There are plenty of great opportunities for self-improvement and indulging in small pleasures in this world, but lack of time and/or money often get in the way and keep us from moving straight forward and jumping on these opportunities. It can be tough to reduce spending and save some money if you don’t have a clue where your money is going and how much of it slips through the cracks. At the same time you can’t really efficiently manage your time if you are not productive and don’t have a defined schedule, which in turn limits your ability to spend more time learning new skills or getting enough rest.

Well, the good news is that the smartphone you have is good for more than just chatting with friends, browsing social media and playing games when you are bored – which you shouldn’t be doing in the first place if you are concerned with productivity and time management. Here is a list of some excellent apps that will help you save time and money during the course of your daily life.

1. HomeBudget with Sync

Effective budgeting should be your top priority, and the HomeBudget with Sync app has everything you will need to keep track of your spending and find that perfect balance between income and expenses. The app features a user-friendly design that is both very visually appealing and easy to navigate. Apart from standard functions like the ability to store a photo of a receipt and view handy charts, you can also access all the budget information in the cloud from different devices, allowing multiple people to effectively keep track of a collective budget.

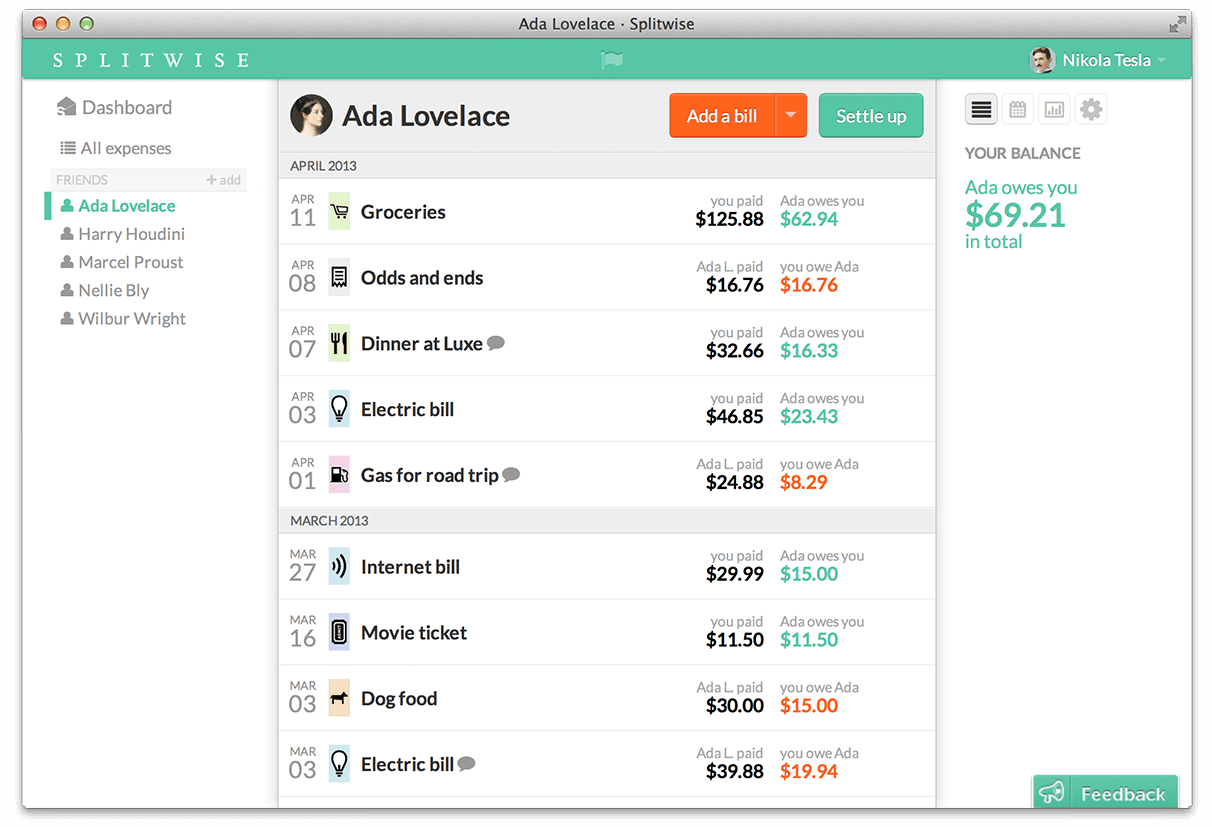

2. Splitwise

One of the worst things for a well-thought out budget is when you live with or frequently go out to eat and drink with a bunch of different people who don’t share the same budget. It can be very easy for one person to end up constantly having to pay more and lose out on transactions like paying the bills or buying rounds. With the Splitwise app you can effectively split up bills and keep track of who has paid for what, without getting into arguments or playing the guessing game.

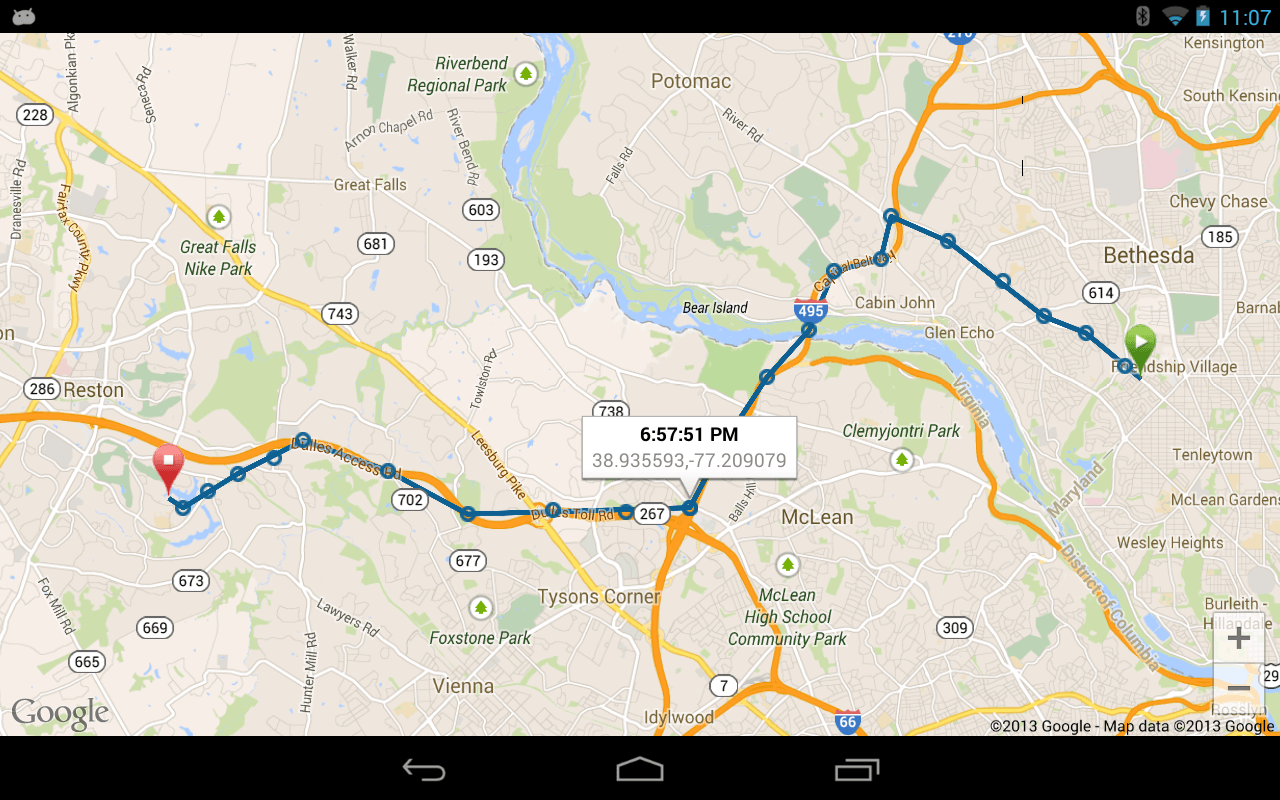

3. TripLog

Budgeting home expenses is all well and good, but what about when you hit the road? TripLog is an automatic mileage-tracking app that enables you to track your mileage, expenses and show your routes on a map. When your mobile device is plugged in the all automatically starts tracking once you go over 5mph. It is a great tool for those who drive a company car and need to write reports, and a good way to see which routes are more effective and give you a look into how much you spend during your daily commute, so you can work out how to save a lot of time and money.

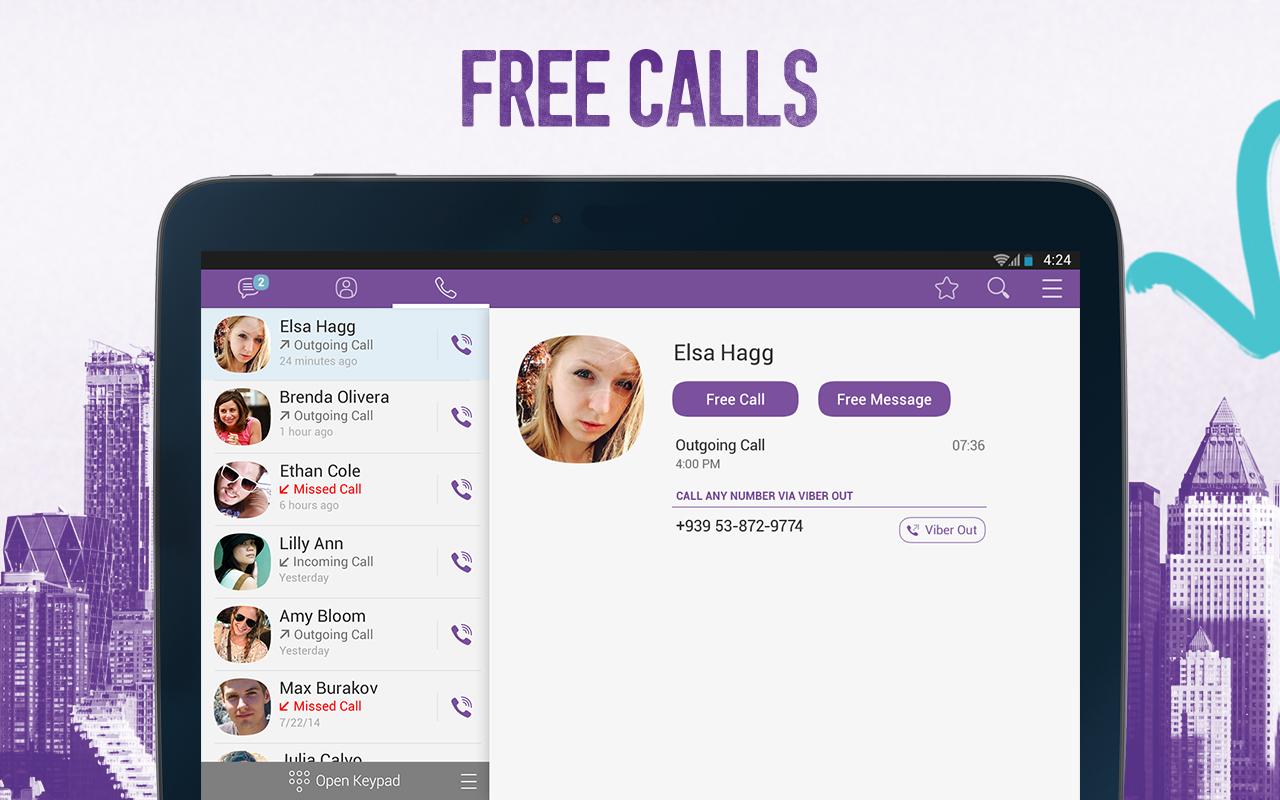

4. Viber

Why spend more money every month and lock yourself into prolonged cell phone contract, when you can talk all you want and send as many messages as you want for free with Viber? Even better, Viber is now available for desktops as well. You will be surprised at just how much you can save on your phone bills once you switch over, especially if you are a very social little birdie and use your phone quite a bit during the day.

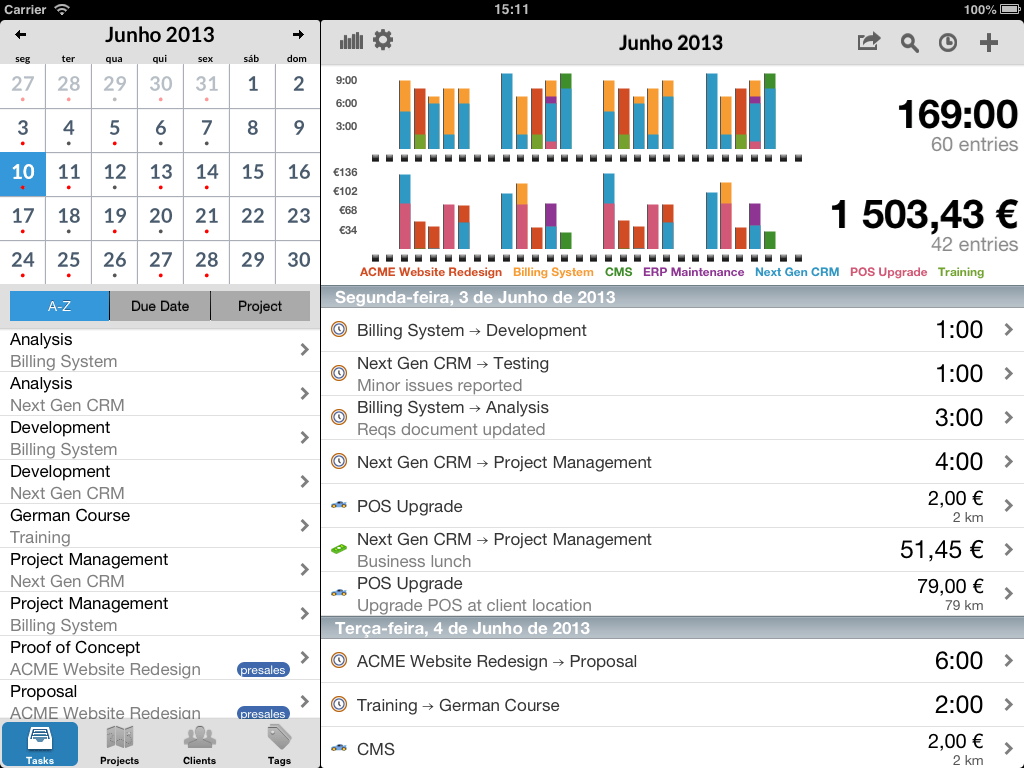

5. CubeAnywhere

Aimed at the more business oriented crowd – be they freelancers, team managers or entrepreneurs – CubeAnywhere gives you the ability to easily keep track of different projects and costs involved with useful charts. You can access the information from anywhere in the world and from any device, as the information is stored in the cloud and the app is integrated with Google’s services, like Google Docs.

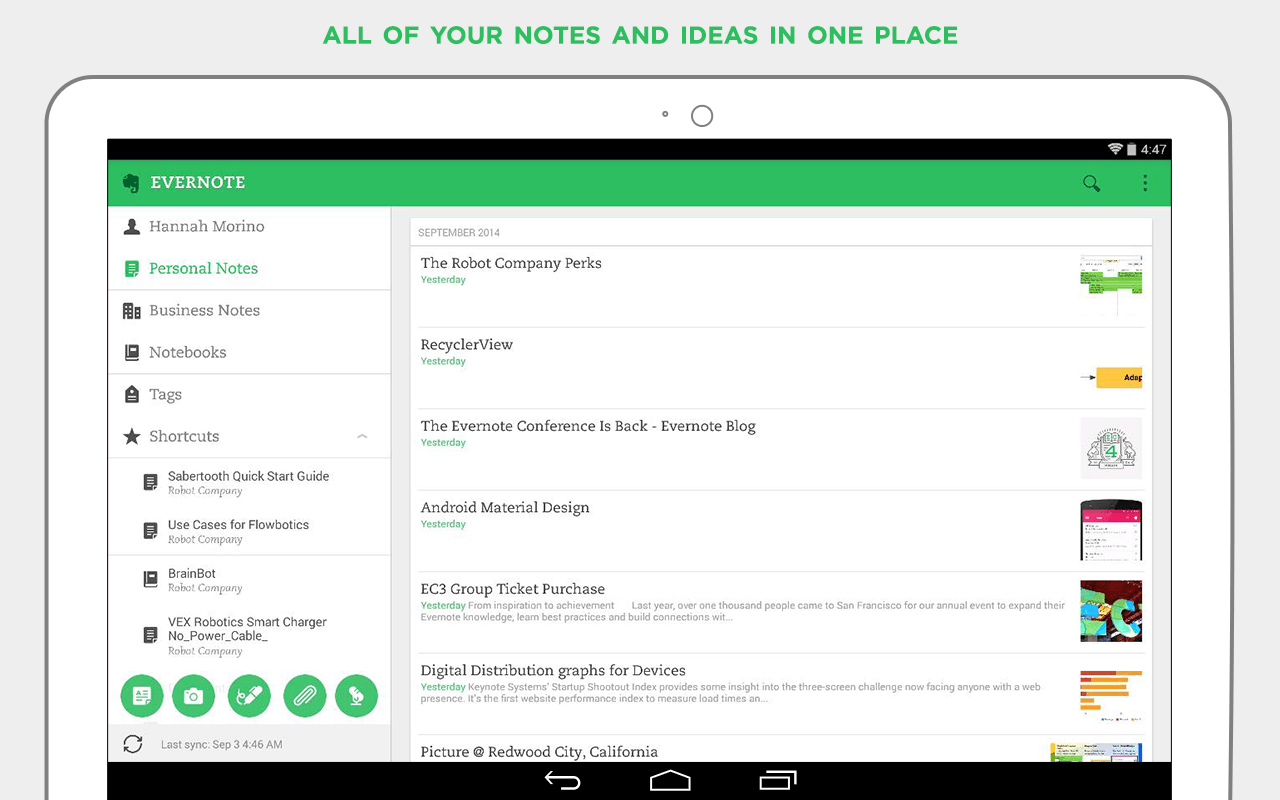

6. EverNote

It’s incredibly easy to forget things or lose track of your obligations, so a good schedule planner should be everyone’s top app. However, EverNote provides a lot more functionality, allowing you to quickly jot down information, take notes when inspiration strikes, and even manage expenses. Not only will you stick to your schedule, but you will be able to write down ideas when you feel most creative and productive, no matter where you are. It will probably be the one app on your phone that you end up using the most.

7. Any.do

If you are looking for a more minimalist streamlined approach for organizing your tasks, for instance checking off items on the list with a quick finger swipe, then Any.do is the right choice for you. All your to-do lists, projects and tasks can be shared with your co-workers, roommates or family members, as well as accessed from any device, so you can all stay on top of things wherever you are. You can even turn missed calls into reminders and put a widget on your home screen to always stay informed on the tasks that are coming up.

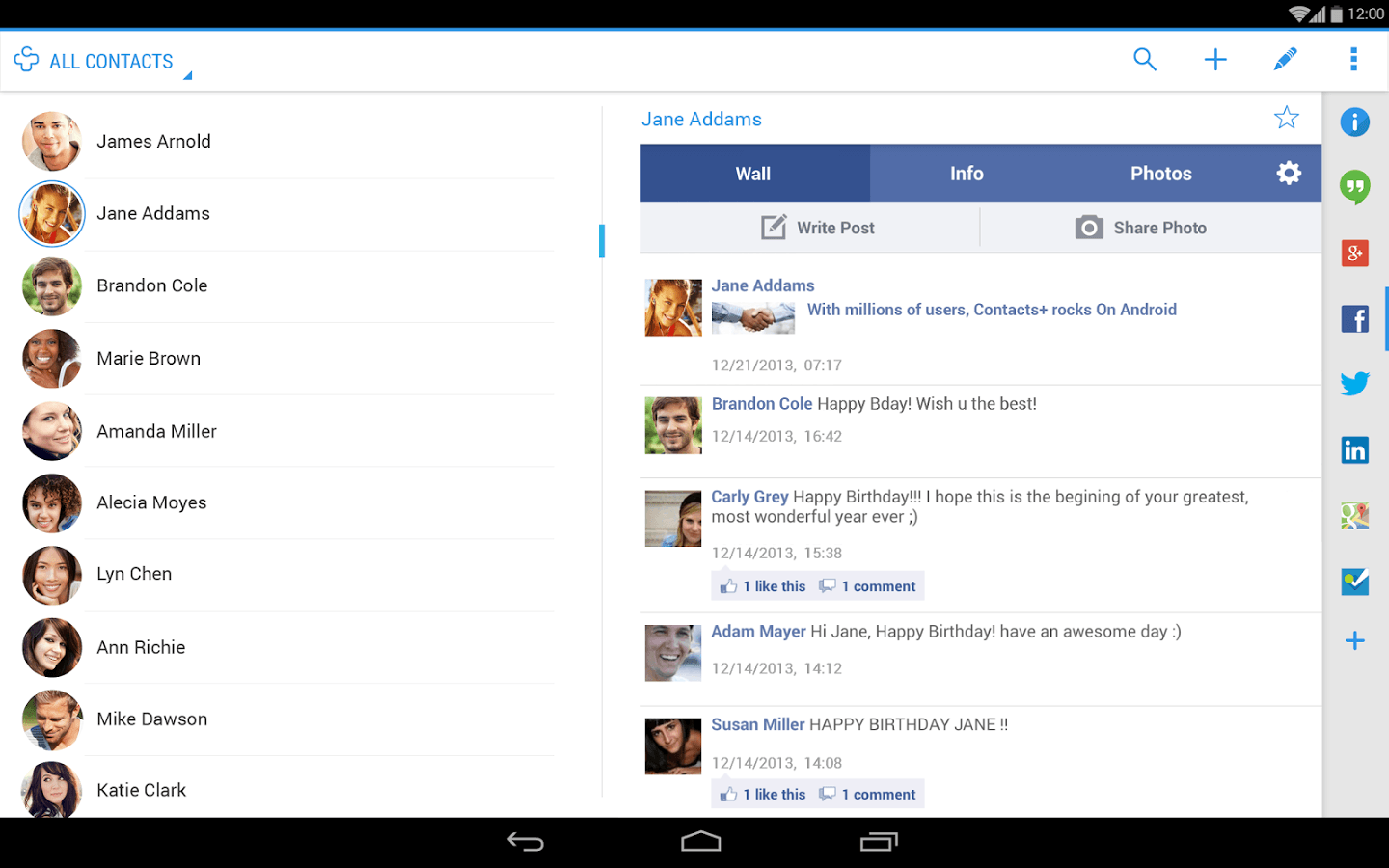

8. Contacts+

A lot of the time you end up mixing up numbers, forgetting who the person you need to call is or just have a very messy contacts list in general, which means it takes time to find and contact the right people. Contacts + allows you to set up a beautifully designed contacts list that can be prioritized by frequency of calls. It is synced with Facebook, Tweeter and the Whatsapp free messaging app, so you can add a current profile picture to every entry and quickly contact them via call, SMS or message them through social media. You can also get birthday reminders.

So, all you busy people out there who are leading a hectic lifestyle and are always strapped for cash or running late, get some of these useful apps and start getting your life in order. With enough time and effort you will be able to become a busy little ant that always stays on top of all tasks, which will lead to you having more free time and wasting less money.