It’s no secret that the economy has been down lately. Now, more than ever before, people are finding side-jobs to make a few extra bucks. This not only includes people with full time jobs, but people who typically don’t have jobs, like house wives and college students. In any case, there are a number of great side-jobs that you can find to make a few extra bucks. Some of them are even fun. Without further delay, let’s get started.

1. Blogging

As I live and breathe, I can attest to this one personally. Blogging is a popular and often enjoyable side job that can help generate a few extra bucks. Typically, you won’t make all that much money unless you’re truly prolific as a writer. However, you can still make some decent money.

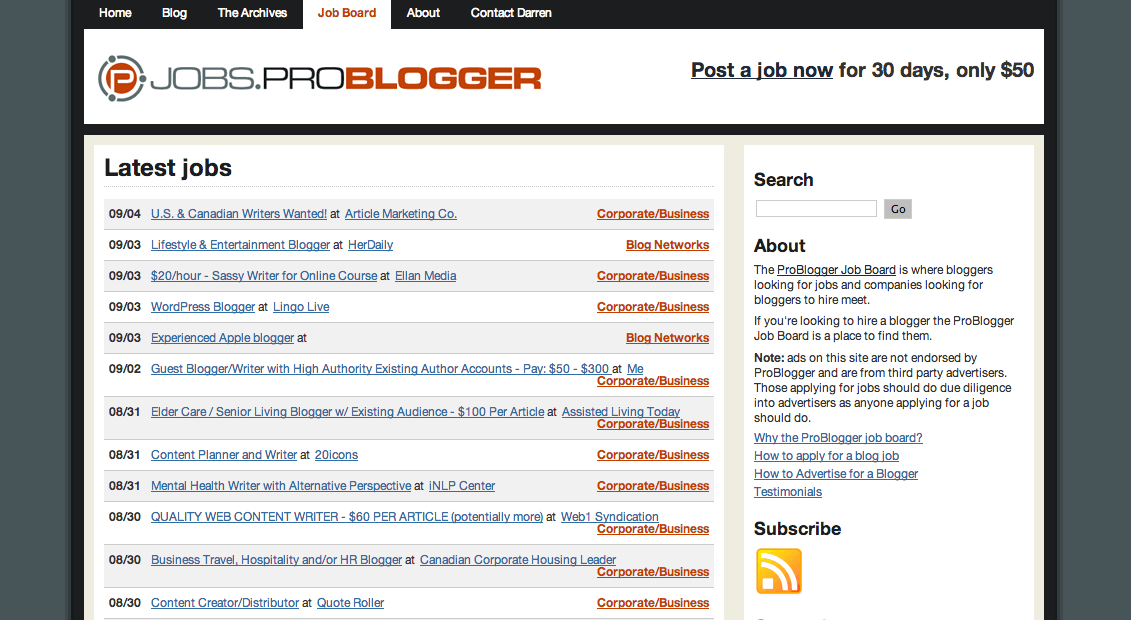

There aren’t a lot of sites to find a good blogging job. We’ve found problogger.net to be an excellent source of legitimate blogging jobs. Of course, if you can’t find one there, Google is always your friend. Once you find a blog to work for, you can start writing immediately. This is great if you happen to be knowledgeable in a field and even better if you love to write.

2. Pet Sitting and Baby Sitting Side-jobs

We included both of these at once because they are essentially the same job. As any parent or pet owner will tell you, there are some days where an absence of a child or pet is a welcome reprise. In most cases, people are willing to pay for that reprise. Most people who try these sorts of jobs are teenagers. That’s just fine, but this job can also be done by adults. Money is money no matter how you earn it.

This can be a great opportunity for someone like the stay-at-home mom. You already have a kid or two at home, why not take on one or two more for a few hours and make some money out of it? The same thing goes for pet sitting. If you’re home pretty often and have the time to keep an eye on a pet, find someone to pay you for it. That’s what makes this one of the best side-jobs.

3. Yard Work

Like pet sitting and baby sitting, most people who search for this type of work are teenagers looking for a few bucks. However, this can be a lucrative opportunity for adults with some spare time on their hands. Mowing lawns, weed-whacking, watering, and other yard chores can be a challenge for some people. Your targets are the elderly, the lazy, and people who lead busy lives. When I was younger, I lived with a guy who mowed two lawns a day for several days a week. He lived almost exclusively on side-jobs.

In most cases, you can do a yard in an hour and most people will pay you between $15-$20 per lawn. If you can set yourself up with a lawn five days a week, you can make $400 or more every month. Some neighborhoods with rich people and larger lawns will pay a lot more too. As far as side-jobs go, this one is pretty great.

4. Tutoring

Everyone has something they can teach. What makes that fact great is that everyone has something they need to learn. Usually, it’s pretty easy to find someone who will pay you to tutor them in something. When people hear about tutoring, they assume that subjects like Math or English are involved. This is not true. People will pay for music tutoring, school tutoring, and if you search long enough, tutoring in all kinds of other subjects. This is definitely one of the most varied side-jobs out there.

Tutoring can be a great way to both meet people and make money. Many tutors can charge reasonable hourly rates and only require a few hours a week. If you can take on multiple students, you can have yourself a relatively lucrative side-job. As an added bonus, you also get the warm feeling that comes from helping people. That’s a win-win.

5. Bartender or Server

One of the greatest things about the service industry is the flexible hours, and that is what makes bar-tending and serving great side-jobs. In most cases, you can find a place that will let you work in the mornings or evenings if you have to. With bar-tending, you’ll likely end up on late night shifts. However, there is great potential to make some good money at these jobs.

As you can imagine, the people who make the most in these side-jobs are people who work in the evenings and on weekends. If that’s the time frame you have available, then this could be the job for you. You may even enjoy this work if you’re a social person. When I was in my late teens, I worked at a restaurant called Hoggie’s. On one Friday night, I once hauled in over $200 in tips in 5 hours. That’s $40 per hour.

6. Donate Bodily Fluids

Okay, this isn’t technically considered a side-job. However, it can bring in some decent pay depending on which bodily fluids and how often you donate. Many blood and plasma clinics that do pay for donations will pay about $20-$30 per donation and allow you to come in up to twice a week. So there is an earning potential of anywhere from $20 to $240 per month just to sit in a chair and give your blood away.

Sperm and egg donations can garner even more. In many cases, sperm donations can earn anywhere from $20 to $500 per donation. It’s arguably one of the better ways to spend an afternoon. For women, egg donation is possible, although the process is a more complicated. The money is better though, as egg donations can garner thousands of dollars.

7. Part-time Airport Shuttle Service

We are now getting into the less common side-jobs on our list. This one is pretty easy to do, but it isn’t one people normally think about. In some airports, you can register your car as an airport shuttle service vehicle. Then you get paid to drive people around. Think of it like taxiing people around, but with your own car and not a taxi cab.

There are some hurtles to pass. You must pay a little more insurance every month and you must spend your shifts driving around airports. If you enjoy driving and don’t mind the crowded nature of airports, this is a great way to make a few extra bucks and meet some interesting people.

8. Part-time side-jobs

So far our list has included side-jobs that you can do yourself. Sometimes, you can just go find a job at a local establishment. Places like fast food restaurants, grocery stores, gas stations, pizza places, and many more often have a need for some part time employees. These usually won’t make you very much money, but we are talking side-jobs here. The extra money is intended to supplement your income, not replace it.

In some cases, part-time jobs can be quite lucrative. Pizza delivery drivers have been known to make decent tips when working on Friday and Saturday nights. Most places pay a little above minimum wage, so you’re not making rock-bottom money. Even if it’s not as much as you want, it may as much as you need. It’s worth a shot if you need the extra cash.

9. Paper Route

Despite the simplicity of the work, this can be one of the most varied side-jobs on the list. It can range from putting papers together for delivery to actually delivering the papers. It can be small, local papers or larger, city-wide newspapers. My girlfriend delivers papers for our local magazine once a week and makes $80 per week. My brother’s friend used to deliver papers for the Columbus Dispatch every day. That paid several hundred a week.

Sometimes you only have to deliver once a week. Other times, you have to do it every day. Usually it only takes a few hours to deliver everything. In most cases, you have to deliver early in the morning or very late at night. However, there are some locations that don’t mind if you deliver in the afternoon or evening. If you can find the right place for you, it’s easy money.

10. Arts and Crafts

Some side-jobs are easier than others, but there are few that are easier than selling your arts and crafts. There are a metric ton of ways to make money doing this. You can make bead necklaces, bracelets, and ankle bracelets. You can press t-shirts. You can even tie-dye clothing, bedding, and other cloth items. You can knit hats, socks, or gloves. The sky is the limit.

In most cases, getting one of these businesses off the ground requires a little investment. After all, you need to buy the beads and wire to make a necklace to sell, right? So it can be difficult to get started if you’re dreadfully short on cash. However, once you have the products made, your customers are everywhere. You can ask your friends and family or random strangers you meet. You can set up shop at local festivals or events to sell your wares. Once again, the sky is the limit and if you’re good at what you do, you can make some easy money doing it.

Wrap-Up

These are some wonderful side-jobs to make a few bucks, but there are also a lot more out there! Pretty much any skill you can think of can be turned into a way to make money. The important part is to not stress yourself out about it. These are easy ways to make money, but they aren’t always easy to find or start. Make sure you do your due diligence and find what’s right for you. What’s the point of having side-jobs if you hate them? Take your time, find something you like, and you’ll find something rewarding that you can do for years.