There’s no getting around it – we have more possessions than ever before. The average American home, which has tripled in size over the past 50 years,[1] now contains a staggering 300,000 items.[2] With all these possessions and extra living space, you’d be forgiven for thinking that we’d know when to stop acquiring stuff. Yet 10% of Americans also feel the need to rent offsite storage too![3] Clearly, we have a problem.

Just imagine how all that stuff piles up over time. If the average home has 300,000 items collected over the course of 10 years, that’s 30,000 things per year. It’s a mind-blowing thought. Needless to say, no one needs to hold on to so many items. Yet it’s not always easy to decide what to keep and what to let go. If you’ve ever looked around your home and realized that it’s time to scale back, you may have become overwhelmed by the sheer size of the task.

Where should you start? And, most importantly, how can you avoid letting go of something and then regretting it later?

The simple, powerful question that will help you declutter

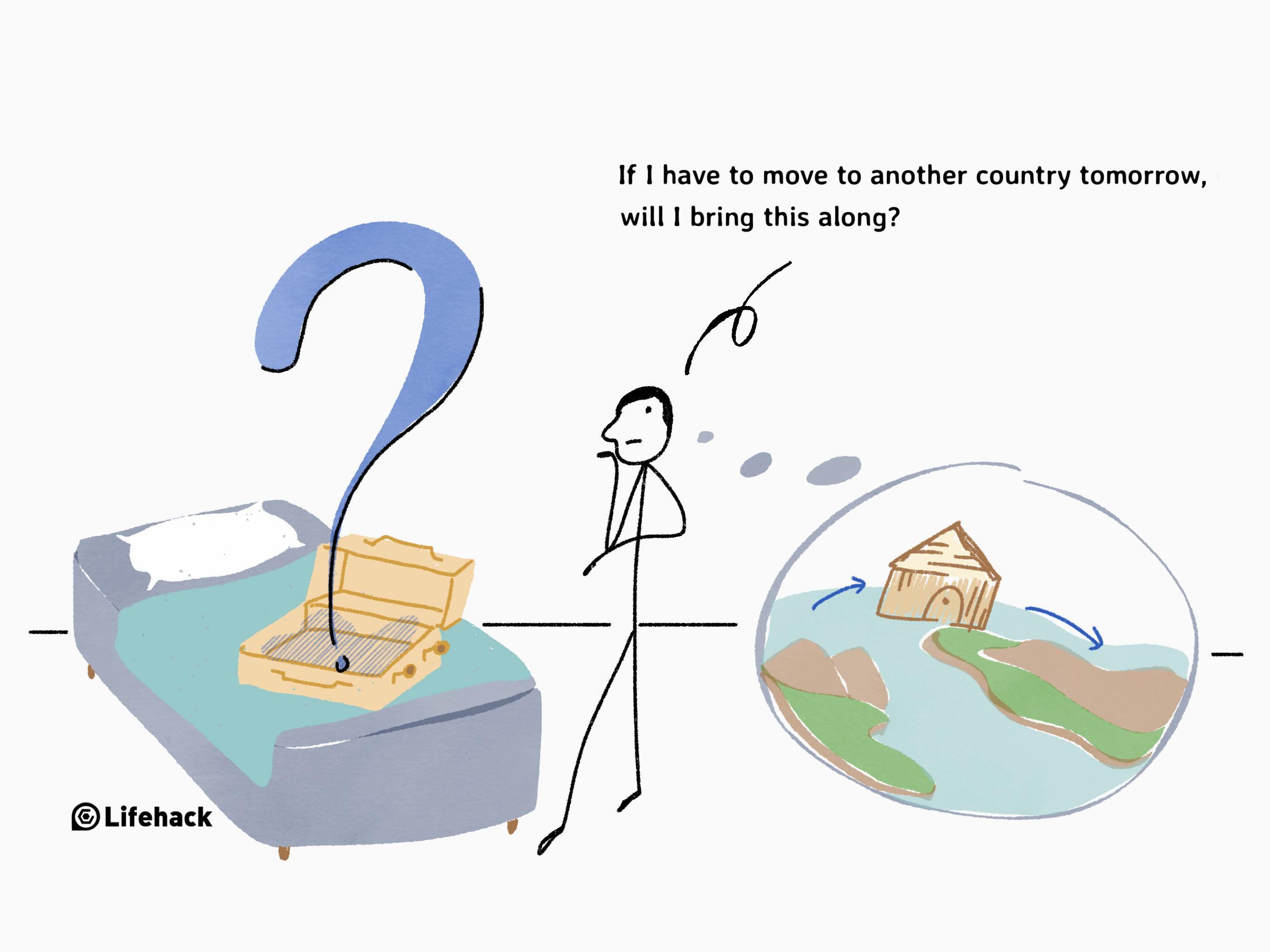

What’s the solution? When considering whether or not it’s time to relinquish an item, ask yourself this question: If I had to move to another country tomorrow, would I bring it with me?

That’s it. This one question will soon help you identify what you absolutely need in your life, and what’s just taking up valuable space in your home. It will immediately help you discern what is most important and useful to you, and what can be thrown or given away.

Why bother decluttering in the first place? There are several benefits. First, you’ll save space. Second, a tidy room can aid concentration. Ignoring unnecessary stuff and searching through messy drawers and piles takes up valuable mental energy which could be channeled towards more productive tasks.

Finally, if you have fewer possessions, you will save time when it comes to cleaning and maintenance. Quite simply, the less you own, the less time you will spend organising and re-organizing your home.

How the question helps you to decide

Ditch the unnecessary

Once you start thinking about your answer, other questions will naturally arise. You’ll start to consider whether you actually use the item on a regular basis, when you next expect to need it, whether it takes up a lot of time or space, and whether it can be easily replaced. For example, you might have purchased a slow cooker with the intention of using it to make dinner several nights a week, but then shoved it to the back of the cupboard and forgotten about it. If it is just sitting there, taking up useful cupboard space, why hold onto it? It’s time to say goodbye!

Another common example is clothing. Most of us are guilty of holding onto clothes that don’t fit us, aren’t in fashion any more, or just don’t fit with our lifestyle. For instance, if you used to work in an office but have spent the last few years raising your children full-time, you don’t need to keep those smart suits that have been gathering dust in your wardrobe. If you choose to go back to work in an office environment, it’s easy to buy a couple of new suits. Don’t let sentiment override your judgment.

Try this RFASR formula:

- Recency – “When did I last use this?”

- Frequency – “Exactly how often do I use this?”

- Acquisition cost – “How expensive and/or difficult is it to get this?”

- Storage cost – “How much does it cost me to store this?”

- Retrieve cost – “What will it cost me if this item becomes outdated, or I need to retrieve it from storage?”

Let’s look at another example. Suppose you have two lawnmowers in your garage, despite the fact you only have a small yard. Focusing on one lawnmower in particular, you figure that you last used it months ago (Recency), you have only used it approximately once a year (Frequency), it is not hard to buy new lawnmowers (Acquisition cost), storing it costs you in terms of space (Storage cost), and repairing it will be a hassle in the future because it is quite an old model (Retrieve cost). Therefore, you decide to get rid of it.

Stop collecting

Getting rid of unnecessary items is only one half of the equation. Once you have finished decluttering, adopt a new approach to shopping. It might be difficult at first, especially if you are tempted by new items or convince yourself that something might come in useful at a later date. For instance, if you have recently cleared out your kitchen of unused cookware, you might feel compelled to buy some attractive new crockery whilst at the mall, just because it looks good and because you now have some extra space. However, it’s slippery slope – unless you check yourself, you’ll end up back where you started!

If you cannot realistically imagine how you will use a new item, don’t buy it. If you know that you wouldn’t bother taking it with you when moving abroad, don’t buy it. You get the idea – make a point of acquiring only what you truly need.

Start today

Decluttering can be a daunting task, but you don’t have to get it done in one session. Why not set aside 20 minutes per day for a month, taking it one room at a time? Remember, keep that simple question outlined in this article at the forefront of your mind. You’ll be pleasantly surprised at how easy it becomes to let go of things you do not need.

Featured photo credit: Picjumbo via picjumbo.com

Reference

| [1] | ^ | NPR: Behind the Ever-Expanding American Dream House |

| [2] | ^ | Los Angeles Times: For many people, gathering possessions is just the stuff of life |

| [3] | ^ | New York Times Magazine: The Self-Storage Self |