Bartering or swapping sites provide easy ways to trade locally for services or needed products. Bartering or swapping can conveniently also take place through the mail . Of course, sites designed for swapping save money, especially since bartering is tax-free. The practice of bartering has been going on for centuries but on the Internet, people from all over the world can connect faster and with more convenience.

1. SwapStyle

SwapStyle is a bustling world wide bartering, sell, or buy clothing site. Women and children’s clothing are available, as well as, sections for entertainment, accessories, shoes, and maternity wear. The site has been around since 2004 and is quite the popular spot for trading or buying. The site is free to join.

2. Rehash Clothes

Rehash Clothes is a swap site for just about everything. There are men’s, women’s, and kid’s clothes available, along with, accessories, DVDs, textbooks and far more. The site was originally designed to design and reuse old clothes into designer clothes. Upon its launch Rehash Clothes quickly gained popularity as a swap site.

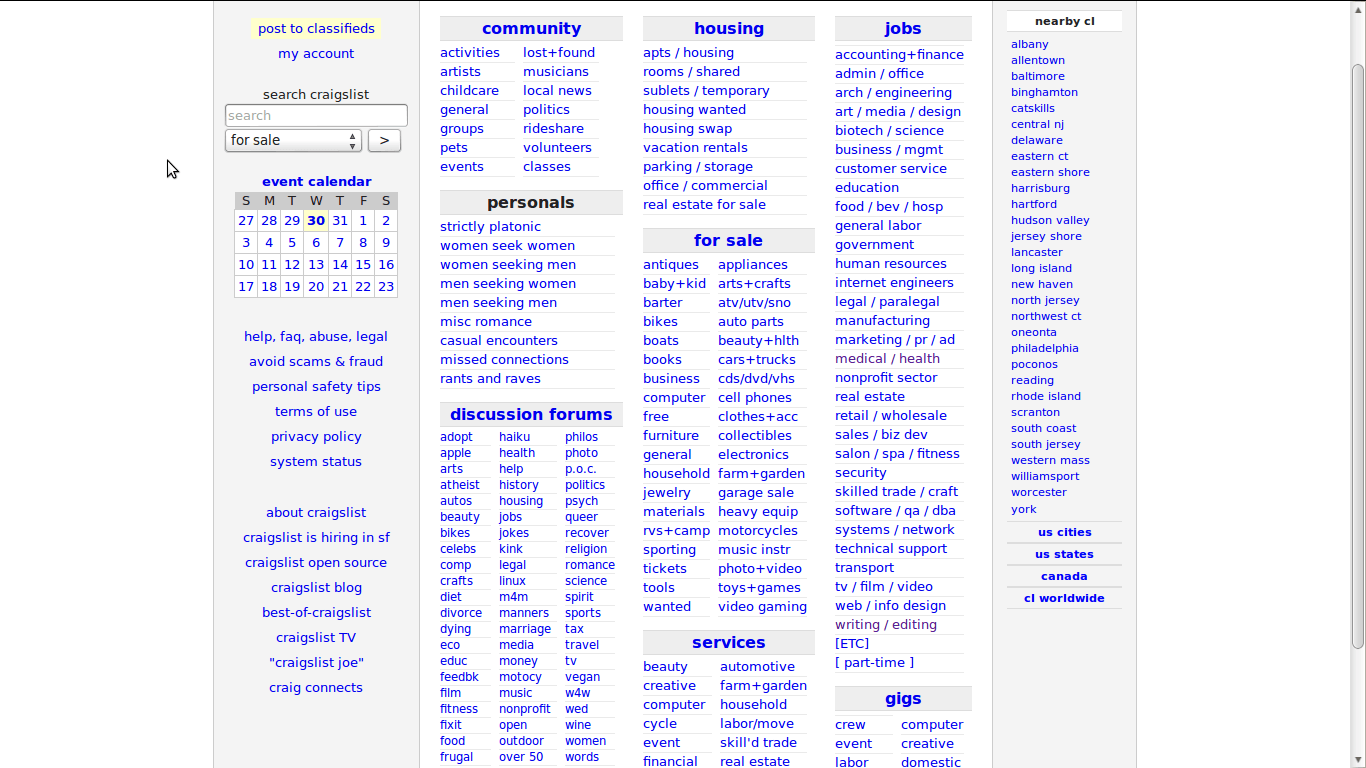

3. Craigslist

Craigslist provides a a great resource for anyone looking to barter or swap. It was started in 1995 by Craig Newmark as a list of local events in San Francisco. Craigslist quickly grew into the large entity today, where people can go and find just about anything.

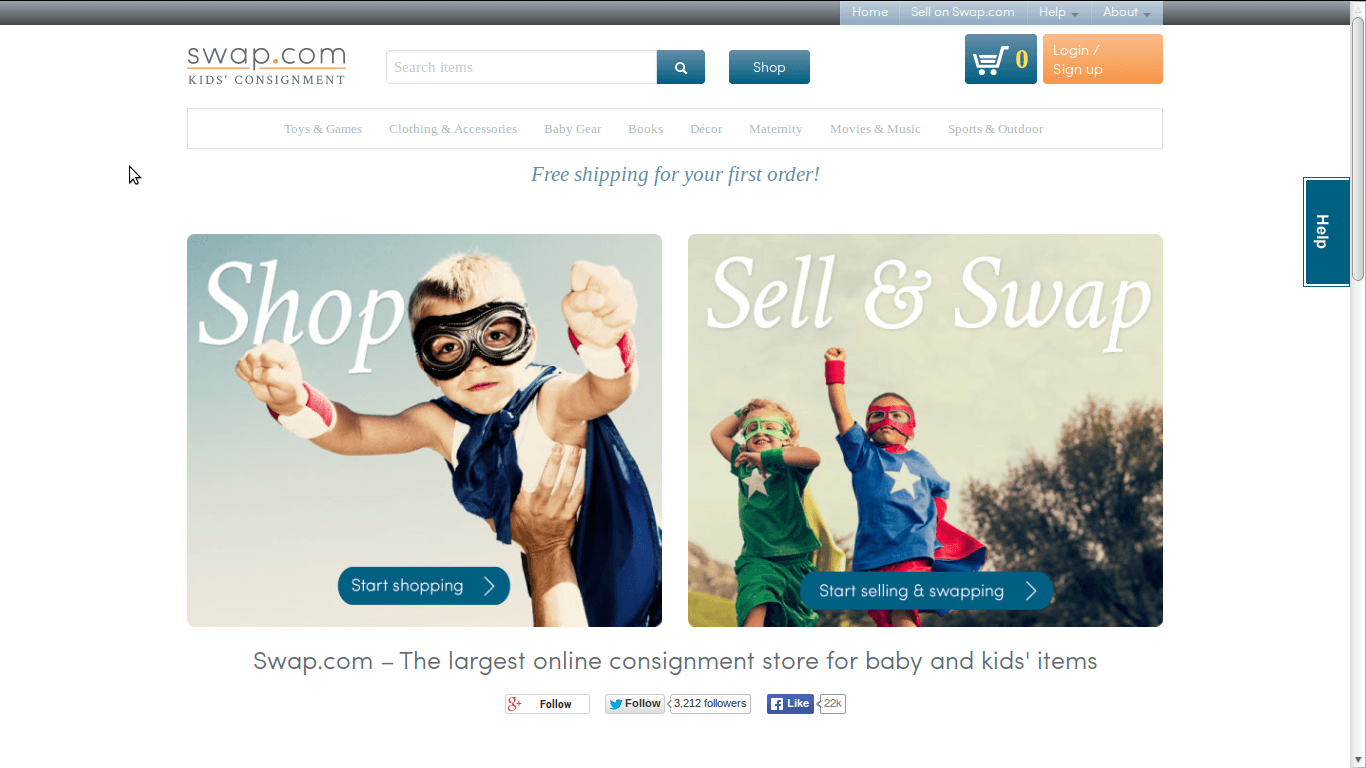

4. Swap.com

Swap.com touts itself as ‘the largest online consignment store for baby and kids’ items. Parents simply box up the child’s clothes, toys, or maternity clothes and swap.com takes care of the rest. The items sent in are photographed and those with consigned items price their clothing or swap for needed items.

5. U-Exchange

U-Exchange is an international bartering site for just about anything. Swap motorcycles, cars, homes, and more. There is no membership fee, people only have to sign in with a legitimate e-mail to begin swapping. U-Exchange does charge a very small fee to trade boats or to swap property permanently. Check out the guidelines before bartering.

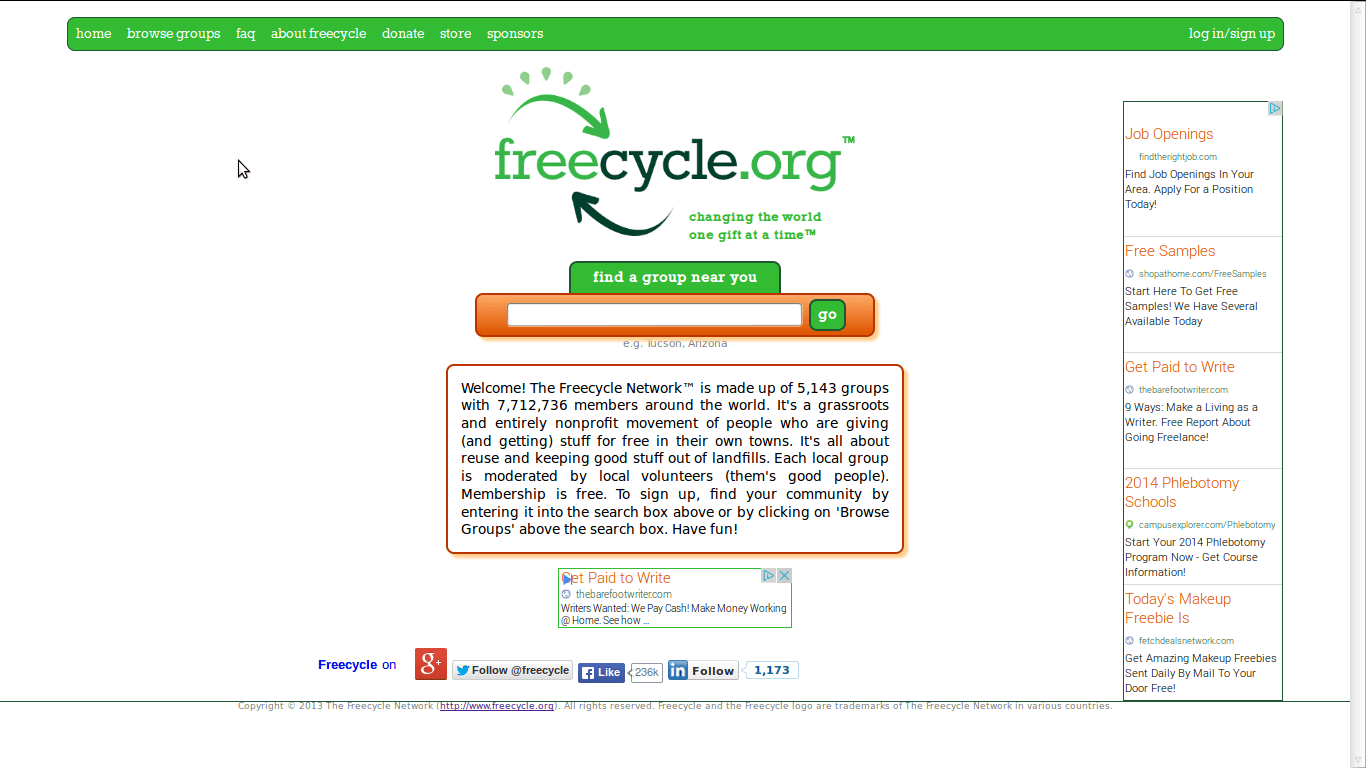

6. Freecycle

Freecycle was begun in 2003 in Tucson, AZ. It began as an e-mail list for locals to find other peoples throw-aways. The site grew quickly and now has over 7 million members worldwide. Simply enter your zip code to find those close to you or enter the zip of a larger city to discover whether some members will ship their items in an international swap.

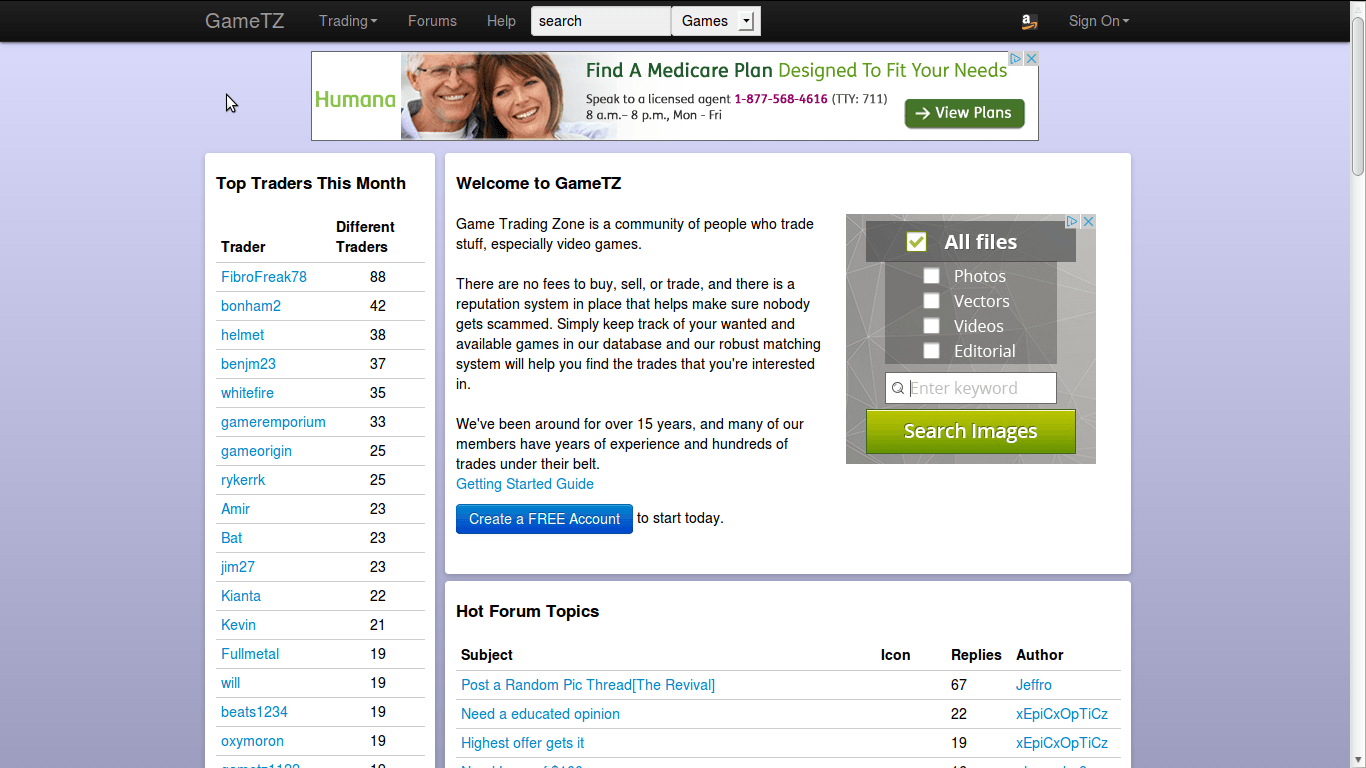

7. Game TZ

Game TZ is a great and inexpensive way to keep a gamer happy. The zone allows users to create a library of their games and to trade between users without a fee of any kind. The site features top traders and what has been traded and received. Game accessories are also available to trade or buy.

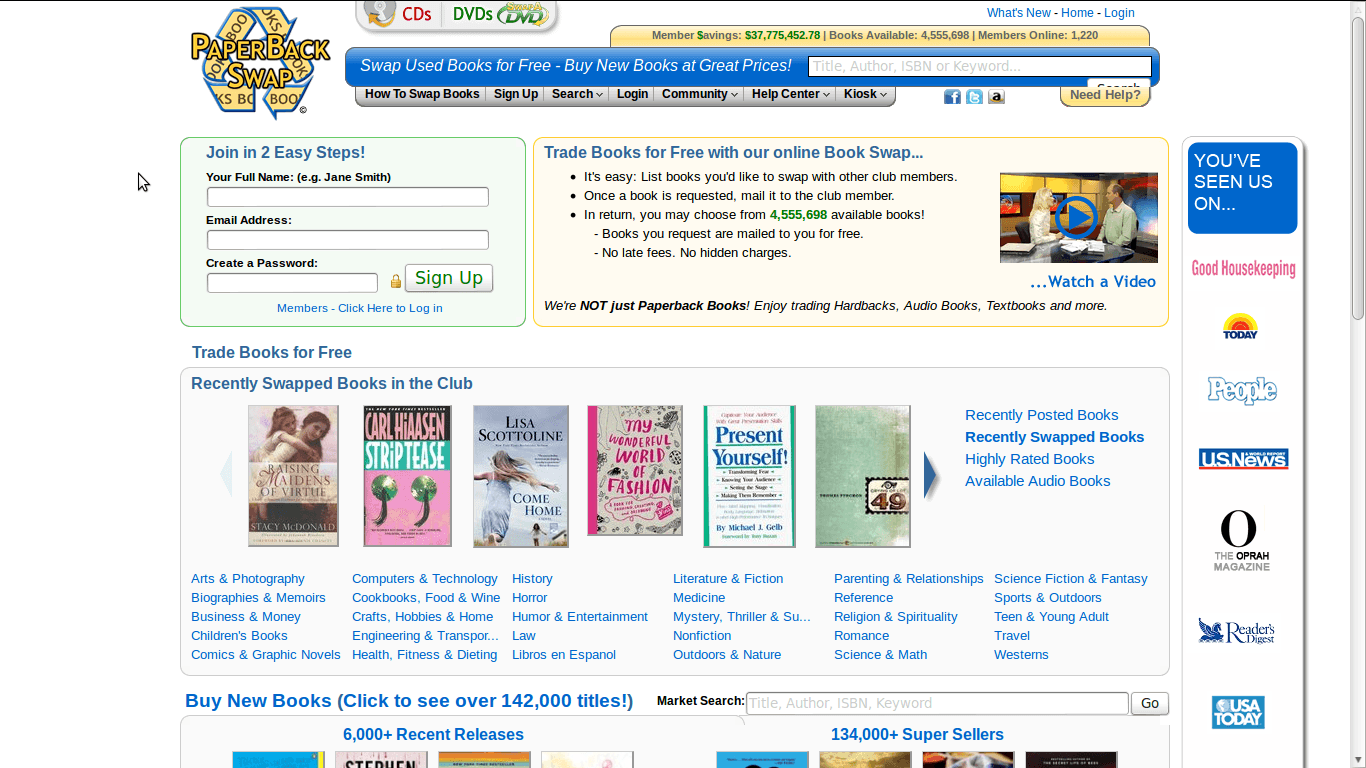

8. PaperBack Swap

Book lovers will truly love PaperBack Swap. Members build up their library in order to swap with other members. When a member lists ten books, they receive two credits. These credits are then used to barter with others in the group. For example, once a book is mailed and received by another member, the member who sent the book earns two credits. Extra credits are available for trading audio books.

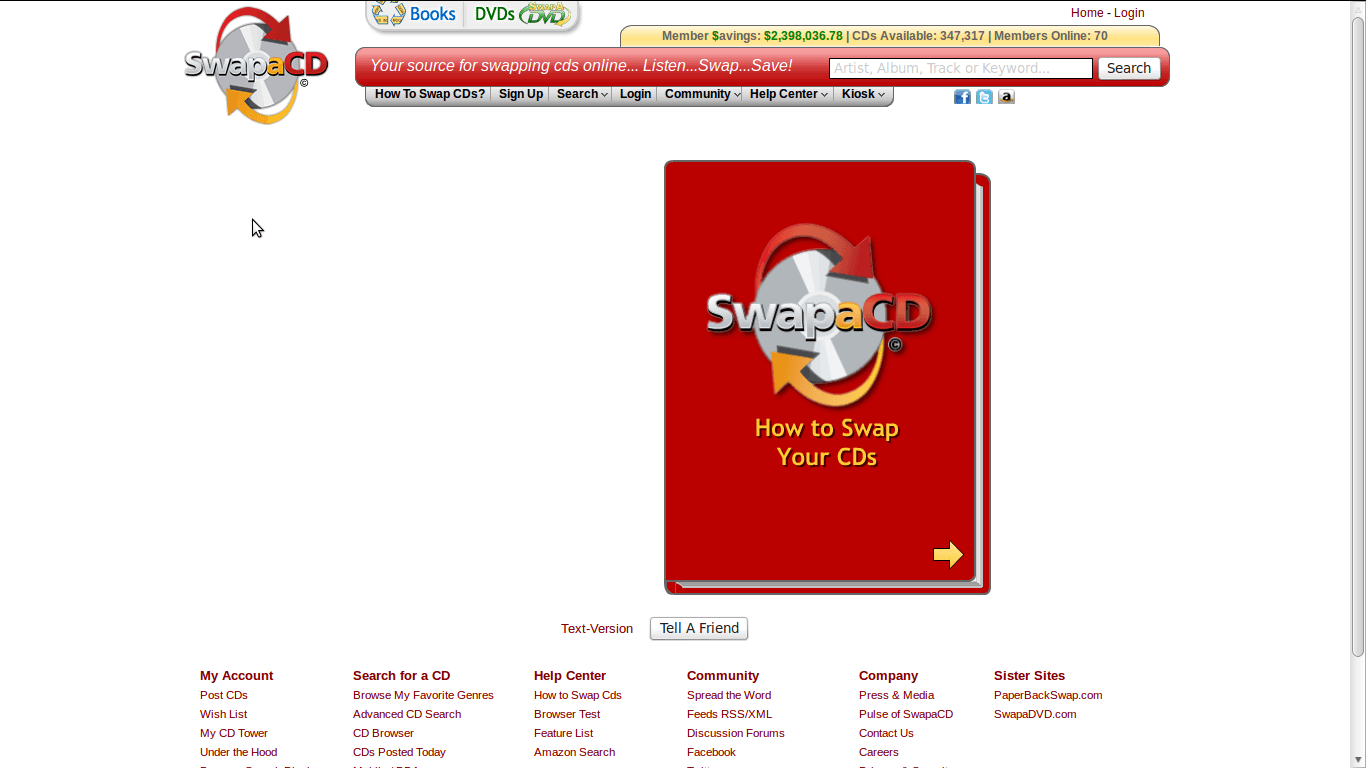

9. SwapaCD

SwapaCD works the same way as PaperBack Swap. Credits are earned in return for building a library and for sending CD’s to members. CD’s cost $0.49 and one credit point to purchase a CD. These credits may also be used in conjunction with the paperback swap site. Members may join and browse for free.

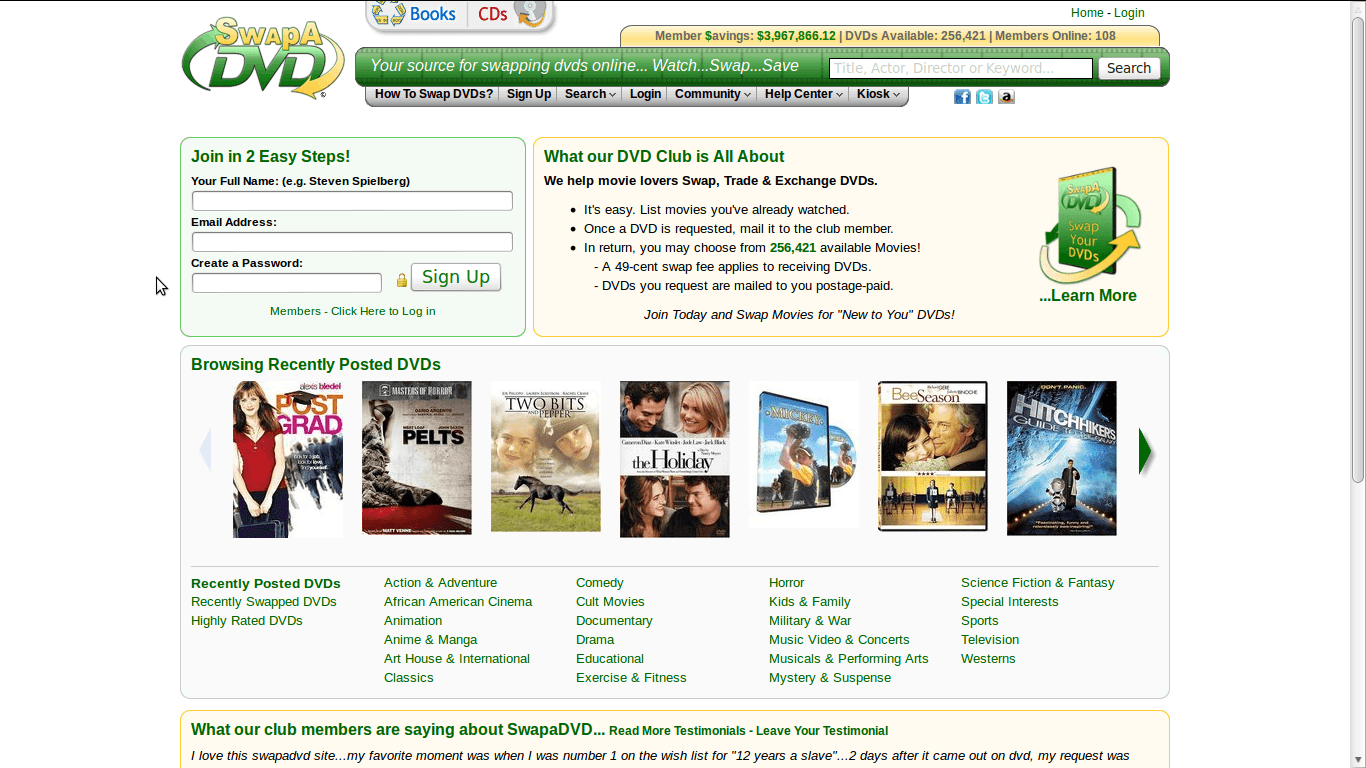

10. SwapaDVD

SwapaDVD is also a part of PaperBack Swap and SwapaCD. Once the user builds a library of ten available DVD’s to swap or purchase, the member is awarded two credits. DVD’s then cost $0.49 plus one credit. When a DVD is successfully sent to another party a credit is awarded to the sender. Paper back books and CD’s can also be swapped or purchased.

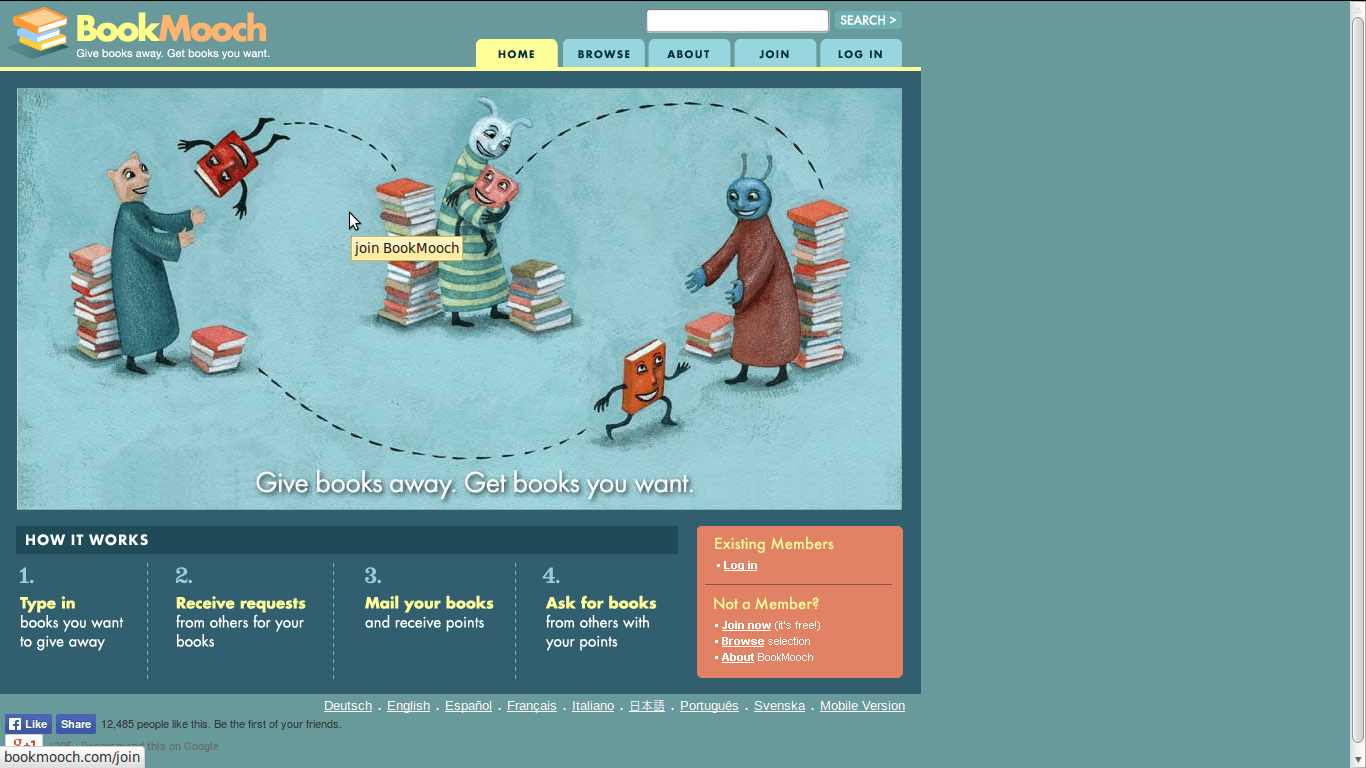

11. Book Mooch

Book Mooch is both national and international book swap site. The site works only on a point system. 1/10 of a point is awarded for each book entered. One point is awarded for every book sent and received, three points if sent out of the United States. A point is deducted for every book received, three points if mailed out of the country. The site is free to join, the only cost are shipping of books.

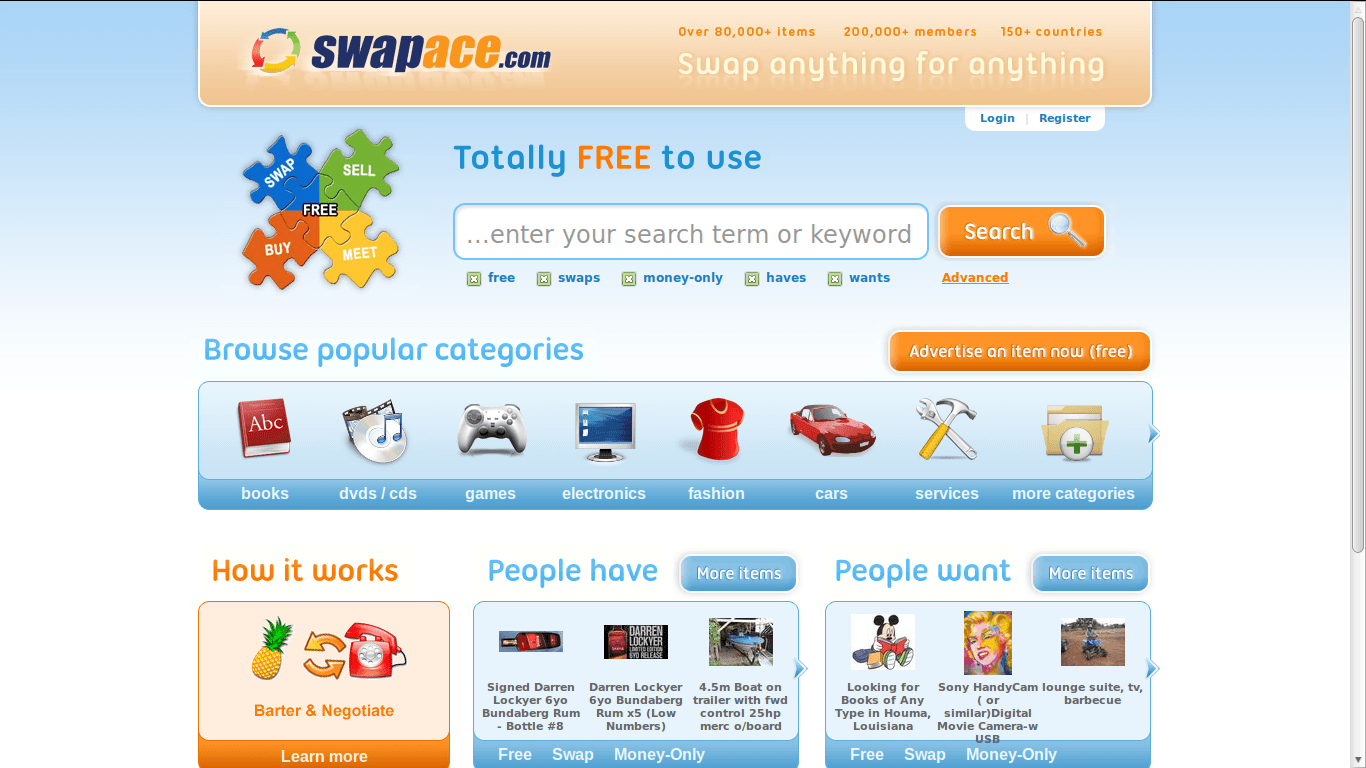

12. Swap Ace

Swap Ace is free to join. Members can buy or trade just about anything, including cars. clothes, electronics, and much more. Bartering deals can be made locally, nationally, and internationally. Services, such as, child care, home improvements, and cleaning services are available.

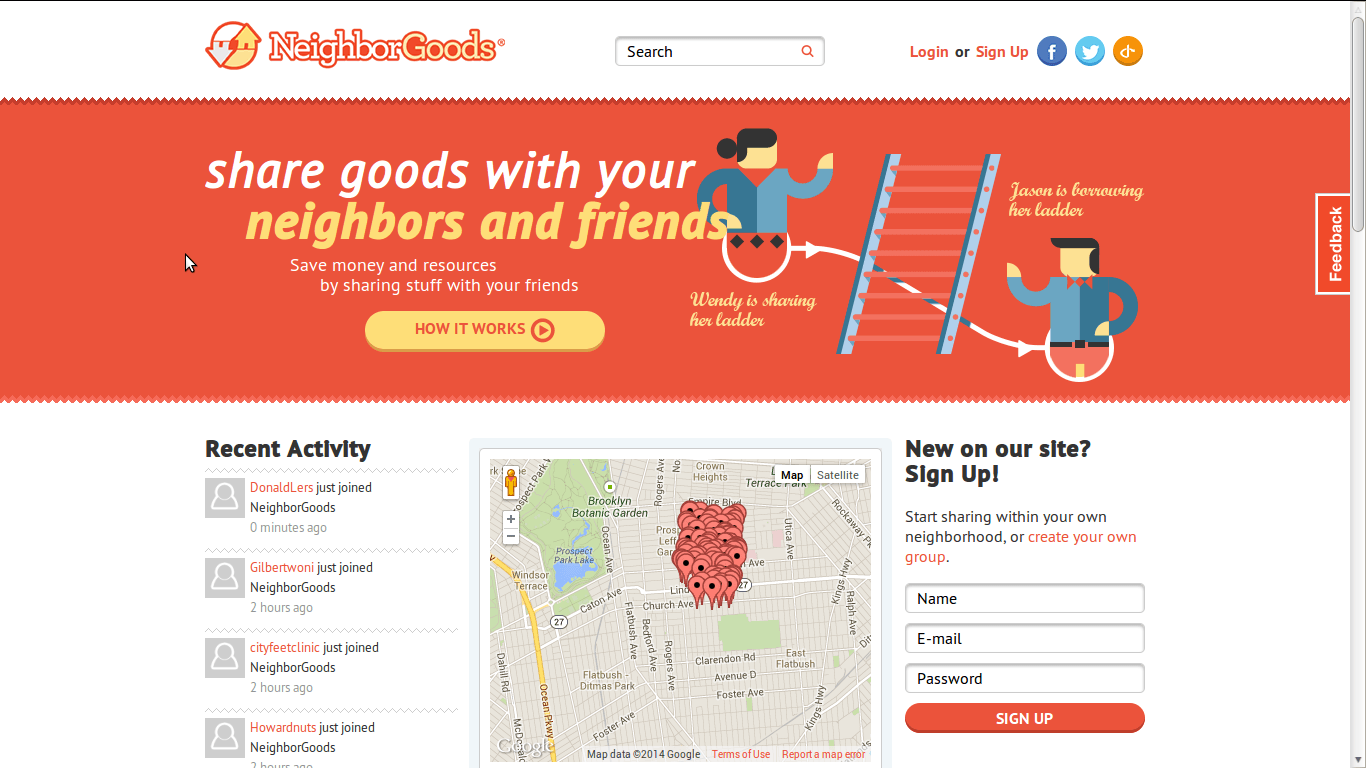

13. Neighbor Goods

Neighbor Goods is free to join in order to barter goods and services at a local level. List stuff you are willing to share or barter in your inventory, which allows others near you to find what you have. Search for your needed stuff on other people’s inventory lists. Plus, Neighbor Goods helps you track your stuff as you lend it out or are borrowing.

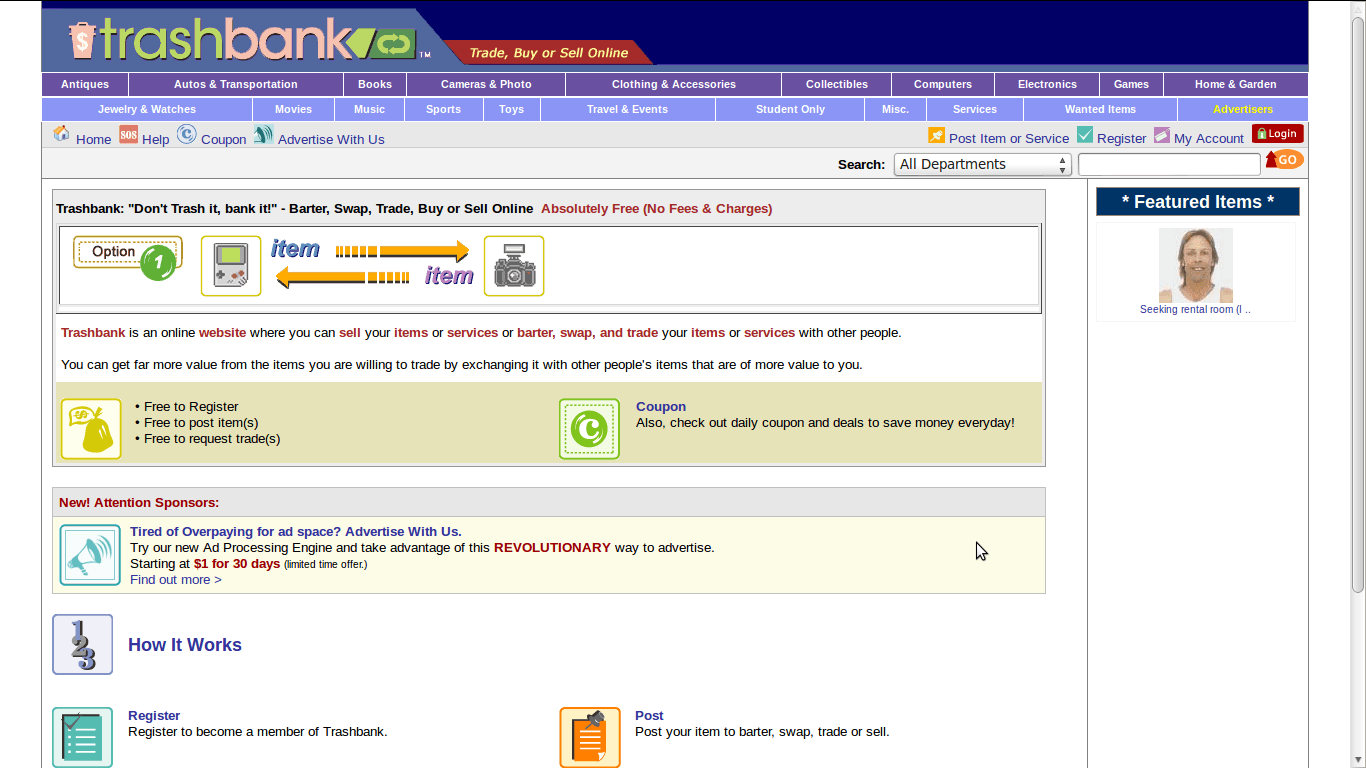

14. Trash Bank

Trash Bank is a completely free site to list, barter, or buy just about anything. The site was founded in 2005 by avid traders. Trash Bank users offer testimonials of their experiences to the trading, buying, or bartering services offered. Bargain travel sites, along with valuable e-coupons are part of the services offered on the site.

15. Barter Quest

Barter Quest allows users to barter or bargain hunt for the best price. Simply list what you have and what you want and the database sorts automatically. You will be matched to who has what you are looking to barter or buy. Every conceivable item is up for grabs.

16. Trade Away

Trade Away is where you can buy, sell, or swap any item for just about anything. Users bid on items, similar to an auction house. Sellers accept the offer that is stellar to them. Registration is absolutely free. Trade anything from antiques to vacation homes.

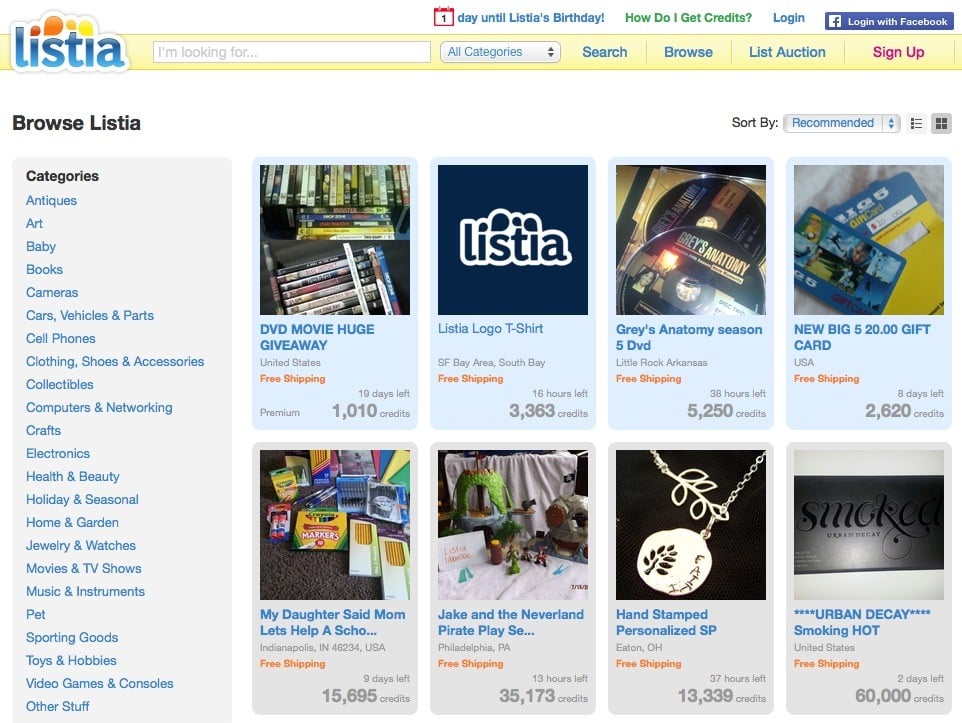

17. Listia

Listia lets you earn points off stuff you barter. Earned points then can be used to ‘buy’ other people’s stuff. On this site you can trade almost anything that moves. Joining is free, and you can join with your facebook or e-mail account.

18. Tukar Tukar

Tuka Tukar is completely free, simply register with a valid social media or e-mail account. Build ‘inventory’ in your virtual garage to start trading, it really is as simple as that.

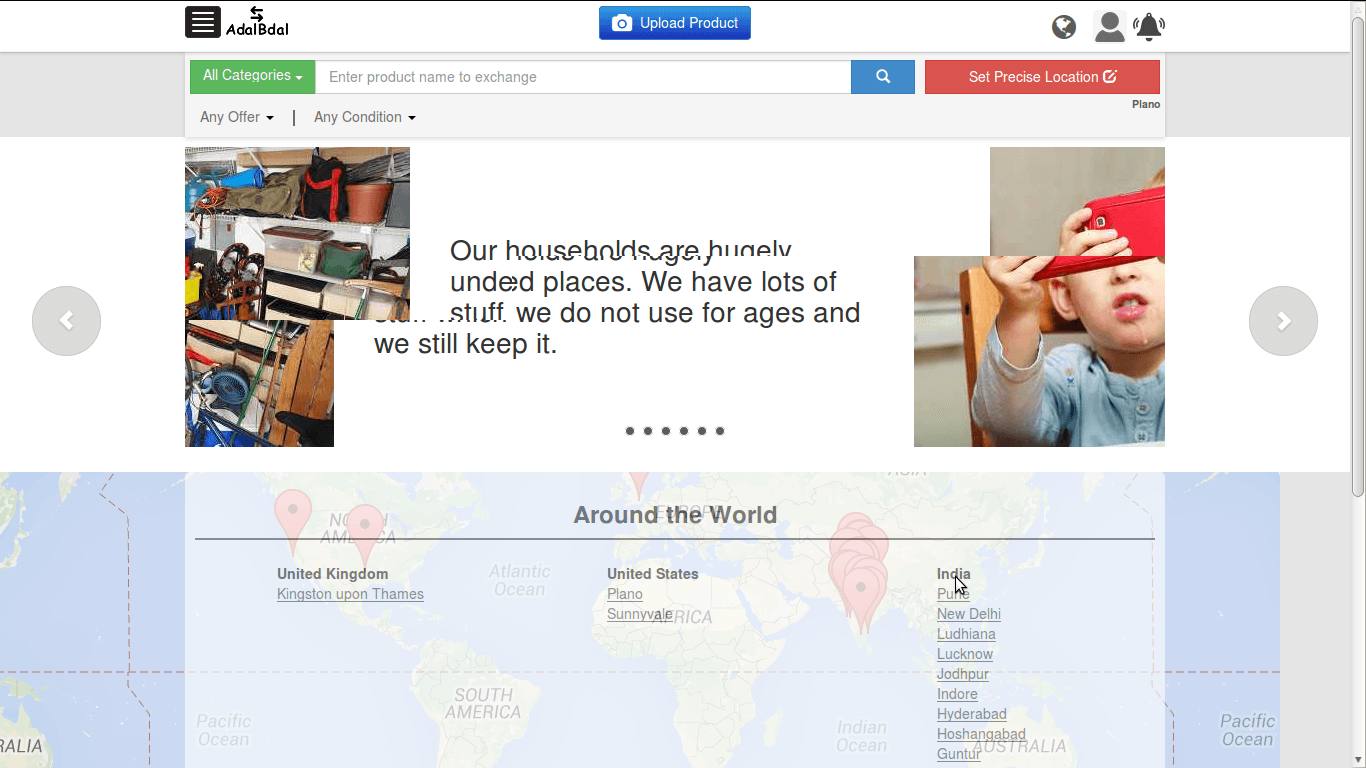

19. Adal Bdal

Adal Bdal is completely free to join and start swapping. Most traders are in India and the site does request permission to find your exact location. The site was created to let people unload there unwanted stuff for stuff that could be used by someone else. There are many items in which bargain hunters would have a difficult time finding elsewhere.

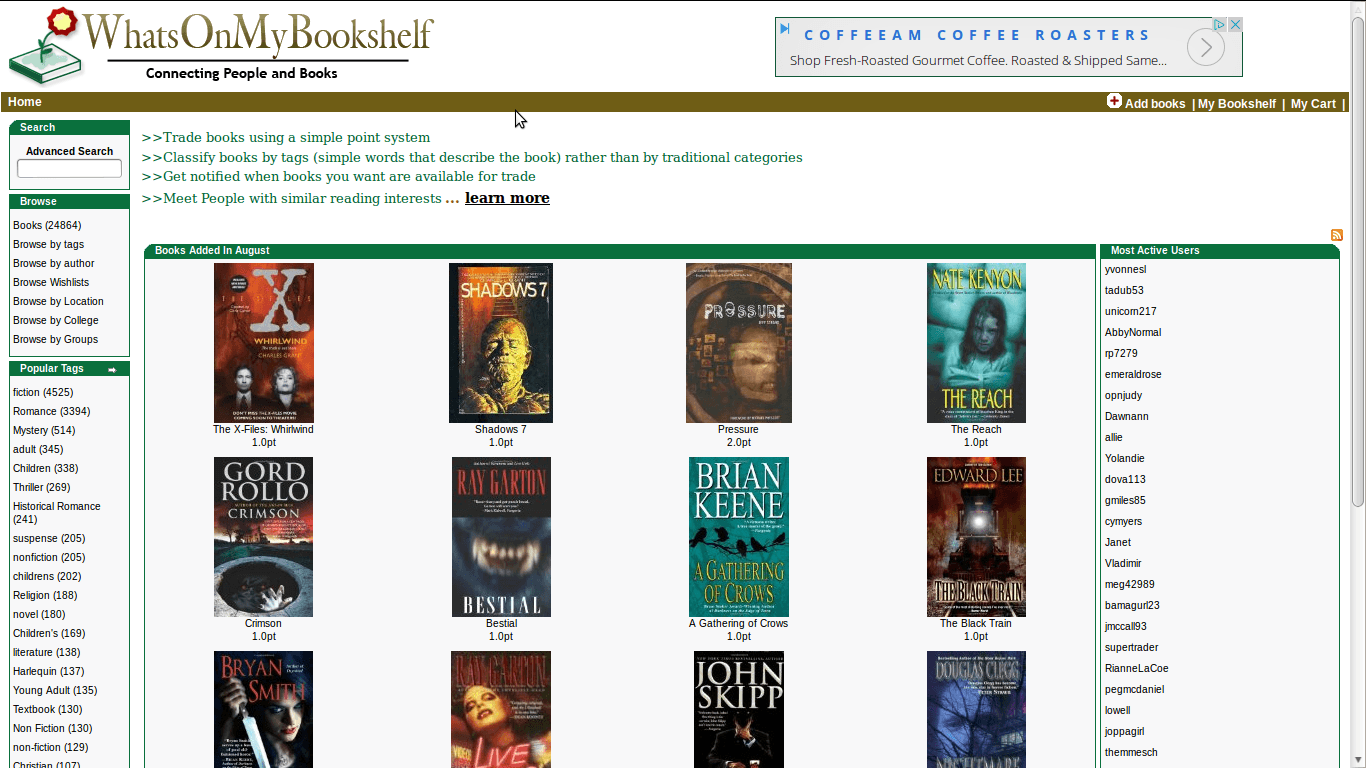

20. What’s On My Bookshelf?

What’s On My Bookshelf is another barter site for books of all kinds. Users receive one credit per every five books listed. The system uses tags, unlike other sites that require books be placed in a genre. Once a book is sent and received, the sender receives 1 point. Points are redeemed through the user choosing a book and having it sent to them.