Today was a great day. You were productive, spent time with your family, and went to bed on time. You close your eyes ready for tomorrow, only to find yourself awake 4 hours later… This is the time that your brain ruminates your revolving debt as you desperately try to get some rest.

If your financial situation doesn’t change, you know you won’t be able to retire with enough money. You then start to wonder if you’d ever be debt free.

Being in debt is one of the worst places you can be, but you’re not alone.

I and thousands of others have been there. Those who were lucky managed to pay off their entire balances.

You can too. But, you need to take action fast.

The good news is that there are clever ways to be debt free — the debt snowball method. It’s not easy, but if you’re ready for change–here’s how you can get your financial future back in order:

Table of Contents

Kickstarting to Get out of Debt

First and foremost, you need to get yourself mentally prepared to before you start your debt-free plan.

1. Commit for a Worthy Cause

There are stories of people having a “magical moment” when they’d decided to become debt free.

The reality is that you don’t need this magical moment. What you need is commitment.

Instead of telling yourself that you want to be debt free, find a reason worth fighting for. Think of what having zero debt would bring to your life.

Would you be able to travel more? Would you be able to sleep better at night?

Despite most Americans carrying some type of debt, having debt isn’t normal. You’ll put yourself in the never-ending “rat race”–living an unfulfilled life. One where you’ll be dependent on a job you hate to sustain a lifestyle you can’t afford.

By having a clear purpose, you’ll focus on reaching your goal despite the obstacles that come your way.

I’d hit rock bottom when I realized that I was living paycheck-to-paycheck. It was at this moment that I became determined to pay off $6,000 of credit card debt. Because I had a purpose I was able to make an extra $500 principle payment each month–paying off my entire balance off in 18 months.

The same can happen to you, but find a reason worth chasing.

2. Create Your Financial Blueprint

Even after committing, you can still fail at paying down debt.

Why?

Because once you do pay it off, you’d be likely to go back into debt if there’s no direction. It’s easy to stay motivated when you’re first starting off. But, when the going gets tough, it’s here where you’ll need something to keep you motivated.

So how do you stay motivated?

Write down your financial goals. For example, if you want to pay down $3,000 of credit card debt, set a due date.

Bad goal: I want to pay off all my credit card debt

Good goal: I want to pay off my $5,000 credit card balance in 18 months

The second goal is better than the first because you can break it down. You’d need to pay $278 each month to pay off your entire $5,000 balance.

But, you don’t break down a specific goal and forget about it. You need to check on it daily to be sure that you’re on track. A great tool to help you do this is a journal.

After setting your specific goal, break it down into daily tasks. This could mean bringing your lunch to work so that you have extra money to pay down your debt. Then at the end of each day, check to see if you’ve hit your daily target.

Learning the Debt Snowball Method

Committing to becoming debt free is great, but you need a plan. The debt snowball method is a great place to start.

This strategy boils down to paying your smallest balance first, disregarding interest rate. This is an effective approach because you’ll get momentum going.

For example, if you had $1,000 of debt to pay off: credit card 1: $300 credit card 2: $500 credit card 3: $200

You’d make the smallest payment to credit cards 1 & 2. Then pay as much as possible to pay off credit card 3. In this scenario, it can be tempting to pay the highest balance first.

The problem with paying off your highest balance first is that it’ll take longer. This will increase your odds at giving up because it’ll feel like you’re making no progress at times.

By paying the smallest balance first you’ll get a quick win and stay committed.

So how to use the snowball method?

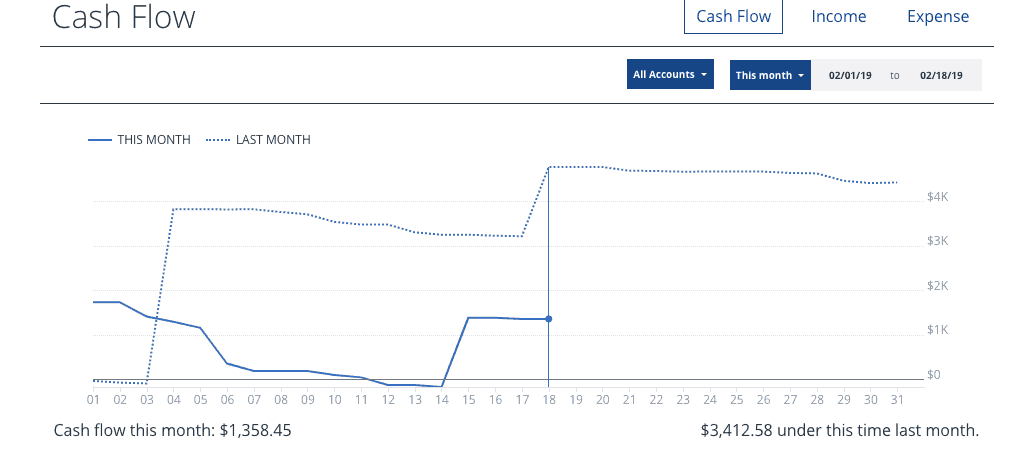

List all your debts on a spreadsheet. Then figure out how cash you’ll have available at the end of each month using Personal Capital. Get your total expenses and subtract this amount from your monthly income.

Use as much of this extra money as possible to pay down your debt.

Unless you have a large debt, don’t worry about accruing interest in your other balances. Pay down your smallest debt, then work towards the next smallest.

More important, stop using your credit cards and don’t make unnecessary purchases. Doing this will only prolong the time it’ll take for you to pay down all your debt.

Should You Use the Snowball Method?

Many debates whether the snowball method is the best way to pay off debt.

The answers is–it depends.

Whatever will help you be debt free is the right choice for you. Using the snowball method carries a cost. Since this method doesn’t take into account interest rates, you may end up paying more in the long run.

First, calculate how much interest you’d pay to make the smallest payment. If you don’t carry large balances, then it won’t matter how you pay off your debt.

Another important factor to consider is what will help you be consistent. For example, if you’re someone who needs to get motivation, pay down your smallest debt first. But, if you’re one who likes to be efficient, pay your highest interest credit card first.

There’s no right way to do this since everyone is different. Paying interest is never a good idea, but if this means that you’d be debt free, go for it.

Exponentially Eliminate Debt Using an Extra Income

An issue that most people face when paying down debt is the rate at which they do so.

The only way to change this rate is by decreasing your expenses or increasing your income. The problem with decreasing your expenses is that you can only do it to a certain point. But, increasing your income is limitless.

Still cut your expenses as much as possible using tools like Trimm and BillCutterz. Once you do you’re ready to increase your income. Starting a side-hustle is the best way to do this.

Great side-hustles to start are:

- Freelance writing[1]

- Affiliate marketing

- Start a blog[2]

None of these side-hustles are easy to create. But, once you earn income from a side-hustle your finances will improve.

Whether you love your job or not, having a side-hustle is a great way to pay down your debt faster. You’ll also feel confident knowing that you’re not dependent one income.

Bonus Strategies to Crush Debt

The debt snowball method is only one of the many ways you can pay down your debt.

If you carry a large amount of debt, then you need to explore your other options. Other options include consolidating your debt for a lower interest rate.[3] For example, if you carry balances on many credit cards, you can combine your debt into one single balance.

Be sure to review your financial goals before making this decision. Credit card companies will offer a 12 to 18 zero interest promotion. Afterward, the interest rate will spike. This can do more harm than good if you’re still carrying a large balance after the promotion is over.

Like balance transfers for your credit cards, you can apply for a personal loan. Here you’d combine other types of debt you carry into one single loan. This helps you save money on interest and makes your monthly payments easier to make. Crunch your numbers to be sure that you’d be saving money.

Final Thoughts

“The best time to plant a tree ”is or was“ was twenty years ago. The second best time is today.” – anonymous

Imagine going to bed and not worrying about money. You’d have zero debt and better money habits. You’d sleep and feel happier.

Wouldn’t you want this to be your reality?

The truth is that such a reality can be yours, but you have to be willing to pay the price. It will take hard work and sacrifice to pay down all your debt. And, despite being on track setbacks are inevitable.

You already know about a few debt strategies you can use to crush your debt. But, you first need to commit. Then, set clear financial goals and take action.

Social pressure and other factors led you to accumulate a lot of debt. Although you’re not where you’d like to be today, you can still change your financial future for the better.

Life is too short to let financial setbacks stop you from being happy. Now go crush your debt. A happier life, one with better sleep awaits.

More Resources About Financial Management

- The Definitive Guide to Get Out of Debt Fast (And Forever)

- How to Use Credit Cards While Staying Out of Debt

- How Personal Finance Software Helps You Get More Out of Your Money

- 32 Hacks for Sticking to Your Budget

Featured photo credit: Jack Harner via unsplash.com