Why do you need to save earlier?

Each one of you must have had different thoughts after reading the title of this article. Also, each of you must be at a different stage of life; some are old, some are in their middle age and some are quite young. Saving is one aspect of our finances that is really important for each one of us, no matter what our stage of life is. The stage of life when we start saving, however, is absolutely important!

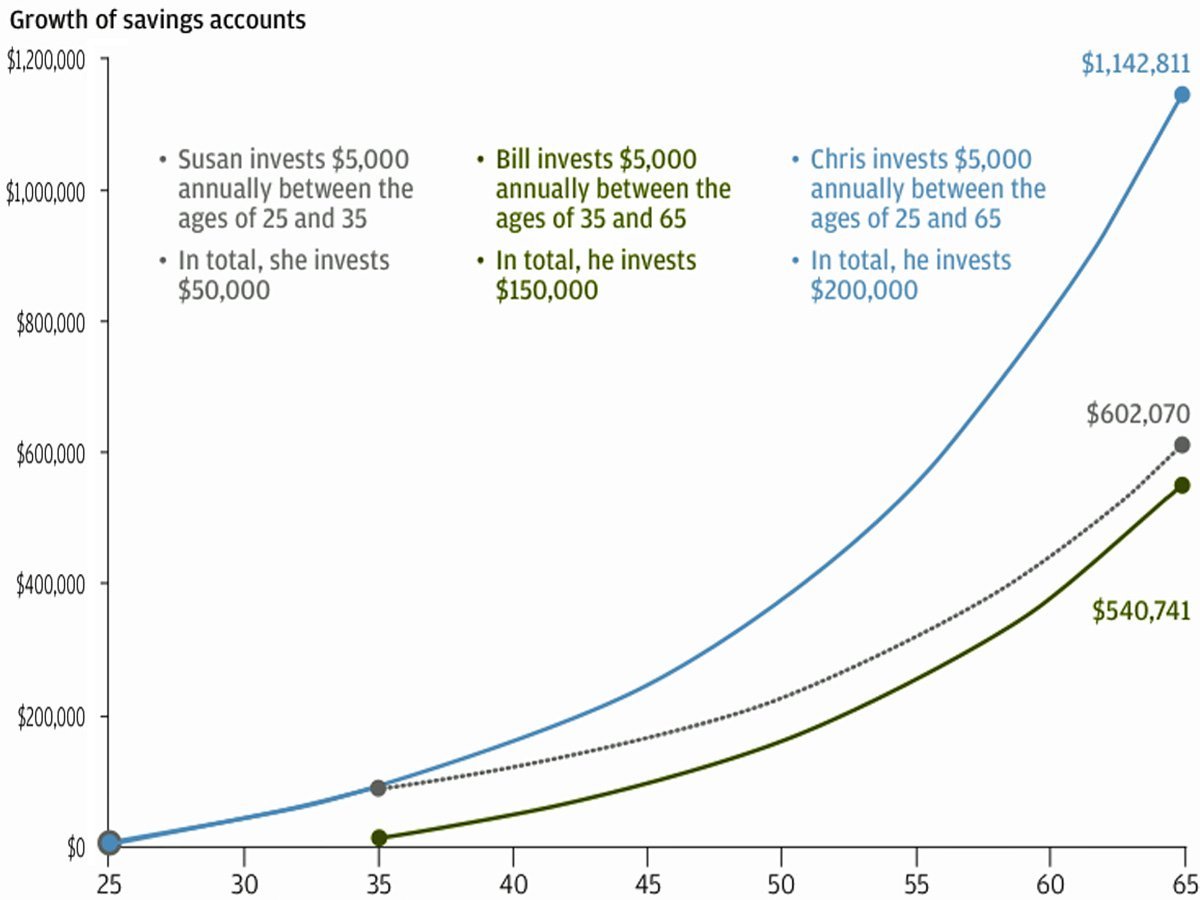

The earlier you start, the better it is. It is as simple as that. Time is such a great helper that if you start saving early then your money can even exceed those who save a lot more than you, but start later in life. This is all possible because of one major phenomenon that is called compounding! Compound interest can do wonders for your money.

Let’s look at a hypothetical example, person A and person B. Both invest the same amount of money but for a different tenure. But A started saving at a very young age. Thus her money had a very long time to multiply and exceeded that of B. A quick look at this chart from JP Morgan Asset Management would explain things better.

Now after a quick scan of this chart, I am sure you would be interested in knowing what compound interest is and what you should do with your own savings to get the most out of them.

“Compound interest is the eighth wonder of the world” ~ Albert Einstein

What it simply means is that you receive interest not only on your original investments, but also on any interest, dividends, and capital gains that accumulate so your money can grow faster and faster as the years roll on. Of course, the sooner you start saving and investing, the more time they will have to grow.

A very good example has been given by Robert T. Thompson regarding starting saving early. He says, “The simple truth is that the compounding of earnings in a retirement account creates the potential for an exponential increase in your retirement savings. And to harness the power of compounding to its full extent requires savings discipline, which is no different than exercise: It’s always better to do a little bit on a regular basis, rather than to postpone, hoping that a longer, more intense workout later on will get you back into shape.”

If you aren’t 25 right now, you might be regretting the lost time after reading this but don’t lose heart. No matter what your age is, the key to financial success is to act NOW rather than to delay things. If you haven’t thought in this direction previously, you can remedy that situation by following our suggestions. Here, we have compiled some ways for you to make the most out of your savings.

- Start investing today. Now that you know what a powerful tool time is, you should not waste even a single day. Each day counts!

- Always put your money in an investment channel that offers the benefit of compounding. No matter how good the rater of return is, compound interest will always outweigh the benefits yielded by simple interest.

- Try to look for those investments where the frequency of compounding is more. For example, opt for those investments where compounding is done quarterly rather than half yearly or yearly. The more the frequency of compounding is, the more your money will grow!

- Save the maximum portion of your earnings. If you start early, you might be well within your targets by saving only a small percentage of your income. However, the later you start, the more you should be saving.

- Set a savings target and stick to it. Although goals don’t harm anyone at all, but the need to stick to your targets increases with age. If you start saving money later in life, you need to practice a lot of discipline with regard to your savings and financial goals. Tracking your income, savings and targets might be a good option for you.

The value of time and compounding cannot be stressed enough. So start saving today and be well on your way of becoming a millionaire by the age you retire!!

Featured photo credit: 401(K) 2012 by 401kcalculator.org via flickr.com