The recent popularity of the ice bucket challenge has spurned a lot of people to be more aware of water. Water from the challenges will evaporate back up in the atmosphere and be returned to the water table in the form of rain eventually and water we use at home is recycled eventually. However, it still costs us a lot of money. Here are some effective ways to save water.

1. Turn off your water when brushing your teeth

People don’t often associate wasting water with brushing your teeth but truthfully you can waste quite a bit of water this way. If you want to know how much, simply put a pot in the sink while you brush your teeth and see how much gets filled. Then multiply that by however many times a day you brush your teeth (usually two to three times). Then add in everyone else in your household. When it’s all added up you realize that you’re wasting a lot of water and that water costs you money. By turning off the faucet when you brush, you can save quite a bit.

2. Take a shower instead of a bath if you’re keeping it short

A bath typically uses around 40 to 50 gallons of water while a 10 minute shower usually breaks about 25. To get those kind of water savings, you’ll need a low flow shower head and to shorten your showers to about 10 minutes but the savings are palpable. You can also put your watering can in the shower while you wait for the water to warm up and use the excess water to water your plants or lawn thus lowering the amount of water you waste.

Part two of this is something you don’t hear very often. If you actually plan on washing yourself for an hour, take a bath. There comes a point where you shower for so long that you go from saving water to wasting water. How long that is depends on how large your tub is, how much water you use in baths, and how much water comes out of your shower head. However, after about 30-45 minutes, there’s really no set up out there where taking a shower is still more efficient. If you’re going to be in there for an hour, take a bath. You’ll actually save water that way.

3. Fix any and all water leaks in your home

A leaky faucet or pipe is literally dripping money all over the place. You can usually see a faucet leaking because it’s right there above the sink or tub. A leaky pipe may be a bit harder to spot and you may have to go rooting around underneath your toilet, bathroom sink, kitchen, sink, etc to make sure they’re not leaking water. A little drip doesn’t seem so bad but when it drips three times a minute, that’s 20 times an hour or 480 times a day. That’s 175,200 drips per year. It adds up quickly doesn’t it?

4. Shower with your partner

If you and your partner shower every day then the two of you shower 60 times a month or 720 times a year total. You can cut that number literally in half by showering together. Given that we know that a 10 minute shower takes 25 gallons of water, you can do the math and it comes out to about 9000 gallons that you save every year. Realistically you’ll probably take a bit longer if you’re sharing but any savings is good savings!

5. Turn your toilet into a low flow toilet

A fun DIY hack for this is to fill up a decent sized water bottle with water and rocks and then drop it into the back of your toilet. It will displace water meaning your toilet requires less water to fill. It’s a cheap thing to do, it doesn’t affect the usefulness of your toilet, and you can get a drastic amount of water savings that way.

6. Don’t flush anything down the toilet that didn’t come from a human body

People will do things like blow their nose and toss the tissue into the toilet and flush it away. That’s insanely wasteful. There are also things you shouldn’t be flushing down the toilet anyway like q-tips and tampons. Unless it’s #1, #2, or something used to clean up after #1 or #2, use the trash can to throw it away. You’ll save 1-2 gallons of water for each time you don’t flush.

7. Figure out a new use for that leftover pasta water

Whenever you have to boil something (eggs, pasta, etc) keep a large container around. When you drain the pasta into the colander (strainer) put the container underneath to catch the water. Use that to water your plants or your yard. This not only gives you a use for the excess water you’d otherwise waste, but also saves you water from your backyard garden hose. That’s a win-win.

8. Wash only full loads of things

You can save a bunch of water by only doing full loads of laundry or full loads in the dishwasher. This is especially true for the dishwasher which uses the same amount of water no matter how many dishes are in it. You can adjust the washer based on load size but chances are that it uses too much water even on smaller loads so you’re probably better off waiting until there is a full load.

9. Put water in the fridge

This actually serves two purposes. The first being that you always have cold water to drink whenever you need it. The second is that you don’t have to turn on the sink faucet and wait for the water to get cold to fill up your glass. A lot of people use gallon jugs leftover from milk or juice (cleaned out of course). You can go all out and get one of those water filter containers like Brita and filter the water as well as store it. It doesn’t have as much water savings as these other things but every little bit helps!

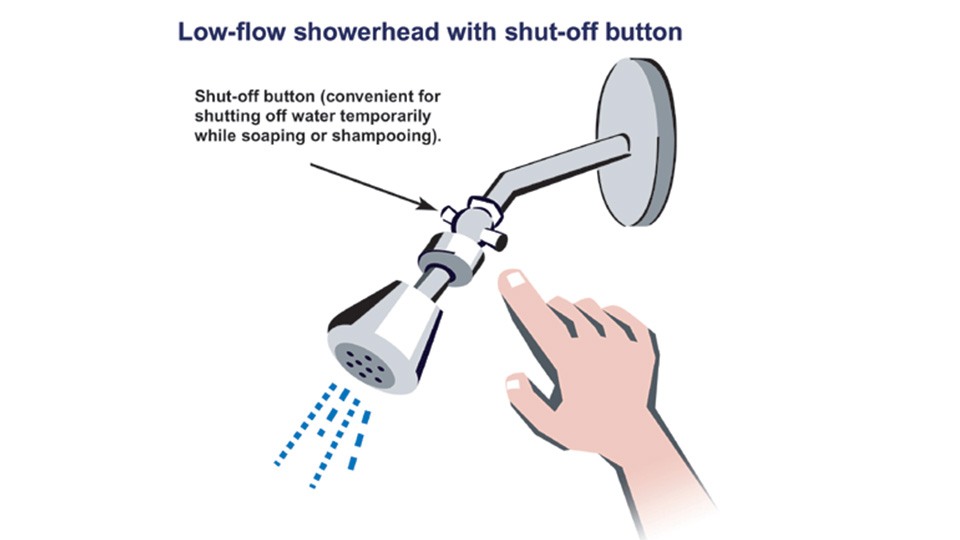

10. Invest in low flow and water efficient alternatives

Things break down which means you’ll eventually need to replace almost everything you own. Next time you get a washer find a water efficient washer that uses less water. You can always get a low-flow shower head because they’re relatively inexpensive anyway. There are also low flow toilets, water efficient dishwashers, and you can even replace your faucets to more water efficient options. Some of it is expensive so we don’t blame you if you want to wait until your appliances break before buying new ones but if you invest and get water efficient things then you’ll start saving water instantly without changing any of your other habits.

At the end of the day, saving water is all about paying attention. Don’t leave water on when it doesn’t need to be on. Don’t flush things that don’t need flushing. By saving water, you’re lowering your impact on the local water table and you’re saving yourself money on your water bill every month!

Featured photo credit: Philly.com via philly.com