I was raised bilingual and started learning a third language when I was about three years old, which means I am really fluent in three languages as an adult. When I was a kid, learning and remembering new words, grammar rules, and exceptions seemed as easy as a pie. I was always among the best in my language classes.

When I decided to move abroad to France and needed to master another foreign language, I thought it would be as easy as in my school days. I’d quickly pick up the new words and reach a decent fluency level in a month or two naturally. How wrong I was!

Learning a new language as an adult proved to be rather challenging.[1] Learning grammar was tough, and remembering the correct pronunciation was even worse!

Here are some of the best ways to learn a new language that I’ve gathered along the way both from my language school and independent studies. I hope that they will help you as well!

1. Focus on Remembering And Learning the Sounds First

Learning a new language when you were a kid seemed much easier, right? Well, there’s an explanation for that.[2] Babies have a remarkable ability to distinguish all sounds in all languages and remember them fast. That’s how we become experts in our native language.

Yet, as we grow older, we lose this amazing ability to remember and distinguish sounds. For example, adult Japanese students find it challenging to distinguish “L” and “R” sounds in the English language.

So, is there a way to regain that ability to memorize sounds and foreign words? Science says yes.

First of all, focus on repeating and practicing the difficult foreign sounds first, rather than mastering the grammar and vocabulary. Invest more time in listening to the language and repeating the phrases and sounds as they are spoken.

If you have a chance to get immediate feedback on your speaking (for example, with a language learning software like Rosetta Stone or Gritty Spanish), that’s another massive booster for your performance.

Additionally, studies prove that you should listen and learn to comprehend different accents and voices if you’d like to master a language faster. Listening to a vast array of speakers will train your brain and help you transfer that knowledge to the real world in a more reliable way.

2. Use the “Spaced Repetition” Technique

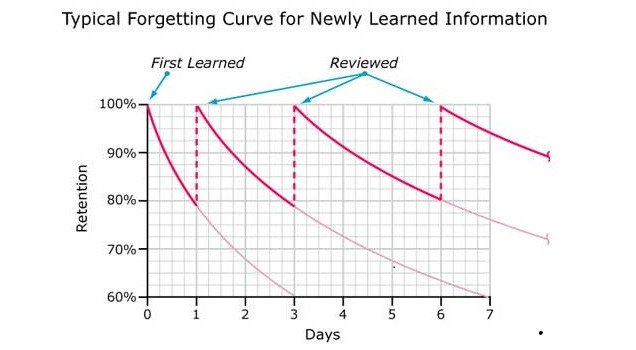

Spaced repetition is an oldie but a goodie when it comes to language-learning tricks.[3] It helps you memorize new words better.

To practice it, you have to review each word and phrase you’ve learned within certain spaced intervals. At first, those should be shorter — you may need to review a new word or phrase a few times during one practice session, and afterwards on the next day. Once it gets stuck in your mind well, you’ll be able to leave days or even weeks between revising without forgetting what you’ve learned.

Here’s a diagram illustrating this process:

Learn more about spaced repetition in this article: How to Use Spaced Repetition to Remember What You’ve Learned

3. Try the “Pinch Yourself” Hack

This technique was introduced by Maneesh Sethi, a frequent traveler who mastered four foreign languages as an adult. His approach was based on the fact that negative stimuli massively boost self-improvement.

According to a study conducted by the Department of Psychology and Center for Neural Sciences at New York University, your body’s threat response improves memory. In their tests, this meant light electric shocks given for incorrect responses.

How you can use this for language learning?

- Get a set of flashcards for memorizing vocabulary or grammar.

- Master the hard pinch (it should be quite hard) to activate your body’s threat response.

- Review a category of flash cards (such as adjectives or group of words). Don’t pinch yourself at this stage.

- Review the same category, now adding the pinch for each vocabulary word. Spend some time studying the card before moving to the next one.

- During the next study sessions, pinch yourself only on forgotten vocabulary. Your goal is to focus your increased memory retention on the words you have trouble remembering. Again, spend a moment on each card before moving on to the next.

4. Schedule Learning Sessions Before Bedtime

One of the huge benefits of sleep is that it allows us to clean our active operating memory, thus boosting our learning capacity.[4] Studying before bed time or getting a nap after your practice session will move all the information you’ve just learned into your brain’s long-term memory storage.

Once the information gets there, it’s safely stored for a longer period. The spaced repetition technique will help you improve the connection between short-term and long-term memory, meaning you’ll be able to remember everything faster and more accurately.

5. Study the Content, Not the Language

According to the results of a study published in the Cambridge Journal, students who studied another subject in French, rather than attending a general language class, performed better in listening tests and were more motivated to learn.[5] However, students in the standard class performed better on reading and writing tests, meaning that both approaches clearly have merit.

To boost your language learning, try including some content on the topics you are interested in to improve your understanding. Read articles online, watch videos, or listen to podcasts to accelerate your progress.

6. Mix Old And New Words

Our brain always wants novelty, but attempting to learn a lot of new words at once can be overwhelming. Thus, to remember new concepts, you should mix them with familiar “old” information.[6]

For example, you can attempt reading a children’s book you know in a foreign language. The language is simple enough and knowing the story helps you guess the meaning of new words without using the dictionary (mixing novelty and old information). Besides, children’s books are more fun to read in another language!

7. Study in Sprints

Finding time to study a new language can be challenging. If you are busy, you may be tempted to put off your studies and cram a significant chunk of knowledge inside your head every other week. Yet, studying in short sprints every day is much more effective.

As our brain has limited “inbox” space, which gets cleared out while we sleep, you will hit your study limit rather quickly if you opt to study for hours at a time.

Studying in small sprints every day and using spaced repetition will give you the best results.

Happy language learning!

Featured photo credit: Start Digital via unsplash.com

Reference

| [1] | ^ | Times: The Secret to Learning a Foreign Language as an Adult |

| [2] | ^ | Scientific American: How to Teach Old Ears New Tricks |

| [3] | ^ | Science Direct: Repetition between and within languages in free recall |

| [4] | ^ | Berkeley news: An afternoon nap markedly boosts the brain’s learning capacity |

| [5] | ^ | Cambridge Journal: Students Learn Language via a Civilization Course—A Comparison of Second Language Classroom Environments |

| [6] | ^ | UCL: Novelty aids learning |