Is your garden lacking color, depth, and excitement? If you are looking to transform your backyard into a personalized space that will impress on a budget, try one or many of these simple projects.

1. Pallet Herb Garden

Pallets can be found all over and are literally thrown away by businesses everyday. A great way to recycle old pallets is to attach terra cotta pots to them and make them into a rustic pallet herb garden. Be sure to research whether the type of herbs you want to grow require a lot of sun or prefer shade and plan accordingly. Creativity is your best friend, design your pallet garden any way you see fit.

2. Bird Bath/Garden Planter

Take the simplicity of painted terra cotta pots, add all the excitement of a bird bath, and what you’re left with is a beautiful bird bath planter. If you want your feathered friends to return to your garden time and time again make sure you are regularly cleaning the bird bath.

Tutorial: https://www.homestoriesatoz.com/outdoor/diy-garden-planter-birds-bath.html

3. DIY Pallet Bench Garden Project

Scrap lumber is more useful than you think. Use either 2x4s or deconstructed pallets to make this simple yet wonderfully colorful bench. Simplicity rules, and anyone who walks by won’t help but notice your artsy homemade garden bench.

4. Flowerpot Wind Chime

If wind chimes are you style, you can avoid buying a new one and make your own. Follow these simple instructions to make an amazing flowerpot wind chime.

Tutorial: https://houseofjoyfulnoise.com/terracotta-flower-pot-wind-chime-tutorial/

5. Chandelier Planter

What’s that old clunky looking chandelier in your garage up to? Short answer: nothing! So why not turn it into a gorgeous chandelier planter? Use clay pots in place of the light fixtures and be sure to attach the pots with a strong adhesive. These planters will look great anywhere including your garden, porch, or even inside your home if you so desire.

Tutorial: https://diyshowoff.com/2013/06/11/chandelier-planter-tutorial-2/2/

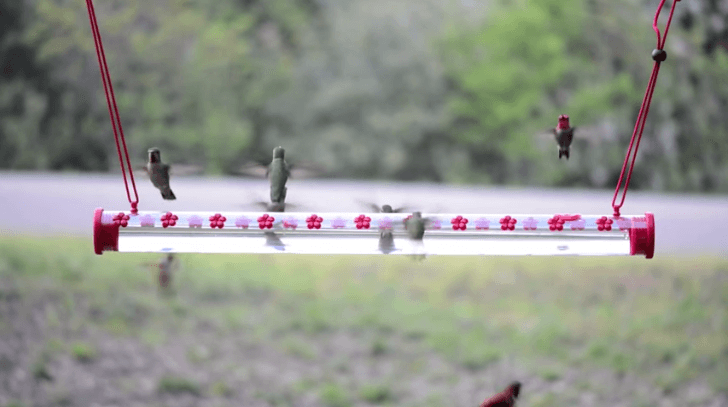

6. Hummingbird Feeder

Hummingbirds are one of the most fascinating species of birds. They are colorful, animated creatures that are as exciting to watch as they are beautiful. I’ve owned many of these feeders and by far the best design and most naturally appealing to hummingbirds seems to be the hummerbar style feeder. This design uses a large tube with plastic flowers as access points to hummingbirds favorite food: nectar! The hummerbar style hummingbird feeders start at about $20, so whether you decide to buy one or make your own, it won’t break the bank.

7. Recycled Chair Garden Planter

My next door neighbor once saw me throwing out a wooden chair that had the bottom broken out of it. He gave me this same idea and my homemade chair planter quickly became my favorite things on my front porch.

8. Clay Pot Rain Chain

With summer on the brain, rain is probably the last thing on your mind. Attaching small clay pots to your rain chains makes them stand out as unique and creative.

9. Recycled Wood Pallet Garden Path

Yet another use for wood pallets is to take them apart and use the lumber to create a path. Consider staining the boards first, or even using this idea to create a small bridge for your garden or back yard.

10. Clay Pot Lighthouses

This idea for your garden is simple enough, but it may require some artistic abilities. Glue terra cotta pots together and once they dry paint them like a lighthouse. Whether you live on coast or anywhere else this project brings a little bit of ocean air to your garden.

Tutorial: https://www.ehow.com/how_4882573_make-clay-pot-lighthouse.html

11. Seashell Encrusted Clay Pot

Following suit with the light house clay pots, these seashell clay pots are awesome. Simply choose a clay pot, gather or buy some interesting sea shells, and attach them with a high power adhesive. Try planting succulents or tropical plants in these customized clay pots.

12. Stump Planters

Stumps or old abandoned logs are everywhere. As long as they aren’t rotten they will make great planters. Try filing them with summery flowers or even aromatic herbs!

Tutorial: https://www.listotic.com/creative-garden-container-ideas/9/

13. Decorative Mushrooms Made With Terra Cotta Pots

Bordering the line of folk-art, mushroom themed clay pots are frankly the most fun portion of this list. Try using bright colored paint combinations and use the pots as the mushroom stem, drain trays as the mushroom caps. Garden gnomes unite!

14. Succulent Wreath

Succulents are one of the easiest types of plants to take care of. Start by creating a ring of moss (Spanish moss is my favorite), and add in succulents. Although traditional wreaths are only for the holidays, these succulent wreaths are pretty timeless.

15. Clay Pot Planter Wall

Construct a basic wooden frame and use either chicken wire or large screen material as the backing. Attach some clay pots and go wild! Use as many as you think are suitable and fill them with the bright plants of your choice.