Plagiarism is rampant on the internet. It’s so easy for people to copy, paste, and claim an idea as their own. Unfortunately, lots of people get away with it. Some even thrive on the labors of others. They may be able to skate by, but what are they really getting out of copying someone else’s work?

The simple fact is, you can’t learn and grow if you don’t put in the effort.

We’re all on a quest for originality

Everyone wants to be unique. Originality showcases talent, and it gives you a competitive edge. People don’t want to buy an idea that has been repackaged. New ideas sell.

The pressure to be creative in a world in which everyone is creating and sharing all the time is enormous. To complicate matters, modern life doesn’t often allow us to have the time and focus that we need to innovate. When this happens, many people have a hard time coming up with new ideas and ways to solve problems.

At the first sign of a creative blockage, people may turn to the work of others for inspiration. Sometimes this is enough to get them on track, but they may also be tempted to copy someone else’s idea so that they can get their product out on time.

Over time, a person can develop a habit of repackaging someone else’s work instead of coming up with fresh ideas. Operating in this fashion may provide short-term relief, but it’s a formula for failure.

Plagiarism is like skipping levels in a video game

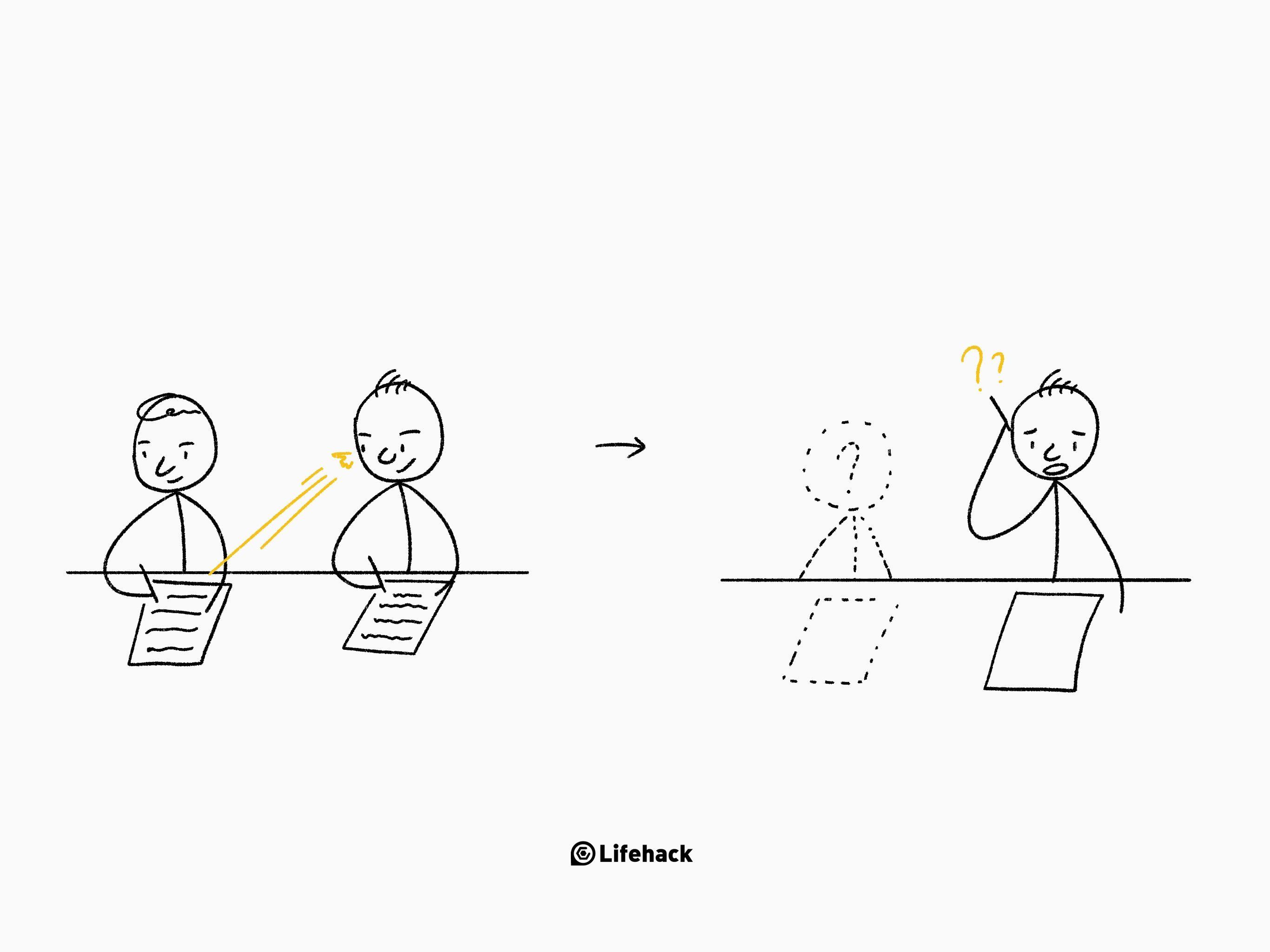

Imagine you’re playing a game, and you get to a challenging level. Your friend is an expert at this game, so you hand the controller off to him. He easily completes the level, but when he returns the controller to you, you find the new level almost impossible to play.

Video games, like life, are designed so that you can only advance when you get the skills that you need. Until you are ready to move on, you won’t be able to beat the level.

Copying is like handing off the controller. You never actually learn how to do what you need to do because someone else did all the legwork. You miss out on developing any real understanding of whatever you’re trying to do when you just copy, paste, and make a few minor adjustments.

Just like you won’t have the skills to make it to the next level if you let someone else do the hard work in the game, you won’t have the knowledge to carry out future assignments if you don’t put in the time on the one in front of you. You’ll be stuck living in the shadows of others’ greatness. When you’re in over your head, you’ll be more tempted to continue plagiarizing in the future.

You can’t copy the spirit of originality

When someone comes up with something entirely new, there’s this beautiful process that brings it into being. Their experiences combined with their skillsets produce this innovation. This is an invisible but ever-present force in new ideas.

A copycat won’t be able to give an idea new life because they don’t have the spark. They don’t understand why a material behaves the way it does, or why this model will work for their customers better than that other one.

The depth of understanding that comes with going through the process of discovery just isn’t there. There’s no substance, and there’s no way to grow. It’s like trying to grow a tree by starting with the trunk instead of beginning with a seed and a root system.

Copycats can never be first in anything, either. Someone who copies has to wait for somebody else to come up with the original idea before they can remix it for themselves. No matter what you make, it’s always going to be one step behind. It’s the knockoff– the less desirable version of the original. It’s a miserable way to live.

Accept nothing less than your personal best

In The Creative Habit: Learn It and Use It for Life, Twyla Tharp states:[1]

“Our ability to grow is directly proportional to an ability to entertain the uncomfortable.”

Instead of panicking and copying someone else’s work, embrace your discomfort and be original! It’s fine to be inspired by others’ works, but you don’t have to plagiarize. You have to believe that you can come up with your own one-of-a-kind idea.

From the outside, there can be a fine line between being inspired by someone and copying, but if you’re the one completing the project, it’s easy to tell if you’re copying. If someone else is doing most of the work, your idea isn’t original.

Finding inspiration without resorting to plagiarism is not difficult. Diversifying the places from which you draw inspiration helps. Talk to others working in your field, read lots of books, and continue to consume content related to your work. This builds your frame of reference so that you can create something different.

Becoming this well-informed is time-consuming, but it’s what will make you an authority in your field. As you learn more, you can learn to ask the right kinds of questions. Knowing what to ask leads you to come up with your own ideas.

Plagiarism is a cop-out

You are capable of doing profound things, but you have to give yourself a chance. No matter how tough it seems, keep striving to be an original. In the end, you’ll hold your head high knowing you’ve done something nobody has done before.

Featured photo credit: Fancy Crave/ Minimography.com via fancycrave.com

Reference

| [1] | ^ | Goodreads: The Creative Habit: Learn it and Use it for Life |