We are addicted to online shopping and why shouldn’t we be? Twenty years ago, if we wanted to buy a new television, we went to three or four different stores, compared brands and prices, and then made our decisions. When we needed to do our Christmas shopping, we hit the mall, fought for a parking space, and trudged through crowds and long checkout lines. It was exhausting.

Then along came our salvation — major retailers opened up online stores, and Amazon, which once only sold books, expanded into the universe of “everything.” Gleefully, we get online and do all of the comparison-shopping we want — or do we?

Amazon has become the largest player in the field of online shopping. It is just so easy to go to one website for absolutely everything we could even hope to need or want, purchase our items, have them gift-wrapped and shipped if necessary, and worry about the credit card statement later. Yet, many economists say that online shopping is one of the biggest reasons for credit card debt today.

Surprisingly, the consumer associations found out that a lot of us do not take the time to run a quick price research and shop around. In the case of Amazon, it is just too convenient not to do so. However, comparing prices from different retailers can save you a lot of money. Doing some research online before buying anything is a good habit to get into. Comparison-shopping is a smart move on everything from buying milk to choosing a new credit card; using websites like CompareCards can help you locate the best cards for your needs like 0 percent balance offers or cards with no annual fee.

However, I did some research for you. Here are six types of products that are much cheaper to purchase on Amazon, and five that you’d better get somewhere else.

Good Buys on Amazon

The thing about a company like Amazon is that there is an entire department that does nothing but run comparisons on popular items, in order to make their pricing highly competitive. So, in recent years, many of the items that were typically more expensive on Amazon are now either the same or less than other major retailers. While food, dog food, and paper products are still higher on Amazon, many others are not:

1. Diapers

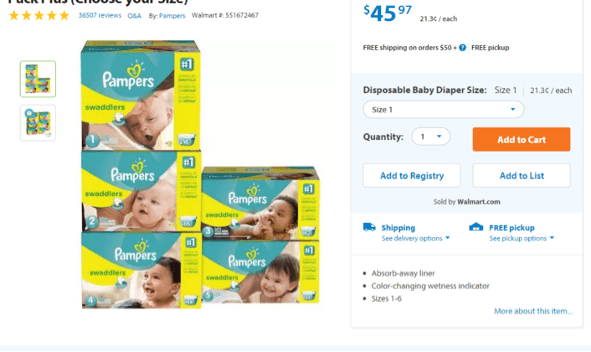

New parents are often baffled by the amount of cash spent on baby essentials. The good news is you can reduce the spending a lot if you start stashing on Amazon. Here’s Amazon’s price on the 216-count package of Step 1 diapers:

And here’s Walmart’s:

Today, Amazon beats Walmart, even if only by a small amount!

2. Small Kitchen Appliances

This category as appeared on almost every list of things never to buy on Amazon, but things have changed a bit today. Here are three random items selected from Amazon’s list:

Ninja Master Prep

And Walmart’s Price

Exactly the same, but with Amazon you don’t need to leave the house and spend extra money on gasoline.

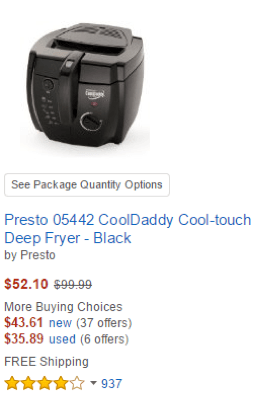

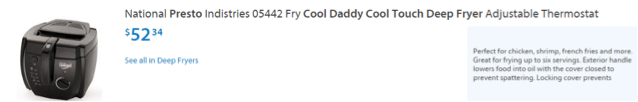

And Amazon’s price on the Presto Cool Daddy Cool-Touch Fryer

And Walmart’s:

And here was quite a shocker. The Hamilton Beach 6-speed classic stand mixer on Amazon was a full $20+ dollars less! Anyone looking for small appliances should certainly check Amazon’s prices rather than just assuming they will be higher!

3. Household and personal care items

A quick researched proved that Amazon offers a bit cheaper prices that Walmart on different household and personal care items like washing powder, detergent shampoos and more. Rather than shop online for such things as shampoo, conditioner and lotions, local members-only warehouse stores and dollar stores have huge variety for far less than online retailers as a whole. Laundry detergent was something possible worth checking, so a comparison was run on Tide Pods Detergent. Amazon’s price was $17.97 for a 72-count package, while Walmart’s was exactly the same. Further, Amazon price members pay no shipping ever, although Walmart does now have such a “club.”

Walmart Price:

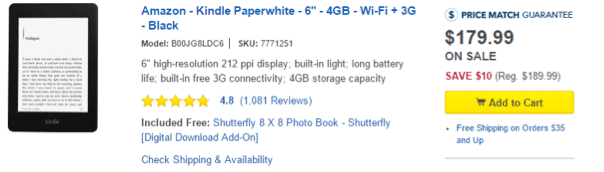

4. Small Electronics

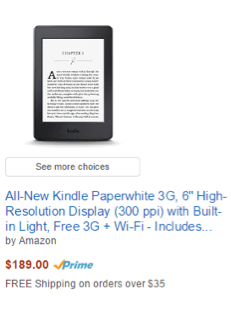

Small electronics are a mixed bag for Amazon. While they meet some prices of Walmart and BestBuy on such things as MP3 players, they are pricier on others. The Kindle Paperwhite 3G, for example was $10.00 more on Amazon:

BestBuy’s Price:

While BestBuy’s price represent a “sale,” it should also be noted that this chain will match any price on any item sold by another retailer!

5. Larger Electronics

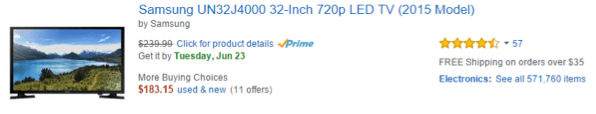

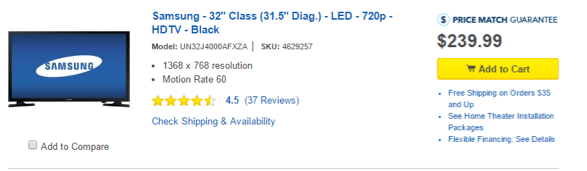

Televisions are always a popular item for comparison. The one selected her was the Samsung 32-inch, 720p LED TV. Comparing Amazon, Walmart, and BestBuy, Amazon came out ahead!

Amazon

While the text says “click for product details, when you do, you will discover that, indeed, Amazon does have new ones at the $183.15 price.

BestBuy

More expensive, but, there is that price match guarantee!

Walmart:

6. Books

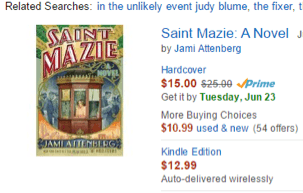

Most comparison lists claim that Amazon is higher than big box book stores. While there are not many left, there is Barnes and Noble, and here are the price comparison on three books that are new releases.

Amazon: Sister Mazie, Pirate Hunters, and In the Unlikely Event:

Barnes and Noble:

Amazon hold its own against the big box store!

And now let’s take a look on the things you should get in your corner store or Target instead of ordering through Amazon.

1. Food

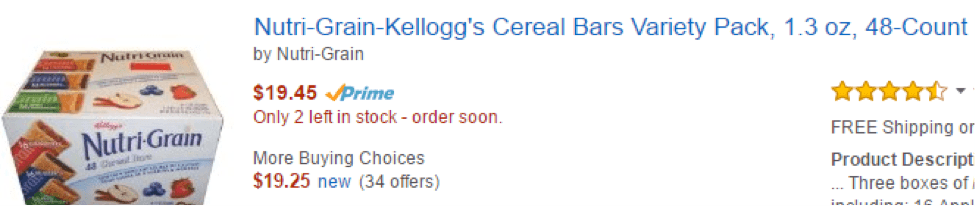

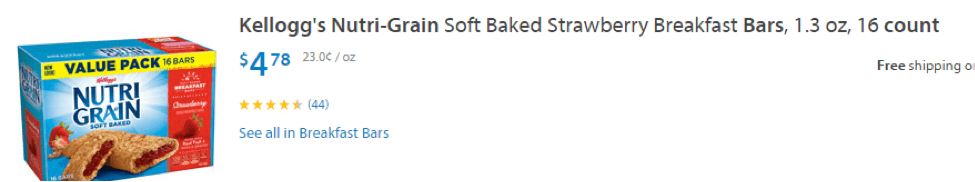

Yes, you can now order fresh food delivery through AmazonFresh if you live it Seattle, Los Angeles, San Fransisco or San Diego area, NYC and Philadelphia city center. Because Amazon only delivers fresh groceries to a few cities on the west coast of the United States right now, comparing prices on fresh foods with grocery store chains across the country is impossible. However, there are plenty of boxed and canned food items that are shipped by Amazon, and in general they are more expensive than the items in stores and at other online retailers. Here is the pricing on Kellogg’s nutria-grain bars at Amazon:

Walmart does not sell boxes of 48-count Nutri-Grain bars, but it does sell 16-count boxes, 3 of which are equal to Amazon’s box. Here is its pricing:

3 boxes of at $4.78 each comes to $14.34, beating Amazon by $5.00!

Want to save even more money on food? Here are some great hacks for spending less on groceries at the supermarket.

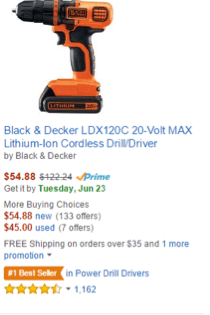

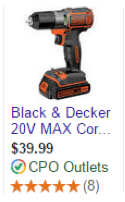

2. Power Tools

Other online retailers continue to beat Amazon prices quite handily. For example, there is the most recent pricing for a Black and Decker 20-volt cordless drill/driver at Amazon:

And here is the price at CPOOutlets.com, a discount online retailer:

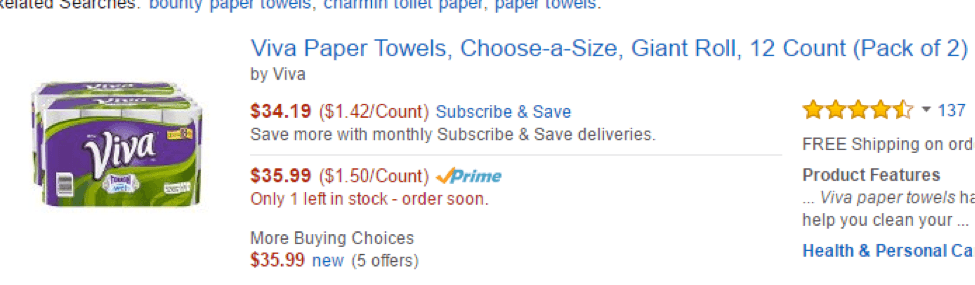

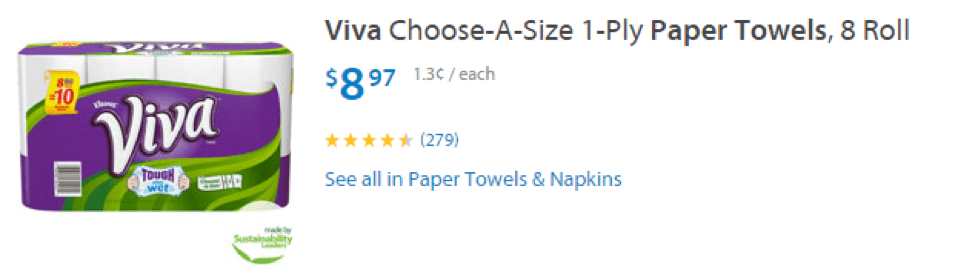

3. Paper Products

Paper towels and toilet paper really should be picked up locally, but for those who just must shop online, here is a comparison price just on one type of paper towel – Viva.

Amazon Price:

And here is Walmart’s price:

Amazon’s price is for two 12-count packages. The equivalent for Walmart would be three 8-count packages for a total of $26.91. That’s a $7.00 price difference!

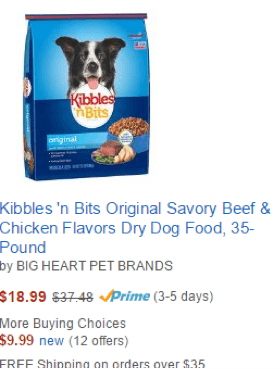

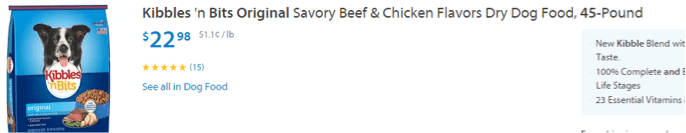

4. Dog Food

Walmart beats Amazon here too. Consider this bit of comparison shopping!

Amazon price for Kibbles ‘n Bits:

And Walmart’s:

If we compare the price per pound, Amazon’s cost is $.54, while Walmart’s is $.51, that’s $1.35 less per 45 bags, times how many bags are purchased in a year?

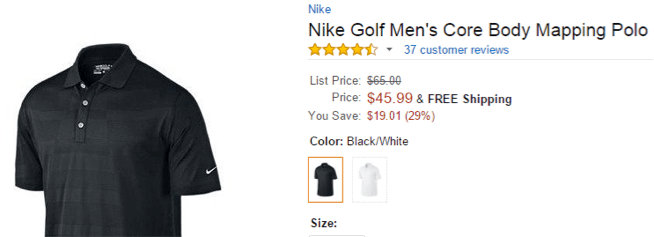

5. Clothing

Name brand clothing continues to be more expensive on Amazon than at other discount clothing retailers. And if you know the item you are shopping for, there is no reason not to just “Google” it and compare. For example, it was quite easy to compare the price of a men’s Nike cord body mapping polo shirt, priced on Amazon at $45.99.

Amazon:

And here is the price on eBay, with no bidding:

Comparison online shopping is easy to do, and, really, if you want the best bargains on anything, you are well-advised to closely check. Going to Amazon, or to other big retailers (BestBuy, Home Depot, Walmart) will is more certain, in terms of product availability, but if you take the time to “Google” the item you want, you will discover a number of discount outlets that are carrying your item at a hugely discounted price. And when you do shop the “big boys,” understand that their prices change quite often, dependent upon what they find their competition is doing. Shipping costs must always be considered as well, as you compare the total price you will actually be paying. But above all, be wise, lots of little savings over time accumulate to bigger ones!