And so it continues, the next big shopping period will be soon upon is. You know there are many good deals online. However, you just don’t have the time to sort them out to good and the bad sites. Today, we have created a list of the 11 best deal sites and shopping resources to help you to order to choose the best deals for you and save you time hunting around for these sites.

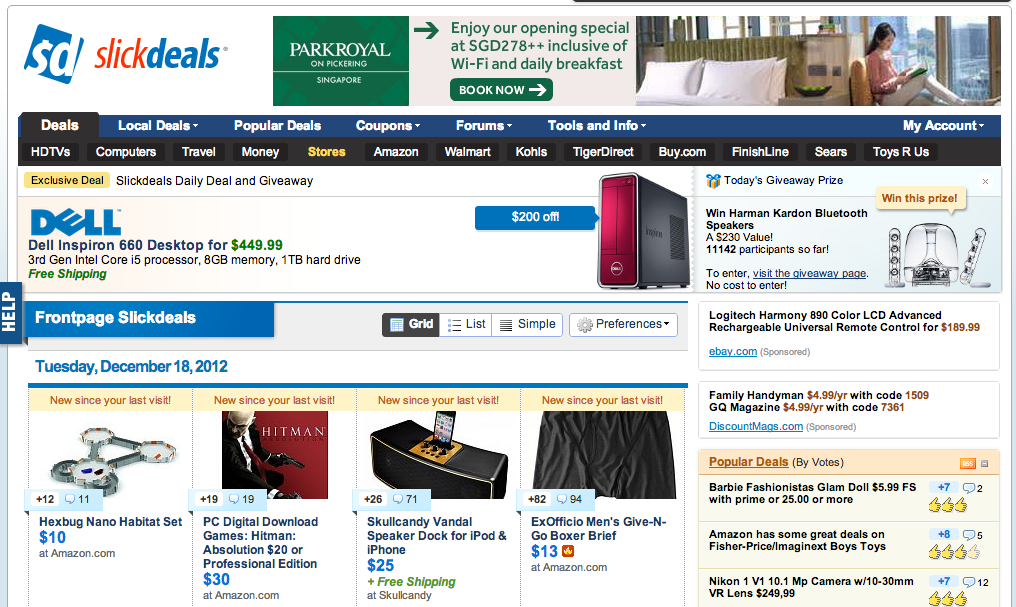

#1 Slickdeals

Slickdeals is a free and user-driven shopping site with looks to provide consumers a platform to share market information.

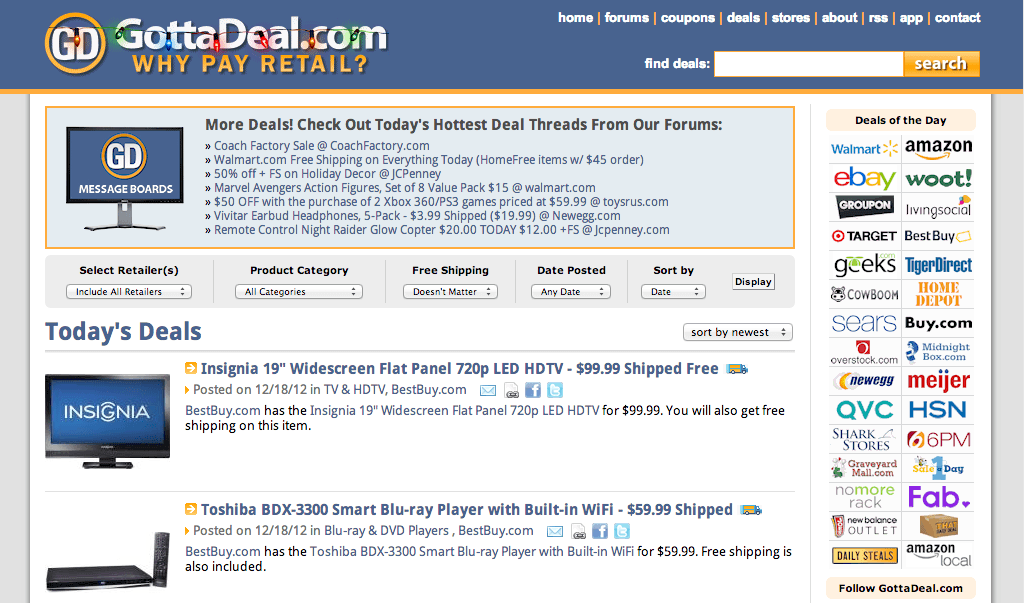

#2 Gotta deals

Similar to Slickdeals, you may find some deals here that are not on slickdeals.

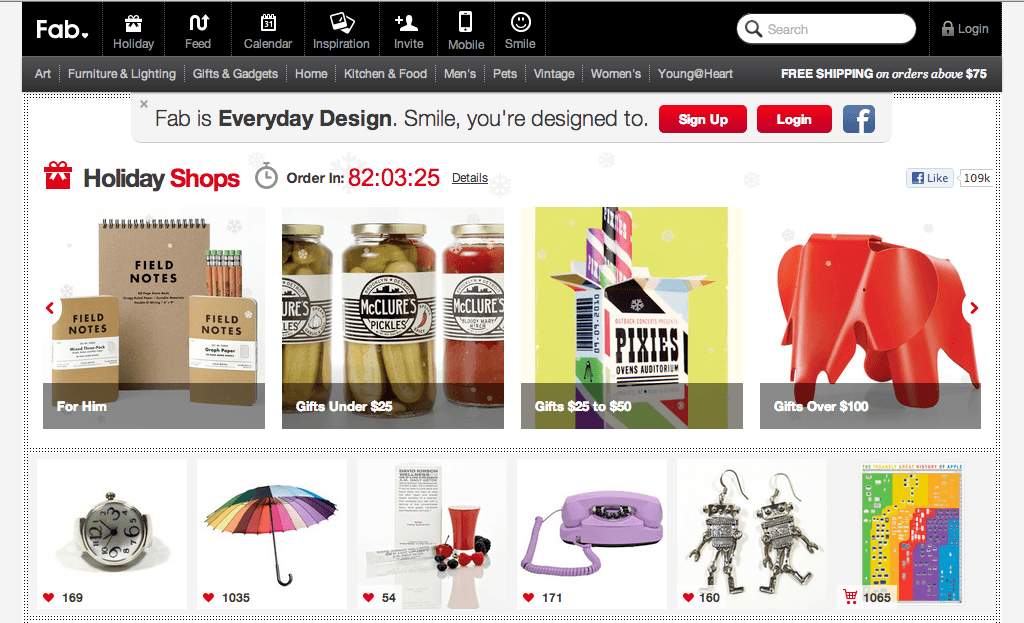

#3 Fab

Fab is all about selling well designed products.

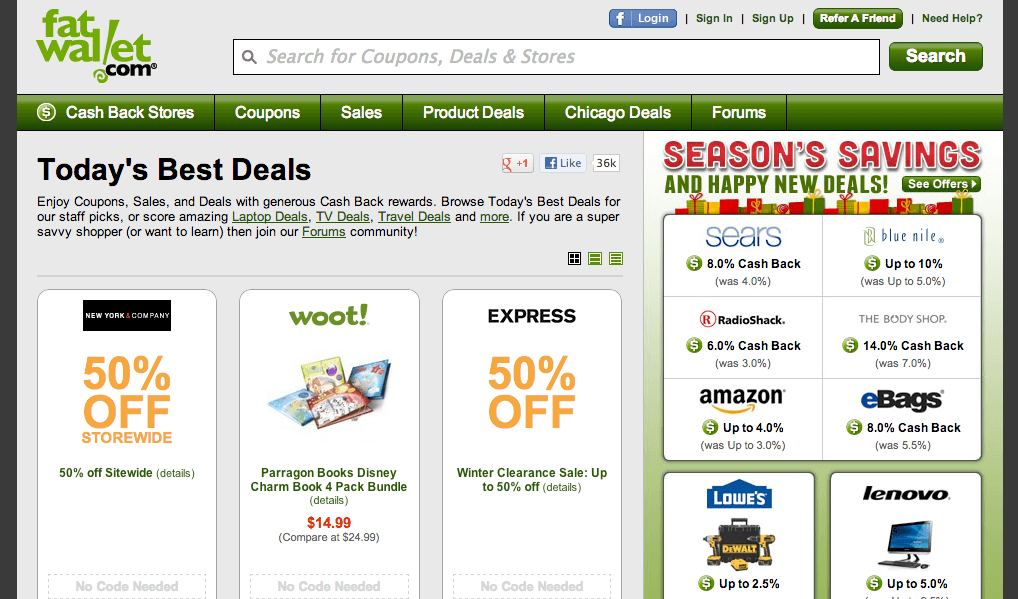

#4 FatWallet

FatWallet is another one of the deal finding sites.

#5 Offer.com

Offer.com provide coupon codes for products alongside deal discovery.

#6 Couponcabin

CouponCabin works directly with some merchant partners and focus on coupon codes.

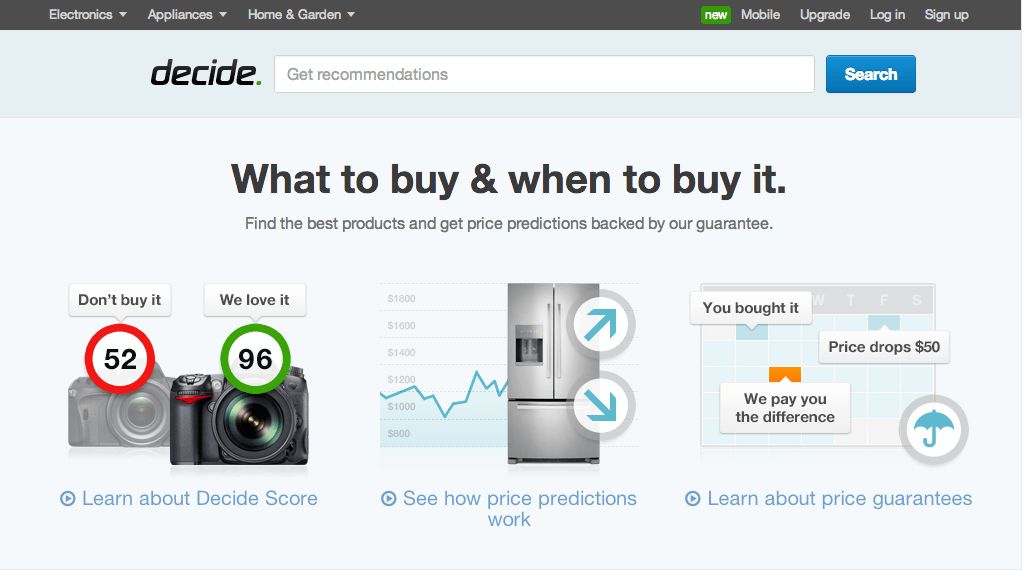

#7 Decide.com

Decide is a price prediction tool which tries to identify the best time to buy something. For members, they have a price guarantee so if their algorithms are incorrect they will pay you the difference if they are wrong.

#8 Plastic Jungle

At Plastic Jungle, consumers can sell their unused gift cards. Plastic Jungle will resell them at a discount for other people. This is a marketplace for giftcards.

#9 Greenmangaming

Greenmangaming focus on covering deals for video games.

#10 Free Shipping Deals

The mission of FreeShipping is to provide consumers with free shipping offers to the stores they want to shop at.

#11 Dealnews

Dealnews is another deal site that tries to find low prices for you.

We hope this list can help you to get the best deals for your holiday shopping. What Online deal sites or shopping resources do you use?

Featured photo credit: Beautiful woman sitting at home via Shutterstock