Confidence — it’s a powerful word and an even more powerful feeling. Can you remember a time in your life when you felt confident? A time when you felt unstoppable… on top of the world? Now imagine you could feel that way more often. What impact would that have on your health and well-being, your career, your relationships?

Not only does being confident feel good, it helps you seize potential opportunities, take more chances and make that big change or take the next step in your life and career. Life is crazy, busy and beautiful. Figuring out how to be more confident is just part of the journey.

So how to be more confident?

Lack of confidence can stem from many places.

Perhaps, growing up, your parents said a certain career was outside your reach and you could ‘never do that’. Or maybe you have a belief system that says ‘I could never start my own business, I’m not entrepreneurial’.

Perhaps you had a bad experience which opened the door for self-doubt to creep in. Or maybe your inner self-critic is telling you ‘you can’t’ or ‘you’re not good enough’. Maybe (ok, likely) you’re comparing yourself to someone else – a friend, colleague or spouse.

Or perhaps you feel there is something missing in your life – a relationship, the dream job, kids, a degree or title.

In my work with thousands of clients, it seems most (if not all) of us struggle with confidence in some area, or at some point in our lives. Whether that be confidence in our appearance, abilities, relationships, careers, decision making, and social situations.

We all have crises of confidence. Times we are self-conscious and moments of self-doubt. And, if your lack of confidence is keeping you in a bad job or poor relationship — or keeping you from moving forward in your life or career, you’re not alone.

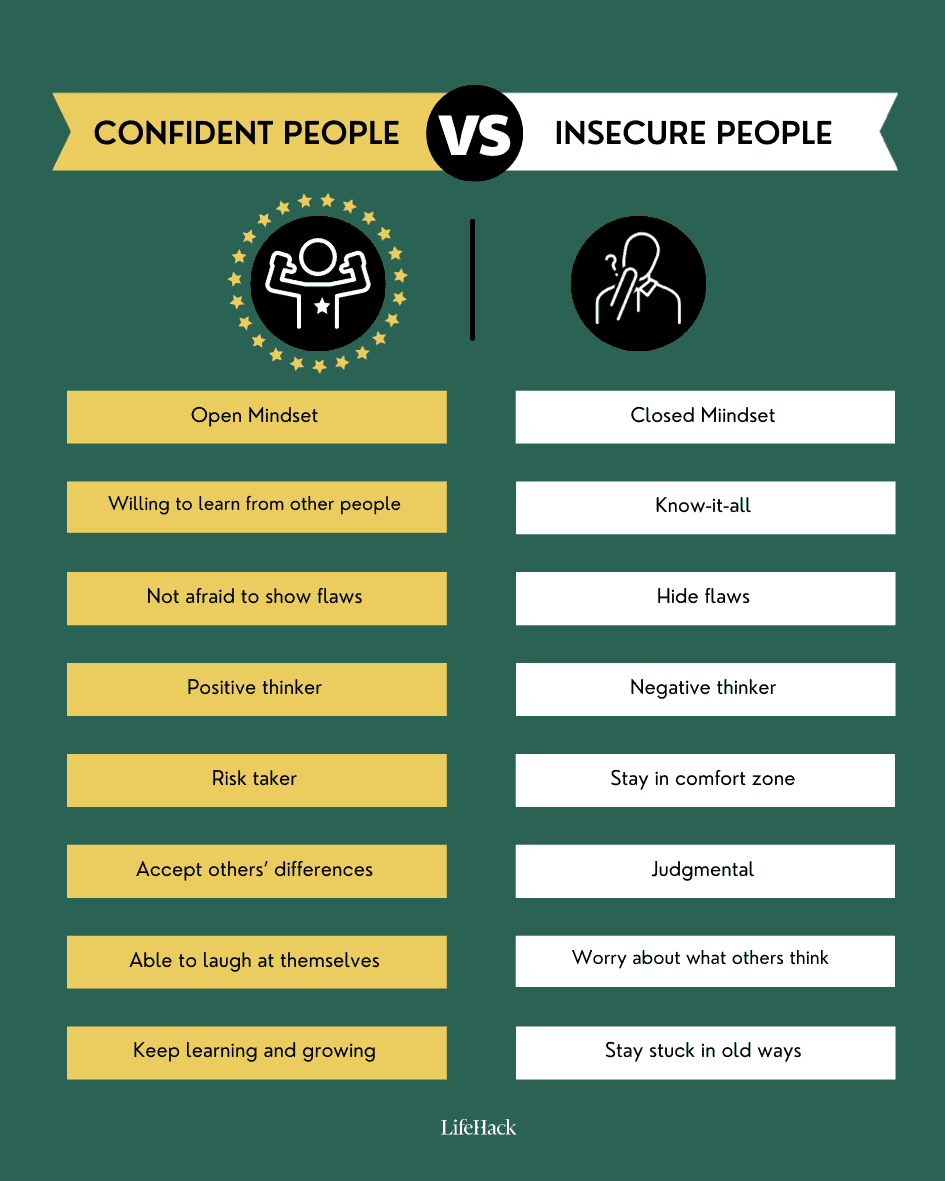

Confident People vs Insecure People

Confident people believe in themselves and have a positive mindset. People lack confidence feel insecure about themselves and their decisions.

Let’s take a look at this infographic which illustrates the differences between a confident person and an insecure person:

How to be More Confident

So, how can you be more confident? Here’s your complete, step-by-step guide:

1. Be Specific – What Are You Not Confident in?

First things first, let’s get specific.

In order to tame the demon, you’ve got to name the demon. Where do you lack confidence? When do you feel self-doubt and your negative emotions creeping in? Where do you feel your skills or abilities are limiting you? Where would you like to have more confidence?

Once you get specific, it won’t feel so overwhelming as you’ll have something tangible to tackle.

Maybe you want the confidence to go out on your own and start a new business? Or maybe you’d like to go back to school to get the degree you’ve always wanted? Perhaps you’d like the confidence to go on an adventure or take a trip you’ve been thinking about for some time.

How?

Take a moment now, identify and put into a complete statement: Where do you specifically want to have more confidence?

2. Uncover What Gives You Confidence

This is personal, so it will vary from person to person. There’s no one size fits all approach to confidence and what works for one, won’t always work for another.

How can you figure out what gives you confidence? Think about a couple times in your life when you felt most confident.

How?

Now, think about what was it about those times that made you feel so empowered.

Was it the environment you were in? Something you were doing? A feeling you had? The more you get clear about this for yourself, the easier it will be to tap into when you need it.

3. Be True to You

One of the surest ways to lose confidence is try to be someone else. One of the best ways to build your confidence? Be true to yourself.

When you’re trying to be someone you’re not, every part of you resists it. You are not everyone else. You are you. And the more you can understand who you are and what you value the stronger you will be.

When you stray away from who you are, you lose confidence because it’s ‘just not you’.

How?

Think about what makes you, uniquely you. Write it down. Think about what you value and what’s important to you. Write that down, too.

4. Remember You Are 100% Smart

When one of my daughters was in the 4th grade, her teacher gave an assignment called 100% smart. In this activity, the kids had to make a pie chart and identify what percentage smart they were in each of the following areas; people, self, body, math, word, music, art.

For example, my daughter was 25% body smart, but only 5% art smart. This was such an insightful exercise for her and something I have shared with many clients over the years. She realized that even though she lacked confidence in art, there were so many other areas where she excelled.

This is true for everyone. So, maybe you’re not the best public speaker, but are you a great parent, smart with your money, or creative?

Too many people spend way too much time trying to improve, change, be more of this or less of that. Instead, what if you spent more time acknowledging your talents, skills and successes?

How?

Try this for one week: at the end of each day, write down at least 3 things that you did well, felt good about, or were proud of yourself for. Know your strengths, know your talents and know you’re 100% smart.

5. Stop Comparing Yourself

Nothing zaps your confidence more than comparing yourself to others. Especially now, with social media and the wonderful opportunity to judge yourself against so many others! Lack of confidence comes from a gap in where you see yourself and where you think you should be.

Imagine you are preparing to give a big presentation or speech. So you do your research, which includes watching some of the best speakers in the world doing their Ted Talks. Of course you are going to feel inferior.

How?

Stop comparing yourself to others. Just stop. If you still feel a compelling need to compare – compare yourself to yourself. Measure how far you’ve come. See how much improvement you’ve made. Acknowledge your wins and successes.

6. Realize You Are Enough

This may sound a little bit corny, but try it. This positive affirmation will resonate at a deep level and have a powerful effect on your subconscious.

How?

Every day for the next 21 days repeat this mantra “I am enough.” Don’t just say it, but feel it, deeply, at the core of who you are.

Want to get more specific? Replace ‘enough’ with whatever word you’d like to ‘be’. What would give you the most confidence?

I am brave. I am strong. I am smart. I am beautiful. I am confident. I got this.

7. Acquire New Skills

Since confidence is often directly linked to abilities, one of the best ways to build your confidence is to get new skills or experience and step out of your comfort zone.

Growing your skills will in turn grow your confidence. And please, as you work on building your skills and expertise, don’t mistake a lack of perfection for a lack of ability. No one is perfect. But if you’ve got a perfectionist bone in your body (like I do), it can make you think that just because you’re not the best, that you’re not good at all.

Make sure to check yourself – am I really not good at this, or am I not good as I want to be just yet?

How?

Ask yourself: Is there a specific area where you are lacking confidence? How can you expand your expertise in this area?

8. Change Your State

Changing your physical and mental ‘state’ is one of the quickest ways to access a feeling of confidence. To do this, you need to know what the state of ‘confidence’ looks, feels and sounds like for you.

How?

Here are a few strategies you can use to access that:

- Remember – Think of a specific time, associated with feeling confident. Sink into that feeling deeply and moment by moment relive every detail.

- Imagine – Imagine how you would feel if you were confident. How would you act? Feel? Be?

- Modelling – Think about someone you know who exudes confidence. Imagine what that person would do.

9. Find Yourself a Cheerleader

Yes, while I understand confidence is a state from within, you can also boost your confidence by the people you choose to spend your time with.

How?

Make a concerted effort to surround yourself with others who provide encouragement, positivity, and inspiration.

Spend more time with people who ‘get you’ and see all of your greatness – and less time with those that zap your confidence or cause you to feel self-doubt.

10. Just Do It

When Nike came up with this slogan in the late 80’s, they knew just how to get the general population off their butts and moving. Turns out, this is a great strategy for being more confident too.

When you stand at the edge of the water; waiting, wondering, worrying if you can do something, you lose confidence. Your fears creep in and you begin to doubt yourself. But when you take a leap of faith, jump in and get started, your confidence immediately builds.

Action builds confidence and each step you take builds it further.

How?

Think of one step you could take right now that would get you moving in the right direction. Then Just Do It and see what happens. An incredible thing about human brain is that once it realizes something is working, it will keep that momentum going!

Read this guide to start to do what matters and make it happen.

Final Thoughts

Being more confident starts with one thing — YOU.

YOU making the decision to take action. And when all else fails, YOU can make a choice.

YOU can choose to be confident. YOU can choose confidence over fear and self-doubt.

Your mind believes what you tell it. If you continue to tell yourself the story that you are not confident, you will believe it and your self-doubt will continue. But if you tell yourself you can do it, that you got this, your mind will believe that too.

Remember, fostering a strong sense of confidence is critical to experiencing overall levels of health, happiness and success.

And once you get started you’ll be unstoppable. Be brave. Be confident. You got this.