We all know that money doesn’t grow on trees, yet many of us don’t really know how to save money, so we don’t worry about unexpected expenses. Luckily, there are some great apps out there that will help you to learn how to effectively save money so you aren’t always digging for spare change between the sofa cushions on the day before payday. Here are some of those apps.

1. LearnVest

This is a personal finance company that was started to help young people learn how to manage their money. It is free to use, and you can link it to your bank accounts. Use it to track your spending, create a budget, and create savings goals. Check in daily for a money minute to see what is going on with your finances.

2. Mint

This is a lot like LearnVest, being a money managing app that will let you link up all of your accounts. You can put all of your expenses into categories, create a budget, check your credit score, get reminders for bill payments, and even receive customized tips for lowering fees and saving money based on how you spend.

3. Level Money

Here is an app that is basically a money meter. It will analyze your spending habits, and we mean all of your spending habits, so you can see where you are wasting money and learn how to save for a rainy day. You may be surprised at how much money you are wasting on little things, and what you can do to change your spending habits.

4. Digit

If you are one of those people who just can’t seem to save money no matter how hard you try, let someone else do it for you. Digit will keep an eye on your income as well as your spending habits, and then take a little bit of money and hide it in a savings account every few days. You don’t have to pay for this service.

5. Acorns

This is an app that will help you invest, even if you only have a few dollars to invest. It will round up all of your purchases to the nearest dollar, and invest that difference into a stock portfolio that is diversified. You can transfer the earnings into an Acorn savings account once you have earned $5.

6. IVA-Advice

If you have a lot of outstanding bills and it seems like you are never going to be able to start saving money, IVA can help. You simply make one affordable payment to a legal professional, and they take care of paying all of the various bills. After 60 months, any outstanding balances are written off, and you are left debt-free.

7. Good Budget

This app shows you how much you spend. You can link it to your bank accounts and credit cards and sync transactions. Then, you can see what you have left that is actually spendable, and how much you need to set aside for important expenses.

8. BillGuard

This service will tag all transactions that you probably wouldn’t be making, and let you know about it. This is a great way to protect your identity, and to make sure that no one is making unauthorized purchases on your accounts.

9. Mint Bills

This is an extension of Mint, and lets you see your balances and bills all in one place. Pay bills directly from the app, make scheduled payments, and even receive alerts about upcoming bills or when your funds are getting low.

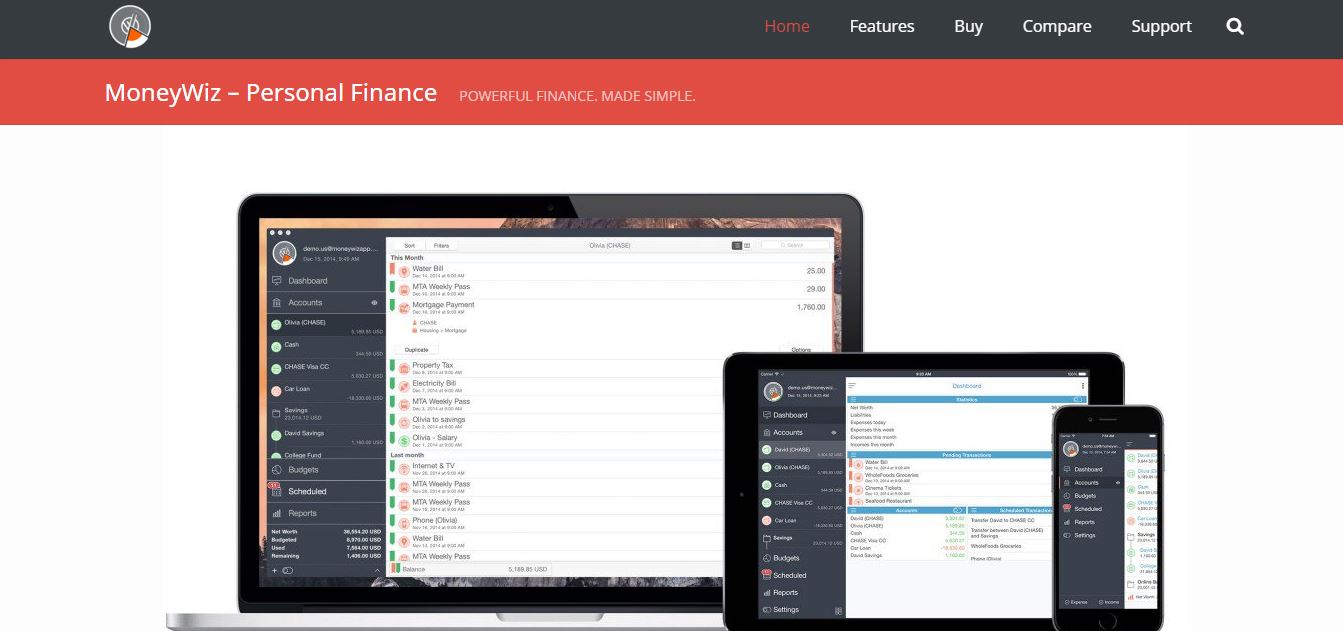

10. MoneyWiz

Not only does this app take care of your bank accounts, budgeting, and bills, it also helps you to get out of debt. You will really learn how your spending and earnings compare, and learn how to make changes so you can save money.

Featured photo credit: Panu Tangchalermkul via flickr.com