PayPal has become somewhat of a standard when it comes to online payments and is very widespread. It’s not that it is the cheapest or even the best online payment option out there, it’s that people have gotten used to it and aren’t really aware of the alternatives. You might be wondering why you shouldn’t just stick with what you know and go for PayPal, after all it’s what nearly everyone uses. The main reasons for looking at alternatives would be competitive pricing and ease of use, although numerous reports have also been made against PayPal’s questionable business practices.

Another point against it is that not everyone from around the world can use it, which cuts you off from several different markets, but some of the other payment systems share this problem, although they run a much tighter ship. Running a successful eCommerce website with plenty of traffic will require a good amount of resources and hard work, so you want to make sure that the customer satisfaction is high and that all transactions go as smoothly as possible. At the same time, you may need an effective way to send and receive money internationally. To accomplish these things, you may want to check these alternative of online payment methods that have proven to be consistent with the quality of their service.

1. Skrill

Formerly known as Moneybookers, Skrill provides you with an online account that is fairly quick to set up and easy to use. You can send money to other users and receive payments, buy items online and they send you a prepaid debit card which you can use for payments stores or ATM withdrawals.

The good

- It’s fast and easy to set up an account

- You can use it anywhere in the world

- Works with a number of major currencies

- Has a reasonable flat fee for transfers (1% and limited to 10 euros max)

- It’s fairly secure

The bad

- Stringent fraud prevention policies can cause problems like freezing accounts

- Poor customer service which makes it difficult to resolve problems quickly

As long as you aren’t one of the few unlucky people who experience a problem and have to deal with their lacklustre customer service, Skrill is a great online and offline payment method.

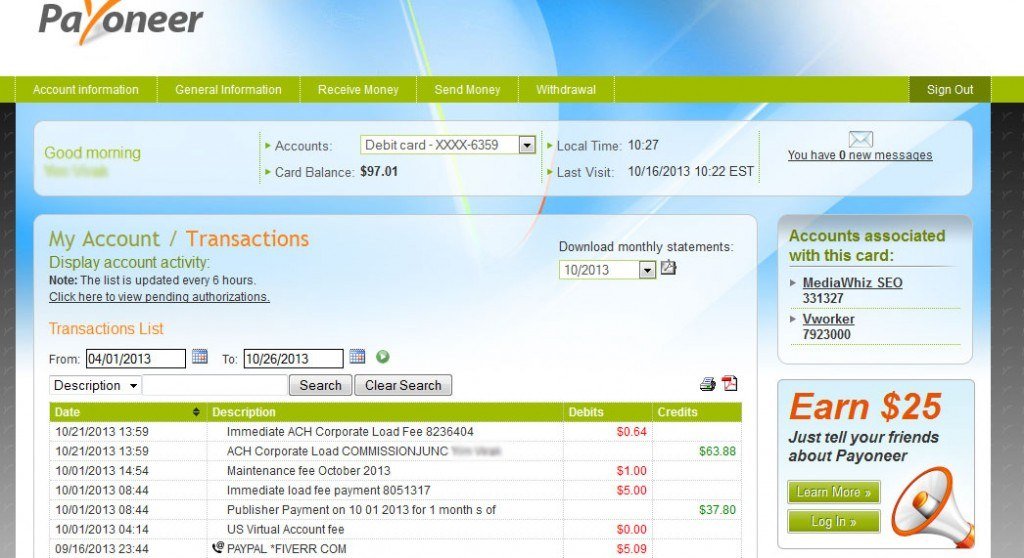

2. Payoneer

Much like Skrill, Payoneer provides you with an online account and a PrepaidMaster card with a fixed activation fee. You can load money onto your account, receive and send payments as well as shop online and in any store that accepts major credit cards and withdraw cash form ATM’s.

The good

- Quick and easy account set up

- Seamless and straightforward transactions

- Can be used around the globe

- Is supported by major freelance platforms like oDesk

The bad

- High fixed account maintenance and ATM withdrawal rates

- Fees involved in bank account transfers unlike similar services where this is free

- Hit and miss customer service

Overall it is a fairly reliable payment system that can be used in any country in the world, but you will need to come to terms with relatively steep rates when compared with similar options.

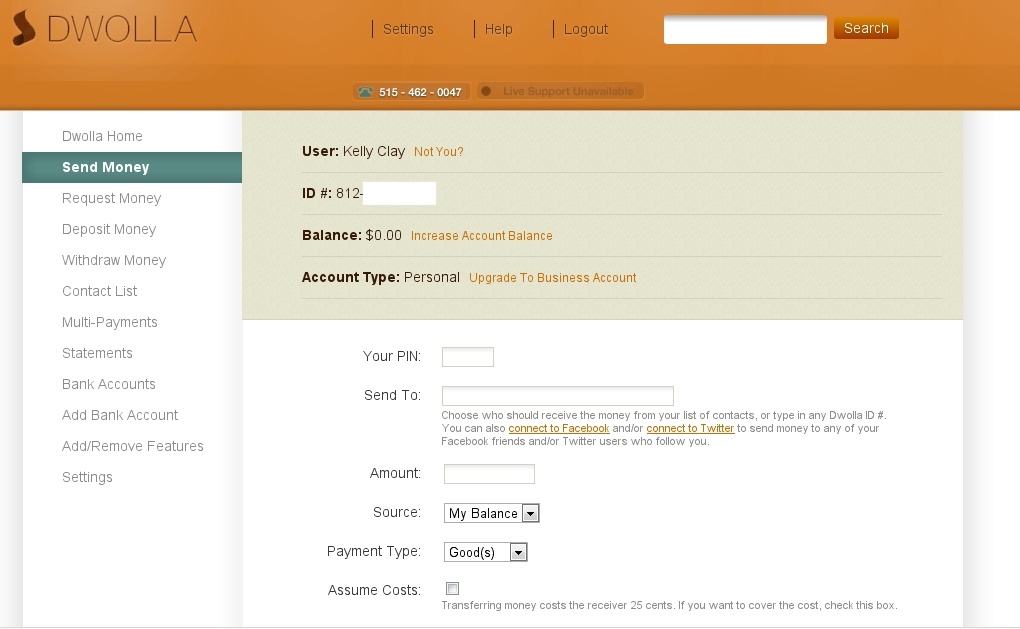

3. Dwolla

Dwolla is a very secure, quick and cheap way to make or receive payments online directly through your checking account. With free transactions bellow $10 and only 25 cents for any amount above it is definitely one of the most cost-effective platforms, although it does require both parties to have a Dwolla account.

The good

- Very low transaction fee of $0.25

- Allows sender to assume transaction fee

- Easy to use

- Instant cash transfer

The bad

- Both parties need to have a Dwolla account to make payments

- The service is only available in the US

If you live in the US this is definitely one of the cheapest and fastest ways to send money, as long as you can convince others to sign up for an account.

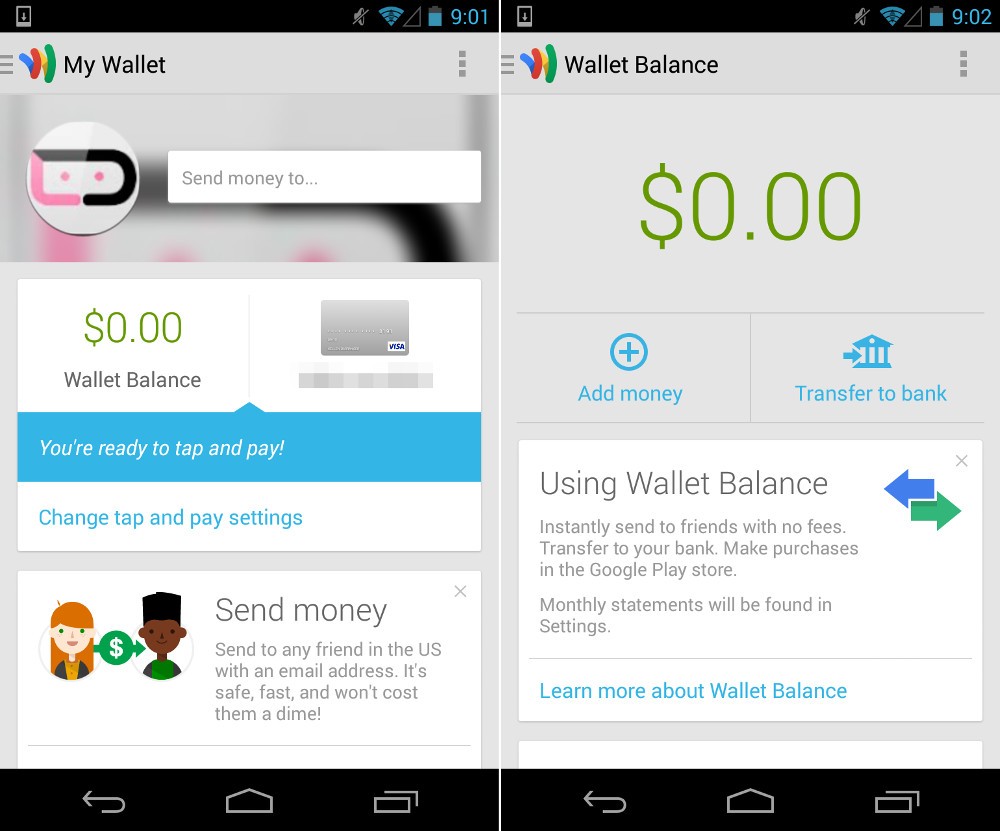

4. Google Wallet

As far as storing all your debit and credit cards for quick and easy use goes, Google Wallet has proven to be a great option for many people. It is essentially an online wallet that contains your different cards, and it also has a card that you can use for in-store purchases.

The good

- Very safe and secure

- Make payments from your smartphone

- Easy to receive and send money

The bad

- Only available in the US

- Sending money and topping off your balance from your credit card carries a 2.9% fee

It is a very good payment solution, but it is limited to the US market.

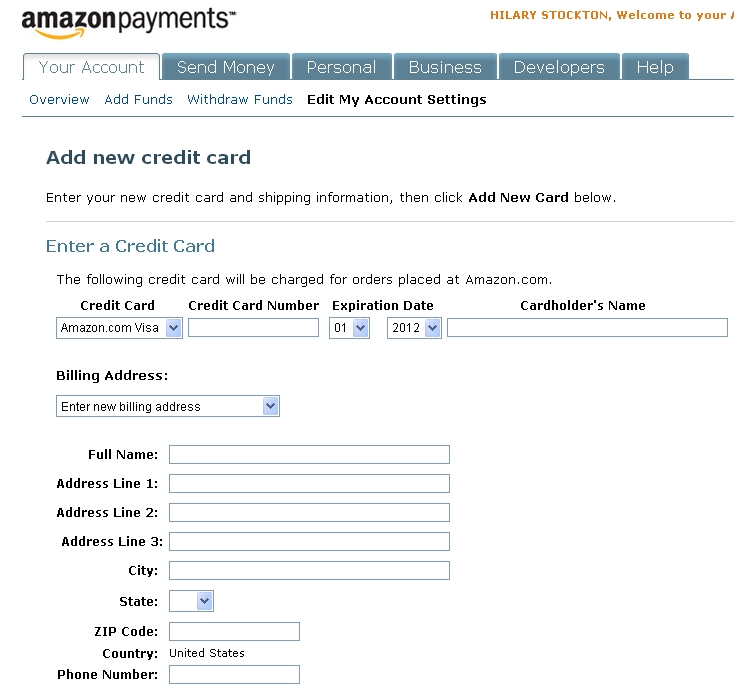

5. Amazon Payments

With a good amount of functionality and a very simple checkout process, Amazon Payments is high up there as far as online payment solutions go. You don’t have to worry about fees up to a certain point and the transactions are fairly quick.

The good

- Send and receive up to $1000 monthly without any fees

- Very reasonable transaction fees 2.9% +$0.30

- Decent security and protection

The bad

- You need a US social security number to use the service

Amazon Payments is a good and user-friendly service, but unfortunately limited to US users.

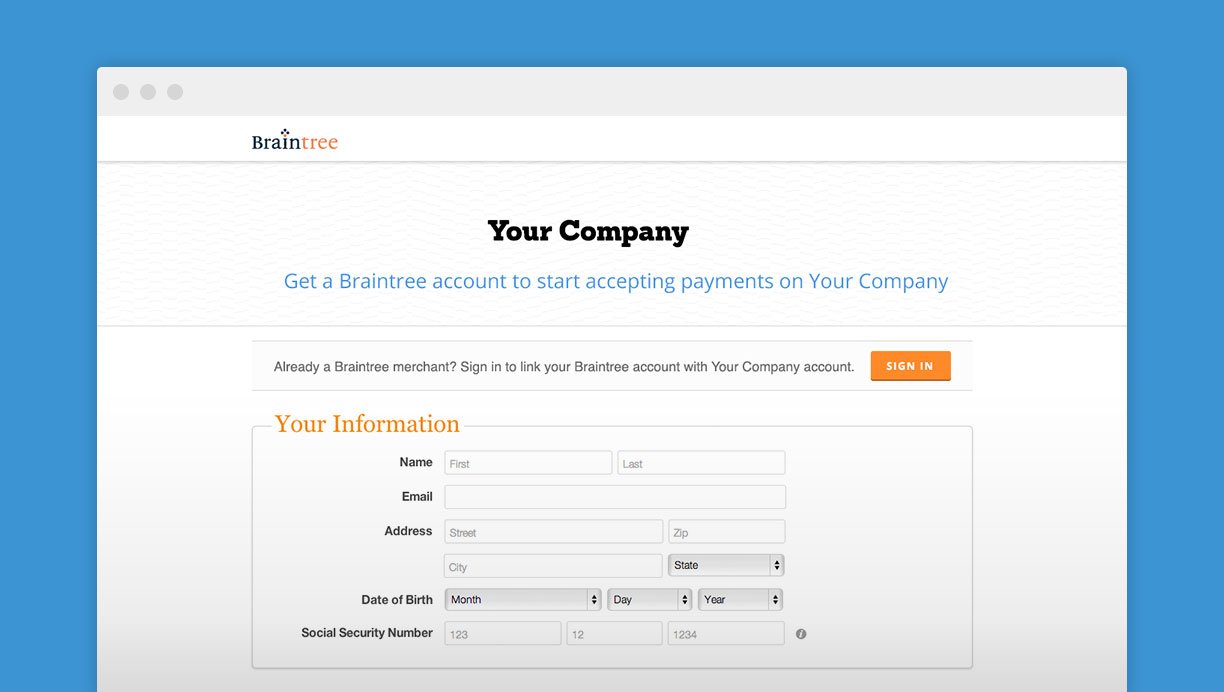

6. Braintree

Primarily geared towards online store owners and merchants, Braintree is a merchant account provider with a flat transaction fee and some useful options for improved customer satisfaction, e.g. multiple languages. You can integrate it into your website with a bit of programming skill and gain access to a fast and effective checkout option. It was purchased by PayPall and is available in most countries around the globe, supporting a great number of currencies.

The good

- Straightforward and reasonable pricing

- Good customer support

- A big list of useful features

The bad

- Requires merchant account

- It takes some programming skill to implement

Braintree is a very good choice for eCommerce websites if you are willing to put in a little work.

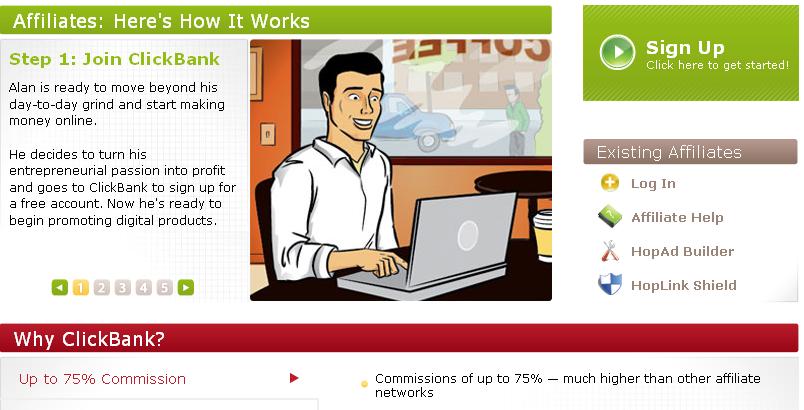

7. Clickbank

Clickbank allows an easy setup and fast transactions when it comes to selling digital content online. You get a good marketing platform with access to affiliates, so you can sell your digital content with ease.

The good

- Great for artists with talent, but no real online business skills

- Reasonable flat start-up fee and 7% fee on all your sales

- They take care of everything for you, allowing you to focus on your work

The bad

- It’s only really good for people looking to sell digital content online

This is a good deal if you’re looking to sell digital content without too much hassle, but not a very versatile service otherwise.

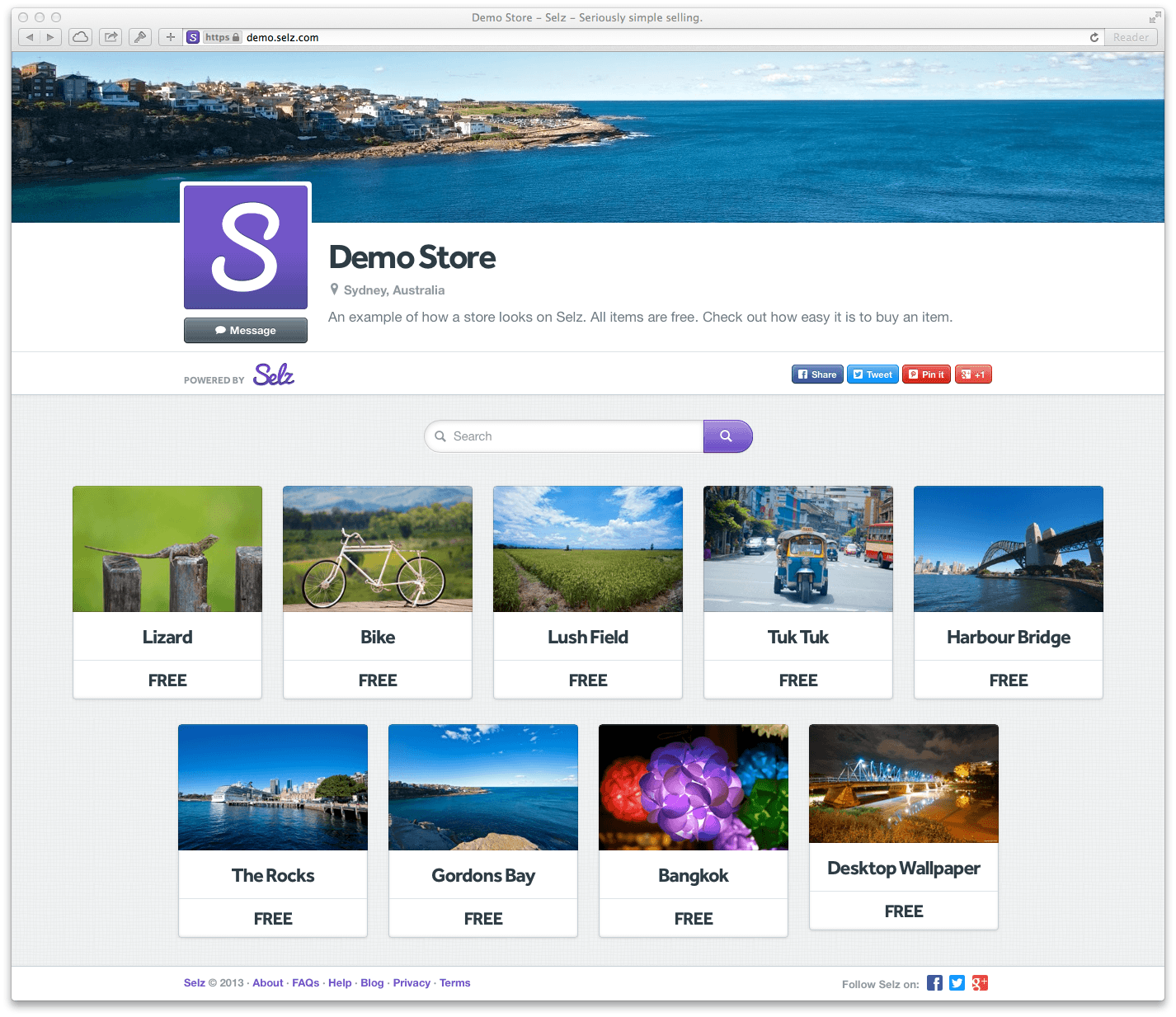

8. Selz

This is another quick and easy way of selling products online, especially for blogs and websites that don’t need to sell all that many items. Selz can be installed in a matter of minutes and is incredibly user friendly, allowing Visa and Master Card payments.

The good

- Users don’t leave the products page when buying

- Fast automated digital content delivery

- Easy to install “buy now” button

- Decent flat transaction fees of 5% +$0.25

- Users can sell from blog or social media pages

The bad

- Not really suited for a robust eCommerce website

- Limited payment options

- Limited shipping options for non-digital content

It is very simple and quick, but it is only really suitable for fairly small businesses, bloggers and artists looking for an easy solution to sell their work from their website or social media platform.

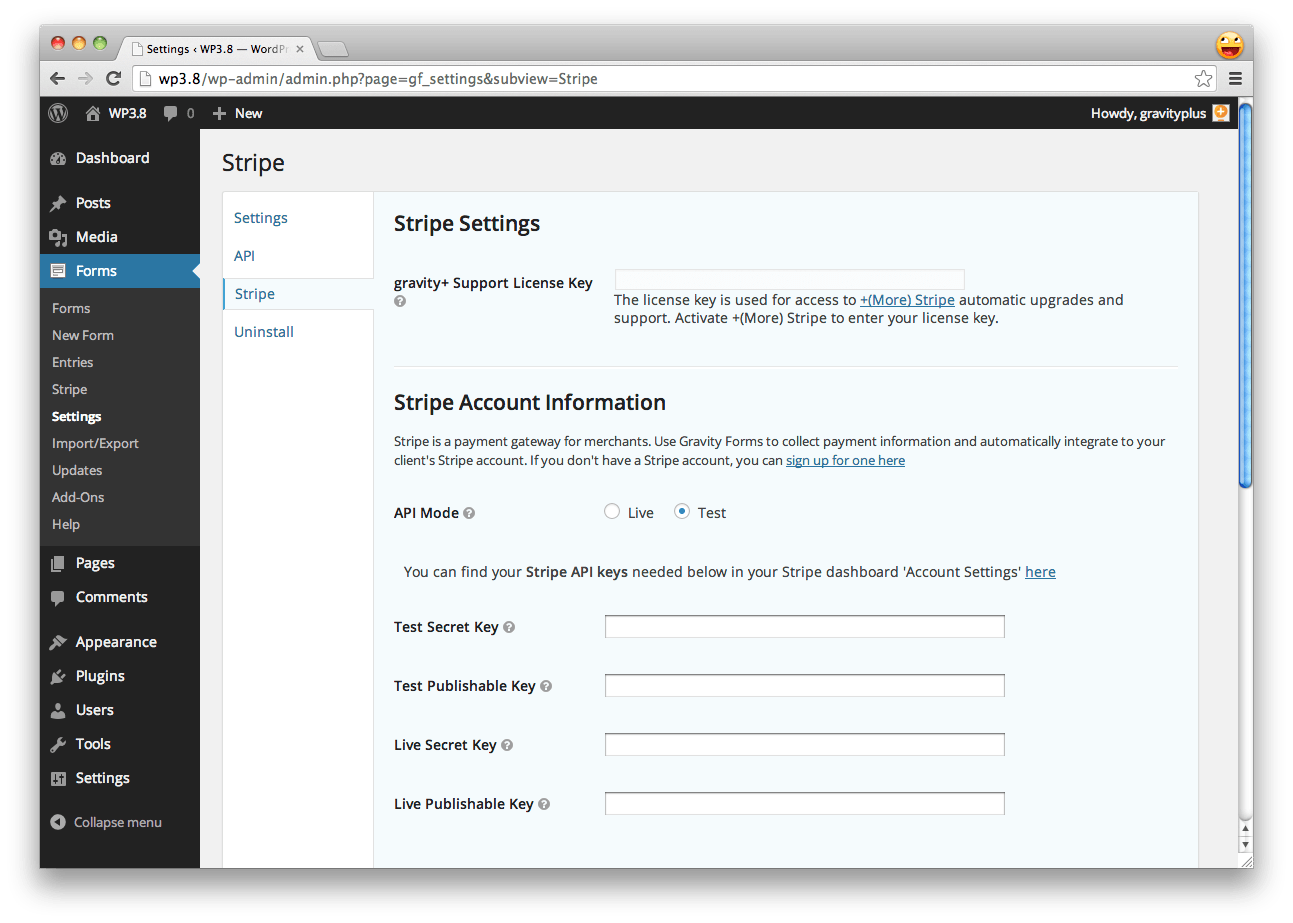

9. Stripe

With Stripe you can accept payments from customers through use of a buy button that allows the transaction to happen on the same page, much like with Selz. There is a flat transaction rate of 2.9% + 30 cents and it is integrated with the most popular shopping cart options.

The good

- Automatically deposits to an outside bank

- Accept payments from all over the world

- Mobile payments

The bad

- Will have to wait for a week after a transaction to collect your funds

- Requires some programming skills

- Only available for merchants in US, Canada, UK, Australia and Ireland

This is a good choice and well-priced option for those based in a few selected countries, with a bit of programing skills or a WordPress website where available plugins make integration a bit easier.

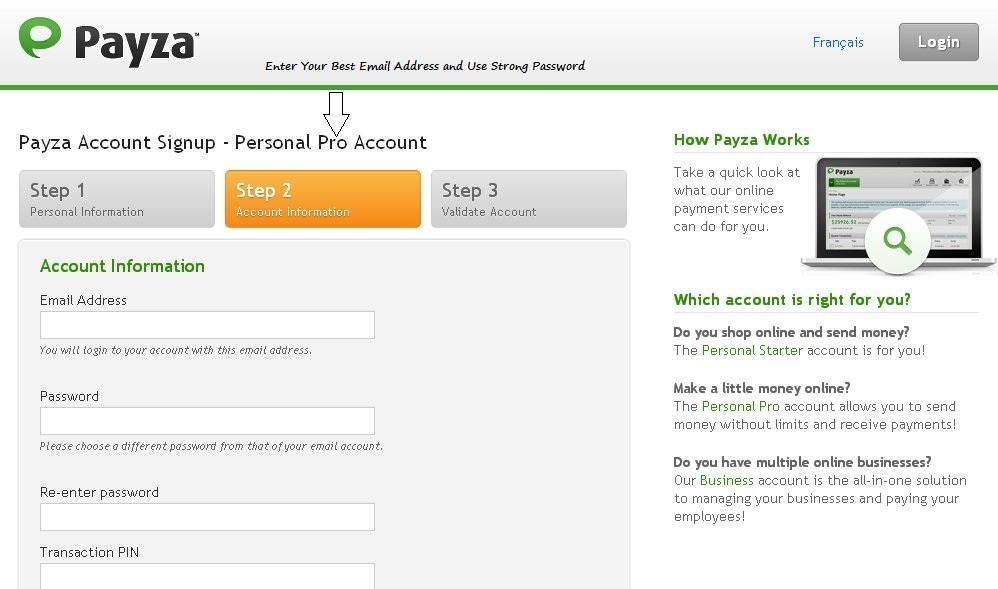

10. Payza

Online purchases, sending and receiving cash and sending out invoices are a breeze with Payza, formerly known as AlertPay. The service is geared towards both private users and companies, and has shopping carts and buy buttons that can be integrated with a website.

The good

- Receive money from around the world in a variety of currencies

- Offers shopping cart integration

- Good security

- Reasonable fees that wary from country to country

- Online and offline purchases with prepaid credit card

The bad

- A lot of people experience processing and verification issues

- Not the best customer support service

Payza is a decent option overall, with some good functionality, but there are still some problems here and there, and their support isn’t all that great.

All in all, there are quite a few good online payment options that give PayPal a run for its money. Whether you are a freelancer looking to receive payments, a blogger looking to monetize their blog or an online store owner who want to give visitors a good PayPal alternative, you will find these to be some great options.