Traveling to exotic places around the world doesn’t have to be something that costs hundreds of dollars everyday. Using a great tool called the “daily backpacker index” from priceoftravel.com, I found thirty cities that you can explore for less than thirty dollars per day!

These cities are all across the globe and are some of the coolest places to visit. So now that my work is done, it’s up to you, which one will you be traveling to first?

1. Pokhara, Nepal: $14.32/Day

Flickr/Christophe

This super cheap city is the tourist capital of Nepal. Pokhara is known for its treks, one of the most famous being Annapurna. You should only expect to pay a few dollars for every meal and beers can be found for less than two dollars!

2. Kiev, Ukraine: $16.73/Day

Flickr/Irisha

This city is cheap compared to many other European cities which can cost upwards of seventy dollars per day. They struggle for tourists in this area of Europe since it’s off the main course that many travelers take. You can find attractions for less than a dollar per person.

3. Phnom Penh, Cambodia: $21.95/Day

Flickr/Peter Collins

This SE Asian city is the perfect place for anyone looking to travel on the cheap. Food is only a few dollars and things like bottled water can be found for only fifty cents. It would be a struggle to spend a lot of money here.

4. Bangkok, Thailand: $22.33/Day

Flickr/Eric Magnuson

Things like attractions and even airfare can be found around here for cheap. The prices of attractions vary, but many temples cost less than two dollars. If you feel like going all out, you only have to pay fifteen dollars and you can visit the Grand Palace.

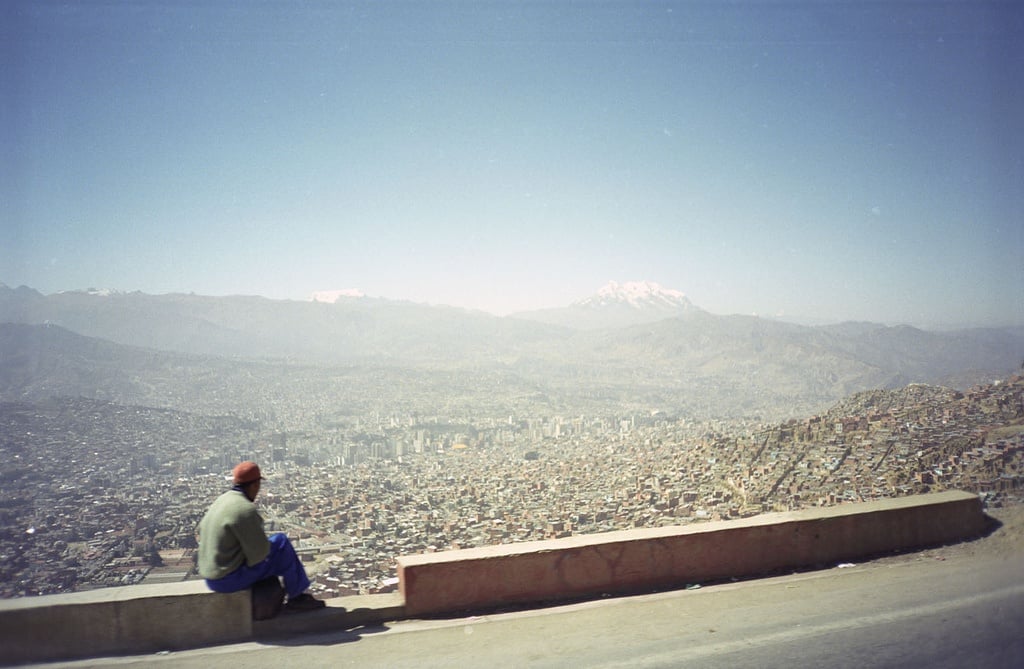

5. La Paz, Bolivia: $22.24/Day

Flickr/Ben Cumming

The high towering city sits between 10,000 to 13,300 feet above sea level depending on the area. You can find transportation for as little as a few dimes depending on what kind you take. Taxi’s are a bit more expensive, so I suggest taking public transportation when possible, but even then the prices are not staggering.

6. Chiang Mai, Thailand: $18.10/Day

Flickr/AG Gilmore

The second largest city in Thailand boasts many free attractions and extremely cheap three-star hotel rooms. Transportation is only a few dollars per trip and beer can be found for less than a dollar.

7. Cusco, Peru: $26.93/Day

Flickr/Gustavo Vargas

A very common tourist destination due to Machu Picchu, it’s also quite cheap. There are a few more expensive parts to the area like flights to Cusco as well as the train from Ollantaytambo to Machu Pichu, which can cost over a hundred dollars.

8. Quito, Ecuador: $22.30/Day

Flickr/Christian Cadena

The city has hostels and hotel rooms for very little as well as food. Many of their main attractions are free as well. It’s safe to say that a day exploring this city isn’t going to even come close to breaking the bank.

9. Vientiane, Laos: $21.32/Day

Flickr/Samnang Danou

This city is known for being very modern, one of their attractions for example is a large water park that opened in 2008. You can find attractions that only cost a few dimes and you can find rice whiskey and beer for just over a dollar.

10. Manila, Philippines: $25.52/Day

Flickr/Joe Forjette

It’s easy to find free things to do in the massive city as well as transportation that can easily be found for less than a dollar. The hotels range in price from being very inexpensive to being very expensive.

11. Kathmandu, Nepal: $18.45/Day

Flickr/Mike Behnken

Depending on how picky you are, you can find some of the cheapest hostels and hotels on the planet, but they can come in pretty shady conditions. You only have to pay a little extra though to get something that is comfortable. Kathmandu is also less than one hundred miles away from Mt. Everest if you would like to see the giant.

12. Bali, Indonesia $27.66/Day

Flickr/Armando Torrealba

Home to Kuta, which is one of the best places to find travel deals, you can relax on the beach all day. They are known for their awesome nightlife and for surfing. You can rent out a surfboard for between two and seven dollars.

13. Phuket, Thailand: $26.75/Day

Flickr/Jeremy Jones

Known for its excellent beaches, Phuket is an island that is in the southern part of Thailand. You can find attractions for only a few dollars or go all out on an all-day snorkeling tour for less than eighty dollars.

14. Krakow, Poland: $27.86/Day

Flickr/Nick Salmond

No matter how little your budget is, you will be able to explore the cities main attractions like museums and palaces. You can get into the Wawel Castle for less than six dollars and if you go at the right time, you can get in for free!

15. Yangon, Myanmar: $27.83/Day

Flickr/Jose Javier Martin Espartosa

The largest city in Myanmar has been rising in prices recently, but is still very cheap. It’s actually a fairly new tourist city since the tourism boycott was lifted in 2012. Hotels are now just beginning to pop up!

16. San Jose, Costa Rica: $29.43/Day

Flickr/Richie Diesterheft

Although it’s one of the more expensive cities in Central America, it’s still pretty cheap. You can find all three meals for only a few dollars each and beers for less than two. You can also get a ‘Guaro shot,’ which is sugar-cane alcohol served with a lime wedge for fifty cents if you want to get your drink on.

17. Cairo, Egypt: $26.76/Day

Flickr/Joonas Plaan

One of the greatest skills you can have on the road is the ability to bargain and that comes in handy while in Cairo. You can get a car to be at your service for an entire day for an affordable price, cheaper food, and you can pick up even better deals at hotels.

18. Sofia, Bulgaria: $25.42/Day

Flickr/Stella

Eastern Europe is a cheap area all around and Sofia isn’t any different. You can get into many free attractions, find reasonable prices on food, and find comfortable hotels. Transportation can be a bit expensive, so I suggest watching which method you take to get around the city.

19. Panama City, Panama: $27.72/Day

Flickr/Matthew Straubmuller

This city has been a tourist favorite of late, so the best time to go to assure low prices is right now, in case they increase as the popularity of the area does. Right now you can find food and transportation for only a few dollars.

20. Hoi An, Vietnam: $23.13/Day

Flickr/Joseph Hunkins

It’s easy to have a good night out here as the beer is only a few dimes (if not less) and they have dollar cocktails. The food is also extremely cheap. You can get a room with AC, cable, fridge, and Wi-Fi for next to nothing.

21 Marrakesh, Morocco: $29.94/Day

Flickr/Grand Parc – Bordeaux, France

The overall prices of this city are very cheap, but you have to be careful where you book your rooms since they can be very low quality. The best places to get food are at street carts and the local restaurants.

22. Delhi, India: $21.54/Day

Flickr/Ville Miettinen

Another massive city, it can be explored for relatively cheap if you plan ahead. You can get into Humayaun’s Tomb for only four dollars and the Taj Mahal for a little over twelve.

23. Beijing, China: $28.41/Day

Flickr/Gordon McMullan

Planning ahead to figure out where you want to stay and which attractions you want to go to is the best method to travel here, since they can get rather expensive if you’re not careful. One great place to go is the Forbidden city which only costs ten dollars!

24. Hanoi, Vietnam: $15.79/Day

Flickr/Yen H Nguyen

One of the cheapest cities on this list, Hanoi is the capital of Vietnam. You can explore the Hoa Lo Prison where many people, including John McCain, served time in, for less than a dollar.

25. Saigon, Vietnam $18.16/Day

Flickr/Tim Lam

Also known as Ho Chi Minh City, it’s another extremely cheap city in Vietnam. You can take a one hour cyclo ride for only two or three dollars and find food and alcohol for less than five dollars.

26. Luang Prabang, Laos: $21.65/Day

Flickr/Attila Terbócs

You can find some great guesthouses around the city as well as many different types of hotels for you to choose from, depending on how much luxury you want on your trip. There are also many great and cheap restaurants in the city that you can enjoy.

27. Sarajevo, Bosnia and Herzegovina: $28.48/Day

Flickr/jaime.silva

The European city is very cheap and is trying to get more tourists after recovering the the mid-90s wars, which makes it a great place to find cheap food and accommodation. You can eat three meals here for as little as ten dollars.

28. Belgrade, Serbia: $27.52/Day

Flickr/Jovan Marković

Like Sarajevo, they are also struggling to bring in tourists. You can find hotels and hostels for a good mix of comfort and price. Attractions and food are also very cheap.

29. Bucharest, Romania: $24.24/Day

Flickr/Gaspar Serrano

This is the next big destination on my travel bucket list because of the prices. You can explore the village museum for only three dollars and even less if you’re a student. The Parliament Palace (the second largest building in the world) is less than eight dollars and that even includes a tour.

30. Jakarta, Indonesia: $25.25/Day

Flickr/kaybee07

Jakarta is a massive city that is known for being hot and humid, but the prices are excellent. Food and attractions are only a few dollars and the hotels are inexpensive as well.

Now that you know about all of these amazing places, how about checking out my other article to learn how you can travel them for even less? I wrote about some of my favorite budget travel tips and you can find that article here:40 Budget Travel Tips That Every Wanderlust Should Know.

Featured photo credit: kaybee07 via flickr.com