A lack of productivity leads to a lack of happiness. You become anxious and stressed when you can’t see yourself making progress or getting things done. That’s why it’s essential to learn how to be productive.

There are also many things that contribute to unhappiness here: social media notifications, e-mails, texts, and chatty co-workers are just a small fraction of the disruptions we’re bombarded with. These “little things” can stack up fast and hamper your happiness and productivity levels.

16 Practical Ways to Increase Your Productivity

With only so much time available each day, productivity is essential. Either putting in more time or working smarter is the key to greater results. Managing your time more purposefully isn’t a secret formula, but it can help you become more effective while working.

Implementing even a few time-saving strategies into your routine should help you feel more productive overall.

Learn how to be more productive with the 16 tips below and reclaim your everyday productivity and your happiness once and for all.

1. Identify Your Time Thieves

We all have time thieves, but most of us haven’t yet identified them. For some of us, it can be the apps on our phones that we scroll through. For others, it can be the bad habit of constantly checking e-mail or spending more time taking breaks than actually working during our peak productivity hours.

If you can identify your biggest time thieves, the activities or situations that throw you off course, distract or interrupt you, or the bad habits that keep you from performing better, you will improve your results much more quickly and learn how to be productive on a daily basis.

Productive people know that eliminating time thieves is key to staying focused in the long run. If you just aim to change one of your worst time management habits, you will change your results immediately. It will most likely give you the impetus to change what else isn’t working once you feel the reward of your efforts and see the clear connection between what you do and your reality.

2. Finish Your Day Before It Starts

Proper planning is the secret to peak productivity, and it’s also a good idea to set important goals daily. Get yourself a planning tool and prioritize your daily tasks with it in order to spend your time on important tasks.

If you know exactly what you have to do and the timeframe you want to complete it in, you’ll be well on your way to learning how to be more productive and finish all of your most important tasks during the day.

Here’s a smart technique for planning and prioritization: How to Prioritize Right in 10 Minutes and Work 10X Faster. You can also try out these tips for better productivity during your day.

3. Recharge Your Batteries

Figure out how many hours of sleep your body needs and make sure you get it. Take time to stretch, walk, or relax in order to recharge throughout the day and after work.

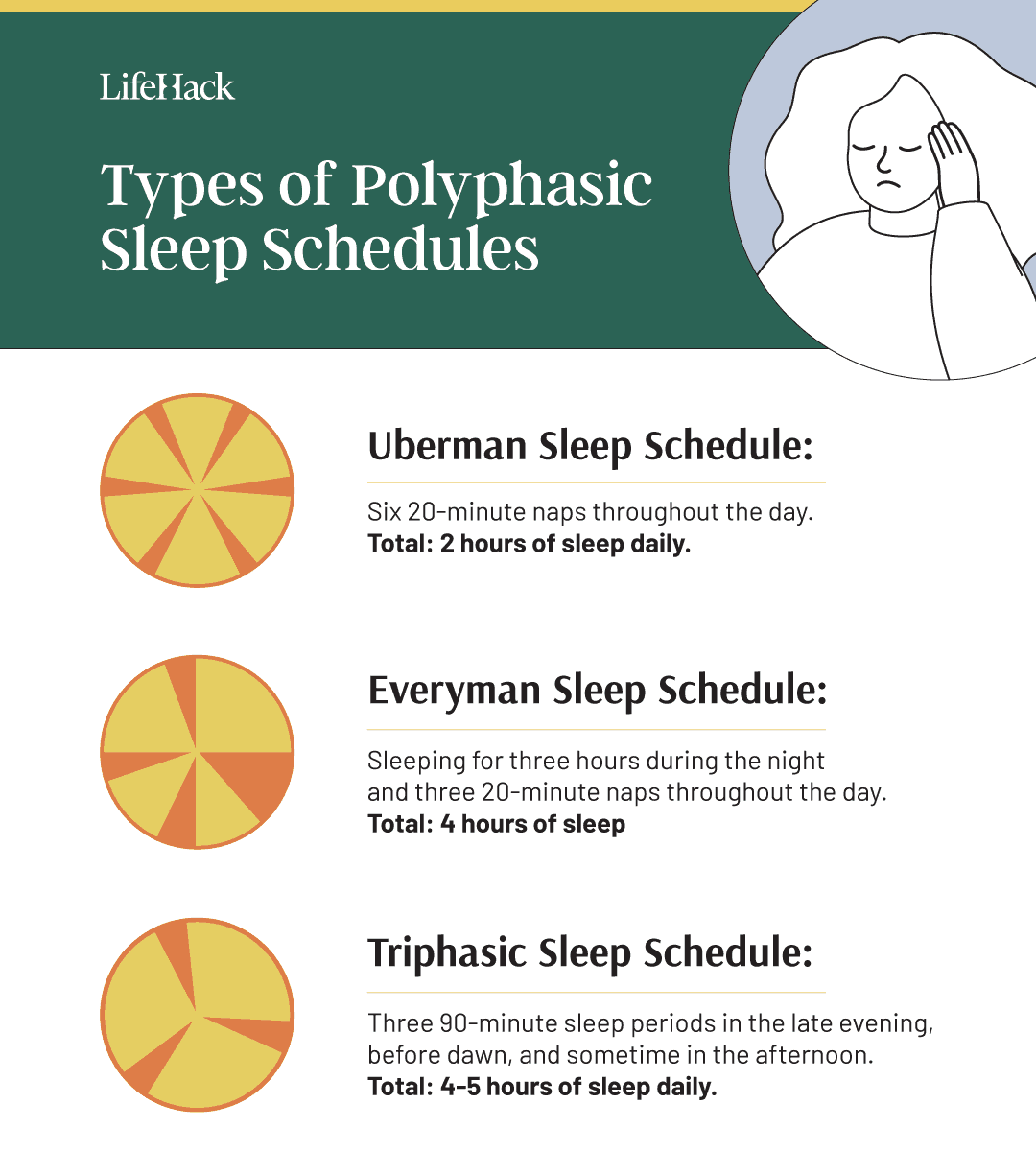

Studies have shown that there are benefits to adapting to a polyphasic sleep schedule such as an increase in productivity, irregular work schedule compatibility, and increased memory and learning.[1]

Another study found that the best way to ensure consistent productivity throughout the day is to work for about 50 minutes, followed by a 15-20 minute break.[2]

4. Become an Early Riser

This is one of the most underused productivity “hacks” on the planet. Ever since I decided to start waking up at 5 AM every day, my productivity levels and happiness have gone up dramatically.

Most people aren’t up that early, so no one can bother you or disrupt you from what you want to do. A productive person will use this time to exercise, meditate, or get a head start on their day.

It could be difficult for some to wake up early in the morning, but nothing beats a quiet house!

5. Learn Keyboard Shortcuts

Not much gets accomplished when the mouse is used for repetitive tasks. Keyboard shortcuts are the best technique to increase productivity while surfing the web. With technology’s help, you can double your work efficiency.

When you use the keyboard shortcut, you gain 8 days per![3]

6. Use Time Blocks

When I wrote this article, I gave myself a one-hour time block. This prevents unnecessary dilly-dallying, like updating your social media and checking your email. Instead, start developing better work habits and manage your time for a more productive day.

There are plenty of apps that can help you do this, or you can simply set an alarm on your phone, so you know when you can take a break and enjoy some free time. During your set time block, do your best to eliminate distractions. Find a quiet space, declutter your desk, and create a short to-do list to keep you on track.[4]

7. Celebrate Small Wins

Every time you check off a task from your to-do list, you release a “happy chemical” in your brain called dopamine. This gives you the motivation to move forward and do even more.

For example, after I have finished writing this article and crossed it off my list of things to do today, I’ll get a nice burst of “happy chemicals” released in my brain. The best part? Zero side effects!

8. Avoid Interruptions

Interruptions are among the most significant barriers to both productivity and happiness. Every time you’re interrupted in the middle of a task, your level of productivity takes a hit.

We’ve all been there: you’re fully immersed in an important project until suddenly, the workplace chatterbox appears out of nowhere and starts talking about the crazy night they had last weekend. By the time s/he’s gone, you’ve already forgotten where you were, and it takes 30 minutes to get back on track.

9. Shut Down the Digital Disruptions

The common time wasters include instant messenger, video games, checking social media, television, and extraneous internet surfing. According to BBC,

people spend 4.8 hours on their mobile phones.[5]

10. Listen to Podcasts

Audio learning has the power to add hours to your day. Not to mention, your cranium is sure to thank you for it.

11. Go on an Information Diet

Most of the world lives on information overload. We must eliminate mindless Internet surfing. Stop reading three different newspapers a day and checking your RSS feeds multiple times a day. Otherwise, you’ll never get anything done.

12. Do Work You’re Passionate About

Make it your goal to blur the line between work and play by doing more things you’re passionate about. This promotes happiness both inside and outside of the workplace.

13. Leverage Like There’s No Tomorrow

Look for ways to use the 80/20 rule by identifying tasks that you might be able to outsource or leverage out to a virtual assistant. Don’t be afraid to trust others with tasks you believe they can do. They’ll likely be happy for the opportunity, and you’ll feel better about lowering the amount of work you have to get done.

14. Measure Your Success

Every now and then, it’s a good idea to measure your results and see how things are coming along.

How’s your progress? Are you moving in the right direction? It’s always a good idea to track your progress regularly. Of course, to track your progress, you need to set specific milestones so you know that you’re on your way to achieving any big or small goal.

15. Get out of Your Own Way

Sometimes, all you need to do is stop sabotaging yourself and get out of your own way to develop productive habits. Sometimes self-sabotage can be obvious, like when you completely avoid moving forward with projects. Other times, it can look like perfectionism, where you are never satisfied with the end result and never quite do your best work.

You might tend to look at all the extrinsic factors of why you can’t be more productive, and you might blame, complain, and point fingers at everyone and everything except yourself.

When the blame cannot be directed externally, you might resort to excuses, desperately searching for a justification that will give you comfort because “you have no control over what happens.”

How many excuses do you have and live by each day? “I couldn’t do this because…or I don’t have time to do this because…” Your excuses might be valid, but in the end, they’re only slowing you down; it is an avoidance technique that we subconsciously use when we don’t feel capable of completing the important tasks at hand.

Not dealing with procrastination is a clear example of standing in your own way. If you don’t tackle it, it will be there the next time you attempt to do whatever it is that you are procrastinating on.

16. Talk to Yourself Differently

Productive individuals think very differently than others. You need to challenge your thoughts and develop a productive mindset. A productive person avoids thinking about all the things they won’t be able to do for X or Y reasons.

Instead, they think:

- I need to do this and this. What is the best way for me to get everything done?

- What is causing the stress, and what needs to change so that I manage this situation better?

- What can I do to improve this, considering the current circumstances?

The words and phrases you use immediately empower you, or they don’t; they either make you feel better or more stressed. You can use positive affirmations as a form of positive self-talk if you aren’t sure where to start.

The words you use to talk to yourself are pivotal to everything in life because they will be your guide, whether they support you or not.[6]. Being more productive will get much easier when your words build you up instead of tearing you down.

The Bottom Line

So, here’s the ultimate list of techniques you should learn to boost productivity. Pick the techniques that work for you and make them your daily habits. As time goes by, you’ll find yourself being a lot more productive.

Start small and take up each suggestion one by one. That way, you can boost your productivity and create joy along the way.

Featured photo credit: Emma Dau via unsplash.com

Reference

| [1] | ^ | SleepFoundation.org: Polyphasic Sleep Schedule |

| [2] | ^ | TIME: The Exact Perfect Amount of Time to Take a Break, According to Data |

| [3] | ^ | Brainscape: How keyboard shortcuts could revive America’s economy |

| [4] | ^ | Todoist: Time Blocking |

| [5] | ^ | BBC: People devote third of waking time to mobile apps |

| [6] | ^ | Psych Central: 5 Tips to Improve Your Self-Talk |