Freelance work may be one of the more difficult ways to make a living out there. Between tax headaches, feast-and-famine cycles, and sometimes having to undertake tasks that either don’t pay well enough or are just plain uninteresting, freelancing can often seem like an unnecessarily tough way to make a living. However, there are some measures you can take to be successful and still work on the schedule that suits your lifestyle and income needs.

1. Know the value of your work.

This crucial first step is where many freelancers make a mistake that can haunt them for months or even years. Sit down and make an honest evaluation of your skills and what you bring that makes you different, better, or more capable than others. Once you have done this, look into what others are charging for comparable services. If you can do better than they can for less, this will give you a good starting point to set your rates. Your clients will want to negotiate, and if the level of work makes it worthwhile, then by all means, do so. Otherwise, don’t be afraid to stick to your guns. Remember, you’re trying to create a mutually beneficial situation. That won’t happen if the client has final control of your payout.

2. Treat your job like a job.

Freelancing seems like a fun way to make money in the short term. The problem is, especially if you are working on the Internet, you will have to structure your time so you can best serve your clients. When your clients are largely in the same country as you, this is one thing. However, especially when you are working from a different continent, you may need to be willing to make some concessions in your schedule. This will make it more likely you will get more work, because your clients will appreciate the extra effort you put in to accommodate them.

3. Manage your time wisely.

Procrastination is the enemy when it comes to working as a freelancer. Many clients schedule tasks for the quickest possible turnaround. Do not be afraid to tell a client you need more time to complete a project if the restrictions are unreasonable or you’ve run into a snag, but it is vitally important that you don’t abuse this. Most clients are willing to be understanding if they ask for something that is simply impossible, but if you blow off work for the beach, word will get around.

4. Be clear on the requirements.

If there are any vagaries in the client’s requirements, don’t be afraid to seek clarification. For example, a client who agrees to pay $30 per 1,500-word article and orders a 15,000-word article but keeps the price the same was either not paying attention or hoping to get the maximum work for minimum payout. If possible, have a contract in place with the client specifying your rates for different lengths or types of work. Remember to allow a little wiggle room for extra research, time, or effort on your part.

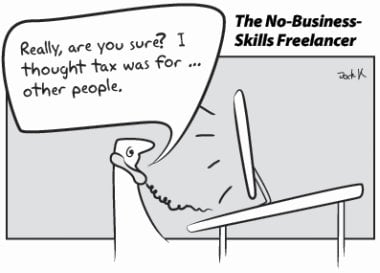

5. Don’t forget about taxes.

Tax laws and requirements vary from jurisdiction to jurisdiction, but one thing that’s universal: You will have to pay them. Be sure to set aside an appropriate percentage of your income monthly, quarterly, or annually. It is generally better to pay monthly and overpay, at least under the US tax code, to avoid having to pay a larger lump sum at the end of the fiscal year. Independent contractors usually start at 30% for taxes, so being able to set aside 40-50% per pay period is ideal to avoid penalties and ensure a return at the end of the year.

6. Sell yourself.

Think of taking on new clients as a job interview and emphasize the talents you have that make you a better fit for a client’s needs. You are trying to market yourself to the client as the solution to their problems. At the same time, you need to make sure the people you are working for are going to be a good fit for you as well. This will help avoid friction and create a more harmonious working relationship. Be confident and clear about what you can deliver, as well as what client support you will need to be as productive as possible. By setting clear expectations, you can avoid a lot of problems before they ever have the chance to become problems.

7. Network, network, network.

Being a freelancer can be hard work. Bearing this in mind, networking is critical to your success. Seek out new opportunities and ask current clients for references. Sites such as LinkedIn and Google+ are good for making connections. Also, don’t be afraid to ask for referrals or to renew a contract when the work is done. This may sound gauche, but there’s nothing wrong with “overhearing” someone at a restaurant, bar, or on the street mentioning they need exactly what you do…and stepping in to offer your services! The worst they can say is no, and you’ve just gained a new opportunity to prove yourself.

8. Be a pack rat.

Always hold on to copies of anything you do for a client, invoices you generate, payment records, contracts, receipts, and communications. Not only are these helpful for generating a profile of your capabilities, but it also makes tax and other record-keeping simple and efficient. Having a good organizational system that allows for at-a-glance order tracking and monitoring is imperative to keeping appropriate records. It’s also great for task management! Hold onto these for no less than three years after the contract is terminated, just so you can reference them if necessary. And ALWAYS keep a hard copy, because one virus and your great organization is trashed. At a minimum, you should keep copies of your records on your hard drive, in a filing cabinet, on a detachable stick or other drive, and it’s never a bad idea to email yourself copies of everything at least monthly. This ensures you have the information in a number of areas at the same time, so a catastrophic loss here won’t affect your data there.

By following these 8 simple steps, you can maximize your freelance work return in no time!