We make hundreds of financial decisions every day. Most are simple — do you want fries with that? — but some decisions can be quite complex. As you approach different phases of life, you may find yourself asking these questions, in need of guidance. There are a great many resources available online but I’ve highlighted my favorite 10 online financial calculators to make your life easier:

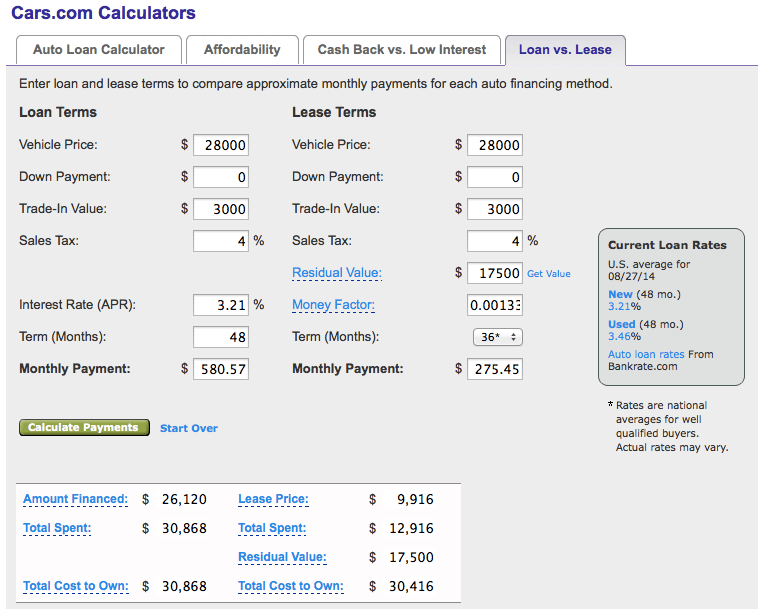

Should I Buy Or Lease?

The number of cars purchased by 18- to 34-year-olds fell nearly 30 percent from 2007 to 2011. This trend has continued with the rapid adoption of services like ZipCar so the importance of getting a good deal is more important than ever before. Use this calculator to weigh your options and make the best decision.

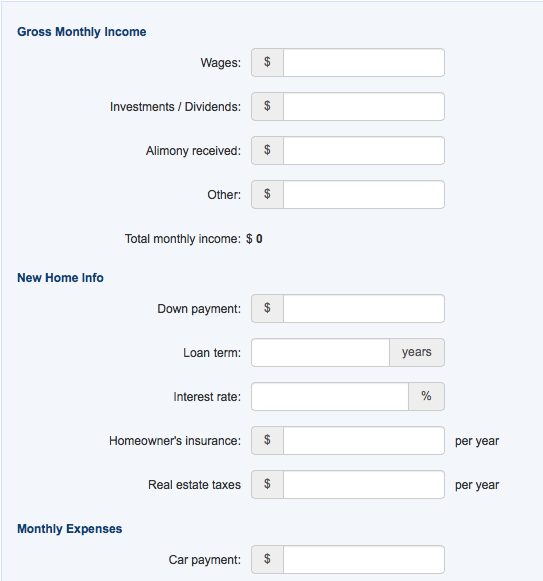

(https://www.cars.com/go/advice/financing/calc/loanLeaseCalc.jsp?mode=full)How Much House Can I Afford?

Likely the most significant purchase you’ll ever make, buying a home can be daunting. Give this calculator a workout in the early stages of your home search to ensure you factor in all expenses and land on a house budget that won’t leave you over extended.

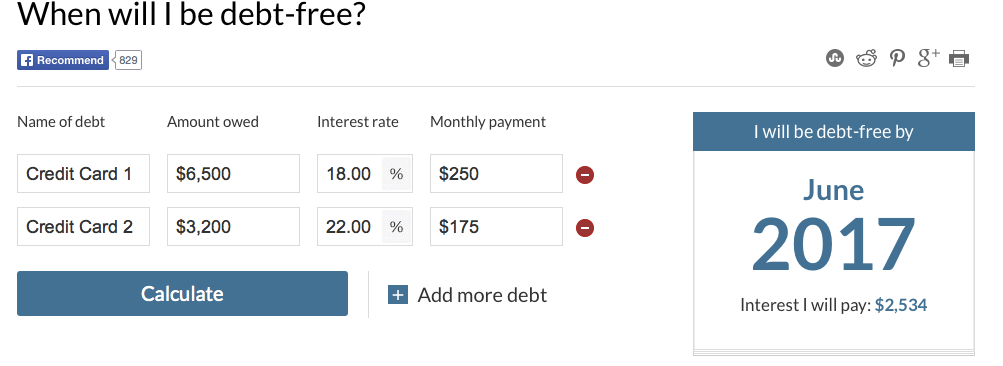

(https://www.bankrate.com/calculators/mortgages/new-house-calculator.aspx)When Will My Credit Card Be Paid Off?

The average American household has more than $15,000 in credit card debt with average interest rates hovering around 17%. Wherever you fall in the spectrum, it’s critically important to develop a debt payoff plan and take a hard look at your credit card balances first. This powerful, easy to use tool allows you to input all your credit card balance and rate information to experiment with multiple pay down plans.

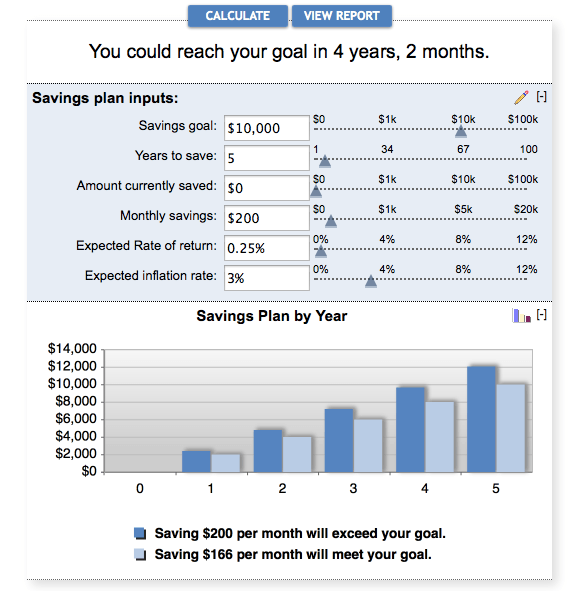

(https://money.cnn.com/calculator/pf/debt-free/)How Close Am I To My Savings Goal?

The power of setting goals cannot be overstated. The power of achieving those goals and raising the bar works wonders for your confidence. Financial goals are no different and this thorough calculator will keep you on track.

(https://www.bankrate.com/calculators/savings/savings-goal-calculator-tool.aspx)What Happens If I Become Disabled?

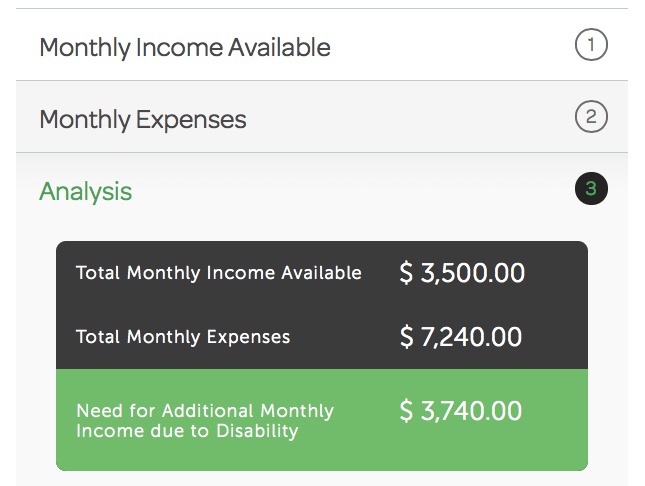

I’ve outlined before (

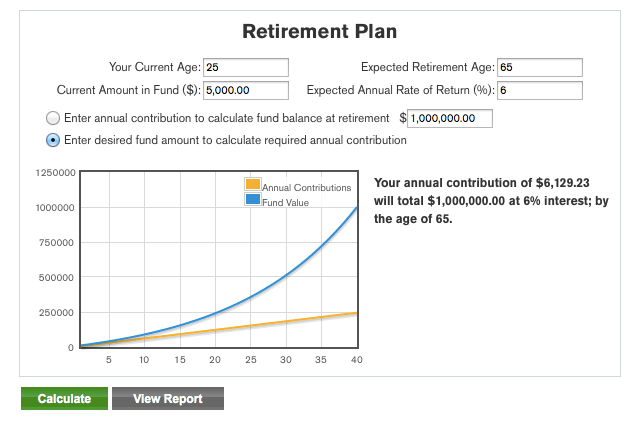

Am I Saving Enough For Retirement?

The age-old question: how much do I need? After consulting your financial planner for a retirement analysis, plug your current retirement savings plan into this robust calculator and adjust as needed. Remember, you need to actually MAKE any desired savings plan changes!

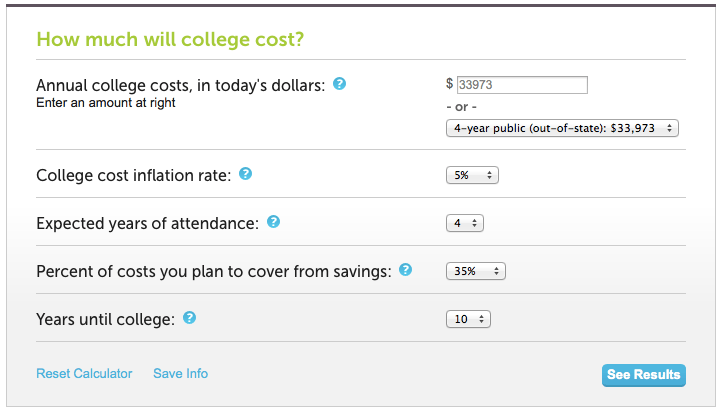

(https://www.bloomberg.com/personal-finance/calculators/retirement/)Will I Be Able To Afford College For The Kids?

Admittedly, paying for your kids’ college can seem like a fantasy. The earlier you start saving, and saving intelligently, the more likely you are to reach your goal. My Father paid every penny of college tuition for me and my two brothers — hands down, there’s no greater gift. The College Board provides this analysis which considers very important factors like inflation and time horizon.

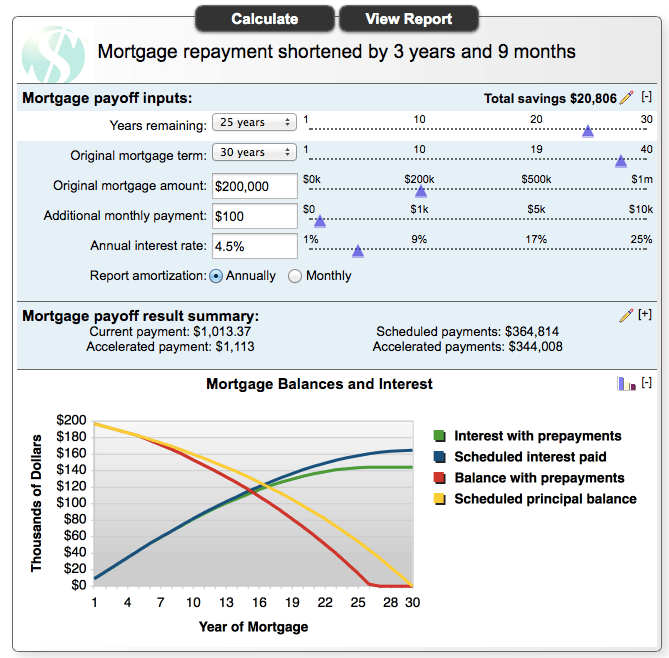

(https://bigfuture.collegeboard.org/pay-for-college/college-costs/college-costs-calculator)How Soon Until I Pay Off The Mortgage?

Many online and TV pundits advocate for debt free living which, for most people, means eliminating the mortgage as your most significant liability. Whether you subscribe to this ideal or you simply want to accelerate payments, this tool will help shape your payoff plan. Keep in mind, if you have a “sweetheart” mortgage interest rate, you may be better off allocating your accelerated payments elsewhere.

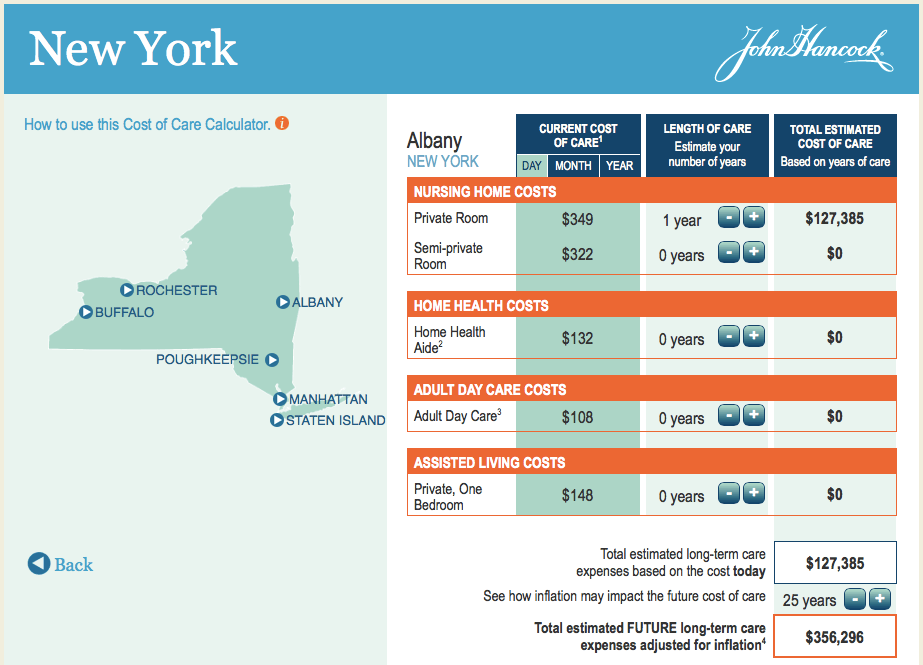

(https://www.aarp.org/money/credit-loans-debt/mortgage_payoff_calculator/)What Will It Cost to Care For My Elders?

It’s no secret the cost of medical care is on the rise. Some industry estimates peg the cost of a private nursing home room to double over the next 15 years. Hopefully your parents and grandparents have made ample arrangements to pay for these expenses. This calculator will help you evaluate the current and projected costs in your area. Don’t know if Mom and Dad are covered? The financial burden may fall on your shoulders so ask them!

(https://www.johnhancockinsurance.com/long-term-care/cost-of-long-term-care-calculator/index.html

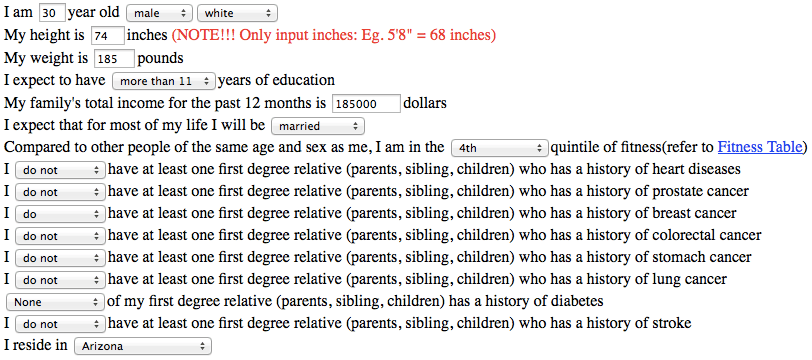

10. How Long Will I Live?

I can’t direct you to the fountain of youth but I can steer you towards this simple exercise the bright Ivy League minds at The Wharton School created. Certainly, it’s not perfect but it will give you an idea of life expectancy so you can plan for an adequate retirement, debt management, life insurance funding, legacy planning and a slew of other important financial decisions.

(https://gosset.wharton.upenn.edu/mortality/perl/CalcForm.html)Albert Camus famously mused “Life is the sum of all your choices.” Making sound financial decisions is paramount to living the life of your dreams and no one can make sensible choices without knowledge and understanding. Use these calculators to identify the impact of significant life events and take control of your finances.

Featured photo credit: picjumbo via picjumbo.com