Most people do not even realize the amount of food that they waste everyday, from getting rid of spoiled produce to throwing away uneaten leftovers. Although most people do not deliberately set out to waste food, there are some great habits that can help to keep food wastage to a minimum.

The easiest way to avoid food wastage, however, is by storing your produce in high-quality containers so as to preserve their freshness. Here are some tools that can help reduce food wastage at home:

Kitchen Hacks: How Clever Cooks Get Things Done

This book provides the perfect hacks to allow you to deal with kitchen tasks that cost you money and time with the hope of improving the general outcome. This useful collection of kitchen hacks will allow you to face and tackle both big and small kitchen challenges such as food wastage.

Prepworks by Progressive Bread ProKeeper

The progressive bread keeper allows you to store your bread under the best conditions so that your bread stays fresher for longer. The bread keeper is perfectly sized to accommodate machine loaves when expanded and it has a Variety of sizes to store baked goods of different sizes.

Casabella Guac-Lock Container

The Casabella container eliminates and presses all the air from the storage container so that browning does not occur and your guacamole can stay fresh for longer. It is also made from durable material that is shatter-proof and order free.

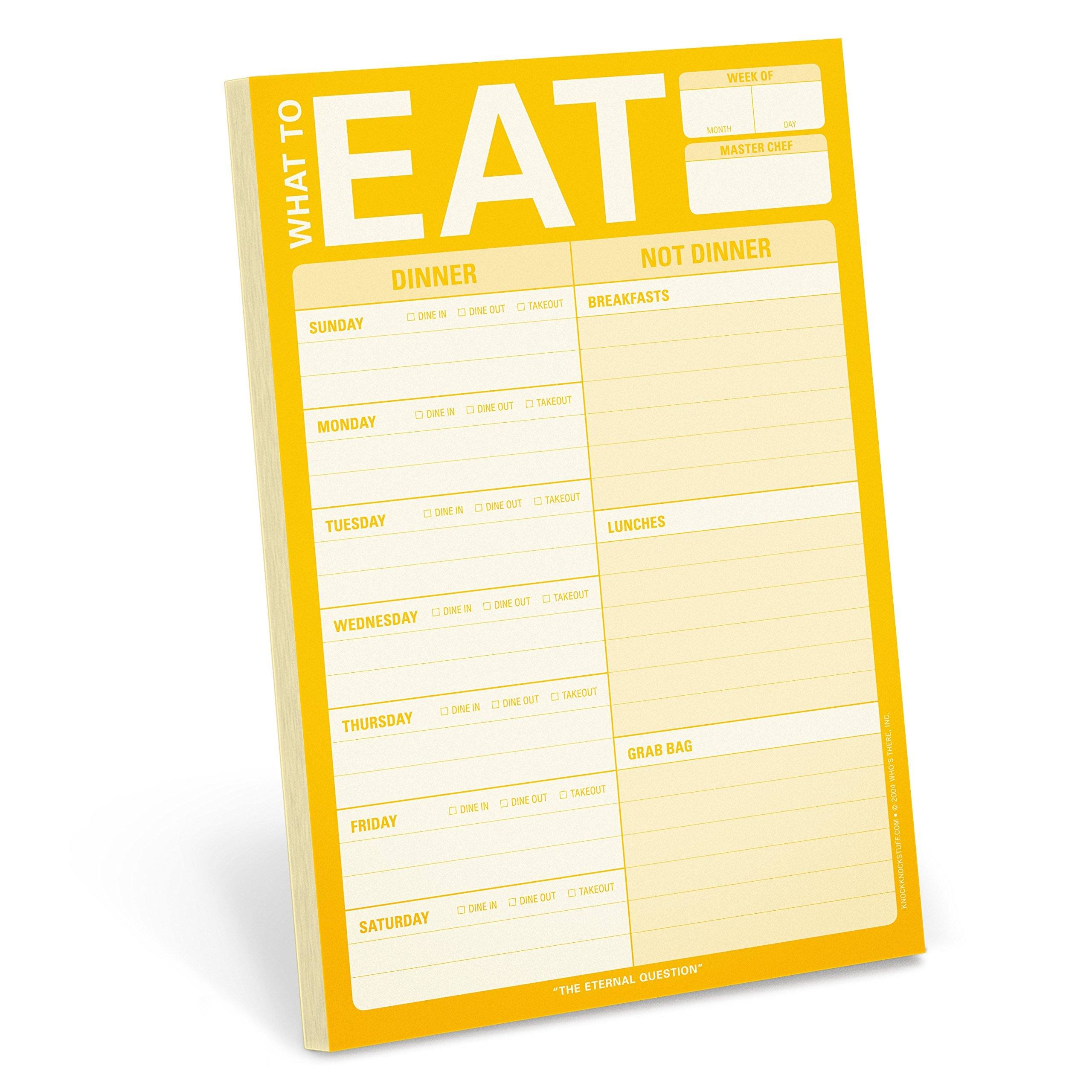

Knock Knock What to Eat Pad

Because of the modern world, planning, tracking and executing household means is a little more difficult than it was back in the day. The What To Eat Pad makes planning easier by allowing you to schedule your meals so that you do not have to waste any.

Premium Washable BahrEco Mesh Bags for Grocery Shopping

This set of reusable produce bags are washable, foldable and easy to carry around when you need to. The bags are also color coded which will allow you to perfectly organize all your produce.

FoodSaver FM2435-ECR Vacuum Sealing System

This vacuum sealer is a must have if you live in a large household and you have to freeze your produce. The vacuum sealer also comes with a pouch rolls that allow you to prep easy to serve meals for the entire week.

Joseph Joseph Nest Storage Plastic Food Storage Container

This container comes with snap together lids that are color-coded for easier use. The container can be used easily in a microwave and a dishwasher.

It is easy to overbuy products but with the right tools, you can store your fruits and veggies to preserve their freshness. They will not only last longer but you will make significant savings in the end by wasting less food.