Being a parent, I find kids are very clued in on what they want, and do not seem the slightest bit concerned that it will involve a monetary cost! What I find even more amusing, is that they have no problem spending our or anyone elses money, but ask them to dig into their savings and I am met with highly indignant faces! Oh yes, before they decide to spend their money, there is deep thought and analysis before a decision is made, and of course the guilt trip I am put on for even suggesting they pay for it themselves, never ceases to amaze me!

Yes, I am a parent who tries to teach my kids about money, but finding fun and inspirational ways to do so, is not always easy, especiallly when dealing with different age groups of kids.

Here are some examples of ways you can teach kids about money.

1. Calculator

Give them a calculator while out shopping, so they can key in the item value and keep you informed of costs on an ongoing basis. Comment on some items so they know what is cheap and what is expensive!

2. Allowances

If you aren’t doing it, just try giving allowances for a few weeks, different allowances for different age groups. Be clear to them that they will get no other money for anything until such a date, so they are in charge of the money they are given. Try giving different amounts starting small and see what their spending pattern is like. See if they spend it all in one go, if spend it on junk food, treats, small toys, books etc. This will give you a baseline to work with. When you have this you will know what areas you need to work with for your child. Of course young children will struggle with this so only use it for kids who understand time and can handle some level of responsibility.

3. Shopping

Take them shopping with you and ask them to take notice of the prices of different items of the same type. For example how branding, quality, weight, discounts etc work. Ask them why they think one is cheaper, more expensive, etc just to increase their awareness of cost. Kids get so bored out shopping so keep them involved. It is a great way to learn.

4. Challenges

Set them challenges to work individually or as a team to buy something and come back with the most money. Of couse you will also need to explain about value to them so do this after they understand the concept of shopping covered in the previous point.

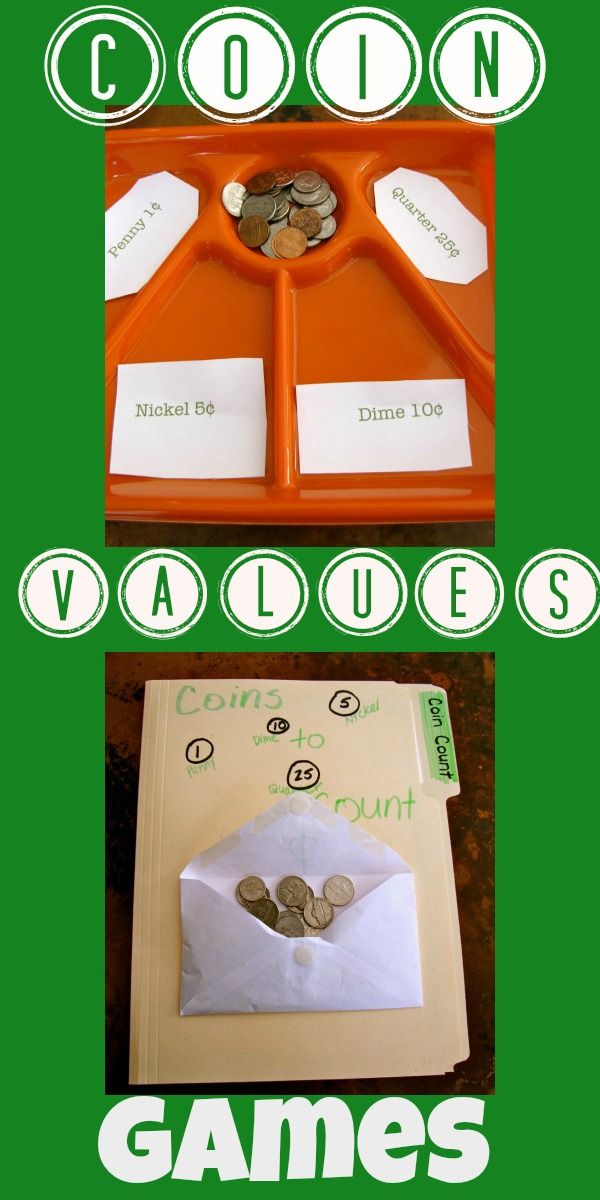

5. Coin Game

Play a coin game with them where they need to work out how many small coins equals one bigger one etc. For smaller kids they may need a reminder chart which you can simply be drawn out. This way they will understand that its not just the number of coins that matters but how much each coin is valued at.

6. Observe transactions

Ask them to observe you paying for something and how the transaction goes. whether it is card, cheque or cash transaction. Let them see how each transaction happens. Teach them that money is a form of exchange for a goods or service! Explain the difference to them with examples.

7. Banking Experience

Take them to a bank and show them how it works. Kids love mystery and stories. Explain where the money goes, that is the money that goes back to the bank and the money that comes out from the bank.

8. Take them to an ATM

I find this always amuses me, as my kids think its magic that a card just gives me what ever money I ask for. I show them that this really comes from my savings or from a loan but that every time I use the card to take money out what I have left, gets lower and lower.

9. Brainstorming

Ask them to think of ways to save more money and get more money. No matter how whacky their ideas may seem, they are thinking it through and that is good. Write down their ideas and try to keep adding to the list. You never know if you may come across a marvelous money saving or money forming idea!

10. Observation Field Trip

Take them shopping or simply on a car journey through a commercial area and ask them to look around them and see different ways people are spending money, and on what they are spending, whether it’s gas at the station, taking money from an ATM, carrying packages or groceries, or whether they are doing a task where they will get a monetary payment in return.

11. Online job chart

Give them a jobs list at home and allocate different monetary values for different tasks. Be sure to have a value of zero for some tasks which they need to do as part of the normal contribution to the household. This also teches kids about value..

12. Money Bingo

Play money bingo where they need to work out how many coins match a number on a box and who ever gets the most right wins. For this to work they will need to add up the correct number of coins and stack them on each number. Of course you will need large boxes and plenty of space.

13. Coin Groupings

Gather all small coins and ask kids to separate them into the same groups. Ask them to write down how many coins are in each group. Then involve them in trades to try to get lots of coin mixes of different coins going. The trades need to be for the same monetary value.

14. Allocation Jars

Give kids three jars and ask them to label and decorate them as they wish. They should be labeled Spend, Save and Give. As a parent you can either decide what amount of money they have goes into each or encourage your child to think about it and then come to an agreement with them over the distribution of the money. Discuss with them also what each jar represent and what will happen to the money in each jar. Kids love seeing things build up and love to shake the jar or take money out and re-count again. Physically seeing their money will give them a greater awareness of money and how it can be used.

15. Coin Rubbing and Tracing

Do coin rubbing and tracing shapes of different coins. For notes, ask the kids to find as many differences as they can see between the notes. This will increase their power of observation!

16. World currency

Encourage them to collect money from around the world and to look up the value of each currency. This is great to let them know about money on a global scale. Open n online converter and show them how to do their own conversions! It will definitely make them think!

“The easiest way to teach children the value of money is to borrow some from them” – Unknown

Photocredits: Pinerest-Moneysavingmom, Freehomeschooldeals, Creeksidelearning.

Featured photo credit: How To Teach Kids Money Skills, by Carissa Rogers, Flikr via flickr.com