If you need to make money quickly, there are several ways that you can do so without becoming overwhelmed or stressed. First, you need to ask yourself just how quickly you need it. Do you need it today to pay a bill or do you have a few weeks? Do you have to have the cash in your hand or can you wait a month to send an invoice? Asking yourself these important questions can help you to decide exactly what you need to do to make this side cash happen. If you need ideas, please check out the examples below, which are broken down by category.

Extremely Fast

If you need money today, there are a few ways that you can get it. First, head to Facebook and ask if any of your friends need a babysitter for that night. Make sure that you describe why you would be a good babysitter, including any previous experience you may have had working with children and ideas you have for making the night fun for them.

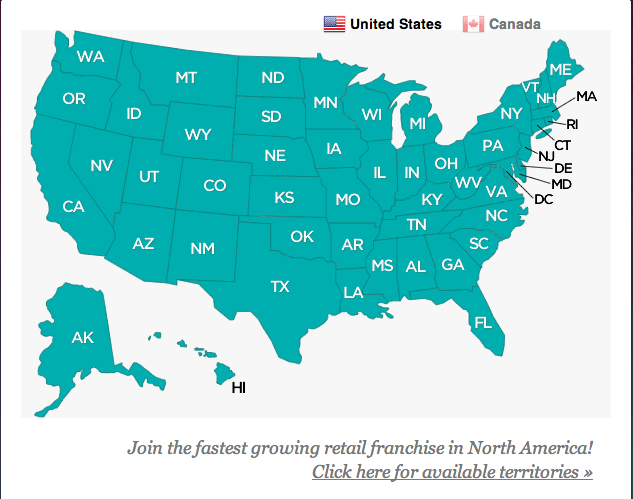

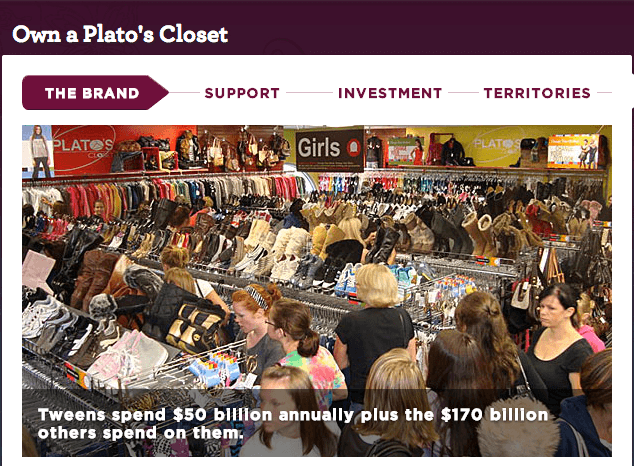

While you are waiting for someone to respond, head to your closet and see what clothes you no longer wear. Take these clothes to a store like Plato’s Closet, where they will sort through items and give you cash on the spot. Remember, many secondhand stores also take shoes, purses, and jewelry. When you bring your items, make sure they are clean and organized. If you go to Plato’s closet and dump out wrinkly clothes on the counter, they will not be impressed. If you go in there with ironed clothes that are all sitting neatly on hangers, you will have a much better chance of selling them.

If that doesn’t work, remember that you can head to a Pawn Shop. Pawn Shops can give you loans on items you love or cash for items you no longer want. Remember to read the contract of any Pawn Shop you do business with. For example, most of them will claim ownership of your item if you don’t pay the loan back in a few days. If you have a unique item and they aren’t sure what it is, be sure to describe it to them in detail so that you can get the best offer possible.

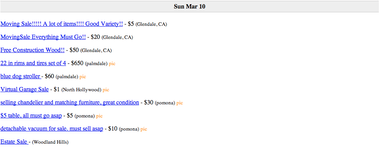

Lastly, if you have a few pieces of furniture you no longer want, you can list them on Craigslist. If it’s a desirable item, it’s very likely that someone will come pick it up the same day you list it and give you cash for it. Make sure to take pictures of your item for your ad in a bright, sunny room. Stand back far from the item and zoom in. This is better than trying to get a detail shot. You don’t need a fancy camera to sell items quickly. You just need a simple camera and a lot of sunlight to get the job done.

A Few Days

If you have a few days before a large bill is due, you’re in good shape. One of the best things you can do to make money is hold a garage sale. I try to hold a garage sale once a year, and I consistently make $200-$500 every time I host one.

If you’re going to have a garage sale, the only way for it to be successful is to be organized. Make sure you sort through your items carefully and label them with prices. Many people are too bashful to ask what the price of an item is, so if they are unsure, they might walk away. Also, check to see that everything you sell is clean, washed, and tidy. Clothes that are pressed and hung up on a line will sell much faster than a pile of clothes in a box. You should also advertise your sale with big, bright signs that have large letters and are easy to read. Also, place an ad on Craigslist.com with great pictures of your products. This will act as a “sneak peek” to those who love frequenting garage sales.

Another way to make money if you only have a few days is to sell items on eBay. You can typically set items to sell in just a few days, and you can have the money in your PayPal account instantly. If you are going to sell on eBay, you have to have excellent pictures. To achieve this, make sure to take photos of your items in a place where they have enough light. Make sure pictures aren’t blurry, and write as much detail as possible in the item description in clear, easy to understand English.

A Few Weeks

If you have a few weeks to spare, and you want to try to make some side income, you definitely have the time to develop a side business. All you need to do is identify a talent that you have. This could mean refinishing furniture, freelance writing, mowing the lawn, building websites, helping a business with their social media, editing videos, or anything else you can think of. These jobs might take a few weeks to create and promote, but once you do, you could easily make thousands of dollars a year.

Some great websites to look into for promoting your side business are Fiverr.com, Upwork, and Odesk.com. Remember that when you set up profiles for these websites, you are representing your company and your brand. Describe your services in great detail. Make sure that you have no grammatical errors in the description. It’s also wise to include a portfolio, links to your work, or recommendations from others. Additionally, remember that if you choose to build up a side gig business, reputation is everything. Whether you are working for a close friend or a stranger online, make sure that you always produce top quality work so that it can lead to referrals down the line.

All you need for this money making tactic to work is a little bit of time, patience, and a very strong work ethic.

Ultimately, you can see that making money quickly is not as hard as you think. Once you know your time frame and exactly how much extra money you need to make, you can set goals and work your hardest to achieve them.

Do you know of any other ways to make money quickly? Have you ever tried one of the tactics above?