Scoring the best airfare prices goes well beyond booking nearly a year in advance. If you use a “fake location” to buy your ticket, you could potentially get a much lower price. In Erica Ho’s article “Use A “Fake” Location to Get Cheaper Plane Tickets,” she let’s us in on this impressive airfare reduction strategy!

Use Point-of-Sale For Your Advantage

As it turns out, the same ticket that costs maybe $300 if you buy it from New York, costs $30 dollars if you buy it in Bangkok. Same ticket, but the only difference is the location you are purchasing it from or, a fancy way to say it, its “point-of-sale.” Ho managed to pay only $371 for a flight from New York to Colombia that was originally costing her more than $500.

Using the Trick for a Flight from Cartagena to Bogotá (Domestic Flight In Colombia)

Using travel search engines like Kayak, Skyscanner and Google ITA, Ho compared the prices of flights from large airlines LAN Airlines and Avianca. All travel search engines take a US-centric approach and displayed the cheapest LAN flight as $116 and the cheapest Avianca flight as $137. This is when Ho changed her point-of-sale.

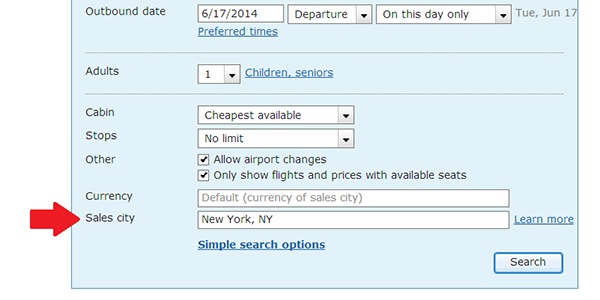

How to use Google ITA’s “Matrix Airfare Search” to change the point-of-sale:

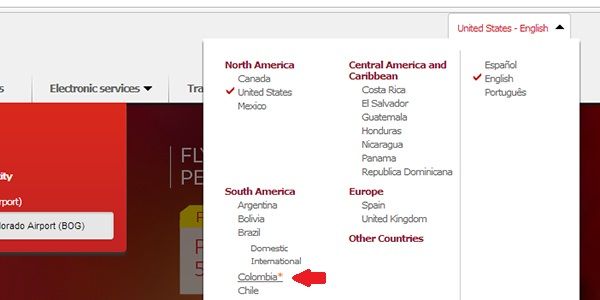

In this case, changing the point-of-sale can only be done using Google ITA. Ho changed her point-of-sale from New York City to Colombia, because she wanted her airfare to be in Colombian pesos, but you can change your point-of-sale to any place in the world (depending on whether you can get a cheaper rate from there).

Remember, the departure and arrival location is fixed regardless of what your point-of-sale is.

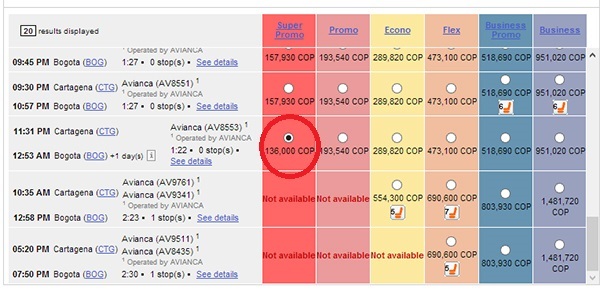

Here’s the price after changing the sale city to one in Colombia:

Now the cheapest flight from LAN is 173,820 COP ($91.96) and the cheapest flight from Avianca is 116,280 COP ($61.59). Just by changing the point-of-sale, you can save $74.41 on the Avianca flight and $22.04 on the LAN flight.

How to buy the tickets on the airline’s website:

This price comparison proves that you can potentially buy a cheaper ticket from Colombia than you can from the US. But you can’t buy this cheaper ticket directly from a travel search engine like Google ITA. You’re going to have to buy it from the airline’s website.

One of the ways to change your point-of-sale on the airline website is to change your site location to Colombia but keep the site language English. Sometimes the website changes the language automatically, so you’ll probably have to either improve language comprehension or load Google Translate. You can also use a VPN approach – by changing your IP address to trick the website into believing you are purchasing from a computer within the country.

You may not get the exact price you saw on Google ITA, but Ho assures that she almost always saves some money when she changes the point-of-sale. To save a maximum amount of money, it’s important that you use a credit card that doesn’t charge foreign currency conversion fees when purchasing your ticket.

Even if you use a credit card that does charge currency conversion fees, though, the standard foreign transaction fee usually sums up to be around 3% surcharge, which in this case would only cost an extra $2.16. Not a bad price to pay for the overall savings!

Tips & Things to Keep In Mind:

1. The best point-of-sales are the country the airline is based in and the country of destination (especially in the case of international flights).

2. Sometimes airline websites may revert prices back to those of your original point-of-sale when you use your credit card. This differs from website to website.

3. Sometimes airline tickets purchased from your home country also charge you the required visa and entry/exit fees, which may not be included in the ticket you purchase as a “resident.”

4. There are some airlines that charge the same for local and foreign residents, so be on the lookout for those!

Using this trick, you can save as little as $7 to more than $100! It doesn’t hurt to try changing your point-of-sale next time you’re buying airline tickets. And with that $7 saved, you could go ahead and buy an extra snack at your destination.