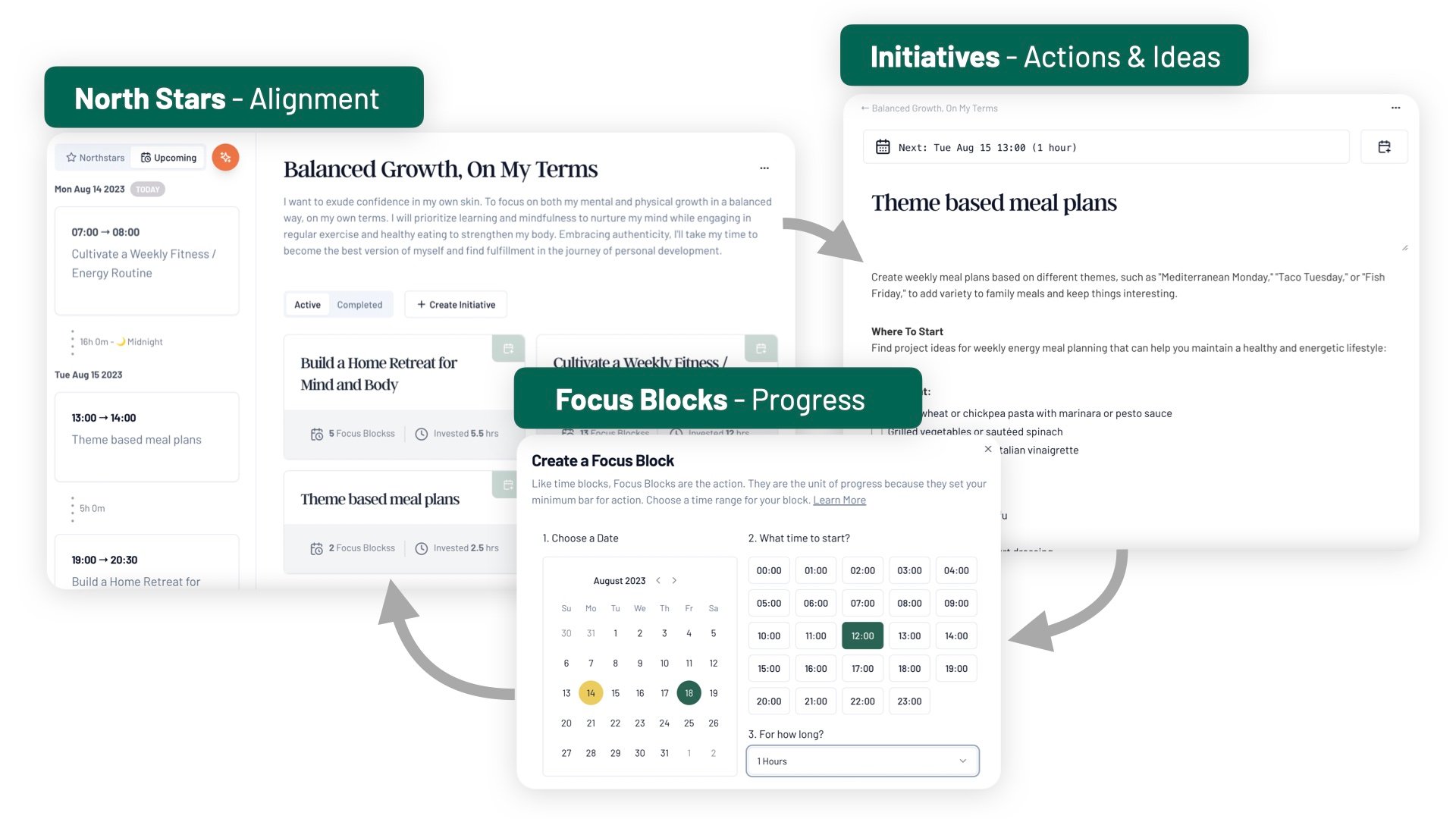

Enter the Time Flow System, a nifty creation by the LifeHack team. Think of its Focus Blocks as “attention containers.” You pour all your concentration into this container, dedicating time solely for that one task—shielding it from the scattergun distractions that usually pester us.

But it’s not just about doing tasks—it’s about doing the right tasks. Those that are in harmony with your overarching objectives, or as we like to call them, North Stars, and those milestones along the way, our Initiatives.

Find out more about the Time Flow System here.

But shifting from multitasking to monotasking isn’t just a switch you flip. It’s a skill—a muscle that needs some gym time. A solid way to give this muscle its workout is through mindfulness.

The idea of mindfulness meditation is simple: anchor your mind in the now. This practice, over time, enhances your ability to keep your brain locked onto a task.

Starting with short bursts—like a 5-minute mental jog—and gradually stretching it out can lead to prolonged focus.

3. Pass the Baton

Sometimes, to move faster and more efficiently, you have to pass the baton. That’s where delegation shines as a prime productivity tool, especially when the to-do list is longer than a grocery receipt.

Delegating tasks is akin to assembling a puzzle with pieces from various sets. It’s about fitting the right tasks to the right people. By letting others handle what they’re ace at, you can give undivided attention to what you do best.

The result? Tasks getting knocked out of the park, and a boost in team morale and productivity.

Before you pass a task off, do a quick scan.

Which tasks are burning your hours without bearing fruit? Which ones feel like they’re written in a foreign language?

Those are prime candidates for delegation.

Next, it’s matchmaking time.

Pair the task with the right teammate. Keep an eye on their current plate, know-how, and track record.

And, crucially, be crystal clear in your brief. Lay out the ‘what’, ‘when’, and ‘how’ so that there’s no room for the guessing game.

And remember, delegating isn’t just about handing over and walking away.

Stay in the loop. Offer a helping hand or feedback when needed, ensuring that the end product aligns with what you envisioned.

Mastering the art of delegation can be a game-changer. Want a deeper dive into this? Check out my guide How to Delegate Tasks Effectively. It’s packed with actionable insights to elevate your delegating prowess.

Bottom Line

Contrary to popular belief, multitasking isn’t your ticket to being super productive. In fact, it’s more like a roadblock. Every time you toggle between tasks, you’re adding time, using up mental energy, and setting yourself up for potential mistakes. The truth is, multitasking can be a drain on both quality and performance.

So, what’s the alternative? Simplify. Focus. Delegate.

Start by putting tasks in order of importance. Next, give each task the spotlight it deserves. Dive deep, undistracted. And when you find tasks that can be better tackled by others? Pass them on.

By putting these principles into action, you’re not just ticking things off a list. You’re working smarter, with clarity and purpose. And that’s the real key to achieving your goals with efficiency and finesse.

Reference

| [1] | ^ | Experimental Economics: Multitasking |

| [2] | ^ | Cleveland Clinic: Why Multitasking Doesn’t Work |

| [3] | ^ | American Psychological Association: Multitasking: Switching costs |

| [4] | ^ | American Psychological Association: Multitasking: Switching costs |

| [5] | ^ | Frontier Psychology: Driving and Multitasking: The Good, the Bad, and the Dangerous |

| [6] | ^ | US Department of Transportation: The 100-Car Naturalistic Driving Study: Phase II – Results of the 100-Car Field Experiment |

| [7] | ^ | Cerebrum.: Multicosts of Multitasking |

| [8] | ^ | Nature: Memory failure predicted by attention lapsing and media multitasking |