Odds are you’re one of the nearly 60% of Americans moderately or very worried about not having enough money for retirement. Regardless of your age, profession, income or social status, a desire for retirement savings continues to top seemingly every personal finance poll. The question is: what simple things can you do to calm your nerves and instill the confidence you need as retirement approaches?

Stop Refusing Free Money

Recent data suggests as much as 80% of companies who offer retirement plans also offer to match employee contributions, up to an average of nearly 5% of each employee’s pay. Effectively, that’s a 5% bonus every single year just for contributing enough to meet your employer’s match program. Ask your Human Resources contact if you’re eligible to participate in your company’s retirement plan. Stop refusing free money!

Max Out Traditional Retirement Plan Contributions

If you are to have any any chance of saving enough for retirement, you need to save much more than the minimum to meet your employer’s match. For most traditional workplace retirement accounts, the 2014 maximum contribution was $17,500. If you contribute most, or all, of the maximum consistently year after year, you’ll be well on your way to a robust retirement

For self-employed workers and non-traditional retirement accounts, check with your financial advisor for annual limits to be sure you’re maxing out in compliance. You do have a financial advisor, right?!

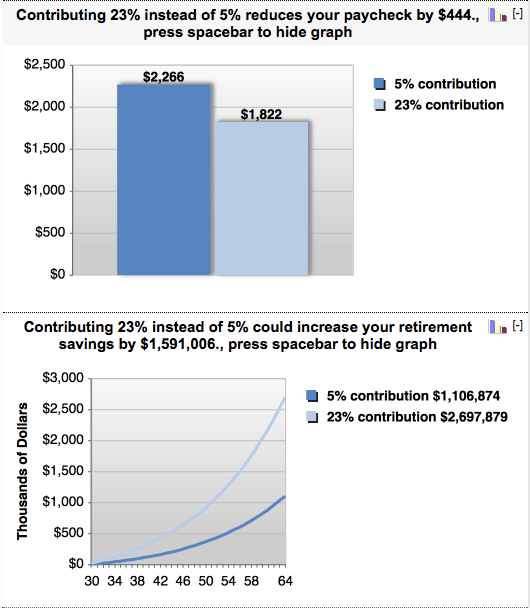

Assuming you’re 30 years old, make $75k per year, plan to retire at age 65 and earn 6% rate of return in your 401k, the below chart shows effect on your bi-monthly paycheck and the monumental difference between just contributing to get the match versus maxing out the $17,500 allowable.

Go to BankRate.com’s 401k Contribution Calculator to customize your own scenario.

Tax-Advantaged Savings

Contributing to traditional retirement accounts is fundamental, but what if your contribution limits are too low to allow adequate savings? Or what if you’re concerned about the taxes you’ll pay down the road on the traditional retirement account income?

A healthy retirement plan should include tax-advantaged savings like a Roth IRA, if you you qualify. Tax efficient investments like municipal bonds may make sense for a conservative portion of your savings. An often-overlooked savings vehicle, perfect for tax-advantaged retirement income, is a cash value life insurance program.

Cash Value Life Insurance may not be a good fit for everyone but the tax-favored savings accumulation, flexibility and death benefit are attracting more and more savers, especially young professionals.

Protect Your Savings

If you’ve followed the nuts and bolts of saving for a healthy retirement listed above, you will be in good shape. If you’re truly a saver, protecting what you’ve worked so diligently to build should go hand in hand with your plan. Protecting your savings means a few different things:

First, don’t take more risk than you’re comfortable taking. Unless you’re burying coffee cans filled with cash in your backyard, every retirement savings plan includes some measure of risk. Fully understand the risk in your investment program or keep asking your financial advisor more questions until you understand and are comfortable with your investment plan. A properly allocated and diversified savings plan helps guard against any major economic swings.

Ensure you don’t get wiped out by insuring your plan. Life insurance and long term care protection should be part of every healthy retirement plan. Owning adequate life insurance can prevent financial ruin and emotional distress for your Family during the savings years — just watch a few of the short videos at non-profit LifeHappens.org to see what I mean. U.S. Department of Health and Human Services statistics show that 70% of people turning Age 65 will need some type of Long Term Care services. Lifetime income annuities may also be a nice compliment to your retirement plan as you get closer to retirement age. These annuity programs can guarantee an income for life but still enjoy a potential market rate of return. It’s important to note the earlier you secure these important retirement protections, the cheaper they will be.

Saving enough for retirement may seem like trapping a unicorn or finally spotting that pot of gold at the end of the rainbow. In other words, it may seem like a fantasy. While your individual retirement goals are different from your neighbors’, follow these four simple concepts diligently and you will absolutely retire with confidence. Saving enough for retirement is simple. Not easy. Simple.

“The ability to discipline yourself to delay gratification in the short term in order to enjoy greater rewards in the long term, is the indispensable prerequisite for success.” Brian Tracy, Leading Speaker, Author and Entrepreneur

Featured photo credit: betacam via freeimages.com