Have you ever experienced this scenario? You’re talking to a friend or colleague about the flights you’ve just booked to some exotic destination for your next vacation, only for them to turn around and tell you that they’ve booked flights to the same destination for hundreds of dollars less! It can be infuriating; just think of all the things you could spend that money on when you arrive at your destination.

This doesn’t have to happen to you ever again! With the tips below you can ensure that you always get the cheapest flights in any circumstance.

1. The early bird saves money.

It’s not really a secret but, as with most things, the earlier you book, the more you can save. The magic number is 60. Prices rise on average about 60 days before the departure date. But don’t book too early. FareCompare research shows that airlines don’t release their cheap seats until about four months out.

2. Being flexible pays off.

If you’re not picky about the exact date that you fly, you could slash a huge amount off your fare. Mid-week flights are less popular than weekends, and Wednesday is historically the cheapest day to fly. Catching the red-eye will also save you a packet. Consider traveling to destinations in their off-peak seasons; his is will vary by location, but a quick Google search usually reveals the answer. Not only will everything be cheaper, but you will get to experience a different side to your destination that most people never see.

3. Size matters.

The nearest airport to you may not be the best one to fly from if you’re looking to save some extra spending money. Bigger and busier airports often have cheaper flights, as there is more competition between airlines and a higher frequency of flights. Compare the price of taking a cheap domestic flight to a bigger airport versus flying straight from your local airport. In my case I was able to fly to another domestic airport for $59, and the international leg was over $200 cheaper from there!

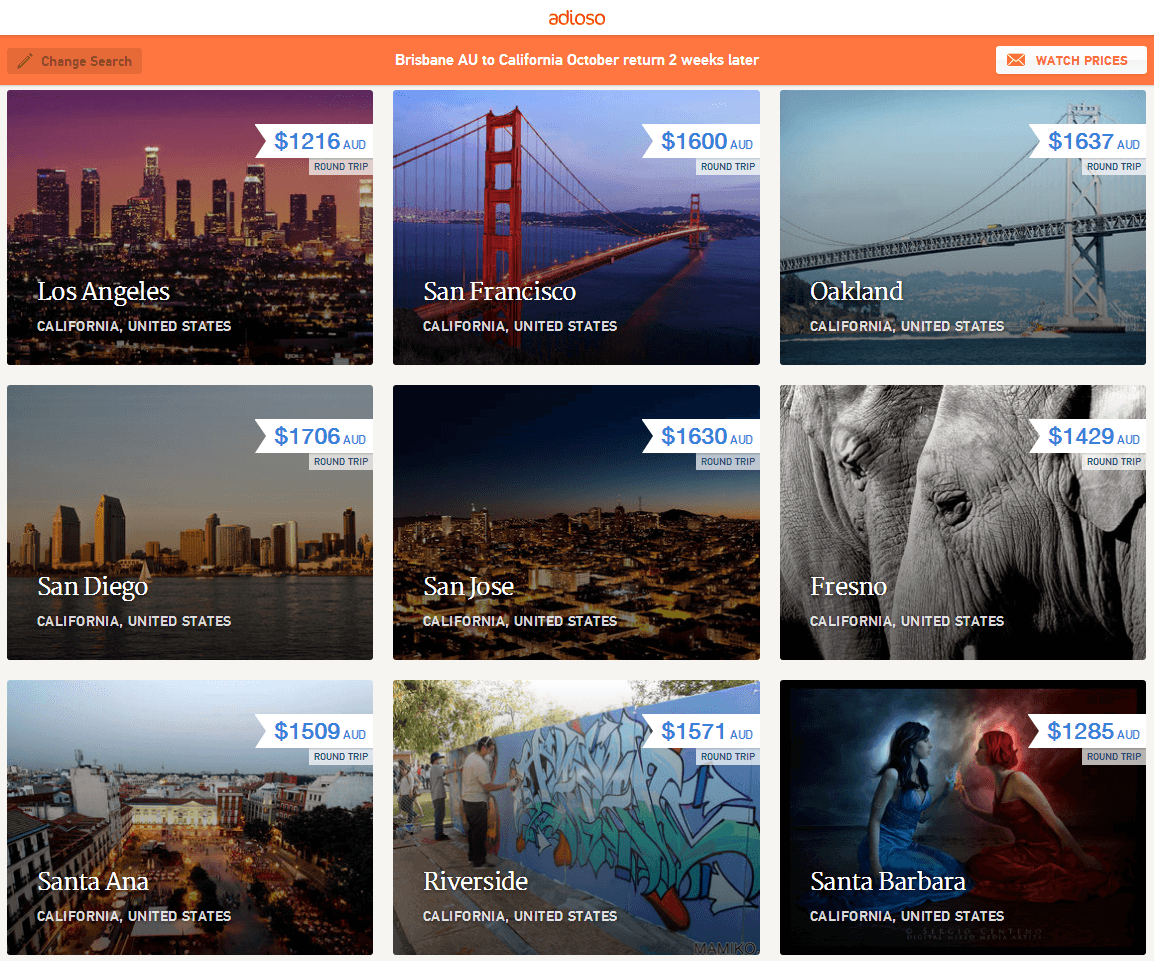

Try using a website like Adioso to compare the price of flying into different airports near your destination. As you can see below, it was $400 cheaper for me to fly into LA instead of San Francisco–something that can make a huge difference to your hip pocket (plus maybe you could fly to LA and then take an awesome road trip to San Francisco in a rental car).

4. Short trip? Save even more.

Most of the budget airlines charge a low base rate, and then charge for add-ons like checked luggage. If you don’t need to take much with you, you could save quite a bit by only taking carry-on luggage (this is usually included in the cost of all tickets).

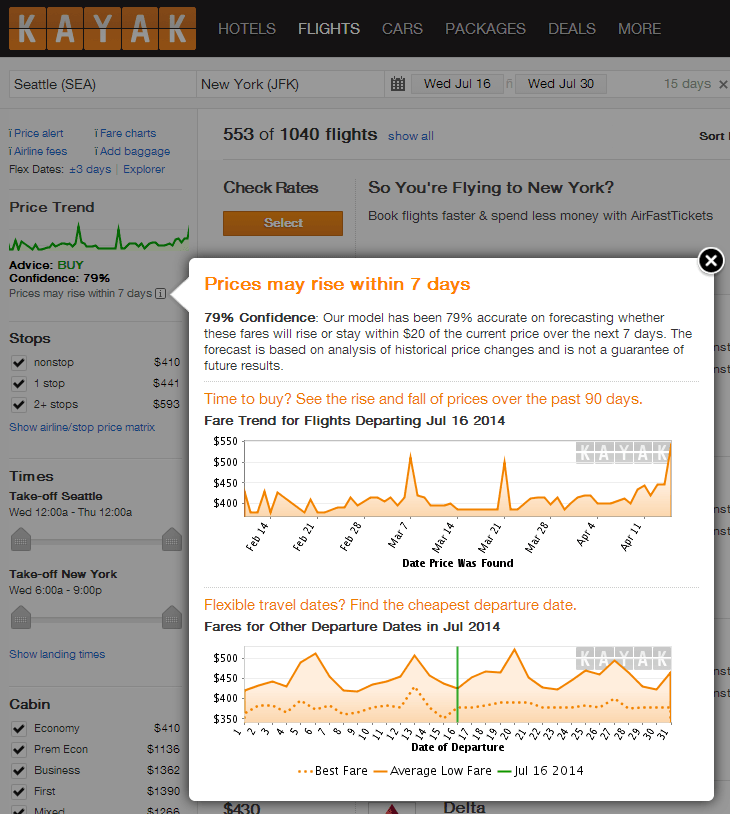

5. Take advantage of historical price data.

Using some great historical pricing tools like Kayak’s Price Forecast, you can work out whether the ticket price for your flight is more likely to rise or fall. This tool will show you whether to book immediately or if you’re better off waiting.

6. Compare the comparisons.

All comparison websites are not equal. Some have access to airlines and fares that others don’t, and booking fees can vary greatly between them. Just because two sites compare flights from the same airline doesn’t mean that the prices will be the same! From experience, there’s no one site that’s better than any other. The one that has the cheapest flight this time may not be next time, so it pays to compare at least two of them.

Some comparison sites to consider:

- CheapOair.com

- Skyscanner

- CheapFlights

- Momondo

- ITA Matrix (by Google)

- Adioso

- Hipmunk

7. Go direct.

Just as some comparison sites get access to fares that others don’t, there are many special fares that the airlines save for their own customers. I’ve saved hundreds of dollars by booking with the airline direct; signing up to their mailing lists is an easy way to be notified of specials as they come up. Be aware–the really cheap ones are usually limited and go quickly, so be prepared to book as soon as you see them!

8. Remove pre-selected items.

Websites often try to make a few extra dollars by pre-selecting certain items and hoping that you don’t notice. Seat selection, various insurances, “green” options are some of the usual culprits and can add $20 or more to your ticket if you don’t un-tick the boxes.

photo credit: Doug Waldron9. Avoid booking fees.

Booking fees are fairly standard on most websites (even the ones that say no booking fees will often build them into the price) but you can sometimes avoid paying any booking fees depending on the payment method you use. Payment by direct deposit/bank transfer, PayPal or Poli are often cheaper or free.

10. Cheap flights can become expensive.

When looking at budget carriers, make sure you add in all the items you need before comparing the price. Flights that are a little more expensive but include things like baggage or meals may actually end up cheaper by the time you add them on to a budget flight. Also make sure you’re aware of how inflexible some cheap flights can be. If your plans change, or something comes up and you can’t make it, the change fee can often be as expensive as the actual tickets. If you’ve got good travel insurance, this may not be an issue.

11. Call in an expert.

FlightFox is a great service that will connect you with travel experts to help find the cheapest flights for your needs. They’ll do the hard work and then tell you how to book the flights, or they can arrange to do it for you. At just $49 it can quickly pay for itself many times over, especially for international or complicated trips (multi-stops, etc).

12. Use your points.

Perhaps an obvious one, but if you have frequent flyer points, you can use these towards your flight cost, or to upgrade to a better seat. Many airlines have partnerships with credit card providers where you can earn frequent flyer points for every dollar you spend. It’s a great way to earn points for things you would be buying anyway (groceries, gas, etc.) as long as you pay it off on time.

13. Get your money back.

Have you ever been bumped off a flight? Did you know that you may actually be eligible for some compensation from the airline? New website AirHelp can advise you of any potential compensation and help you apply for it. You may even be eligible for a refund if your ticket price drops after you purchase! Another website, Yapta, will track your flight details and let you know if it drops after you purchase.

There you have it! Want to save even MORE on your trip? Check out our tips on how to get the best hotel deals, and car rental hacks.

Do you have any other tips? Share them with our readers in the comments below!

Featured photo credit: Traffic/Don McCullough via flickr.com