Amazon is arguably the most popular eCommerce retail website in the world. It’s pretty hard to beat in terms of product range, discounts and sales, free delivery, speed of delivery, support, and pretty much anything else.

With such a fantastically competitive offering it’s easy for us Amazon shoppers to become complacent and assume we’re already getting the best possible prices on everything we buy there. But we’re not. Here’s why!

With so many different sellers on Amazon – there are currently a few million third party sellers competing via Amazon’s online marketplace – it is virtually impossible to search through every new offer all the time. There’s so much information there that the truly awesome deals can get hidden in all the white noise.

That’s why, if you’re serious about saving money when shopping for top quality products, you have to start making use of the some online tools and services that can do the job for you. Fortunately, there are plenty of free services that can save hundreds of dollars (possibly more) on your next big shop.

Find The Best Deals On Amazon Best Sellers

Ok, so it’s quite easy to find lists of best selling items all over the Internet. From the NY Times best-seller lists, to Amazon’s top 1000, lists of top selling products are ubiquitous. But finding the best deals and biggest discounts on these best selling items is not so commonplace. Fortunately, there’s a freely available tools that does just this.

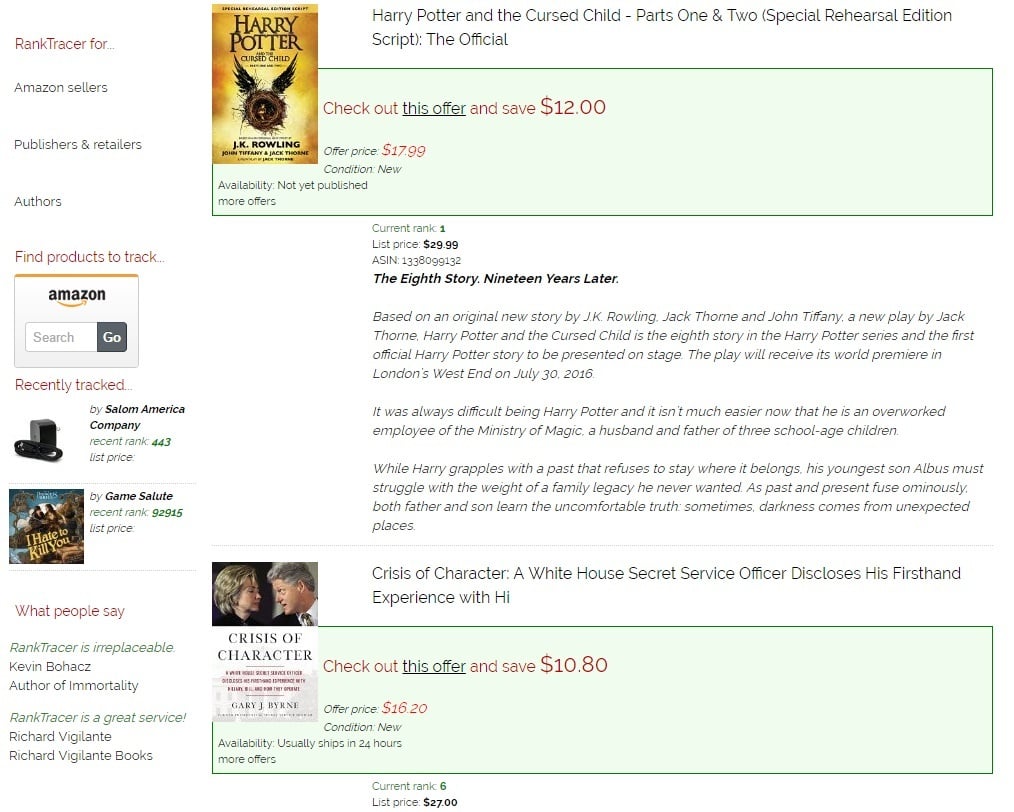

RankTracer’s Amazon best seller page not only returns a list of the best selling products on Amazon, it also goes through each product and finds the best deal or discount to return to you at the same time. This means that your best seller list now has extra information directing you to the biggest available savings on those products.

Here’s an example of their results showing the biggest deals on the best selling books:

So far so good. But what if you don’t necessarily want to buy one of the top 10 items in a given category?

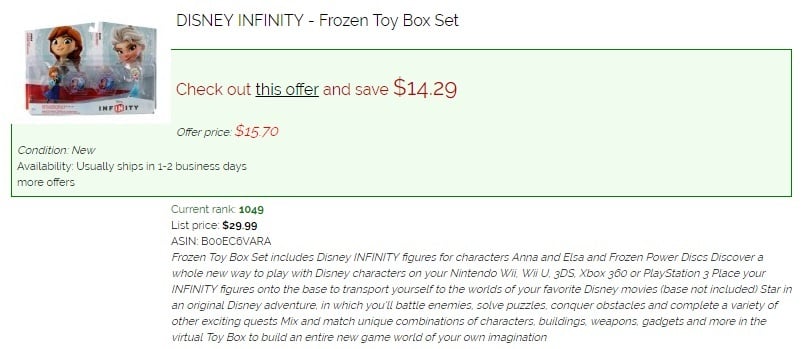

Fortunately, this tool offers two methods of searching for discounts on products; the first is ‘by category’ (i.e. books, electronics, clothing, etc) and the second is by keyword (i.e. ‘pressure cooker’, or ‘frozen princess doll’). This makes it a cinch to narrow down the search to any specific product you like and find the best available deal on it.

I decided to look for discounts on a gift for my niece (she loves Frozen), and here’s a few deeply discounted items I found:

Not bad for twenty seconds worth of effort, right? That’s about $48 in savings over three products. Not bad considering the total list prices for all three comes to $94.97 – making those discounts a touch over 50%.

But what happens if there is a specific thing you want to buy but there’s isn’t currently a discount or sale on offer? Well, if you don’t mind being patient and waiting a bit you can either check back each day or you can automate the process of tracking a product’s price over time and receive alerts when the price drops.

Track Product Price Drops

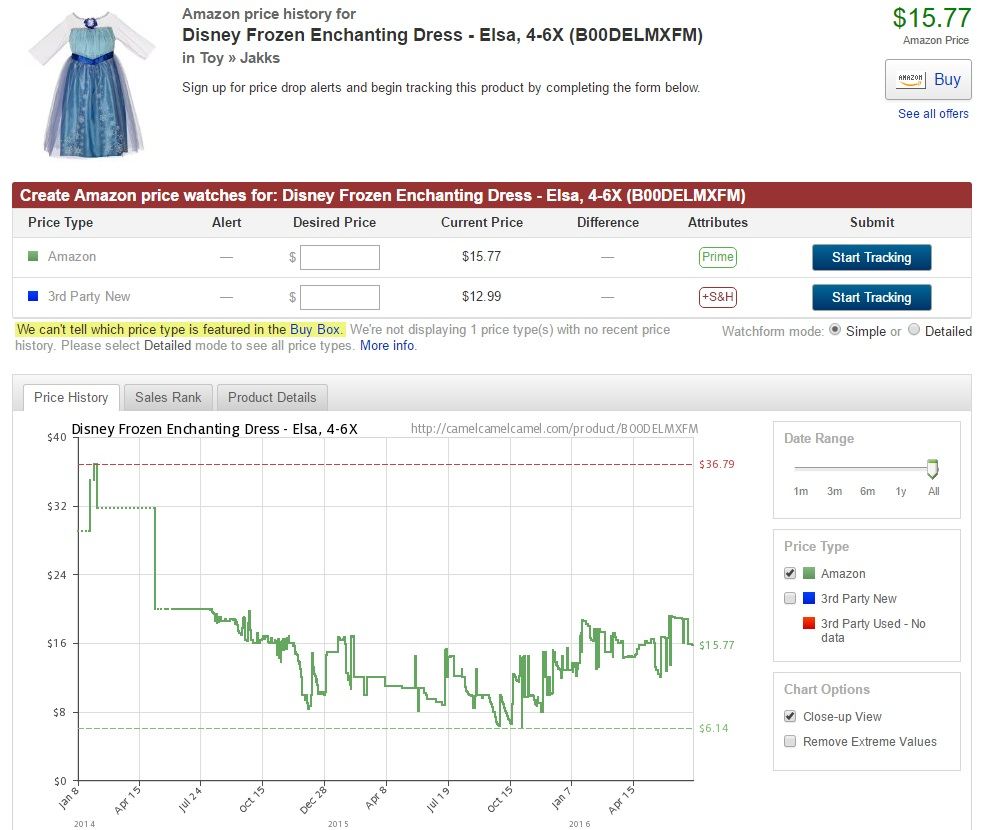

There are a bunch of Amazon product price tracking tools available online. The one I use is CamelCamelCamel because it is quick and easy to use and, above all, free. To get a feel for the type of data they can provide on Amazon sales prices, here’s price data for the same ‘Disney Frozen Enchanting Dress – Elsa‘ item shown in the previous section:

What’s super interesting about this graph is that it show the dress actually went down to as low as $6.14 sometime in late October/early Novermber of 2015. Basically, the current price ($15.77) is about average – it’s been a lot cheaper and it’s been more expensive too.

It’s worth noting that RankTracer’s Amazon best seller page actually returned a better price for this item. CamelCamelCamel quotes a best price of $15.77 today, whereas RankTracer quotes the best price at $13.49.

Go To The Source

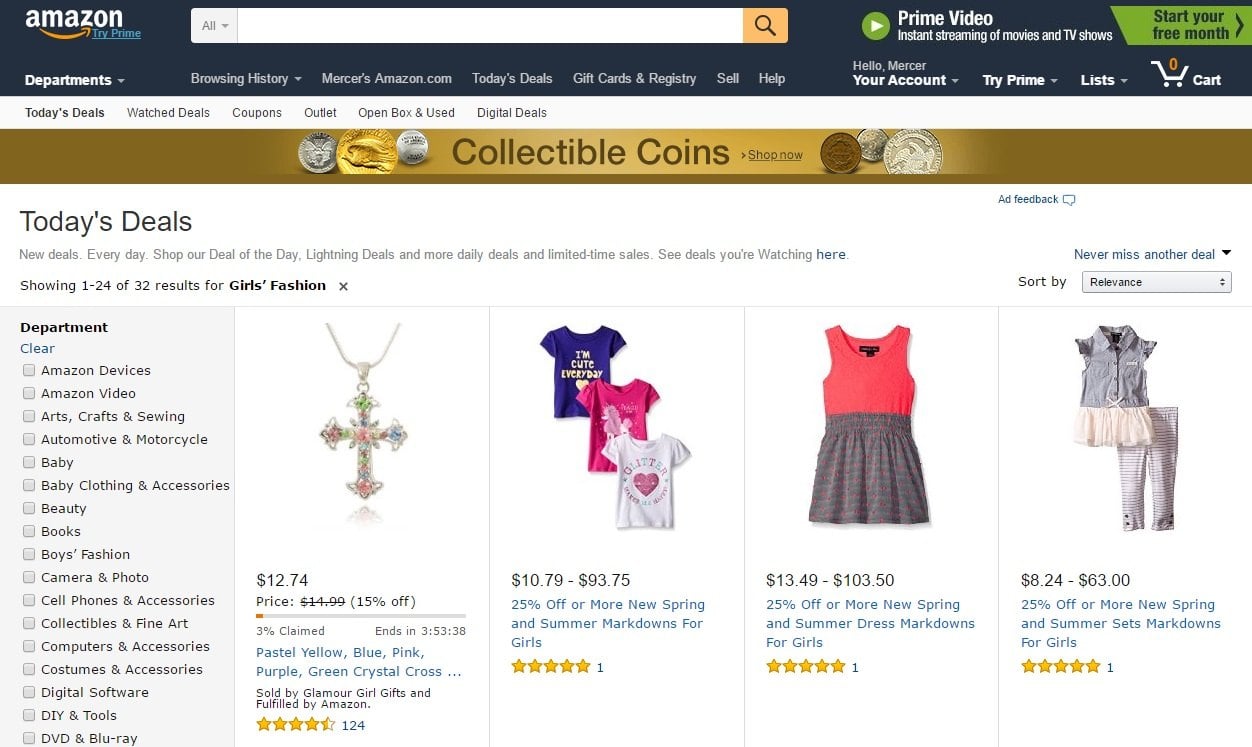

If you’re serious about really finding the best bargains available it may be time to go straight to the source. Amazon’s staff do a fantastic job of coming through popular products and finding the ones that offer simply massive discounts (sometimes more than 60%) and add ’em all to their Gold box deal page.

You can also make use of their wide range of filters and search criteria to help find items you’re interested in. The problem is that there is no real search feature and the list is created by someone else – meaning you may not find the items you’re after. I narrowed down the Gold box deals to girls fashion hoping to find the Frozen dress:

Hmm, not ideal.

So while the Gold box page offers incredibly low prices and massive deals that will save you plenty of cash, it can’t offer every product in their catalog and so can end up being of limited use. But, if you’re searching for gifts and not specific items then this page is absolutely perfect.

So those are my top three tips for getting the most out of your Amazon shopping. How much money have you saved by using the above-mentioned tools and resources? What other strategies do you use to save money on Amazon? Share your tips in the comments.