The 80 20 Rule or Pareto Principle, named after the nineteenth-century Italian economist, Vilfredo Pareto, who discovered that approximately 80% of Italian land in 1896 was owned by 20% of the population, has become a common axiom in business and life.

The principle was highlighted in 1992 by a United Nations Development Program report that showed that roughly 80% of the world’s wealth was in the hands of 20% of the population.[1] Businesses have reported that 80% of their sales come from 20% of their customers and, Microsoft discovered that if they fix the top 20%, most reported bugs they eliminate 80% of the problems in their software.

It seems the Pareto Principle is all around us.

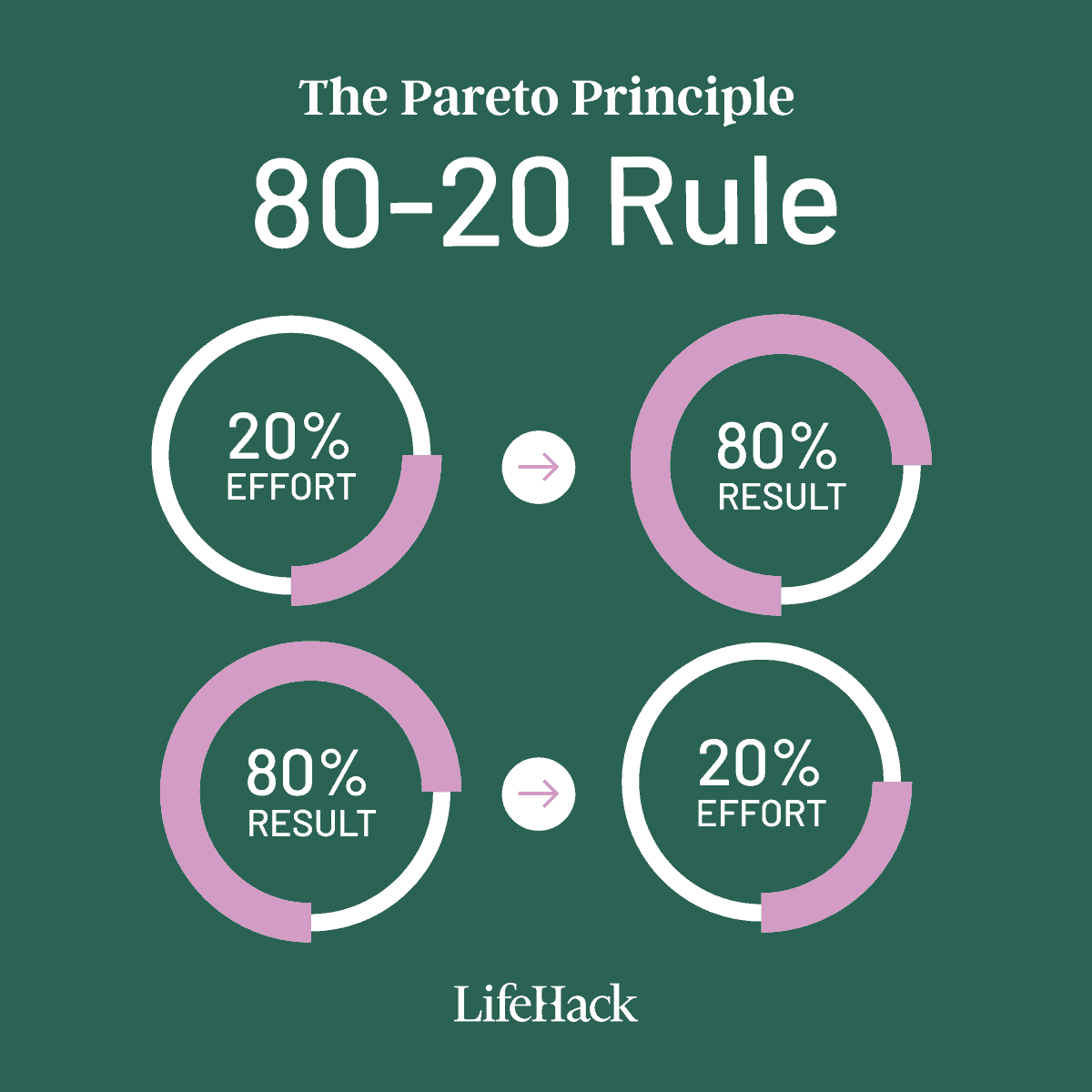

When it comes to our own productivity, the principle can be applied in that 80% of our results come from 20% of our efforts. The trick is to discover what that 20% is so we can apply our most effort to that 20% and eliminate as much of the 80% that does not produce the results we want.

So how do we do that?

Table of Contents

How Does the 80/20 Rule Work?

Pareto noticed that people in society were divided into two categories:

- The “vital few,” which consisted of the top 20 percent with respect to money and influence.

- The “trivial many,” otherwise known as the bottom 80 percent.

As he researched this further, he came to discover that this divide didn’t apply only to money and influence, but other areas, too. Virtually all economic activity was subject to his previous observation.

He observed that 80% of Italy’s wealth at the time was controlled by only 20% of the population.

It boils down to a universal truth: all things are not created equal. Every input does not lead to the same output.

Sure — in an ideal world, every minute of your time, every ounce of your effort, every decision on your agenda would be equally important. But in the real world, it’s only 20% of what you do that really matters.

So what does that mean for you?

Here’s the key takeaway: you need to focus your efforts on the 20% that’s going to give you the biggest pay-off for your time. Your attention is a finite resource. So it’s about being strategic with your time management and trying to maximize the time you spend on the important matters.

Don’t distract yourself with trivial concerns. Occupy your time with what matters the most.

You can apply the 80/20 rule to pretty much anything in your life. Use the principle to set effective goals or streamline your work schedule. And equally, you can apply it to your family life, fitness goals and more.

What is an Example of the 80/20 Rule?

The 80/20 rule is everywhere. Once you learn how it works, you’ll start recognizing it in pretty much every aspect of your life.

There’s one example that’s been very consequential in business. It’s the fact that around 20% of customers make up 80% of a company’s sales.

The upper crust of a company’s consumers are their loyal big spenders. They’re the ones who’ve been with the company through thick and thin and are more willing to cough up higher prices.

Smart companies focus their energy on keeping a long-term relationship with their loyalists — a more lucrative return on the investment of their time and effort.

Since the development of this rule, humankind has used this particular ratio in all kinds of situations. Even if the ratio isn’t always exact, we see this rule applied in many industries and in life. Examples are:

- 20% of strategic investments could account for 80% of your capital.[2]

- 20% of donors could contribute 80% to your fundraiser.

- 20% of the online content you curate could attract 80% of traffic to your web page.

- 20% of sales reps will generate 80% of your total sales.

- 20% of customers account for 80% of total profits.

- 80% of the revenue will stem from 20% of the workers.

How Is the 80/20 Rule Misapplied?

Simply, the 80/20 rule is ‘the law of the vital few’. It’s a hierarchy of importance — where a few tasks, time or investments are worth more than the rest.

But unfortunately, because the 80/20 principle is so widespread, the concept has often been misunderstood.

Don’t be misled by these 3 myths:

1. 80 + 20 = 100

Sometimes, people try to create a diagram explaining the 80/20 rule with a pie chart. One fifth of the pie chart is labeled 20% and the rest is labeled 80%. While those of us with basic math skills can see how this adds up to 100%, the calculation undermines what the rule is about.

The 80/20 rule argues that 20% of the input creates 80% of the output. Inputs and outputs aren’t the same thing and, therefore, can’t be put into the same pie chart. The 80/20 rule could just as easily be called the 55/3 rule, if 55% of the results were created by 3% of the inputs.

Don’t get caught up on the numbers. Both 80 and 20 are just examples of one type of uneven balance. The fact that they add up to 100 is a coincidence.

2. Eliminating the 80%

One argument I’ve heard against the 80/20 rule goes like this: “If you keep applying the 80/20 rule, eliminating the wasteful 80%, eventually you’ll end up with nothing.” I suppose the people who argued this point felt they were being clever by using a literal, mathematical interpretation of the rule.

Once again, the numbers here aren’t that important. The actual applications are less mathematical. When you have a limited amount of time, you won’t be able to perform every task possible. The 80/20 rule suggests you look through all the tasks you normally could perform. Pick the top 20% that create the most results and focus on them. Whatever time you have left can be spent on the less productive 80%.

3. 80/20 to Perfection

Another way I’ve seen the rule misapplied is when building skills. It might take two years to become 80% proficient. But in order to get that last 20% of skill, you need to invest another 8 years. While this is a fair use of the rule, the advice with skills often goes against the 80/20 rule. Instead of eliminating the need for that last 20%, you invest most your time to master the last 20%.

The point of the 80/20 rule is that you should downplay or minimize the inefficient 80% of inputs. There are times, of course, when this rule doesn’t apply. Mastering a skill can be one of those areas where the 80/20 advice is faulty.

However, by recommending the opposite of the 80/20 rule, you can’t really claim the 80/20 rule is in practice here. That would be like saying “haste makes waste” is the same advice as “he who hesitates is lost.”

How to Really Use the 80/20 Rule for Productivity

Here’s how you can apply the Pareto principle to boost your productivity:

1. Be Absolutely Clear on What It Is You Want to Achieve

The easiest and most effective way to do this is to be absolutely clear about what it is you are trying to achieve.

What is the outcome you want to achieve? Most people do not get clarity on what it is they want to achieve, and so get sucked into working on things that will not deliver a big contribution to the overall objective.

For example, if you have a project to move house, spending an inordinate amount of time discussing the colour you want to have the walls, what furniture you would like and what plants you will have in the garden will not move you very far towards moving house.

Instead, deciding how many rooms and in what location you would like the house would give you far more important data on which to be able to go to a real estate agent. You are going to find the right house much more quickly than by discussing colours, furniture and items in your garden.

Before you begin any project, make a list of all the tasks involved to take the project to completion and then flag or highlight the tasks that will give you the biggest contribution towards the completion of the project. Those tasks will be the 20% of tasks that will take you 80% of the way towards completing the project. Focus on those.

2. What Are Your Majors and Minors?

Jim Rohn coined this question and it essentially means there are parts of the work you do each day that have a direct contribution to the overall objective you are trying to achieve.[3] Other parts of your work do not have a direct contribution to that objective but could be described as housekeeping tasks. The trick is to know what they are.

Brian Tracy often talks about this with the sales process.[4] Major time is when you are in front of the customer talking with them. Minor time is traveling to the customer or being in meetings with your sales manager in the office. Of course, traveling to see your customer or meeting with your sales manager is important, but they do not contribute directly to your sales performance so that would be classed as minor time.

When I was in sales many years ago, I learned that while you might be popular with your sales admin team, if you meticulously write out your sales reports every day, doing so did not improve sales performance. I observed that the best salespeople in our company were the ones who had terrible admin reputations and were not the more popular people in the office. The thing is, they were the best salespeople because they understood that being in front of the customer led to higher sales which ultimately led to higher salaries.

Take a look at your calendar for last week and identify what tasks you did that had the biggest positive impact on your objectives. Then, plan to do more of those next week so you are working on the 20% of tasks you know will take towards achieving 80% of the results you desire.

3. Stop Thinking, Start Doing

I come across this with a lot of my clients when I am coaching them in developing their own businesses. Far too much time is spent on planning and thinking.

Now, planning and developing ideas do have their place when you are creating your own business, but there is a line. If you spend 80% of your time thinking and planning, your business is not going to launch.

Take a simple example. When I began my YouTube channel just over three years ago, I spent a week planning what type of videos I would produce and then I began recording. My first video was terrible, but the process of putting out the videos week after week led to my learning better ways of producing videos which fuelled my channel’s growth.

I see far too many people planning and thinking about what they want to do and not producing the content. If you spend 80% of your time producing content and 20% of your time planning out your content, no matter what medium you are producing for, you will see positive results. If you turn that ratio around, you are not going to see much by way of results.

Stop for a moment right now and ask yourself:

“What could I do today that will give me 80% of the results I most desire?”

4. Use Your Calendar to Review How You Spent Your Time

Your calendar is your most powerful analytical tool when it comes to seeing how you spend your time each week. If you see you are spending a lot of your daily time in meetings and dealing with co-worker issues, you will find you are not focused on the 20% where the real results are.

If you have taken the time to write down the activities that give you 80% of your results, then review your calendar at the end of the week to see where you are spending your time you will be able to make adjustments; so you are more focused on the activities that give you the biggest positive results. Block time each day to work on those tasks.

Try to eliminate those tasks that do not bring in much by way of results. If you can do so, delegate them to other people better able to complete those tasks for you so you can spend more of your time each week on tasks. This will give you a much better return on your time investment.

To really take advantage of the 80:20 principle, you need to be aware of where you are spending your time each day.

If you are a content producer, then you need to be producing content, not wasting time analyzing analytics. Of course, analytics is important if you want to see growth, but without content, you will not have any analytics on which to base your future content. So 80% of your time needs to be spent on producing content.

If you are in sales, if you spend 80% of your time planning out your sales calls and only 20% of your time in front of your customers, your sales performance is not going to be very good. Turn that ration around. Spend 20% of your time planning out your calls and 80% in front of your customers.

Bottom Line

The 80 20 rule is the productivity hack that many of us need, and for good reason. As you can tell, it’ll help you to focus and prioritize the more important aspects of your life.

Not only that, but it’ll maximize those outputs at the same time and ensure you’re not spending too much time working on them. All you need to do is start asking q

So to make the 80 20 rule work for you, remember these:

- Be very clear about what it is you want to achieve. What will a successful outcome look like? Then identify the 20% of action steps that will get you 80% of the way there.

- What are your majors and minors? What daily activities could you do that will create constant motion towards achieving whatever it is you want to achieve? Do those every day.

- Reduce the amount of time you spend thinking about doing something and just start doing it. If you are spending 80% of the time thinking and just 20% of your time doing you have the ratio back to front.

- Identify which action steps you have taken over the last week that had the biggest positive impact on your goals. Do more of them next week. Prioritise them and schedule the time in your calendar.

Reference

| [1] | ^ | International Monetary Fund: The Rising Inequality of World Income Distribution |

| [2] | ^ | Forbes: The Pareto Principle: How to Use the 80/20 Rule to Retire Faster |

| [3] | ^ | Jim Rohn: 5 Tips for Using Your Time Wisely |

| [4] | ^ | Brian Tracy: A Balanced Life–Part 1 |