Investing can be scary. The fear of the unknown always is. And the case for Millennials is worse, especially considering many of them graduated into a financial crisis and witnessed the stock market plummet nearly 40% in 2008. That kind of traumatic experience sticks with you, just as the Great Depression forced an entire generation of Americans to develop very frugal habits.

However, it’s important that young adults overcome their fears and start investing to secure their financial future. Waiting too long and starting too late can result in not having saved enough for retirement. After all, the stock market doesn’t plunge every other year and investing volatility is why experts always recommend you pick long-term investments, not short-term trades.

Below, we will discuss how to start investing in 2016, including the power of compounding interest, the average return of the stock market over the last 100 years, how to choose a brokerage account that is right for you, and finally, investment tips for beginners who may need some guidance.

Average Stock Market Returns

For starters, let me provide some basic background on expected average stock market returns. Between the beginning of 1900 and the end of 2015, the stock market returned an average 11.53%. To make sure that these dates were not cherry-picked, let’s remember what happened during this time period: two World Wars, the Great Depression, Vietnam War, Korean War, an oil embargo, multiple terrorist attacks, and a number of recessions caused by economic boom and bust cycles.

Even if you decide to solely focus on the most recent recession, including the roughly 37% drop in equities in 2008, the stock market has returned over 8.40% between 2007 and 2015. This is because the drop in the S&P 500 was closely followed by a slow recovery that ultimately helped investors recover their investments and then some. The point is, despite recessions and individual years with negative returns, the stock market averages a strong positive return over time.

Time in the Market vs. Timing the Market

It is also important to point out that investors cannot time the market. In fact, research shows that a handful of days each year are actually responsible for the majority of the gains in that year.

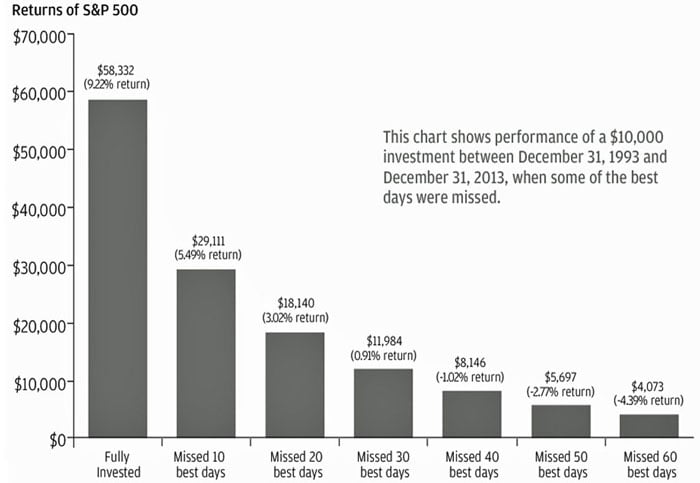

The chart below, which reflects data compiled by JPMorgan Asset Management, demonstrates that an investor would have earned a 9.22% return if they were fully invested between 1993 and 2013. But if an investor were to have missed the top ten trading days out of ten years, the return would have decreased to 5.49%.

New investors should ask themselves: out of the more than 2,500 trading days in that 10 year period, would you have been able to pick the top 10 highest earning days?

Start Early – The Power of Compounding

Another reason why Millennials and young families should start investing as early as possible is the power of compounding. If you aren’t familiar with the concept of “compounding” returns, it is when you earn a gain on your principal the first year, and then begin to earn returns on your previous returns.

For example, if you invest $1,000 and earn an average 10% return annually, your investment will grow to $1,100 after the first year. After the second year, you won’t just earn another $100 but $110, for a total of $1,210. And the third year you will earn $121 for a total value of $1,331.

On a small scale, this doesn’t seem like much, but assume you invest $1,000 per year for 30 years and average a conservative 8% return. Instead of having $30,000 in a checking account, you will have accumulated a little more than $132,000.

Now let’s make this more realistic – assume you have a Roth IRA and you contribute the maximum (for your age) $5,500 per year for 30 years. At an average rate of return of 10% annually, you will have nearly $1.1 million dollars. But here’s why investing as early as possible is essential – if we change the number of years we’ve invested from 30 to 25, we only end up with $654,000 in retirement. Those final 5 years of investing on a large capital base comprise a significant amount in terms of gains and mean the difference between a comfortable retirement and a strained one.

Compounding returns are critical to investors because they allow you to turn small principal contributions over a long period of time into large nest eggs. Keep in mind that Albert Einstein called compounding interest “the most powerful force in the universe.”

How To Choose A Brokerage Account

Once you’ve made the decision to start investing for your future, you must decide on your investment strategy and how to execute it. There are many brokerage houses or investing platforms available today – some of which have been around for decades, while others have leveraged new technology to offer consumers alternatives to traditional companies.

Traditional Investment Management

A decade ago, investors had to choose between mutual fund managers such as Vanguard, Fidelity, and BlackRock (iShares) and discount brokerage firms such as TD Ameritrade, E*TRADE, and Scottrade.

Mutual and index fund managers are ideal for passive investors. If you don’t know much about investing except for the basics, an index fund or ETF from Vanguard or Fidelity may be best – both securities use broad indexes as benchmarks and can be a way for investors to mimic returns from the S&P 500, Dow Jones Industrial Average, or NASDAQ.

On the other hand, if your employer 401K is already held with one of those mutual fund managers, you may want your private investment portfolio to be at a brokerage house. Discount brokers offer a variety of services, but they are ideal for investing in specific securities or trading stock options.

Nevertheless, most investors aren’t stock-pickers, and evidence confirms they shouldn’t be. Research shows that “actively managed funds lost out to their passive peers in nearly every asset class during the 10 years between 2004 and 2014…”

So why pay your financial advisor a costly fee if they are going to have you invested in passively-managed index funds? Enter the robo-advisor.

What Are Robo-Advisors?

The robo-advisor is technology’s response to high fees charged by useless financial advisors and planners. Robo-advisors, such as Wealthfront and Betterment, are online wealth managers that provide automated, virtual investment and portfolio management advice without the intervention of a physical human being.

By asking you a handful of questions regarding your financial goals, risk tolerance, and personal financial circumstances (e.g. income, assets and age), algorithm-based robo-advisors are able to determine your ideal investment plan. Their programs then recommend a number of investment options and allocations, taking into account the need for diversification across different asset classes and geographies. The other benefit to investors is that, because robo-advisors don’t rely on individual advisors to manage clients, their fees are much lower.

Although both alternative asset managers are cheaper than traditional financial advisors, both companies have pros and cons. If this investment style seems appealing to you, it is crucial investors research and compare Betterment vs Wealthfront to determine which one better fulfills your needs.

Stock Market Investing Tips – Dos and Don’ts

Finally, when you pick a platform and start investing, it is important to develop a basic investment philosophy. While each investor has a different risk tolerance and way of choosing his investments, here are a few stock market tips to help you understand the fundamentals.

- Set long-term goals. Investing is not a get-rich quick opportunity, and taking on too much risk can easily result in financial ruin. Evaluate your age, risk tolerance, time horizon, and financial goals (e.g. income generation, wealth preservation, or growth).

- Control your emotions. Hope, greed, fear, and passion are emotions that will cloud your judgement. Investing with objectivity will protect you from making costly mistakes.

- Minimize risk and maximize reward. Don’t take on excessive risk for small gains. Ideally, take on little risk for huge potential gains.

- Don’t worry about taxes. If you think a stock has overshot its true value, sell. It is better to take your gains and pay capital gains taxes than to lose money holding a stock too long.

- Buy best-in-class companies. Unless a mediocre company is deeply misunderstood by other investors, always buy the best and strongest companies in an industry.

- Don’t be afraid to hold cash when you don’t see any bargains in the marketplace.

- Don’t believe the hype on Wall Street and always be skeptical of financial analysts. They have a vested interest in keeping you invested, especially when they have positions in the names they are advertising.

- Don’t let a financial advisor convince you to make an investment you aren’t comfortable with. If the investment, company, or industry doesn’t make sense to you, why invest in it?

- Life insurance is not an investment. Unethical financial advisors make exorbitant commissions selling whole life insurance, which they claim is an investment opportunity with guaranteed returns. The high premiums you pay outweigh any returns you may earn. Term life is the best life insurance you can buy, then take your savings and invest in an index fund.

Final Word

Starting anything new can be intimidating, but that’s no excuse to procrastinate and avoid securing your family’s financial future. To eventually reach financial independence, young adults and families need to start investing early to take advantage of time and compounding returns. If you are skeptical or fearful, starting small is an option. Ultimately, successful investing is all about taking simple steps and executing on fundamental principles on a regular basis. Let 2016 be the year you begin your journey to financial freedom!