Spring is coming and with it comes spring cleaning! This is the ideal time to make some side cash, because you can gather everything you don’t use and sell it in a garage sale.

If you are really serious about making money from your garage sale, there are several tips and techniques that can help you get there, and we’ve listed each and every one of them below. Follow these tips, and you’ll be well on your way to having a few hundred dollars in your pocket.

Give Yourself Time

There’s no way that you can have a successful garage sale if you are rushed and stressed. Setting up a sale takes time and effort. For example, today would be a great time to start if you want to have a sale a month or two from now.

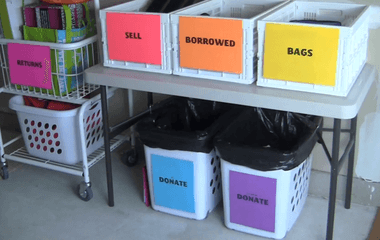

Go through every room in your house one by one—spend a weekend on each if you need to. Grab a big box and a garbage bag to bring with you when you clean; everything that’s trash goes in the garbage bag, and everything that’s for sale goes in the box.

Store your boxes of items from each room in the same place.

Organize and Clean

Now that you have all your boxes in the same place, it’s time to organize.

Empty the boxes and pack like items together. All kids clothes go in one box, while all toys go in another. Wipe down items with mild soap and water to ensure they are clean and look their best.

Price Everything

Most people will not want to ask the price of something, so if it’s not clearly listed, they might walk away. In order to make sure that you earn the most money possible, be sure to put a price tag on every item.

If you have a lot of smaller pieces, you can put them all in one box with a clearly marked label. For example, you can say “All Books $1” or “All clothing items $5 each.” This saves you time and lets the buyer know what you are expecting.

Have Your Sale On a Saturday

Garage sale enthusiasts plan their Saturday mornings around them, so, it’s best to choose a Saturday in the spring so that you have a better chance of selling everything. Start your sale very early in the morning, but be sure to actually set it up even earlier than that. My most successful garage sale officially started at 8, but I sat outside early and sold almost 30 items before that time even rolled around!

Advertise On Multiple Channels

With the Internet age, it’s important to advertise your sale in multiple ways.

First, you should make signs to put around your neighborhood. Don’t choose small signs with small writing, since no-one can see them! The letters on your signs should be as big as a ruler: any smaller, and cars passing by won’t be able to read what you have on them!

Also, be sure to put an ad on www.Craigslist.com with a picture of your big-ticket items. This could include your sofa, or a stack of hardback books. Ads without photos are easy to ignore, and most people won’t even bother to look at them, so make sure that you have a big, bright picture that’s enticing to buyers. You can also post a reminder ad on the morning of saying, “Sale going on right now!”

Pro Tip: Don’t forget that old-school methods like putting an ad in your local newspaper are also an effective way to get buyers to come to your house.

Accept Low Offers

People go to garage sales to get quality items for low prices. They will bargain with you, and you should definitely haggle with them. It’s hard to pinpoint exactly how low you should go, but just remember that the entire goal of the garage sale is to clean out your house and make money. So, if someone offers you $10 for a side table that you spent $60 on, that’s okay—remind yourself that you didn’t want it anyway, which is why it’s out on the curb. You’d be surprised at how much you’ll make when these little items add up, so be generous and accept low offers.

Only Take Cash

This seems like a no-brainer, but it’s an easy one to forget. Many people might try to pay you with a check or offer to pay you online but don’t accept it! Although most people are likely genuine, you don’t want to be scammed. Cash in hand is the best and the only approach. Even if people have to drive to the bank to withdraw cash from the ATM, go ahead and let them do so for your own security.

Donate the Rest

When your garage sale is over, pack up the leftover items and donate them to a local thrift store. Be sure to pick up a receipt for tax purposes so that you make a little extra money at the end.

We hope that these tips help you to have a successful garage sale this year! Good luck!