Just like any other business, restaurants are always trying to sell you more. Without money the restaurant can’t survive and that means they aren’t immune to the same kind of trickery other businesses engage in to make you spend more. Here are some sneaky restaurant menu tricks that try to talk you into spending more money.

1. They use ridiculous adjectives

Have you ever just looked at the words on a menu? The ice cream is always “sweet and creamy”, buffalo wings may be “tender, juicy, and drenched in a delicious, tangy sauce”, and so on and so forth. Restaurants go through a great deal to make each dish sound as delicious as humanly possible. The reason is fairly obvious. When you’re hungry for ice cream, you imagine that cold, creamy, and sweet treat and your mouth just waters. Restaurants want your mouth to water because it’s money in their pocket.

2. They don’t use dollar signs

Some restaurants do but the staggering majority of restaurant menus do not. When you see dollar signs, you think of money. They don’t want you to think of money. They want you to think of food. The removal of the dollar sign is a slight psychological trick but it’s quite effective. You may be more likely to buy something if you’re not reminded of the fact that it costs you money until after you’ve ordered it rather than before.

3. They use number trickery

Practically everyone knows this one. Restaurants will turn a $10 meal into a $9.99 meal because it makes the same thing seem like a better bargain. Some still will use the $9.95 model to make it even more so. Some restaurant chains (including a very clever Chinese restaurant near where I live) will even use things like $9.85. When people are surfing prices, they’ll see the cheaper stuff and unconsciously want it more. Higher end restaurants don’t typically do this because if you’re going to an expensive place, you know you’re spending money so they don’t try to mess with you too much.

4. They use family titles to entice customers

Realistically speaking, which of the following are you more likely to buy? “Grandma’s fresh homemade chocolate cookies” or “chocolate chip cookies”? It’s okay if you said grandma’s cookies because that’s what most people would choose. By connecting the cookies to family by calling them “grandma’s”, restaurants invoke memories of your grandma’s homemade chocolate chip cookies. The resulting nostalgia motivates you to try out those cookies. It’s effective too. Especially in those Ma and Pa diners. Large fast food chains generally can’t get away with stuff like this (although they still try sometimes).

5. They use ethnic terms to make dishes seem more authentic

Enter any Italian restaurant ever and you’ll see dozens of examples of this. Let’s do another word exercise, shall we? Which sounds more authentic? “Shrimp spaghetti” or “Shrimp scampi tagliatelle”? It’s okay if you picked that second one, I would have too. The truth is tagliatelle is actually just the Italian word for “noodles”. Nothing fancy there, just a straight translation via Google Translate. However, by using ethnic language on dishes, it makes the food seem more authentic. For those of us bored with American food, some shrimp scampi tagliatelle sounds amazing even if, word for word, it means “noodles with shrimp doused in butter”.

6. They use brand names to create product associations

It sounds complicated but it really isn’t. TGI Fridays uses Jack Daniels BBQ sauce. Fans of whiskey know the Jack Daniels name and are thus more likely to enjoy sauce made from one of their favorite beverages. Buying brand name stuff is “cool” and “hip” and many claim it does taste better than non brand name. It isn’t rocket science. People will simply buy stuff more often if they’ve heard of it before.

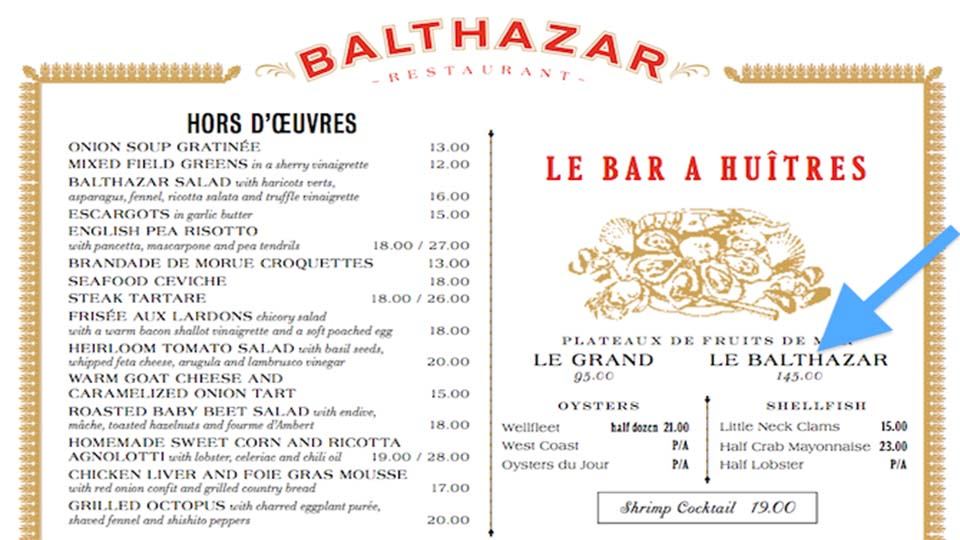

7. They use anchor items

An anchor item is an item that is ridiculously expensive that is set on the menu next to other expensive items to make them seem like a better value. Let’s do a thought exercise. Which is the better deal? A $10 steak or a $20 steak? Okay, so what about a $20 steak and a $30 steak? All of a sudden, the more expensive option in the first scenario becomes the better deal in the second scenario. You put that same $20 and $30 steak next to a $50 steak and all of a sudden $20 doesn’t seem like so much, does it? Restaurants use this tactic to trick you into thinking more expensive items are good deals because they’re placed near an even more expensive item.

8. They highlight certain items to make them seem special

Mid-range and low end restaurants do this constantly. You’ll look in the menu and see pictures of particularly tantalizing looking items. Chinese menus will have “chef specials” that are listed separate from all of the other dishes (and they tend to be the most expensive). This is all a ploy to get you to think with your eyes and not your wallet. Upscale restaurants tend not to do things like this because they believe it to be tacky.

9. They increase the price of the second least expensive wine

This one is a little hard to describe and requires an explanation. According to Urban Spoon, restaurants will intentionally mark up the second least expensive wine. As Urban Spoon explains, many people are cheap (in this economy, there’s no reason to be ashamed of that) but they don’t want to appear cheap. Thus, they order the second least expensive wine. Restaurants became wise to this and made the second least expensive wine more expensive. It’s still the second least expensive but it’s the worst deal out of any wine on the menu.

10. They design their menus in a unique way to prevent you from comparing prices

Not all restaurants do this (most Chinese take out restaurants don’t) but there are still plenty that do. Many restaurants will put their prices down the right side so you can compare prices and get the ones you want. Other restaurants (particularly expensive ones) will put their prices all over the place and use fonts which are difficult to read. This is so you have a harder time comparing prices. They’ll generally align the columns to the center so you have to read through the item descriptions to get to the price which means you’re distracted and more likely to choose an expensive item.

11. They use the “right next door” tactic

We talked earlier about the anchor item that is the most expensive item on the menu. It turns out that part of the menu is pretty important because they employ a second trick there as well. They’ll put the items with the highest profit margins next to the anchor item. That way, when you meander away from the anchor item (because it costs too much), you’ll land on items that look like better deals but will also make the restaurant the most money.

12. They’ll use useless language to make bland items sound more exotic

This is one of my favorite ones because it’s simply ridiculous. You know how people saying things like “PIN number” when “PIN” means “personal identification number”? Restaurants will do this, too. They’ll use language like “beet roots”. Beets are roots so the roots part is totally unnecessary. Let’s face it, though, beet roots sound better than just beets.

13. Restaurants know where you look at the menu and organize it accordingly

According to studies, people look at the top right of the menu first and the bottom left of the menu last. Thus, many restaurants will put the most expensive stuff (usually the anchor item) in the top right while they put the cheap stuff at the bottom and the left. Generally the cheaper stuff is also in smaller text. That way it’s at the worst part of the menu and it’s harder to read than everything else which draws your attention to the more expensive items.

14. They use boxes

This doesn’t seem like a big deal but it can be. Restaurants will often highlight things like high-profit items or more expensive items in decorative boxes to draw your eyes to them. It’s a very simple premise but a very effective one. When you’re just browsing around the menu, chances are that you’ll look at the part with all the decoration and pretty colors than just the plain text parts.

15. They use vague language to keep their portion sizes a secret

It’s also commonly referred to as bracketing and you’ve seen this before. When you go into a place and see that you can order a regular salad or a half salad. Or a half sandwich or a full sandwich. You don’t actually know how big those are but you have a general idea. The half sizes are generally marked up to make the full sizes seem like a better deal. Thus, people on a diet spend more while people who order the full think they’re getting a better deal. All without revealing the actual serving size.

16. They use the “first in show” tactic

Our last menu trick is the first in show tactic. Many restaurants organize their menus. You’ll find beef, chicken, appetizer, a la carte, etc sections. Sources have revealed that people are most likely to pick the first choice in those categories. Thus, restaurants will put their most profitable items first. That way, if you’re one of the many that pick the first choice, the restaurant makes the most money of you.

The important thing to note here is that restaurants have high turnover numbers. People who go out to eat at the nice places tend not to do so very often so restaurants need to figure out a way to make enough money to keep the doors open. So this isn’t something they devised in order to be evil or terrible companies. Let’s face the facts here, grandma’s home made cookies and tender, all-white-meat chicken basted in tangy, spicy sauce sounds delicious, doesn’t it? Being cognizant of the tricks doesn’t mean you have to hate them. You just know they’re there!

Featured photo credit: McCullagh.org via mccullagh.org