Budgeting is hard. It’s time-consuming and requires you to face the fact that you spend money. And often times, the money you’re spending could have been saved. Do you really need that six dollar latte? Do you have to have that scarf that you will wear one time and then forget about? No, I don’t think so.

But often times, we get caught up in a moment and use money that would have been better spent in a savings account or going toward credit card debt. After all, statistics show each household with a credit card carries more than $15,000 in credit card debt.[1] So why are we racking up more bills? When smartphones starting making a big appearance in our world, the phrase you heard so often was, “there’s an app for that.” And, well, there is!

Self-control just doesn’t work when you spend money? Technology can give you a helping hand!

While it will require a small learning curve sometimes, and while it does mean you have to pay attention to your spending and track your habits, using money saving and budgeting apps can do wonders for your bank accounts. If you can get into the habit of turning to some of these apps before handing over your credit or debit card to the cashier at your favorite clothing store of coffee shop, you may find yourself with a healthy savings account, and potentially even some “leftover” money!

The following apps will be rated on the same scale and look at uniqueness and personalization, price, usability and appearance. If you’ve used any apps on or off this list with success, be sure to share!

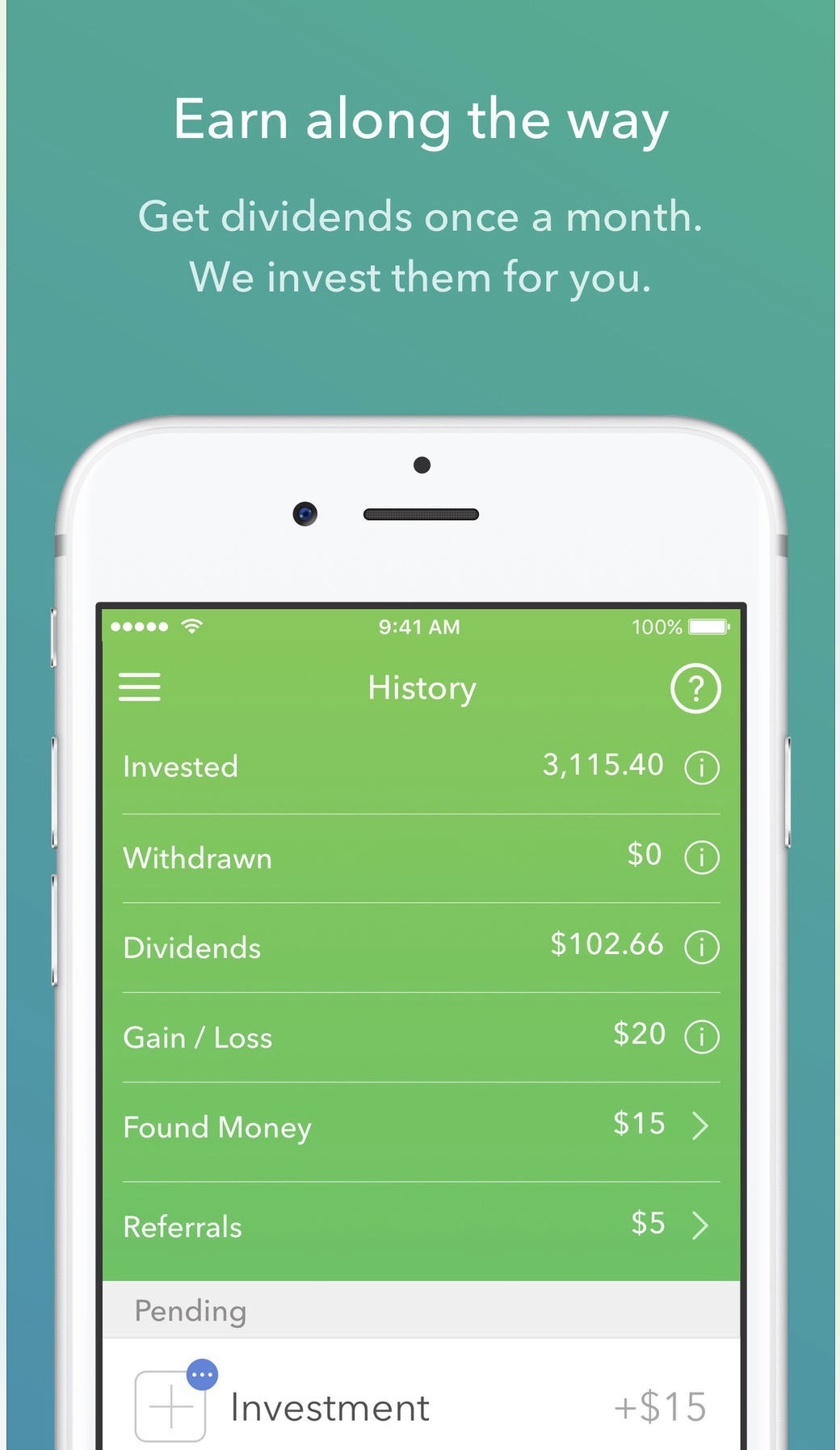

Acorns

This app is incredibly user-friendly, and the concept is simple: Automatically invent spare change from every purchase. So let’s say you go to Starbucks and buy a coffee for $3.24. You would be $0.76 away from an even $4.00 purchase. So Acorns applies that difference to your account. Boom, you just invested $0.76. You can even set up recurring investments, such as $5.00 a day. This simple savings can add up to about $2,000 a year. And if you have a 401k or another type of savings already, imaging the benefits you’ll reap by investing just $35 a week on top of that![2]

Uniqueness and Personalization 10/10

I love this app for everything it represents! It couldn’t be more personalized, since it is going directly off of your purchases.

Price 10/10

Acorns is free!! I try to stay away from money saving apps that cost me money, as I feel like it defeats the purpose!

Usability 10/10

I know I’m giving this app a perfect score, but I believe it deserves it. Acorns really makes saving money simple and at no point does it feel intimidating or confusing.

Appearance 10/10

Acorns is bright, clean and easy to read and understand. I like to look at it and therefore, I’m prone to use it more.

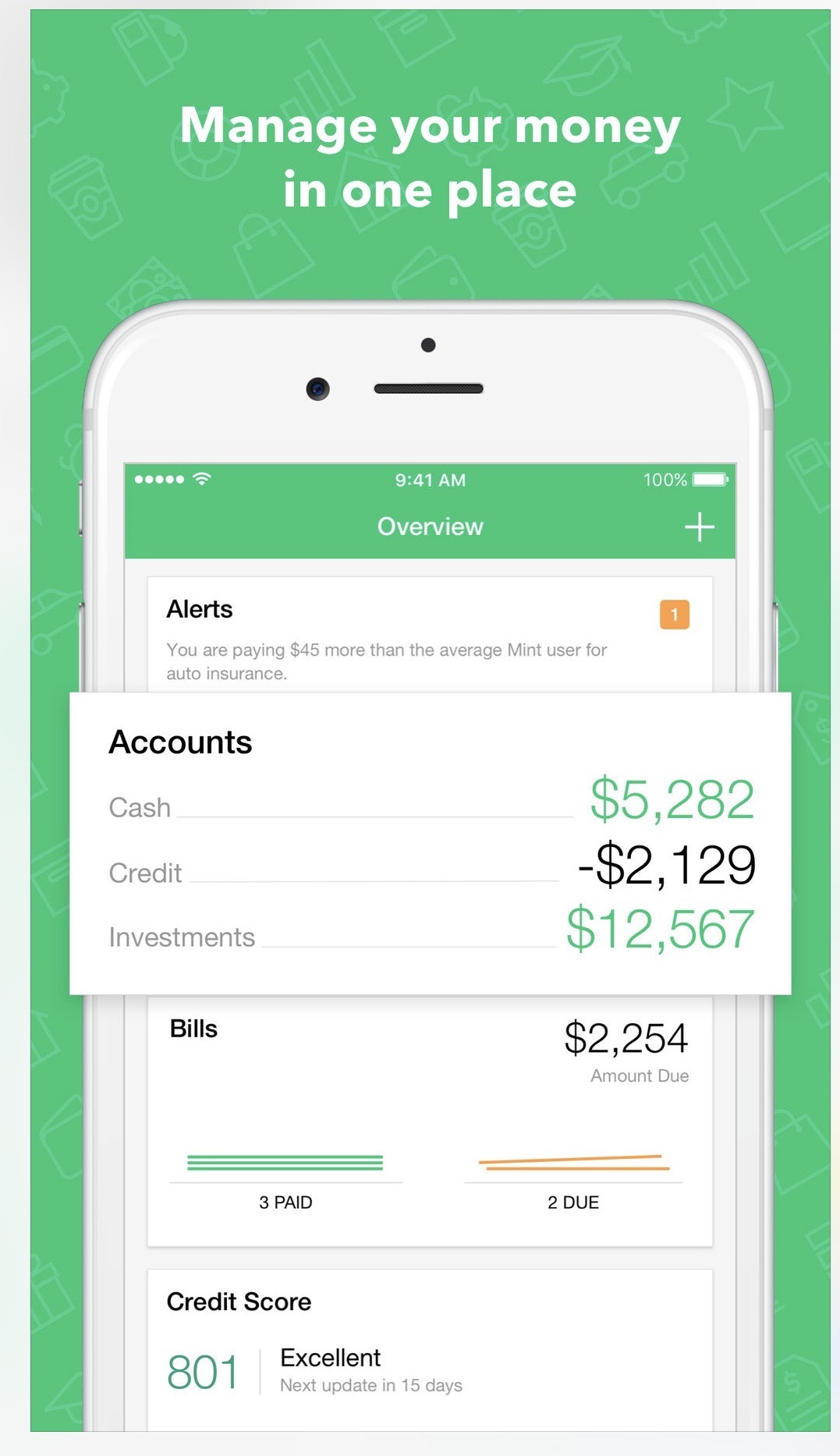

Mint

I personally love this app. For me, it serves a great purpose because I can see all of my accounts, bills and budgets in one place. If you, like me, have more than one credit card and multiple recurring subscriptions, it’s really helpful! You can also link your savings accounts, 401k, IRA, and even see your net worth. It’s secure and free and gives you a (fairly accurate) free credit score regularly. Oh, and if you are one of the rare people who use cash only, you can still use Mint, you just have to manually enter in your transactions.

Uniqueness 8/10

I’m not giving Mint a perfect score, because I think there are plenty of ways to budget, be it an Excel spreadsheet, paper and pen or an app, but I did rate it high because it’s one of the most convenient out there.

Price 10/10

Mint is free, and I love that. It truly gives you no excuse to not save money!

Usability 7/10

I’m giving this a 7 because even though I use this app regularly, I do find that sometimes it gets a little hung up. One of the nicest features is being able to see your money flow in real-time, but occasionally I have to refresh a handful of times before it’s actually current. It’s not a big deal, but it is a little annoying.

Appearance 7/10

Mint’s website is great. It probably would’ve gotten a 10, but the app is set up just a little differently, and it’s enough to knock the score down.

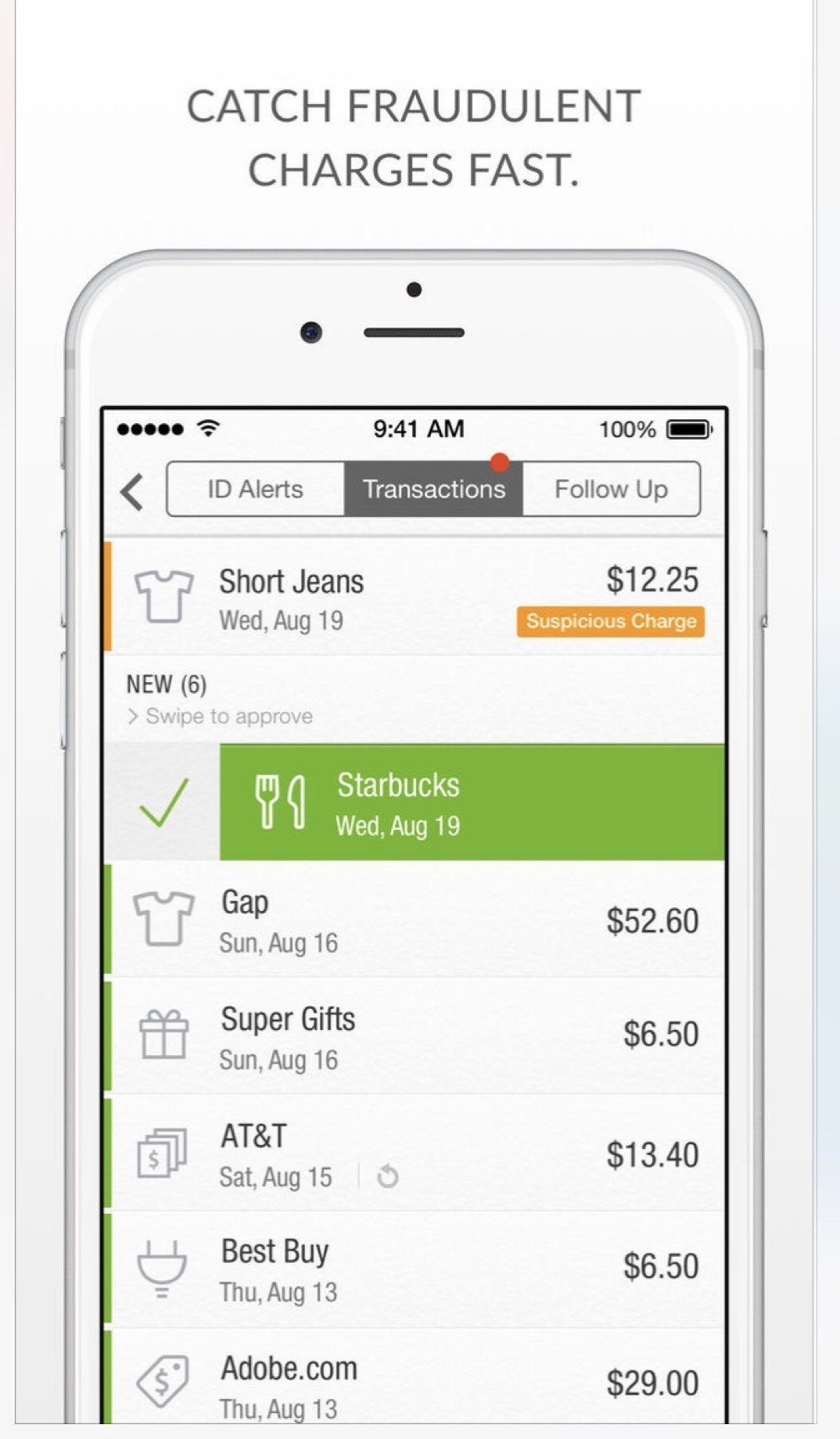

Prosper Daily

This app is also known as BillGuard, and it’s not only helpful for saving and spending, but also for making sure you are the only one with access to your hard-earned money. Like the other apps, you can track all your accounts in one place and see what you’re spending, but Prosper Daily also allows you to quickly identify fraudulent charges. You can also check your credit score as often as you like, but please note that free credit scores are not always accurate. They do tend to be in the ballpark though, so they are helpful for getting an idea of where you are and measuring success.

Uniqueness 9/10

While this app isn’t especially unique overall, I scored it high because I love the fact that it flags suspicious activity. This can be more helpful than hoping your credit or debit card company catches something. Awareness is key!

Price 10/10

This is yet another free app, so it gets a perfect score from me.

Usability 9/10

Easy to understand and simple enough to use.

Appearance 9/10

Nice, clean graphics and helpful charts.

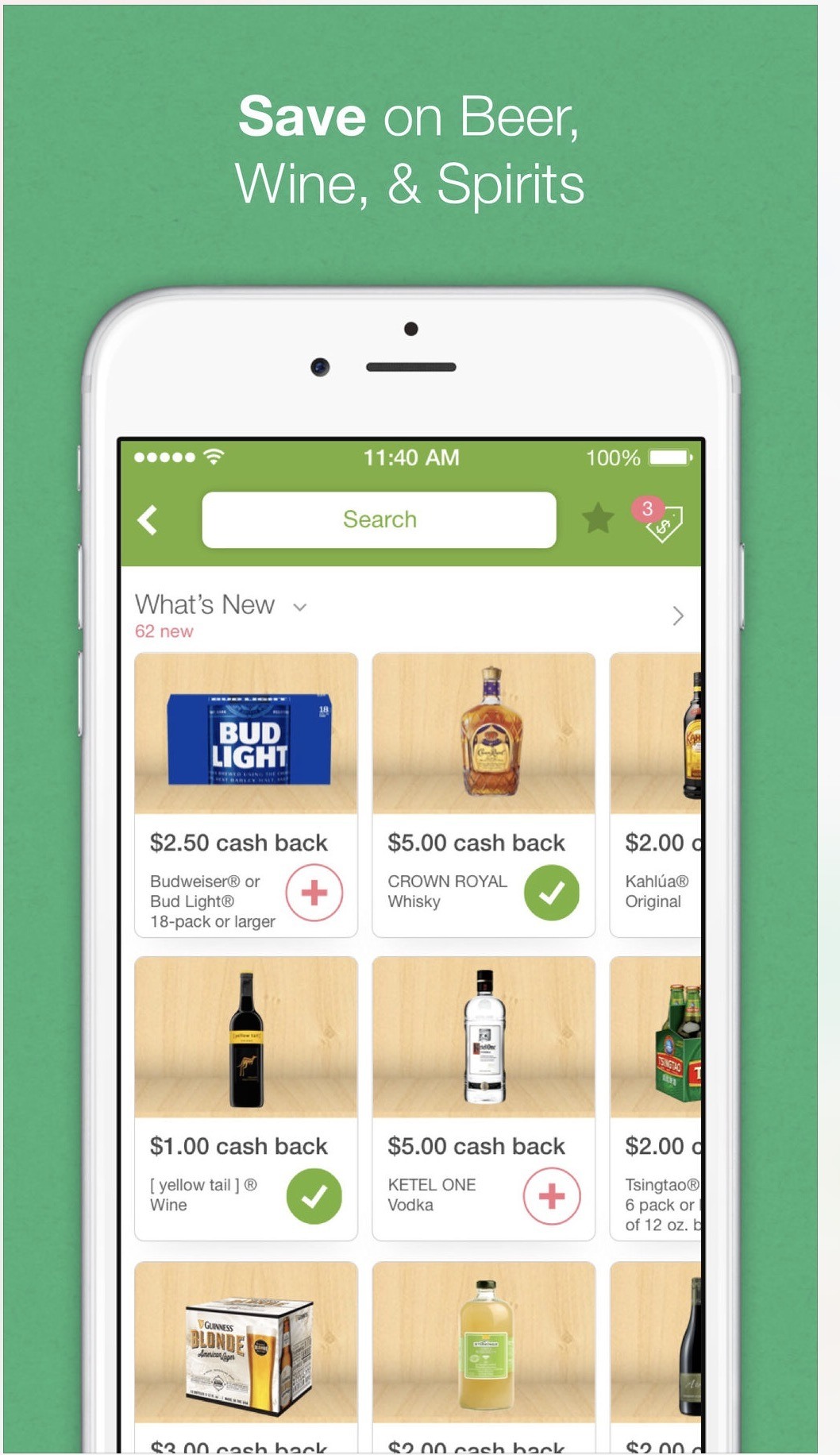

Ibotta

I’m obsessed with this app. Seriously.

For a while, my friends probably thought I was being paid to advertise for this company, because I could not stop talking about it! Ibotta is a rebate app for groceries.[3] Some of the cash back amounts are small (think $0.25), and some are upwards of $5.00. To date, I’ve made over $100 on the groceries I needed to buy anyway! If you use code edbmoql when you log in, you’ll get $10 right away! Not a terrible bribe, huh?

Uniqueness 10/10

While there are a handful of grocery rebate apps (and yes, I have about all of them) Ibotta remains the most unique to me because it offers so much. Not only can you earn cash by getting groceries, but you can also get rebates at certain restaurants and retailers.

Price 10/10

This one deserves beyond a perfect score. I mean, you’re paid to download it!!!

Usability 10/10

Some rebate apps/sites send a check via snail mail. While I’m always happy to receive money, I hate to wait for it! Ibotta let’s you send the money straight to Venom or Paypal once you reach $20.

Appearance 10/10

Easy to see, understand and use. Perfect score from me.

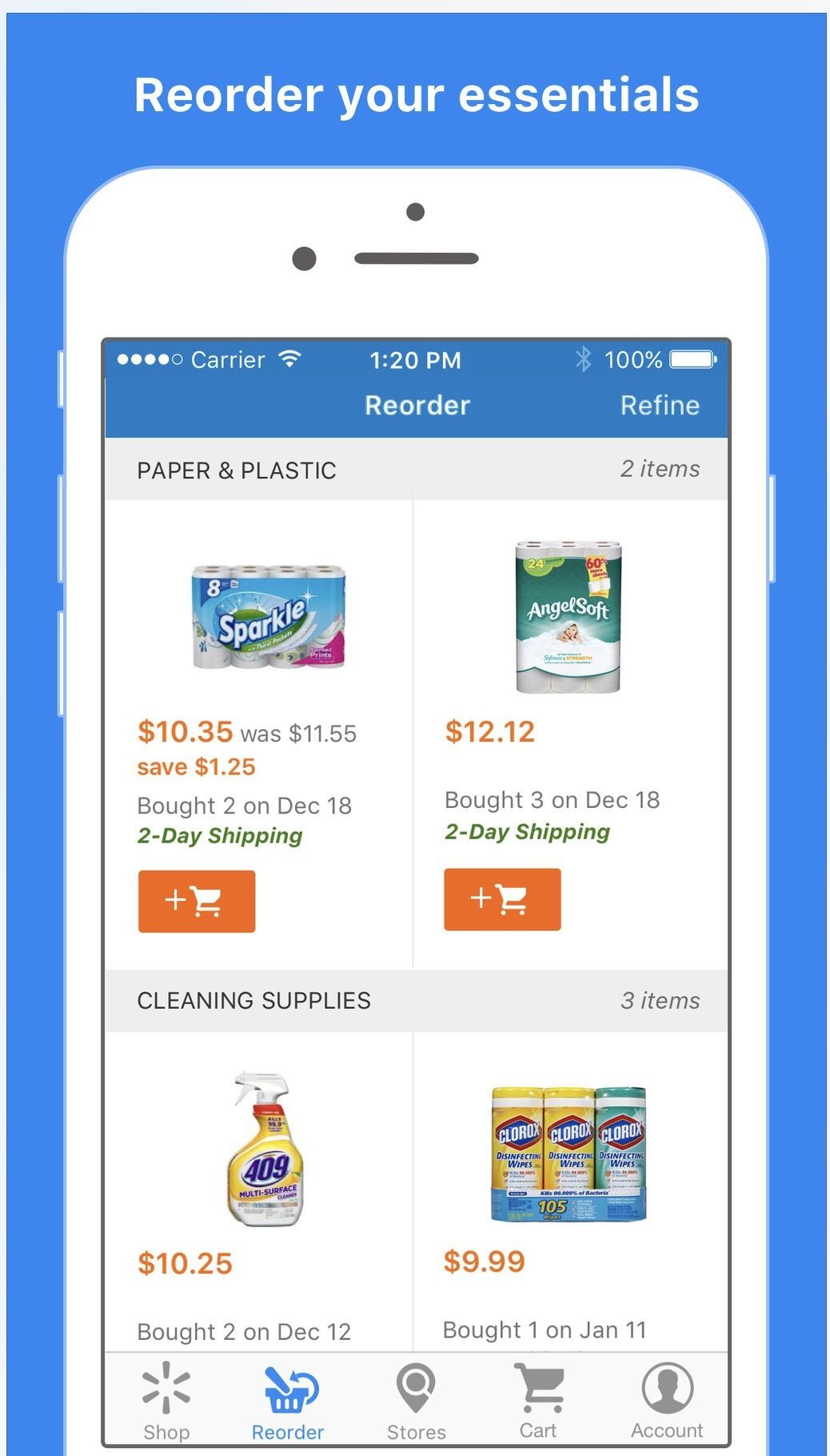

Walmart Savings Catcher

This app is great if you buy all of your groceries and household items at Walmart, because the savings will add up quickly. This isn’t a coupon app, but almost a rebate app! It works like this: scan the barcode of your Walmart receipt in the app and watch your earnings begin. It’s that easy. If the app finds any of the items you purchased at a better price, they pay you the difference on a Walmart gift card. Plus, the savings catcher is built into the regular Walmart app, meaning you can also reorder prescriptions, order online and check out sales.

Uniqueness 10/10

I think it’s very unique that Walmart did this, as it really shows how much they wanted to keep their customers. They already price-match, but this app goes a step further by making sure you, as the customer, really did pay as little as possible for the items you needed.

Price 10/10

Free app = perfect score.

Usability 7/10

I’m only giving this a 7 because you have to remember to scan your receipt every time. I know it’s like this with any rebate/savings app, but for some reason this app is the hardest for me to remember to use.

Appearance 8/10

This app is nice enough to look at, and it serves its purpose.

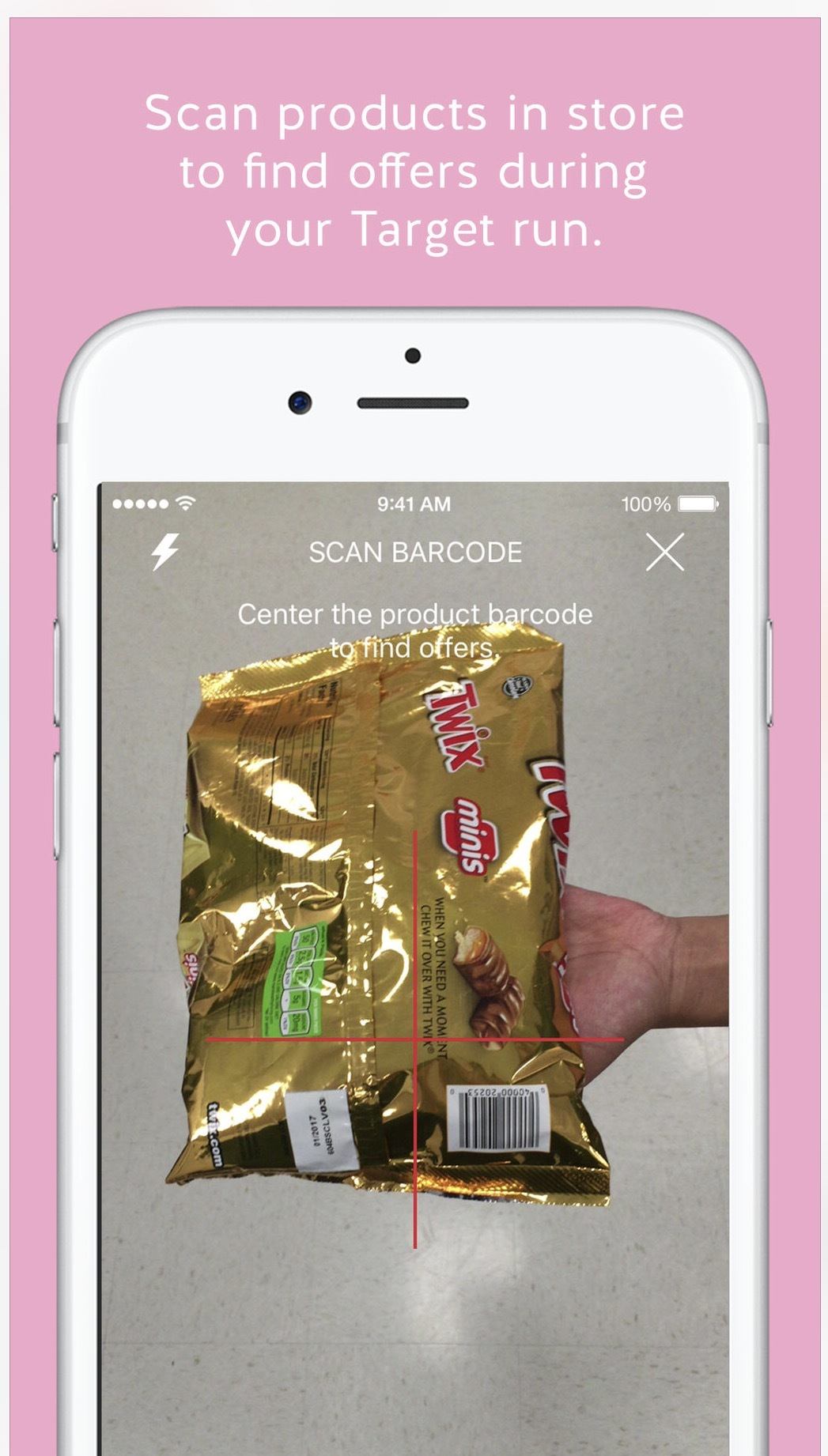

Cartwheel

Last, but certainly not least, is the app for Walmart’s competitor, Target. The Cartwheel app also allow you to browse and shop through the Target site, but I love it for it’s coupons! While I have been known to clip and print coupons in the past, if I’m going to Target, all I need is my smartphone. Cartwheel allows you to “clip” coupons (ranging from dollar amounts to percentages) by selecting them. They are all added to your personalized barcode which is scanned by the cashier at checkout. There is something so satisfying about watching your total drop after the beep of that scanner gun!

Uniqueness 9/10

I don’t know that coupons in an app are especially unique, but I rated Cartwheel high because I love how it’s done. While you don’t get cash back, you do get so see how much you’ve saved.

Price 10/10

Cartwheel costs $0.00.

Usability 10/10

This app is so easy to navigate and use. The only issue I’ve ever had was if I lost signal in the store. I especially love the option to scan the item’s barcode in the store to instantly check if it’s on sale!

Appearance 10/10

Clean and simple to understand, view and read.

Reference

| [1] | ^ | America’s Debt Help Organization: Americans in Debt |

| [2] | ^ | Lifehacker: The Very Best Apps for Saving Money Effortlessly |

| [3] | ^ | Clark: 11 apps that pay you to shop for groceries |